https://linktr.ee/penfarming 金融職人|文案編輯|雜食性閱讀者|Heptabase 愛用者 🌐 區塊鏈科普網站【鏈習生】專欄作家 🗞️ 電子報【創作者經濟IMO】主編 👤 臉書專頁【閱讀筆耕】

Read Bi Farming|How much cryptocurrency is in your asset allocation ratio? (with teaching)

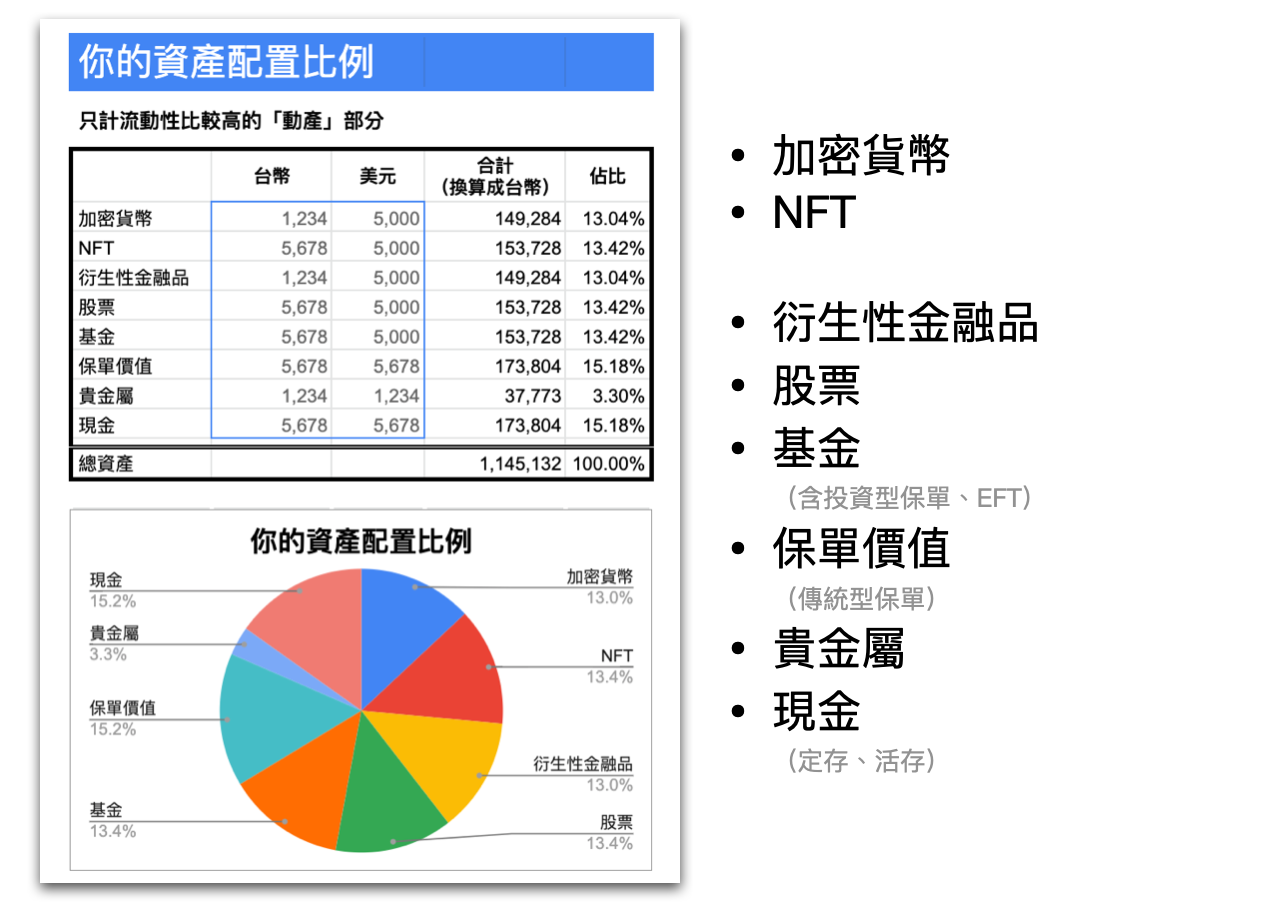

Although ARK Invest continues to be in the doldrums, its founder Cathie Wood's suggestion last year - including a little cryptocurrency position in asset allocation - is still in my ears, and I really want to know what the ratio of my cryptocurrency position to total assets is. How many?

Today, I finally got the spreadsheet out in one go, and I also spent some time taking stock of my belongings one by one (laughs), focusing on the part of the movable property that can be realized faster. Let’s experience it together!

Your asset allocation ratio? 👉Enter here.

■ Instructions for use

After entering, only the frame " encircled by light blue borders " on the screen is an area that can be freely entered. Other grids have anti-accidental protection measures because of the placement of linked formulas; " Update " is instantly obtained from the website of Cathay United Bank. A teaching article has been written before, and those who are interested can refer to it.

Some remarks:

- It is recommended to watch it on a computer, the screen size is larger, and it will not run the version.

- Based on privacy, you can pack it back and play slowly in " File → Create Copy ".

- As mentioned above, after packing it back, you can insert other assets by yourself, such as bonds , if you feel that the types are not complete enough.

- On the other hand, after considering the inclusion of real estate , the entire pie chart may be opened by half, compressing the display space of other assets, so we should focus on the observation of movable properties first.

- Regarding insurance policies , there are various types. How to find out who is the asset? A simple judgment is to see whether it can be "policy loan". If so, it means that it has a policy value reserve (similar to the termination fee); and then see whether it is linked to the fund. If so, I would tend to move it to the fund project. No, it is the number to be filled in for the policy item!

■ Everyone's asset allocation

🌱 lazy long hug

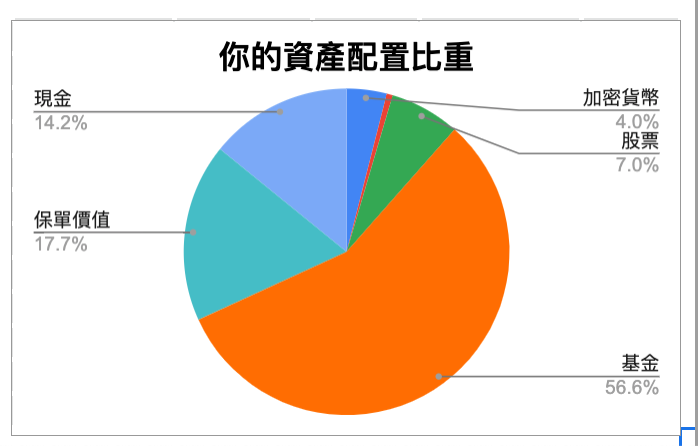

It turned out that my cryptocurrency position only accounted for 4% of the total asset value, and now I want to increase its holdings, maybe HODL about 7-10%.

In addition, the accumulation of regular fixed (occasionally single) deductions for many years, nearly 57% of the water level is placed on the fund, and 7% of my stock position is also the kind of "unglamorous" blue-chip stocks and ETFs, in short It is a lazy person's ability to do his best. If you plan to find an opportunity to dispose of some funds and switch to the stock market/currency market, all options are considered.

*

🌱 Brunswick

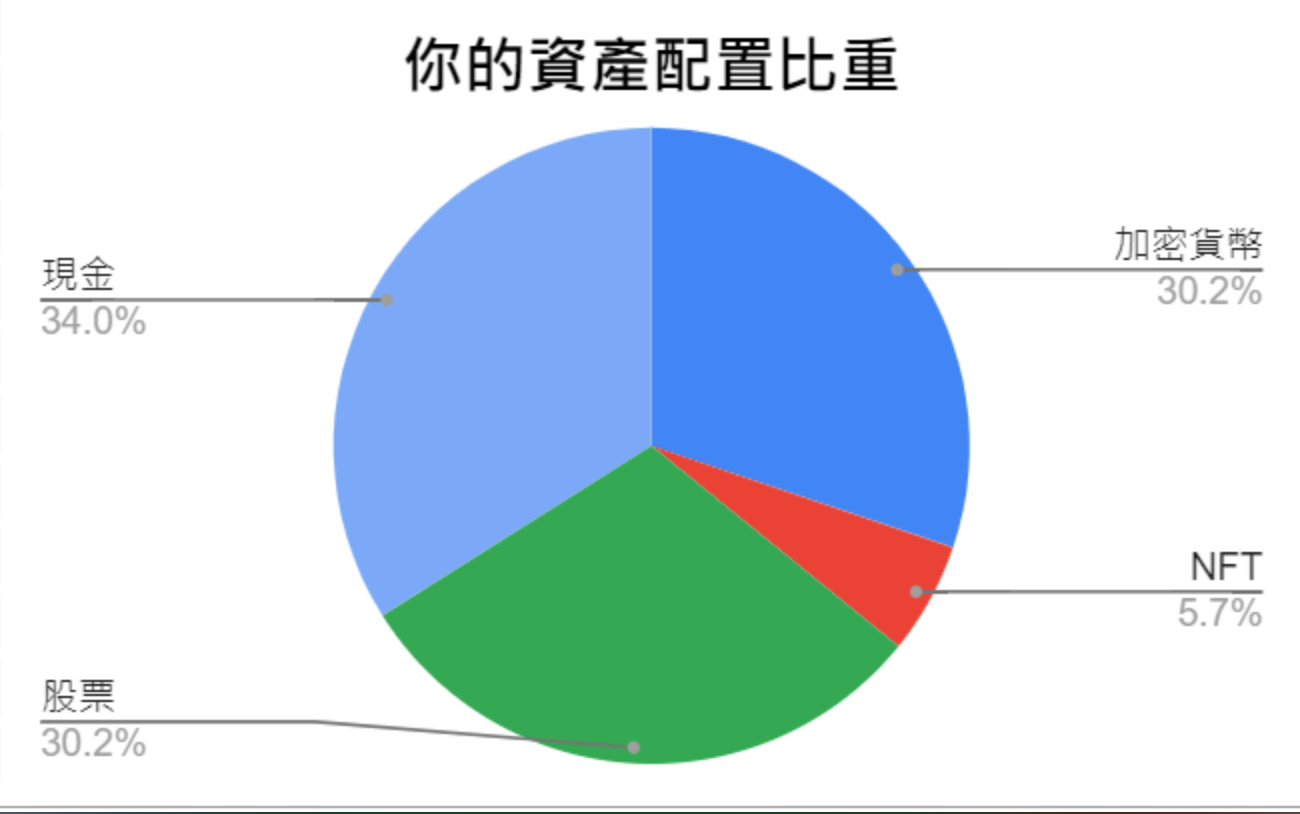

What follows is my feedback from others after I posted the spreadsheet to the community to share.

The following "Bunshi diagram" is almost a perfect rule of thirds, and the proportion of cash is as high as 34% - he said that he has been saving cash on purpose during this time, and he doesn't know what to do? When it comes to cash, I am reminded of a reflection in the book "The Mentality of Getting Rich " about its value, not just the fixed deposit rate that you see on the surface . A sum of cash that saves you from having to sell during a bear market actually earns more than a 1% annual return on cash.

If I can make my finances unbreakable, I'll have plenty of time for compounding to work wonders.

*

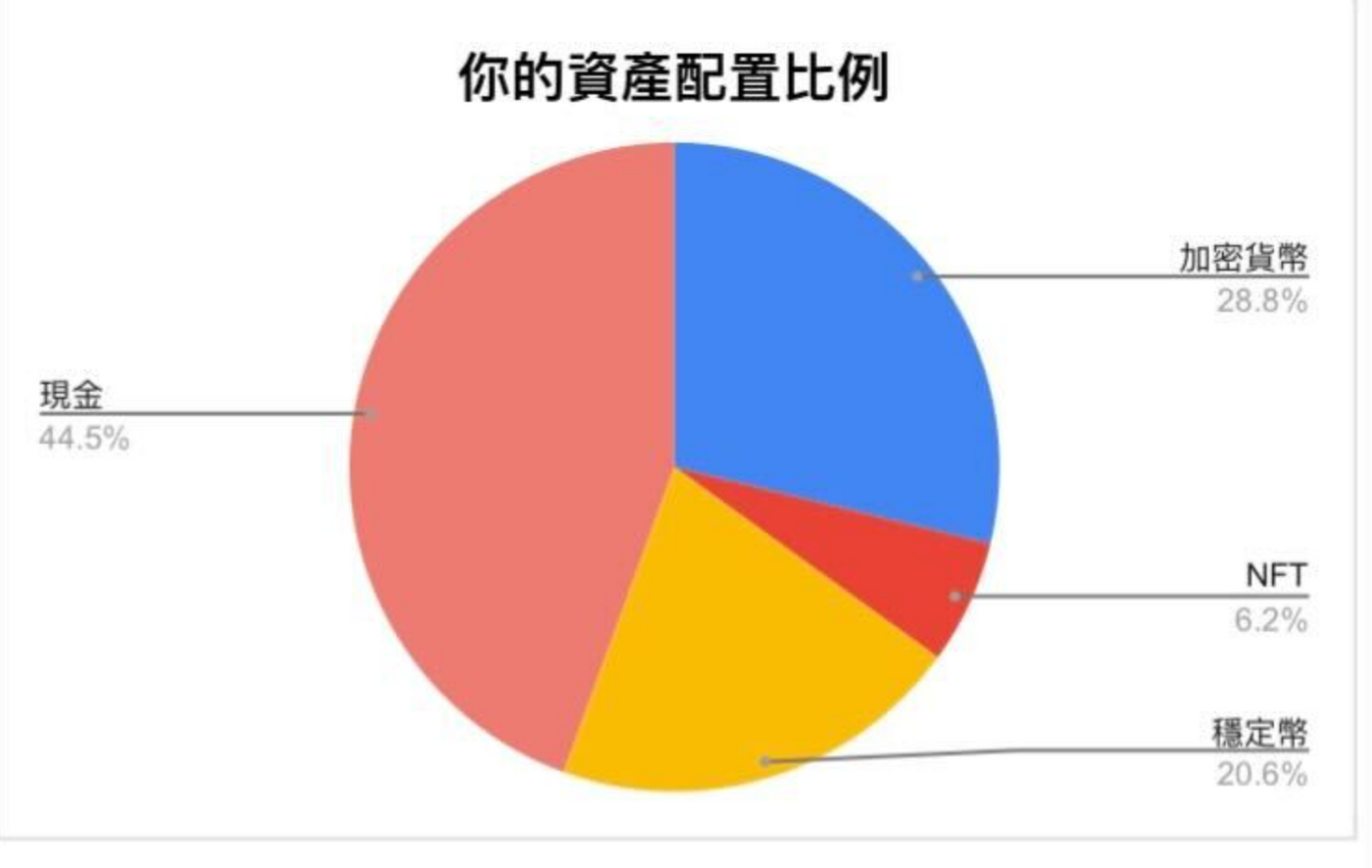

🌱 Cash-like

The following user is even more curious. The "cash-like" position in his hand has reached 65%. This is the case where stable coins are also included; and he only allocates legal currency and digital assets, and does not touch other traditional financial products at all. A man with a story!

*

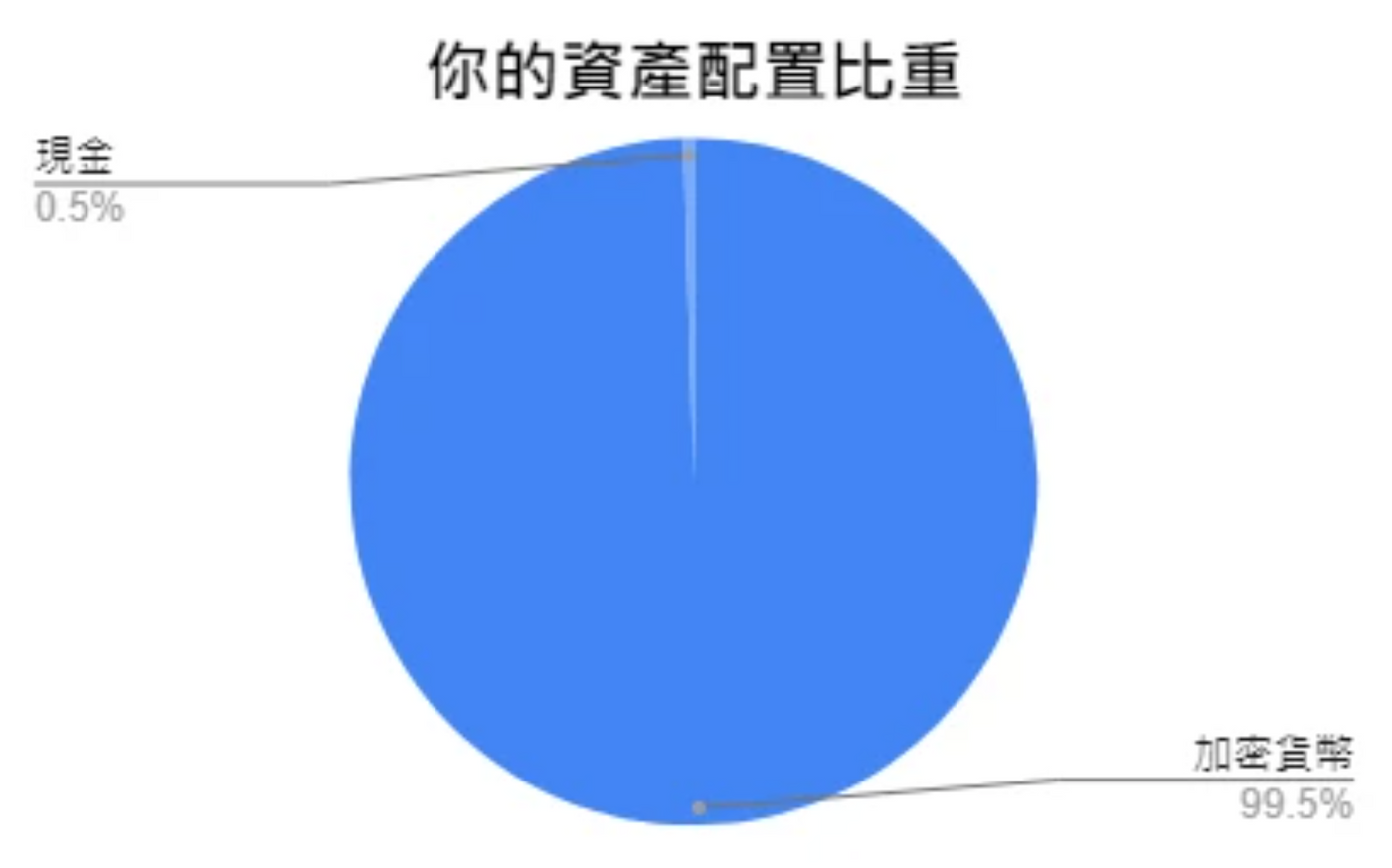

🌱 Europe and India wave

I finally received this piece, I don't know if it's a joke or if it's really serious, if it's the latter, I will give the highest Respect!

🌱 Join [ Zhongshu Nervous System ] around the fireplace👇

The special topic #Reflections on writing and #頭内心話is being serialized.

🌱 I am on other platforms👇

【 Facbook | Twitter | Liker Social | Matters | Medium | vocus 】

🌱 My teaching text and invitation link👇

≣Sign up for noise.cash | Become a "noise coffee" and experience social finance together .

≣Sign up for Presearch | The search to earn that kills three birds with one stone.

≣Sign up for MEXC | Go and jump on the Matcha Exchange, cash out OSMO and run wool .

≣Sign up for Potato | Three things to learn from Potato Media .

Like my work?

Don't forget to support or like, so I know you are with me..

中書神經系統

1. 關注各種有關書的消息。 2. 長文:專題 #寫作的反思 與 #爐內真心話 連載中。 3. 短文:每日「鏈習生幣圈日報」新聞的盤後觀點 murmur 眾聊。

Comment…