一個懶散的地球人

Talking about Olympus DAO: Decentralized Central Bank

Summary:

1. Olympus DAO is an algorithmic stable currency protocol. It is the first attempt to issue a stable currency protocol that is not linked to the price of the US dollar, but is linked to purchasing power. Inflation-affecting currencies that can be used as stable units of account, establishing a solid and reliable foundation for a crypto-economic system.

2. Olympus DAO uses the digital currency assets locked in the protocol vault as a reserve, and gradually releases and issues its token OHM.

3. Olympus DAO proposes the concept of liquidity bonds, which allows users who provide liquidity to OHM to purchase OHM token bonds at a discount from their own liquidity pool shares, while Olympus DAO obtains liquidity pool shares as a reserve to ensure that no There will be a catastrophic liquidity drying up and a price crash.

4. OHM holders can choose to pledge to obtain more OHM rewards, or after investing in the designated liquidity pool, they can purchase OHM bonds at a discount of the liquidity pool shares. The minimum price of OHM will not be lower than 1 USD.

5. Olympus DAO introduces the game theory of economics, allowing users to obtain a high annualized rate of return after providing liquidity and staking, while establishing its own cash flow to give back to the community, reducing the risk of token selling and creating a win-win situation .

Foreword:

Stablecoins play a very important role in the field of cryptocurrencies. On the one hand, they are a bridge between the traditional financial market and the cryptocurrency market, and on the other hand, they also provide benchmarks for quotations and liquidity between different cryptocurrencies. However, almost all stablecoins, whether backed by algorithms or cash reserves and coupons in traditional finance, are linked to the price of legal tender (such as US dollars), which is essentially not much different from legal tender in bank accounts. It also means that stablecoins will be influenced by central banks, government policies, and the domestic economy.

Olympus DAO is an algorithmic stablecoin protocol. It is the first to try to issue a stablecoin protocol that is not tied to the price of the US dollar, but is tied to purchasing power. And it can be used as a currency for a stable price unit, establishing a solid and reliable foundation for the cryptocurrency economic system.

How the Olympus DAO works:

Olympus DAO uses the digital currency assets locked in the protocol vault as a reserve, and gradually releases and issues its token OHM. Users can go to the decentralized exchange SushiSwap to exchange for OHM from the OHM/DAI liquidity pool to obtain OHM, or provide OHM and DAI to the liquidity pool to obtain SushiSwap liquidity pool share tokens, and use the liquidity pool share tokens to buy OHM bonds. In addition, OHM tokens can also be used for pledge. 90% of the new OHM tokens released by Olympus DAO will be distributed to users who pledge OHM, and the remaining 10% will be owned by the protocol vault.

The general stablecoin protocol can recover the digital currency assets locked in the vault by destroying the tokens. However, Olympus DAO proposed the concept of liquidity bonds, which allows users who provide liquidity to OHM to purchase at a discount from their own liquidity pool shares. OHM token bonds, and Olympus DAO obtains the share of the liquidity pool as a reserve vault to ensure that there will be no catastrophic liquidity depletion and currency price collapse, which is equivalent to a permanent and irreversible vault lock-up.

Olympus DAO initially created a liquidity pool with a quotation of 1 OHM = 14 DAI. As long as the price of OHM is higher than DAI, the protocol will gradually mint and issue new OHM to the market. Only when the price of OHM is lower than DAI will the locked assets in the vault be sold and OHM will be destroyed in equal value until the price of OHM is the same as DAI. Since the price of DAI is close to USD and Olympus DAO mints (sells) new OHM at quotes above 1 DAI and burns (repurchases) old OHM at quotes below 1 DAI, this ensures that the vault reserves will always be sufficient to recycle all The released OHM, and the minimum price of OHM will not be lower than 1 USD, forming a stable currency with only a price lower limit but no price upper limit.

Unshakable treasury, Protocol Owned Liquidity:

Olympus DAO believes that the liquidity pool assets in the decentralized exchange are borrowed, even the locked assets in the lending protocol are borrowed. In the event of drastic market price changes, users will redeem liquidity in order to avoid losses or liquidation, resulting in the drying up of liquidity and more serious price fluctuations and runs. Olympus DAO proposed the concept of liquidity bonds, selling its own token OHM at a discounted price in exchange for the user's share of the liquidity pool, and the user received additional OHM tokens at a lower than market price after the bond maturity date. This makes the protocol no longer "borrow" liquidity from the market but "own" it directly, which is of great help to the normal operation of the protocol and the stabilization of token prices.

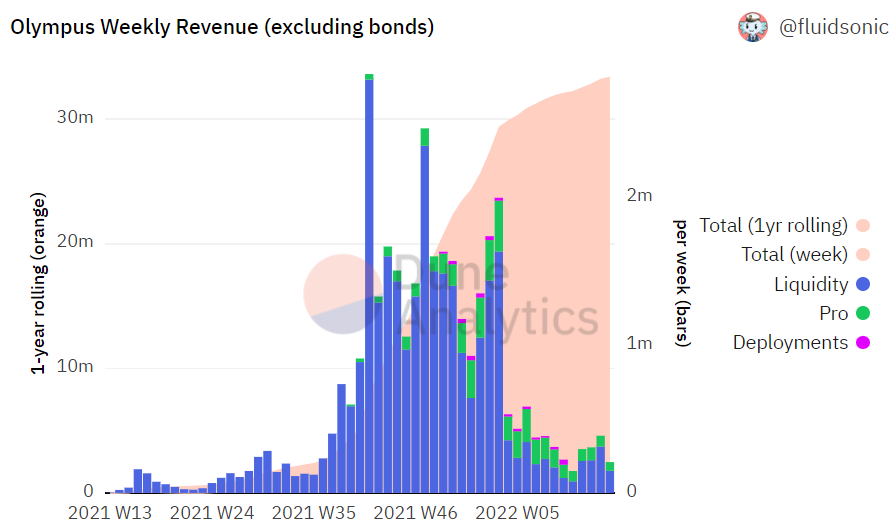

Another advantage of the protocol’s direct liquidity is that the assets of the reserve vault are no longer just passive lock-ups, but a share of the liquidity pool that can generate income. According to the statistics on the chain , in the past year, the AMM transaction fee collected by the Olympus DAO Reserve Vault from the liquidity pool has reached nearly 30 million US dollars. This does not necessarily mean the user's loss, because the user can get 90% of the treasury income by staking OHM, and selling the liquidity pool share to exchange the discounted OHM token bond means that the user no longer needs to bear the burden of liquidity mining. Impermanent loss.

(3, 3), from intrigue to coexistence and prosperity:

How to maintain the liquidity of the protocol tokens and reduce price fluctuations has always been a topic faced by cryptocurrencies. When the price rises, people tend to chase the price and compete to buy, and when the price falls, they panic and sell irrationally. This makes the cryptocurrency market an intriguing casino, where people plunder other people’s assets while investing their own money, until a winner emerges and the liquidity scavenger runs away. It not only caused losses to many people, but also made people lose confidence in protocol functions and token value. The lack of follow-up liquidity made it difficult for team projects to continue operating and fell into a vicious circle.

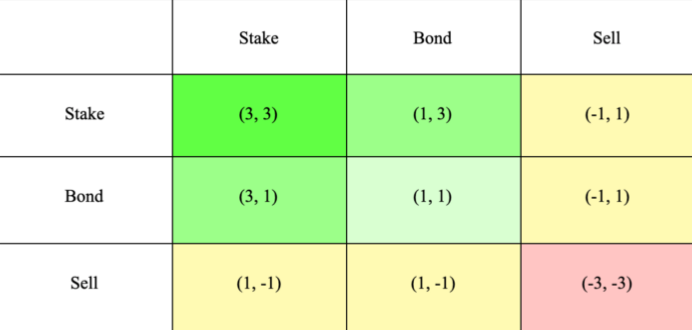

In view of this, Olympus DAO proposes a concept and user incentives that can allow the project team to operate for a long time, and this design is called (3, 3). (3, 3) represent that participants in the cryptocurrency market can make 3 choices at any time, namely sell (Sell), buy bonds (Bond), and pledge (Stake). Selling tokens will cause the price of the token to drop and reduce the liquidity of the protocol. Buying bonds is equivalent to buying tokens to provide liquidity to the protocol, while staking will remove the supply of tokens from the market, causing shortages and rising token prices. , the liquidity of the protocol and the rise and fall of the currency price depend on each other's choices.

Since the healthy functioning of the protocol depends on the behavior of different participants, it can be simulated by the prisoner's dilemma in game theory. Buying bonds provides liquidity, resulting in a +1 effect; staking provides liquidity and holds it for a long time, resulting in a +3 effect; if one of the parties sells tokens, it will offset the positive help from buying bonds and staking. Make the seller gain (+1) and the holder lose (-1); if both parties sell tokens, it will jeopardize the stability of the agreement and cause both parties to suffer losses (-3, -3); when both parties sell tokens Both determine that when staking will have the greatest positive effect, it will form a win-win situation (3, 3).

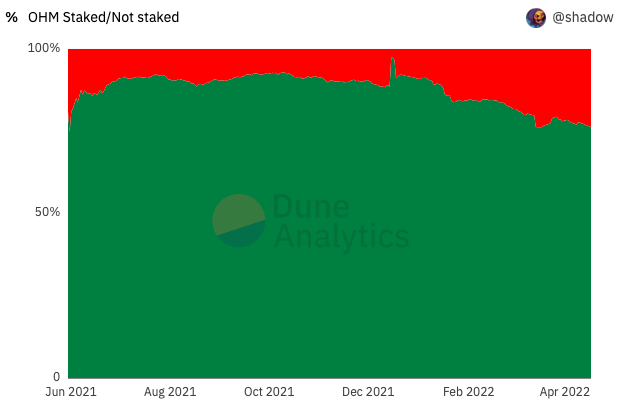

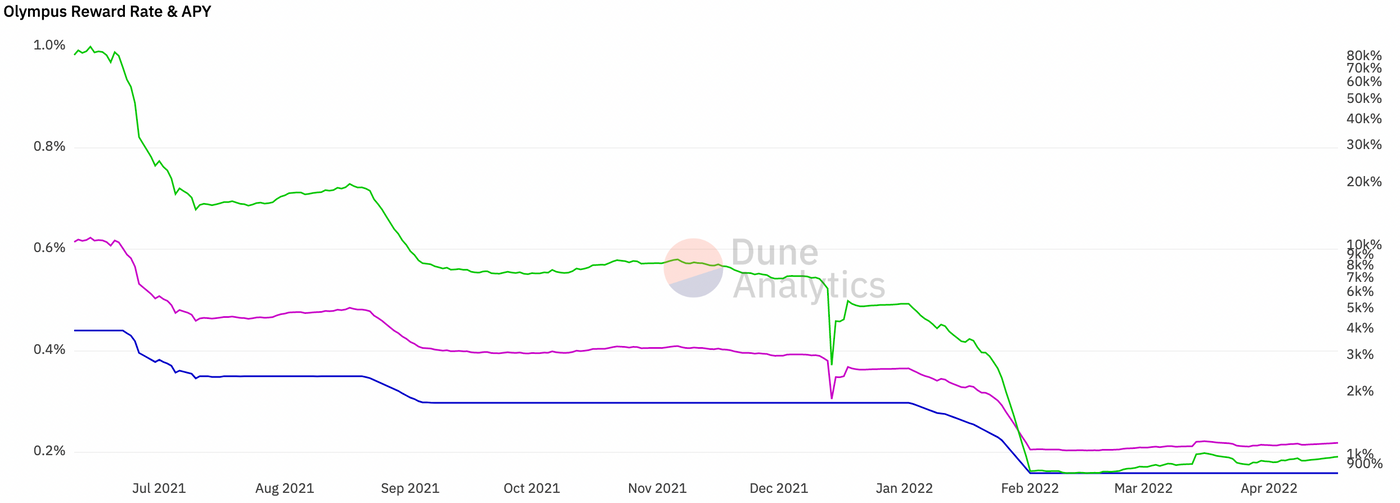

The success of Olympus DAO in the design of the operating mechanism, since the establishment of the protocol, the pledge rate of OHM has remained above 75%, and the concept of its own liquidity and bonds has been adopted by many follow-up projects, making Olympus DAO has become the protocol that has been copied the most times and has the most fork imitations after Uniswap. The large amount of locked liquidity pool shares in the treasury also generated considerable cash flow for the protocol itself and users who pledged OHM. In the first 8 months of the protocol's establishment, the annualized rate of return for pledged OHM exceeded 7000%. The current pledge APY is close to 800%.

Conclusion:

As a protocol for algorithmic stablecoins, Olympus DAO has come up with many novel experimental and innovative ideas. Sell its own tokens through bond discounts to exchange incentives for the protocol's own liquidity reserves; Olympus DAO also introduces the game theory of economics, allowing users to obtain high annualized returns after providing liquidity and staking , while establishing its own cash flow to give back to the community, reducing the risk of token selling and creating a win-win situation. The minting and destruction mechanism of OHM ensures that the price of OHM cannot be lower than 1 USD; the share of the liquidity pool with a large number of locked positions in the vault is similar to the value of OHM endorsed by various digital currency assets, thereby generating a “basket of digital currency”. Commodities” are linked to purchasing power. However, its success has also attracted many copycats. Each project claims to provide a more attractive APY rate of return in an attempt to divide the market. How to gain the favor and consensus of users among many algorithmic stablecoins will be Olympus DAO Issues that must be faced in the future development path.

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…