https://linktr.ee/penfarming 金融職人|文案編輯|雜食性閱讀者|Heptabase 愛用者 🌐 區塊鏈科普網站【鏈習生】專欄作家 🗞️ 電子報【創作者經濟IMO】主編 👤 臉書專頁【閱讀筆耕】

Reading Bigeng|DeFi What is decentralized finance?

This article is excerpted from the popular blockchain science website "Chainee" . What is DeFi? DeFi’s operating methods, application scenarios, and investment risks will be read one article at a time . Let’s take a look at the ecology of decentralized finance!

👉Collect the Writing NFT version of this article👈

The emergence of blockchain means that we no longer need to rely on centralized institutions such as "traditional banks" for asset transfers. Instead, we can realize the ideal of "finance without borders" through the blockchain-driven DeFi decentralized financial system. . What exactly is DeFi? What is decentralized finance? What are the common DeFi applications?

This article will cover the concepts ofblockchain and Bitcoin . If beginners are not familiar with blockchain technology, they can read these two popular science articles first.

What is DeFi?

The full name of DeFi is Decentralized Finance, which is translated into Chinese as "decentralized finance". DeFi generally refers to a financial system that uses smart contract technology to operate. Unlike traditional finance that relies on the operation of centralized institutions, Defi can automatically perform financial services such as transfers, transactions, and loans to achieve a decentralized financial system.

In the transaction process of users using DeFi, there is no intervention by centralized institutions (such as banks, governments, securities firms) or manual review. It is an open, transparent and borderless financial service that anyone can participate in.

How does DeFi work?

≣ What is a smart contract?

Smart Contract is a program code on the blockchain. When specific conditions on the program code are met, the corresponding action will be automatically executed, which is very similar to the operation of a vending machine.

Imagine that when you go to the vending machine, you see some delicious snacks or drinks, and then you put in coins and select the product, it is like "specific conditions are met" of the smart contract, and you pay the fee , letting the machine know you want to buy something.

Next, the vending machine starts working. It checks whether the amount you invest is enough, and then distributes the corresponding products based on your selection. This is like a smart contract that "automatically executes corresponding actions." The machine automatically performs the results you want based on your operations.

In general, smart contracts and vending machines operate in similar ways. The former runs on the blockchain, with specific conditions set in advance. When these conditions are met, corresponding actions will be automatically performed; the latter automatically sells goods based on consumers' coin input and selection. This automated mechanism gives smart contracts the ability to implement various interesting functions on the blockchain.

≣ How DeFi works

Now that we understand what a smart contract is, let’s take “lending” financial services as an example to explain how DeFi operates.

Suppose there is a DeFi lending platform that allows users to freely borrow or lend cryptocurrencies without relying on traditional banks or financial institutions as middlemen. The platform uses smart contracts - which clearly define the rules and conditions for both borrowers and lenders, such as interest rates, terms, etc. - to automate the lending function.

A wants to borrow 10 Ether coins.

B is willing to lend 10 Ether coins.

Both A and B have established accounts on the platform and deposited their guaranteed funds (margin, collateral) into the smart contract.

The execution process of the smart contract is as follows:

A initiates a loan request on the platform, borrows 10 ETH, and agrees to repay the principal with interest within a certain period of time according to a certain lending rate.

The smart contract automatically checks whether there is enough margin in A's account to borrow 10 ETH. If the conditions are met, the contract will be executed.

The contract transfers 10 ether from B's account to A's account, while locking the collateral provided by A in the contract.

During the term of the loan, A must pay interest and repay the principal to B. Once the repayment is overdue, the smart contract will automatically implement corresponding punitive measures, such as confiscation of the deposit.

In this case, the smart contract acts as an intermediary in the lending process, automatically executing the lending transaction without the involvement of a third party. This makes the lending process more efficient and transparent, and there are no potential trust issues during transactions.

The difference between DeFi and CeFi

The concept opposite to DeFi is called CeFi (Centralized Finance), which is translated into Chinese as "centralized finance". The biggest difference between the two is that "the objects of trust are different."

CeFi operates based on people's trust in centralized institutions. For example, in traditional finance, we need to rely on centralized institutions such as banks and governments as third parties to use various financial services.

DeFi operates based on blockchain smart contract technology. The basis of trust comes from code (code is law) and does not require a centralized organization to use financial services.

Let us also compare the difference between DeFi and CeFi in terms of “lending”:

≣ CeFi Advantages and Disadvantages

Centralization ❌ The lending services of traditional banks require the participation of middlemen (such as the Joint Credit Information Center), which results in higher transaction costs.

Cumbersome application process ❌ Traditional bank loans may require filling in a large number of forms and documents, which increases the processing time and procedures.

Geographic limitations ❌ In some areas, especially developing countries, it may be difficult for people to access the services of traditional banks.

Security ⭕️ Traditional banks are regulated and have a long-term and stable operating history, providing higher security.

Credit Rating ⭕️ Traditional banks usually have a complete credit rating system and provide more suitable lending conditions based on the customer’s credit status.

Customer Service Support⭕️ Traditional banks provide dedicated customer service support departments to help customers solve various difficult problems.

≣ DeFi Advantages and Disadvantages

Decentralization ⭕️ Through pre-defined rules and conditions, smart contracts can automatically execute all transactions without the intervention of intermediaries, which brings greater autonomy and transparency; it also saves the fees charged by middlemen during transactions.

Low participation threshold ⭕️ Compared with traditional banks, using DeFi services does not require cumbersome form documents, identity verification and other requirements, and users can participate easily.

Openness (no borders) ⭕️ Anyone can join and use the DeFi platform freely and equally.

High Liquidity ⭕️ Due to the borderless nature of DeFi, users around the world can trade on the DeFi platform 24/7, which provides higher liquidity.

Technical Risk ❌ Smart contracts may have loopholes, leading to potential loss of funds. In addition, due to the lack of supervision by a central agency in DeFi, once something goes wrong, users usually have no recourse, further increasing risks.

Regulatory Compliance ❌ Currently, the DeFi field faces regulatory challenges, and a lack of compliance may lead to legal risks, thereby limiting the widespread adoption of DeFi.

The operation is not easy ❌ For newbies in the currency circle, using the DeFi platform is a relatively advanced operation, including hot wallet management, smart contract signing, etc., which is difficult, let alone users who have never been exposed to cryptocurrency.

*

Based on the above, we use a table to compare the differences between DeFi and CeFi.

DeFi four major values

≣ Value 1: Decentralization

DeFi does not rely on the operation of centralized institutions, but automatically executes transactions and services through smart contracts, which eliminates trust issues and effectively reduces the costs and risks caused by centralized operations. More importantly, since the intermediate costs of centralized institutions are eliminated, the profits generated by all financial services can be returned to the users who provide value, allowing users to enjoy the benefits they deserve.

≣ Value 2: Global (open, transparent)

Regardless of nationality, race, gender, age, class, wealth or political stance, everyone has equal rights to use DeFi, and no one is excluded; in addition, all transactions and contracts are public and anyone can view and Verify transaction data on the chain, which increases the transparency and security of the system.

≣ Value three: low cost, high efficiency

DeFi removes the costs and fees incurred by many centralized institutions and provides lower-cost transactions and financial services. And the Defi system operates through smart contracts, so users can conduct transactions at any time, which improves the liquidity of assets and greatly improves market efficiency.

≣ Value Four: Financial Innovation

The development of DeFi has also spawned a wave of new financial products, such as Liquidity Collateral Derivatives (LSD) and the Real World Assets (RWA) track. These innovations allow more value to enter the DeFi ecosystem.

In terms of the value of RWA, the biggest benefit is to increase the market liquidity, usage efficiency and transparency of assets.

Whether it is gold, real estate, debt, art or ownership, these tangible or intangible values can be represented in the form of tokens on the blockchain. For example, in July 2023, a holder of the luxury brand "Patek Philippe" mortgaged his watch and turned it into a tokenized debt certificate. In this way, he successfully borrowed a loan of US$35,000 from a stranger, similar to the blockchain of pawnshop transactions.

This initiative not only provides creditors with more diverse ways to recover funds, but also demonstrates the practical application potential of "asset tokenization" to everyone.

The four major tracks of DeFi applications

There are countless DeFi application projects in the blockchain industry, so we have selected the four most common categories of DeFi application tracks, namely decentralized exchanges, pledges, lending protocols and derivatives protocols.

In addition, we also introduce the largest Defi platform among these four categories of DeFi tracks based on the TVL (Total Locked Value) ranking of the data platform DeFiLlama .

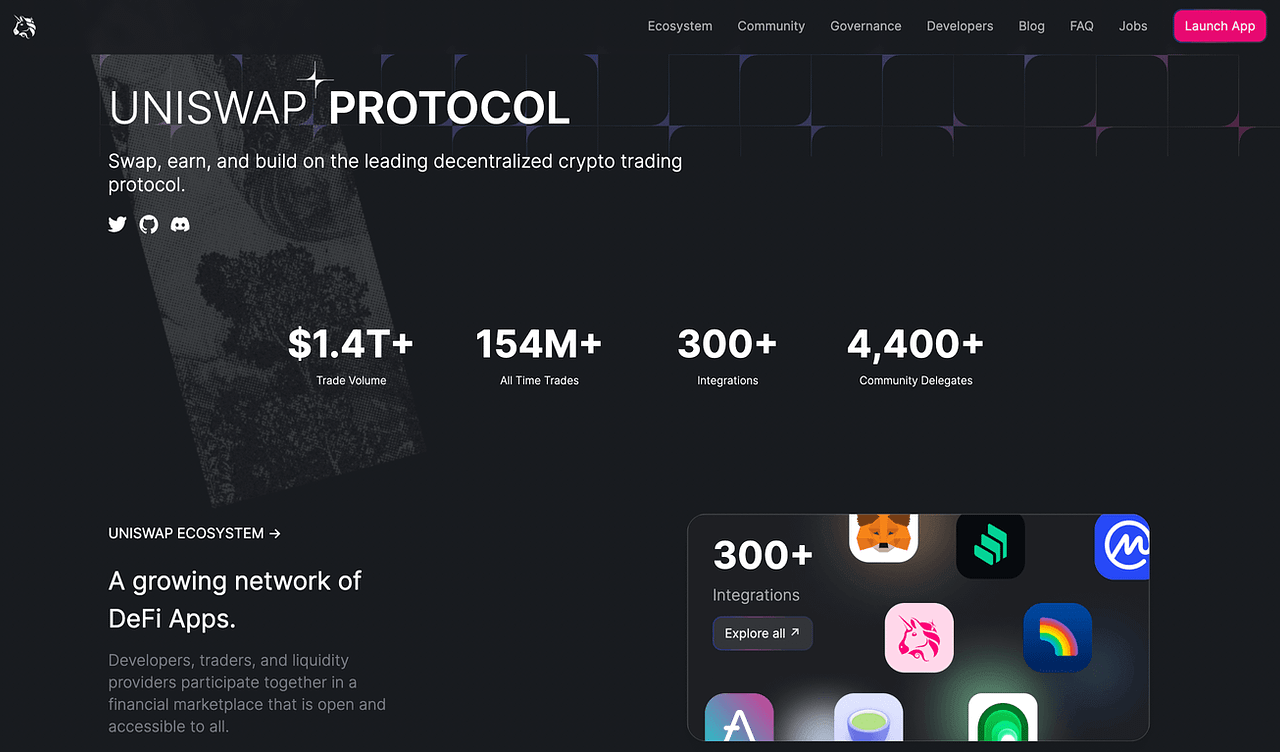

≣ DeFi Track 1: Decentralized Exchange (DEX)

【Decentralized Exchange】

Decentralized exchanges are an important member of the DeFi ecosystem. These exchanges are built on the blockchain and use smart contract technology to allow users to conduct transactions without the need for third-party intermediaries.

In DEX, there are multiple trading pools, and the liquidity of these pools is provided by users. We use the term “swap” to describe the act of exchanging cryptocurrency to these pools, which is different from traditional pending order transactions:

Users can directly exchange coins in the trading pool to complete the transaction "instantly" without waiting for confirmation from the exchange.

Moreover, the handling fees when exchanging coins will also be "allocated" to users who provide liquidity to the pool.

提供流動性將加密貨幣添加到中心化/去中心化交易所的交易池中,以便其他用戶可以在該平台上進行兌幣,這樣的動作叫做「提供流動性」或「添加流動性」。[Uniswap, the leading decentralized exchange]

Uniswap is built on the Ethereum blockchain and is the largest decentralized exchange (DEX) in the entire cryptocurrency industry.

This DEX faucet was created by Hayden Adams, a former Siemens mechanical engineer, in November 2018. It was inspired by articles by Ethereum founder Vitalik Buterin and discussions on the American Village Forum reddit.

On Uniswap, there is a group of liquidity providers who put cryptocurrencies into Uniswap, thus establishing one trading pool after another, allowing buyers to trade easily because they do not need to find matching buyers in the spot market. home or seller.

Unlike traditional markets that require "order books" to wait for transaction matching, Uniswap uses a technology called "Automated Market Maker (AMM)", which is a smart contract that can adjust the price of tokens according to specific rules, allowing users to Can be freely exchanged between different currencies.

Uniswap is very decentralized. Anyone with sufficient liquidity can list their own tokens on Uniswap without paying any listing fees. This makes Uniswap like a public resource, bringing more convenience and choice to the entire cryptocurrency community.

≣ DeFi Track 2: Liquid Staking

【Liquidity Staking】

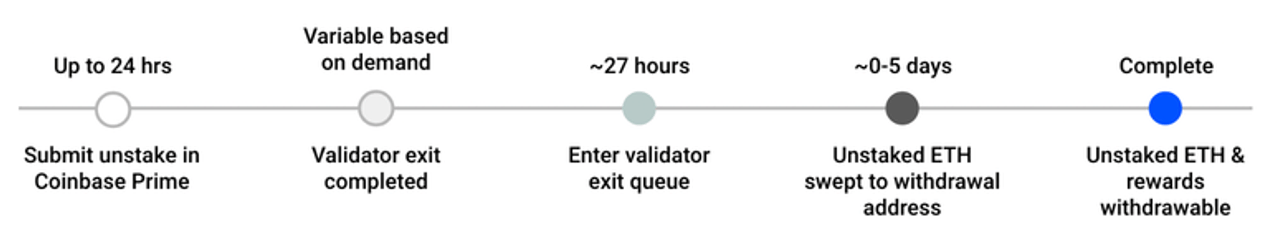

Staking is a mechanism for participating in the operation of cryptocurrency. Users lock the tokens they hold to the blockchain validator (Validator). On the one hand, they contribute to "maintaining the security and efficiency of the blockchain" and at the same time, they can also earn money. Get rewards, usually in the form of the blockchain’s native cryptocurrency.

Take "Ethereum 2.0 Pledge" as an example. The way to participate is to own a certain amount of Ethereum coins and apply to become a node in Ethereum 2.0. Users must deposit (lock) at least 32 Ethereum coins to participate in this service. If you want to unstake (unlock the tokens) you usually have to wait a week, so what if you need funds urgently?

As a result, liquidity staking solutions such as Lido and Frax Finance have emerged on the market, which provide liquidity to stakers of Ethereum and other blockchains.

[Liquid staking leader: Lido]

Lido is a platform founded in 2020, built on the Ethereum 2.0 blockchain and founded by the P2P Validator team.

In the Ethereum 2.0 network, validators and node operation facilities are required, and this is the service provided by Lido. Lido's goal is to make staking more friendly and easier, helping users participate in staking and release locked funds, increasing liquidity .

In the past, there may be many problems in participating in staking, such as the need to lock 32 Ethereum coins, which may be a relatively high threshold for ordinary users to participate. Lido's service solves this problem, allowing users to participate in staking by investing only a small amount of funds, and at the same time, they can withdraw funds at any time, increasing the flexibility of the use of funds.

The specific method is that users pledge Ethereum (ETH) and obtain stETH certificates at a ratio of 1:1, and can enjoy staking rewards without operating nodes. In addition, stETH can not only be directly exchanged back to ETH at a 1:1 ratio, but can also be traded on other platforms, so that users' funds will not be locked and capital liquidity can be released.

stETH 是Lido 發行的ETH 的錨定代幣,其價值與ETH 1:1 掛鉤。用戶獲得的質押獎勵也會以增發stETH 的形式發放給用戶。Lido currently provides staking services for five public chains including Ethereum 2.0, Polygon, Solana, Polkadot, and Kusama.

≣ DeFi track three: Lending Protocol

【Loan Agreement】

協議(Protocol)指的是一個使用智能合約提供去中心化交易的市場或工具。The DeFi lending protocol uses smart contracts to replace banks as the intermediary between borrowers and lenders, allowing users with idle funds to lend funds and earn interest. Users who need funds can successfully lend funds at the cost of a certain interest.

Users who want to participate in the lending agreement first deposit cryptocurrency into the DeFi platform as a guarantee. The smart contract automatically matches the borrowers and lenders based on the previously defined rules and conditions, and directly issues loans to borrowers who meet the transaction conditions, without the need for banks or other parties. Involvement of intermediaries.

Common lending protocols are Aave and Compound.

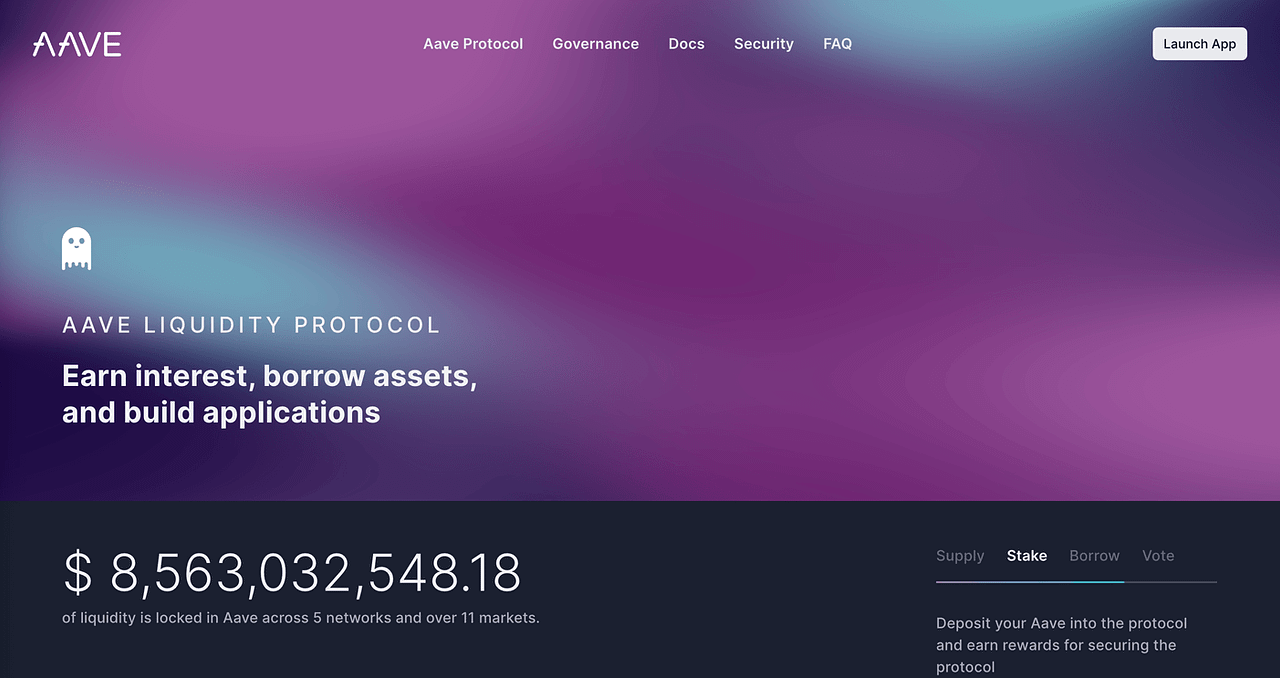

[Leading Lending Agreement: Aave]

The Aave protocol is the largest DeFi lending protocol on Ethereum.

Aave was founded by Finnish Stani Kulechov in 2017 (then named ETHLend) and was officially launched on the Ethereum blockchain in January 2020; in the traditional financial system at that time, lending services were often stuck with many thresholds and The middle steps include high interest rates, expensive handling fees, and cumbersome documentation requirements. These restrictions make it difficult for many people to easily obtain fair and reasonable lending services.

The emergence of Aave is to solve these problems. Borrowers can be automatically matched directly with fund providers (lenders) without going through banks or other intermediaries. This makes the lending process faster and more convenient, and can obtain more Competitive interest rates and low fees - Aave's purpose is to establish a fairer, transparent and open Defi lending protocol structure. This spirit is also reflected in its logo, which is a "ghost" pattern.

Aave is famous mainly because it pioneered the "flash loan" service, which allows users to borrow money without providing collateral. They only need to complete the repayment of the loan principal and interest in the "same block". You can conduct transactions smoothly.

閃電貸閃電貸款是去中心化金融世界中一種新型的無擔保貸款,在2018 年由Marble 所推出,後來由Aave、dYdX 普及,其特色有: 1. 不用抵押品:借款人無需提供抵押品。 2. 借貸迅速即時:借款和還款均在同一筆交易中,必須在一個區塊時間完成,否則這筆交易就會被撤銷。 3. 透過智能合約完成:由程式碼設定閃電貸的具體條款,進行借貸。在一般的借貸關係中,抵押品的存在是為了確保借款人能夠還款。而大部分DeFi 借貸項目中,並沒有傳統銀行的KYC 與借款人風險評估,更沒有聯合徵信社來調查借款人的信用,所以確保借款人能還款的方式是要求其提供大於借款價值的抵押品,俗稱「超額抵押」。而在閃電貸的服務中並沒有抵押品,那麼有辦法確保借款人能順利還款呢?區塊鏈技術使之成為可能:由於區塊鏈的交易必須在礦工將交易納入區塊中,將區塊上鏈,並且大部分節點接受這個區塊後才算確認。這代表著,在交易成功上鏈之前,一切都是可以被撤銷的;閃電貸運用了這項機制,在智能合約中要求借款和還款必須在同一個區塊被上鏈,解決了還款的問題。

≣ DeFi Track 4: Derivatives Protocol

【Derivatives Agreement】

A derivative is a contract that relies on changes in the value of an "underlying asset".

The value of a derivative adjusts as the price of something (e.g. a stock, Bitcoin) changes. Although you do not need to actually own these things, you can participate in them by signing derivatives contracts and share the risks and opportunities brought about by price changes in these things.

Similar to the lending agreement, the derivatives agreement is also designed to expand the functions of the DeFi ecosystem and provide more contracts such as futures, options, leveraged tokens (Leveraged Tokens), synthetic assets (Synthetic Assets), etc., so that participating users can have more Trading strategy selection.

Common derivatives protocols include dYdX, GMX and Perpetual Protocol.

[Leader of Derivatives Agreement: dYdX]

dYdX is built on the second layer (Layer2) of Ethereum and is a decentralized "derivatives" exchange. It was launched in 2018 and mainly provides two trading services: "perpetual futures contracts" and "margin trading".

Unlike most decentralized exchanges, dYdX uses an order book model , allowing buyers and sellers to place orders at the prices they want, and then the system will match counterparties based on these prices. This design helps create greater transaction depth , which means more people participate in transactions, making it easier to find suitable trading partners.

However, in June 2022, dYdX announced that it would move to the Cosmos ecosystem in the next version (dYdX V4). This decision was made because on the original Ethereum network, transaction speeds were becoming slower and slower, and the processing power was insufficient to meet the growing transaction needs of dYdX. Therefore, dYdX hopes to change the environment and provide users with a better trading experience.

Recently, in July 2023, dYdX has been put into public testing on Cosmos, paving the way for its official launch in the future.

*

In addition, DeFi projects provide a wide range of financial services, including Stablecoin, Liquidity Mining/Yield Farming, Liquid Staking Derivatives (LSD), Real Word Asset (RWA), Insurance, Cross-chain Bridge, etc. are relatively advanced contents and will not be introduced one by one in this article.

🌱 Welcome to subscribe to the [Creator Economy IMO] newsletter.

https://creatoreconomyimo.substack.com/threads

🌱 Join [ Zhongshu Nervous System ] around the stove, and the special topics #Reflections on Writing and#热内真情are being serialized.

🌱 I appear on other platforms【 Facbook | Twitter | Liker Social | Matters | Vocus 】

Cooperation contact: penfarming.writer@gmail.com

🌱 My teaching materials and invitation links

Register on Binance

Register Presearch | Search to earn three birds with one stone. User experience .

Register for MEXC | Matcha Exchange, redeem OSMO and play wool .

Register Potato | Learn three things from Potato Media .

Like my work?

Don't forget to support or like, so I know you are with me..

中書神經系統

1. 關注各種有關書的消息。 2. 長文:專題 #寫作的反思 與 #爐內真心話 連載中。 3. 短文:每日「鏈習生幣圈日報」新聞的盤後觀點 murmur 眾聊。

Comment…