中共体制有一种拔然脱俗的可能,共产党可以带人成神带人飞。

China's energy triangle behind "carbon neutrality"

Author: Chen Shuai / Zhang Fake

Editor: Director Dong / Li Motian

Produced by: Technology Group of Yuanchuan Research Institute

Support: Su Chen, new chief executive of Zhongtai Electric / Hua Xiuning, new energy analyst

The fate of a country is often closely related to the "innovative revolution of the energy system" . For example, the rise of the United States in the second half of the 19th century was inseparable from the most contemporary "crude oil system" it built:

On the production side , Rockefeller founded Standard Oil Company, which improved the refining efficiency through improved equipment and efficient smelting technology, and then controlled 95% of the US market. Controlled 85% of the global market;

On the transportation side , Rockefeller abandoned the widely popular railway transportation at that time, and pioneered the establishment of huge oil pipelines, which greatly reduced the cost of oil;

On the consumer side , Henry Ford pioneered the assembly-line production method, came up with a cheap Model T, and completely digested Rockefeller's oil.

"High-efficiency refining technology-new oil pipeline-innovative automobile production line" finally formed a cycle system of "production-transmission-utilization" , which successfully replaced the "coal system" dominated by the United Kingdom and greatly accelerated the development of American industry. In 1929, the United States owned 78% of the world's automobiles, gasoline and fuel oil accounted for 85% of the total oil consumption[1], and the industrial civilization was far ahead.

Therefore, in World War II, when Hitler carefully took care of Romania's oil fields and Japan was racking its brains to search for crude oil in Indonesia, the United States could squander its fuel resources without any scruples, driving the torrent of tanks and huge fleets of the Allied countries to flood the Fascism. By 1945, its oil production (235 million tons) was 89 times that of the Axis powers combined.

The cycle system of "production-transmission-utilization" has also become the cornerstone of American oil hegemony after World War II. Even in the 21st century, America's power in the traditional energy world is still expanding. On the production side, the United States regained its position as the world's largest oil producer in 2019 through shale oil. Even if the Middle East is scorched, its impact on the United States is limited.

In stark contrast, although it is not an oil-poor country, China, as the world's factory, imports more than 200 billion US dollars of oil every year, and if you count the oil pipeline contracts signed with Russia and Iran, and in order to cross the Strait of Malacca, In the ports built in Pakistan and Myanmar, my country's investment in energy security is astronomical.

To really break this situation, what China needs is an innovative revolution in the energy field. This is the hottest track today: the "silicon energy" revolution , which consists of photovoltaic-UHV-new energy vehicles , corresponding to a new "production-transmission-utilization" cycle system.

In the past 20 years, China has simultaneously planned industrial policies of an unprecedented scale on multiple fronts, and the total expenditure on power generation, transmission and consumption of electricity is almost no less than trillion. These policies, in the eyes of some economists, are called "distorted resource allocation", and public opinion is also swaying between "deception, overheating" and "cold winter and cold".

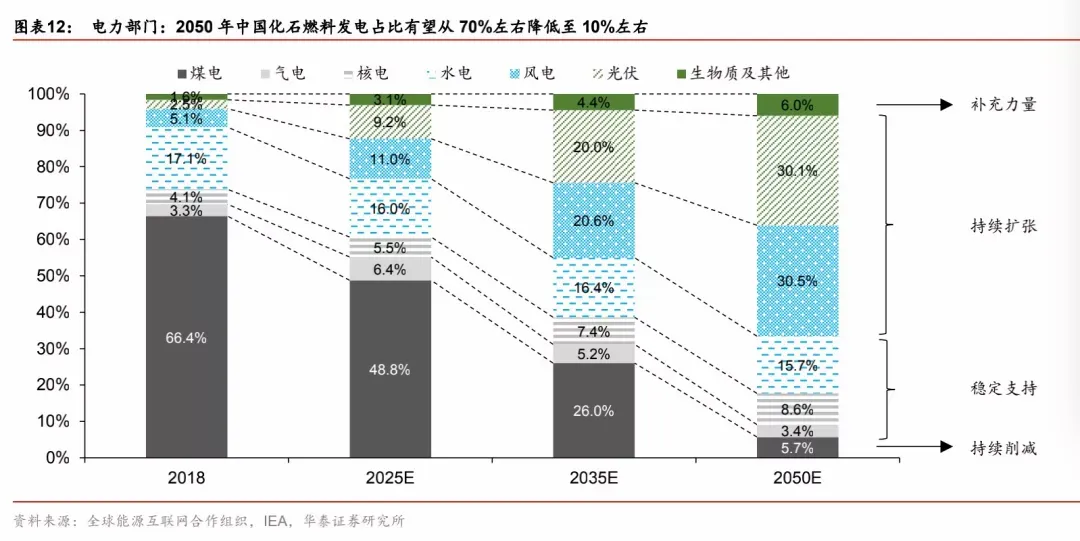

However, it is undeniable that the cycle system of "photovoltaic, UHV, and new energy" has ushered in breakthroughs and development in 2020. China's energy triangle is gradually being completed, which also gives decision-makers the opportunity to achieve "carbon neutrality" in 2060. and” confidence. Under the guise of "clean energy" political correctness, the essence of "carbon neutrality" is an energy revolution in which silicon energy replaces carbon energy.

For China, this is an arms race more important than semiconductors.

01. Photovoltaics: Endless Energy

The first corner of the "big triangle" is photovoltaics. Before talking about photovoltaics, let's talk about a word that has been very hot in the past and has been particularly hot in recent years: stuck neck.

The so-called stuck neck refers to the lack of certain components or materials supplied by foreign countries, and the domestic industry cannot operate in an uncomfortable situation. That is, the downstream manufacturing capacity of a certain industry is very large, but if the equipment depends on imports, and the materials also depend on imports, once overseas supply is cut off, the industry will stop immediately. The semiconductor industry, which is stuck and uncomfortable, is a typical case.

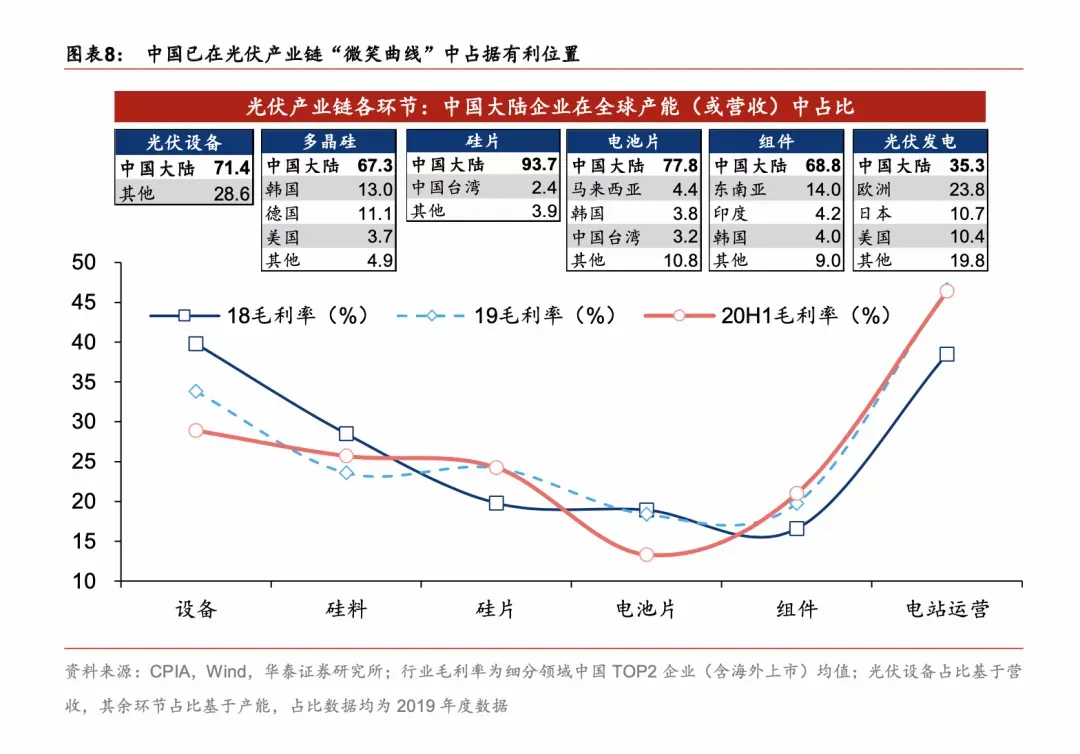

But China's photovoltaic industry is a special case. At present, China is the country with the largest proportion of the global photovoltaic industry. Chinese-funded enterprises in the four major sectors of silicon materials and modules account for more than 50% [3]. Not only are all equipment localized, but the output also accounts for 70% of the world's total . Not only the product has high gross profit, but also the craftsmanship has broken world records many times.

The position of China's photovoltaic industry in the industry chain, Huatai Securities

Photovoltaic technology originated from Bell Labs in the United States, and the industry is vigorously promoted in Europe. At the beginning of this century, as the German government began to vigorously support the photovoltaic industry, photovoltaic power generation has become the mainstream of EU countries, and demand has exploded, and China has entered this industry.

However, at that time, China's photovoltaic industry was still in a state of processing with supplied materials, that is, buying other people's silicon wafers and sticking them on the board to make photovoltaic modules, and earning a lot of money by eating overseas subsidies, so that successively The two richest men, Shi Zhengrong and Li Hejun, were born, but the core technology is always in the hands of others.

This model with a very low ceiling was quickly hit: in 2012, represented by the United States, the European Union, and India, the West launched a series of "anti-subsidy and anti-dumping" investigations on China's photovoltaic industry. The fat meat of clean energy is not only wanted by China, but also seen by others, raising tariffs and fixing prices, striving to put the emerging Chinese photovoltaic industry in its infancy.

Under the cold wave of the industry, Wuxi Suntech, once the world's largest photovoltaic cell manufacturer, was insolvent in 2013 due to multiple blows such as the financial crisis and anti-dumping investigations. Shi Zhengrong, who was China's richest man seven years ago, resigned sadly. It is said that a greeting circulated among the visitors to Wuxi at that time, "You are also here to collect debts[4]?"

Once it collapsed, photovoltaics became a rat crossing the street for a while, but almost at the same time, the "visible hand" quickly picked up the industry from the bottom. In 2013, the government launched a new policy of large-scale photovoltaic subsidies to vigorously stimulate domestic demand. The benchmark electricity price subsidy policy was introduced at the beginning of the year, and the domestic industry growth rate reached 212.89% by the end of the year[14].

By the end of 2020, the central government's subsidies for renewable energy have totaled more than 210 billion yuan. Due to the high cost, the development of photovoltaics mainly relied on government subsidies in the first ten years. And as long as there are subsidized industries, there will be fraudulent subsidies. However, although the large-scale subsidies made up for the two notorious richest men, they also made up for a counterattack of a small company with a cool style.

This company is LONGi shares that came out of the circle some time ago. The company was founded by Li Zhenguo, a graduate of Lanzhou University, named after Jiang Longji , the old president of Lanzhou University. After the first batch of domestic leaders fell, LONGi keenly grasped a process change trend called gold steel wire cutting, betting on monocrystalline silicon materials more suitable for the gold steel wire process, and achieved great success.

After that, LONGi bet on the localization of production equipment, and finally created a wealth myth with a stock price of 40 times in 8 years and a market value of 400 billion yuan, becoming the world's largest manufacturer of solar monocrystalline silicon rods and silicon wafers. Behind this, in addition to the resolute government subsidies that have shaped a huge domestic market, there is another important factor, which is the obvious characteristics of this photovoltaic industry:

To put it simply, photovoltaics is essentially a cost-driven industry. The efficiency improvement and cost reduction caused by technology, process, scale or management will eventually accumulate into comprehensive advantages.

In this case, Chinese companies backed by the largest consumer market can steadily reduce costs and improve quality through continuous trial and error of various processes, and then expand the scale to gradually win. In this kind of spiral victory template, the three indicators of "mass production-process/technology-profit" have realized a positive cycle of self-reinforcing.

LONGi is not an exception. In recent years, China has emerged a spectacular "photovoltaic army", sweeping the entire photovoltaic industry chain. Among them, there are LONGi in the whole industry chain, Tongwei Co., Ltd., which dominates silicon materials, Follett Glass, the king of photovoltaic glass, and Foster, the leader in plastic films. Even in the field of photovoltaic inverters, Huawei has always been the world's number one. 5].

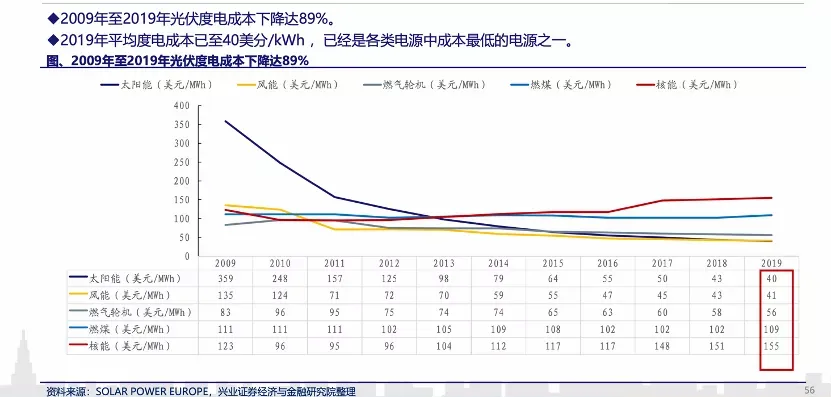

The industry has won the battle, and it has also brought about social changes. In the past ten years, the cost of photovoltaic power generation has dropped by 89%, which makes the cost of photovoltaic power generation in nearly 80% of my country's land lower than that of coal. For the unsubsidized and affordable photovoltaic grid-connected projects in Qinghai Province, the on-grid electricity price is only 0.227 yuan per kilowatt-hour, which is only 60% of the coal-fired on-grid electricity price in eastern Zhejiang Province.

Photovoltaic is not the only renewable energy source. While vigorously developing photovoltaics, China is making long bets on renewable energy, including wind power and hydropower. According to IRENA data, in 2019, the cumulative installed capacity of China's onshore wind power, solar photovoltaic, and hydropower accounted for 34%, 35%, and 27% of the global total, ranking first in the world [13].

Around 2019, photovoltaics, which have crossed the critical point, are making great strides until new problems emerge.

The geographical distribution of photovoltaic resources "high in the northwest and low in the southeast" is a perfect departure from the "low in the northwest and high in the southeast" of China's electricity demand. This has led to a series of problems: Xinjiang and Gansu, the two provinces with the most abundant light resources in the northwest, have a "light abandonment rate" as high as 30%, which means that 30% of the electricity generated is wasted. An important reason is that the power generation is too far from the power consumption center.

How to transport the electricity from the Tianshan Mountains in Xinjiang to Shanghai alleys 3,000 kilometers away? This became the second question for decision makers.

02. UHV: sending goose feathers for thousands of miles

The solution to the problem of photovoltaic delivery depends on another piece of the puzzle in China: UHV.

To transmit electricity, it is necessary to rely on common high-voltage lines. The higher the voltage, the farther the power will be transmitted. The common high-voltage lines are generally 220 kV, and the UHV, which is an enhanced version of high-voltage lines, is 800 kV, or even 1000 kV volts of high voltage. If ordinary high-voltage lines are electric railways, UHV lines are electric high-speed railways.

Qinghai to Henan ±800kV UHV project construction site, 2020

In 2004, Liu Zhenya, the new general manager of State Grid, advocated direct UHV. However, the launch of the UHV, like the high-speed rail back then, was met with fierce opposition. Some experts "creatively" called UHV a "Clone Tyrannosaurus Rex" plan: in order to increase the supply of meat, all the existing cattle, sheep, pigs and poultry would be used to feed the Tyrannosaurus Rex, which would not be worth the gain [6].

The traditional idea of power generation is to expand the railway network, transport coal from the west to the east, and build power stations by themselves. The dispatch of small power stations is also convenient, the technical difficulty is low, and it can also solve the problem of local employment. The idea of ultra-high voltage is to build large-scale pit-head power stations in the western coal mines to reduce the cost of power generation, and then input them to the eastern big cities through large-scale high-voltage power towers that stretch for thousands of miles.

The opposition believes that the coal that could have been dispersed and transported to small power stations in various places, processed in one place, and then sent out with expensive high-voltage towers, is not just using all cattle, sheep, pigs and poultry to feed the Tyrannosaurus Rex to increase the supply of meat. ?

This is indeed the case: for more than ten years, China's UHV investment is equivalent to five Daqin railways, but the electricity transmitted is only half of the coal generated by Daqin railway. Even if the Daqin Railway is doubled, the investment in railway coal transportation is far less than the investment in UHV construction.

Although the economic account is not wrong, the limitations are also obvious. One sentence summary is: the pattern is small.

The use of railway coal transportation routes, although the current cost is lower, also means that China's energy will be locked on the coal route. Over time, the transmission of clean energy will be a problem that will have to be faced in the future . The decision-making level made a choice between the stubbornness and poetry in front of me and the distance: only a small country can make a choice, a big country needs all of it, and the UHV and the railway will be launched together.

The technical breakthroughs of UHV are not listed below. Let’s first look at the investment amount: Since 2006, the UHV construction has experienced three major investment peaks. After 14 years, the total investment has reached 6,091 billion [8]. You know, the Three Gorges Dam and the Beijing-Shanghai high-speed rail, the investment in a single project is "only" 200 billion.

Through this nationwide grid, more than 500 billion kWh of electricity is transported from the west to all parts of China. More importantly, after 2016, UHV suddenly helped photovoltaics open the door to cost. The "light abandonment rate" in Xinjiang has dropped from 30% to 5%, and in Gansu, where the abandonment of light was equally serious, it was only 2.4%. One of the important reasons is the large-scale access of UHV.

For example, the UHV from Jiuquan, Gansu to Hunan, built in 2017, imported 40 billion kWh of clean energy equivalent to the annual power generation of six Changsha power plants across 2,383 kilometers into Hunan [9].

Another Hami South-Zhengzhou project that acts on Xinjiang has delivered 31.258 billion kWh of electricity, of which more than half is new energy generation. For Qinghai, where the light rejection rate is still very high, UHV is also arranged. For example, the Qingyu UHV DC project is the world's first UHV transmission channel for 100% renewable energy transmission in high-altitude areas. The project starts in Qinghai and ends in Zhumadian, Henan.

In this way, this is the two major tracks of parallel development. The photovoltaic-ultra-high voltage perfect combination point has appeared, and China has gathered the second piece of the new energy competition.

But UHV is not the ultimate panacea for photovoltaic energy. After all, photovoltaics can only generate electricity during the day and turn off at night. If you want to stably access the Internet, the better way is to store energy. In addition, how can the extra electricity be generated better? What about applications?

The third puzzle piece, with controversy, is whizzing.

03. Electric Vehicles: Feedback of Demand

The first thing to note is that China's "production-transmission-utilization" energy triangle is not a pixel-level replica of the United States. The biggest difference is the "use" of this link.

The "utilization" link in the United States at the time was the consumption of oil resources by the huge car ownership, thus making the energy triangle work. At present, China does not have new electricity demand - even if the sales volume of new energy vehicles reaches 50% in 2035 according to the plan of the Ministry of Industry and Information Technology, the growth of electricity demand will not be a steep curve considering the total number of vehicles.

However, the development of new energy vehicles will directly drive the rapid development of another field, which will directly complement the "production-transmission-utilization" triangle. That field is: energy storage.

As mentioned earlier, because of the characteristics of electricity that is produced and used immediately, production and demand need to be strictly matched at any time. For example, if the photovoltaic generates too much electricity during the day, it can only be wasted if it cannot be stored and connected to the grid in time. This is one of the reasons for the serious "abandoned light". To solve the problem of "abandoning light", a very important means is energy storage.

Simply understand, the importance of energy storage is equivalent to why you need a bowl to eat - if you compare electricity to "industrial food", photovoltaic and wind power are "production machines" (to help produce more food) , and UHV power grids are "the Grand Canal". ” (helping to transport more grain) , energy storage is equivalent to a “granary” (helping to store more grain) [11].

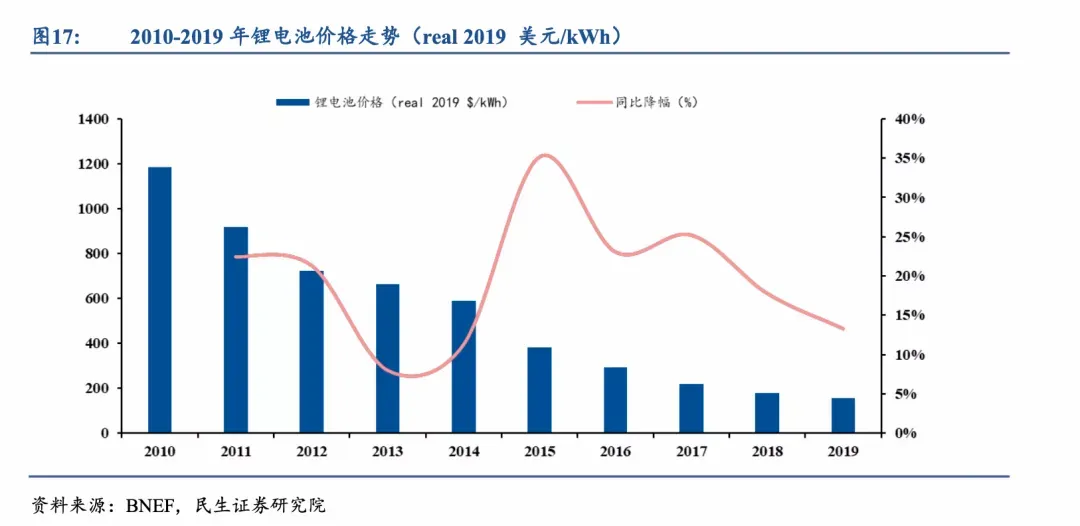

Among various energy storage methods, lithium battery energy storage is undoubtedly the most convenient, but the disadvantage is also obvious: expensive. The cost of energy storage per kilowatt-hour is as high as 0.6~0.8 yuan, which is twice the price of electricity. This directly leads to the fact that it is better to discard the extra electricity than to save it. However, if the cost of energy storage can be greatly reduced, "abandoning light" can be solved.

How to reduce the cost of lithium batteries? A formula called Wright's Law can help with this.

In 1936, Theodore Wright was studying production costs and found that for every cumulative doubling of the number of aircraft produced, the manufacturer would achieve a continuous percentage decrease in cost, such as the cost of producing the 2000th aircraft was higher than the cost of producing the 1000th aircraft. The cost is 15% lower, and the cost of producing the 4000th aircraft is 15% lower than the cost of producing the 2000th aircraft.

Lithium batteries also conform to this law: every time the battery output doubles, its cost will drop by 28%[12] .

And electric vehicles will bring a surge in battery production: an electric vehicle with a range of more than 200 miles is equivalent to 5,000 iPhones, and even if only 1% of vehicle sales are converted from gasoline power to electric vehicles, the demand for batteries is relatively The number of smartphones worldwide will more than double. The popularity of electric vehicles will lead to a decline in battery costs that will re-accelerate.

Lithium battery price trend

To sum up briefly, with the promotion of the outbreak of electric vehicles, the cost of energy storage will continue to decrease, and the cost of photovoltaic + lithium battery energy storage will continue to decrease. According to GTM data, the cost of electrochemical energy storage power stations will drop significantly from 2012 to 2017. 78%. And in the future, by 2030, the cost of energy storage will drop to 1,000 yuan/kWh, and the combination of solar energy storage in most parts of my country can achieve parity.

So far, China's three industries of "photovoltaic-ultra-high voltage-new energy" will make the triangle of "production-transmission-utilization" of energy form a closed loop, and self-hematopoiesis can be continuously strengthened.

The new energy vehicle industry that unlocks the energy storage industry is an important part of closing the energy triangle. It not only brings the photovoltaic market, but more importantly, it helps the Chinese auto industry find a corner.

A strong auto industry has always been the standard of an industrial powerhouse. Needless to say, in Germany and Japan, automobiles in Britain, the United States, France and Italy also account for about 10% of the export volume. However, China's automobile industry has not been too successful after decades of technology-for-market changes, and the living space of its own brands is constantly being replaced. extrusion.

Many industries in China lag behind the United States, not because they cannot do it, but because they cannot form a positive cycle. In the automotive industry, because Europe and the United States started early and have a deep foundation, the industrial chain has long been nested to form a rock-solid ecosystem of automotive interests. Such a strong moat makes Chinese players useless even if they achieve a breakthrough at a single point. If you insist on attacking the whole country, it will not be worth it.

What to do in this situation? Can only wait.

In the past 100 years, the window period of the auto industry has only opened twice. The first time was the Ford T-type assembly line in the 1920s, and the second was Toyota's lean production in the 1970s. The former gave birth to a strong American auto industry. It completely left Europe, and the latter made Japan come from behind to become a car upstart, and it is still the "pillar stone" of the Japanese economy to this day.

The new energy vehicles that have restructured the industrial chain are the third window and the only opportunity that may allow China to overtake a corner in a country's economic pillar industry. In addition, due to the full electrification of the core components of new energy vehicles, more business models have been derived from this, making the automotive industry linked to the Internet and artificial intelligence for the first time.

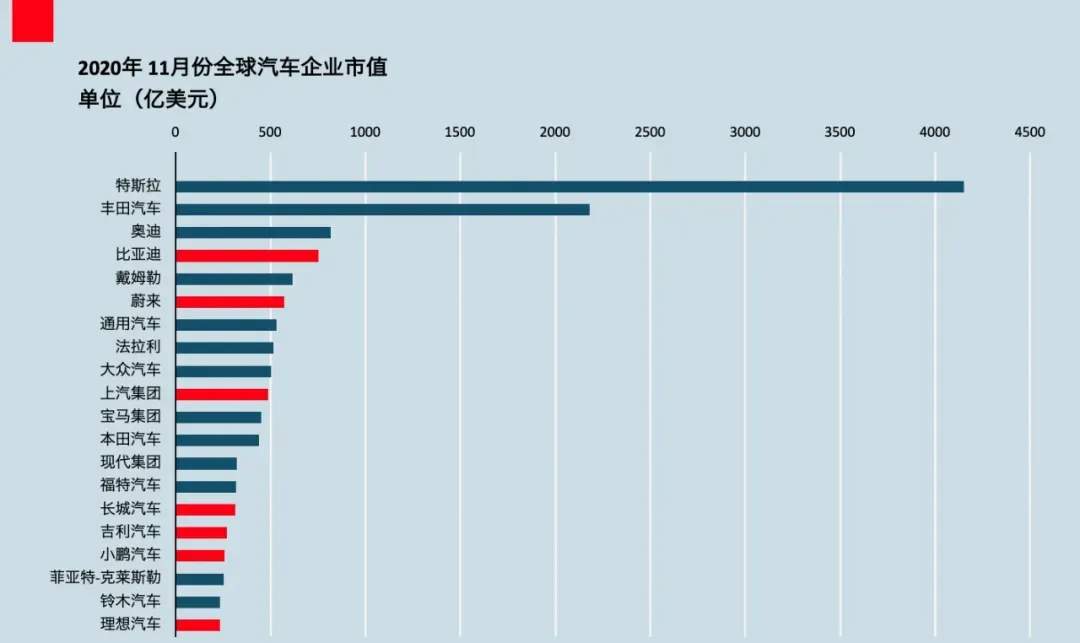

The market has also given high expectations for this reshuffled super track. Tesla sold a total of 500,000 vehicles in 2020, less than one-twentieth of Toyota's sales in the same period, but its market value is several times that of Toyota. In terms of market value, in November last year, BYD's market value surpassed that of Mercedes-Benz, NIO's market value surpassed that of BMW, and even Xiaopeng Motors can be called brothers to Fiat.

With the blessing of electric vehicles, the top ten car companies in the world by market value even entered three Chinese companies, which made Chinese car companies who have been pondering market change technology and overtaking in corners for decades, reaped unexpected surprises.

Market capitalization of global auto companies, 2020

And behind this is also inseparable from the large-scale subsidies of the Chinese government. Since 2013, the total amount of subsidies for new energy vehicles in China has exceeded 300 billion [10], which has directly spawned the world's largest new energy vehicle market and new energy battery market. , as well as new car-making forces that have sprung up like mushrooms after a rain.

On the technical route of new energy vehicles, China has also adopted the same strategy as UHV: I want all of pure electric, hybrid, and hydrogen energy. The routes seem to constrain each other, but it is actually an effective policy philosophy: in the early days of a super track, no one dared to kill the potential technological signs prematurely, and China cannot afford to bet on the wrong route. Stay and go and see.

This kind of pepper-sprinkling-style subsidy has gradually cooled down in 2019, from the early nanny-style comprehensive care to the weaning subsidy, the introduction of catfish Tesla, the subjective initiative of the policy is linked to the level of industry development, compared to blindly subsidizing and blindly opening up , Adjusting the ratio of the "carrot + stick" combination at different stages can better screen out the players who can really play.

Careful readers may find that: China's "production-transmission-utilization" energy triangle is behind the three huge industries of "photovoltaic-ultra-high voltage-electric vehicles". These three industries have very obvious common points: the track They're all super huge, policies are long bets, and they're all chasing, and they've all been successful -- albeit controversial.

What's the secret behind this? Behind this is actually a unique model of Chinese industry overtaking.

04. Epilogue: The Secret of Overtaking

In 2000, Wan Gang wrote to the State Council, proposing the development of new energy vehicles. In the same year, 32-year-old Li Zhenguo founded Xi'an Xinmeng Electronic Technology Co., Ltd. (the predecessor of LONGi) . In the summer of 2005, the National Development and Reform Commission organized a seminar on ultra-high voltage. Half a meter thick material walked into the venue.

Fifteen years later, the cost of photovoltaics is lower than the price of coal, and the market value of LONGi shares is close to 400 billion yuan. The UHV power grid, which has experienced three rounds of construction climax, as the core project of the "new infrastructure" for economic recovery, has been fully restarted, and the investment is expected to reach as high as 180 billion a year. Tesla is mass-produced in China, and the leader of the domestic electric vehicle industry chain represented by the Ningde era has begun to rise.

Behind all coincidences, there are certainties.

At the level of industrial law, electricity has reached the critical point of surpassing oil at the technical level. The energy industry is divided into 4 segments: production, transportation, storage and application. With the dual clamping of technology and scale effects, large-scale cost reductions have occurred in these four links, which is the basis for the arrival of electrification transformation.

At the level of industrial policy, China has always been characterized by super track, long betting, and chasing . Rather than accurate predictions, China is more of a deep-stacker, using its huge stacks to make extensive bets on a super track in search of doubling returns.

New energy power generation field: The global energy market exceeds 5 trillion US dollars, and China is simultaneously betting on multiple new energy sources such as photovoltaics and wind power. Once technological breakthroughs occur, Chinese companies will rapidly expand production relying on huge production capacity, occupying 70% of the global photovoltaic power generation. % or more of capacity.

Energy Transmission: The power equipment market exceeds $2 trillion. China also placed bets on UHV power grids and coal transportation lines. When China's UHV technology was nationalized, China immediately set off a wave of UHV investment, and even exported its production capacity to Brazil, Kazakhstan and other places, becoming a global UHV construction project. "General Contractor".

New energy vehicle field: The global auto market exceeds 3 trillion US dollars. At the same time, China is betting on pure electric vehicles, gasoline-electric hybrid vehicles, and even hydrogen energy. When China masters battery technology, its production capacity has skyrocketed to more than 70% of the world's, and new energy vehicle sales have exceeded 50% of the world's.

It is precisely because of this saturated betting on the big track that it waited for the final result. But there is hardly a second example of this rare ability to saturate the race track.

On the one hand, China has enough chips to bet on the track, and for small and medium-sized countries with insufficient financial strength, industrial policies often face the difficulty of choosing one or the other, and every bet is still very risky, let alone multiple games. Bet multiple times. Of course, this frenzied betting model requires fiscal discipline, timely correction, and severe punishment for cheating.

In the field of new energy vehicles, Japan does not actually continue the myth as it did in the last century: test the water and pure electricity, and try it out; develop hybrid vehicles, but the world ignores it; bet on hydrogen energy, the future is far away. It is worth noting that the hydrogen energy route that Japan is betting on is not technically weak, but because the domestic demand market is too small and the external market does not accept it, it is difficult to become the mainstream.

More importantly, for China, which has 38% of the world's manufacturing capacity, as long as it breaks through the core technology of a track, it can be combined with its own large-scale manufacturing capabilities, and it will completely crush the competition in terms of cost and scale. opponent. Although the names of "developed country grinder" and "overseas middle-class grinder" are exaggerated, they actually have some truth.

The outflow of manufacturing that was interrupted by the epidemic actually gave China an excellent period of strategic opportunity. You know, the counterattack plan on the other side of the ocean has been put on the agenda.

Taking photovoltaics as an example, according to the data of the American Solar Energy Association (SEIA), during the Trump term, the photovoltaic industry in the United States is basically standing still. However, within a week of taking office, Biden signed a series of executive orders on the development of renewable energy, showing a nurse-like care for the photovoltaic industry. As soon as China announced that it will be carbon neutral by 2060, Biden announced that the United States will bring the number forward to 2050.

China, which has gathered the "big triangle", will start a real energy competition with the United States.

Academician Ding Zhongli said before: Emission right is the right to development, and it is a basic human right for developing countries . The energy competition behind "carbon neutrality" will affect China's industrial layout, the quality of China's development, and the future living space of our nation.

The full text is complete. Thank you for your patience in reading.

References:

[1] CITIC Futures, a century of crude oil prices

[2] The Legend of American Business Tycoon, Documentary

[3] Carbon Neutral Feature Series: Twelve Long Slope Tracks under the Carbon Neutral Commitment, Huatai Securities

[4] Behind Shi Zhengrong's defeat of Suntech in Wuxi, Li Shi Business Review

[5] In the era of parity and low price, China's photovoltaic industry has entered a period of stable growth. Industrial Securities

[6] Chronicle of electricity shortage

[7] Wulu and Lanlan: A Chronicle of Century Engineering Decision-making and Construction, Zhang Guobao

[8] Jiuquan-Hunan UHV transmission project put into operation can meet 1/4 of Hunan’s electricity demand, Xinhua News Agency

[9] Silent contest, four handshakes behind Tesla's entry into China, Fantong Dai boss

[10] Looking for one of the topics of Tesla in China: energy storage, Guosen Securities

[11] Carbon Neutrality Special Series: Twelve “Long Slope Tracks” under the Carbon Neutral Commitment, Huatai Securities

[12] BigIdeas 2021, ARK Invest

[13] The power of cycles, the edge of growth - 15-year review and prospect of Xingye Dianxin photovoltaic industry, Xingye Securities

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…