正所謂: 理財小知識,你我都要識 :) ig: wealthlife_store

3 financial inspirations from the epidemic

The sudden appearance of the epidemic in 2020 has greatly changed our work patterns and living habits, and a bigger and more obvious blow to the global economy, all of which remind us of "It's time to change"

1/ Add value to yourself, develop multiple skills and interests

According to a recent World Economic Forum report, a variety of jobs are expected to disappear in the next five years due to the impact of the epidemic, including data entry clerks, administrative and executive secretaries, accountants and bookkeepers, customer service personnel, and mechanical maintenance personnel. In contrast, industries related to machines and artificial intelligence have new demands.

Even if your job is fortunately not affected by the epidemic right now, or you are facing a layoff crisis.

But it is certain that after the epidemic, all walks of life will have a new order, new types of work will appear in the market, and existing ones will change their business models.

Learning one more skill is not only to keep up with market demand and not easily eliminated, but also to have one more choice in the workplace, reducing the cost of "breaking up", and even if you switch industries, you will be better than others.

As Warren Buffett famously said, the best investment in life that will never lose is to "invest in yourself". Start today, dig a lot of your own interests, and then seriously develop into an expert in that field.

If you don't have an idea, trying new things is the best way. For example, enrolling in a course you've never taken, learning a new skill or sport, reading books that help you understand yourself better, and you may find surprises.

2/ Create multiple revenue streams

As the epidemic of the century hit, news of layoffs and pay cuts in all walks of life came one after another, and the unemployment rate in Hong Kong hit a new high in 16 years. Under the severe setback of the tourism industry, professional pilots with an annual salary of one million became unemployed overnight. However, who would have thought that professionals would also lose their jobs.

If you only have a single source of income, the situation is the same as putting all your eggs in one basket.

So we all have to learn to spread the risk of income sources. "Habits to Get Rich" mentions investing a portion of your savings to create passive income; or starting a side business such as running an online store or part-time job to generate additional income. If one basket breaks, at least there are other blues to protect your eggs (fortune).

Driven by this epidemic, becoming a slasher is already a major trend in the future.

3/ Actively learn financial management

This unexpected epidemic took away countless lives, and at the same time caused countless people to lose their jobs. Then ask: Do you have enough money to pay for medical expenses when you are unfortunate enough to suffer from the epidemic? Do you have enough emergency reserves to cover your day-to-day expenses in the unfortunate case of being laid off? And under the epidemic, countries all over the world have poured out "silver printing paper". Will your current asset purchasing power gradually increase or decrease? I think you have a yes answer too.

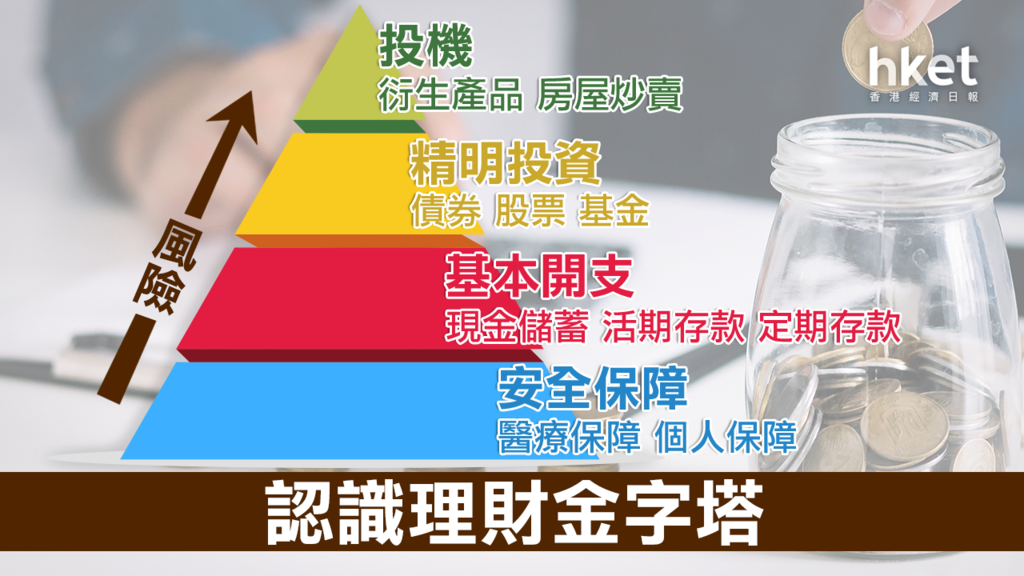

Therefore, ensuring that your assets can handle unexpected expenses and protecting your asset value are important learnings.

It simply starts from understanding the financial pyramid, from the bottom level of personal security, to disciplined savings, preparing emergency reserves, to researching various financial tools that increase asset value, such as trading funds, stocks, foreign currency, gold, virtual currency, savings insurance, real estate, etc.

Learning how to manage money well is the same as managing risk. So now, please start studying financial management from 2021, a topic that will accompany you throughout your life.

2021 Let's work together! :)

If you think the article is helpful to you, please give me a like :)

ig: wealthlife_store

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…