內容工作者 IG - https://www.instagram.com/uncle_lashi/ FB - https://www.facebook.com/%E8%8F%88%E5%96%9C%E7%9A%84%E6%B8%9B%E6%B3%95%E7%94%9F%E6%B4%BB-149415249877359

[Binance Contracts Teaching] Reflection on the five-character formula contract strategy commonly used by uncles after going bankrupt twice

Binance Futures Tutorial – What is a contract? ( Intimate Link Recommended ID – “T3TWUI2E” Online Up to 20% Rebate)

In the exchange of virtual currency, common services will be –

- buy virtual currency

- trade virtual currency

- Virtual Currency Contract Trading

The contract strategy transaction is a "digital electronic system transaction", and there is no actual purchase of "virtual currency", so you only need to put "stable currency" in your wallet to start trading.

Stablecoins such as USDT and BUSD are virtual currencies that are exchanged with the U.S. dollar at about 1:1, so they are often used as a trading standard.

Spot trading is that there are real "virtual currency holders" doing transactions in the market, while Binance provides a safe and compliant platform, and charges a fee if the transaction is successful.

What about spot and contract trading? What are the advantages and disadvantages?

Advantages and disadvantages of spot and contract trading

Spot goods

- Safe, don't be afraid of bursting

- no leverage

- less traffic

- The cheaper the more I want to buy

contract

- Dangerous, there is a possibility of liquidation (I have two explosions a month)

- Leverage available (1-100 times or more)

- high flow

- There is a contract premium

- The cheaper it is, the more you want to escape?

Contract trading is often used as a "risk aversion" tool for a large number of spot traders, and it is also a "speculation paradise" for short-term traders?

For example, if you are a big money trader with 1,000 bitcoins in your hand, and the market has reached a bitcoin high recently, although you are not short of money and do not want to sell your spot, in order to avoid a rapid market decline .

So I trade on the bitcoin contract and short bitcoin, so when the bitcoin market falls in the future, although bitcoin is falling, the contract is profitable to achieve the function of "risk avoidance".

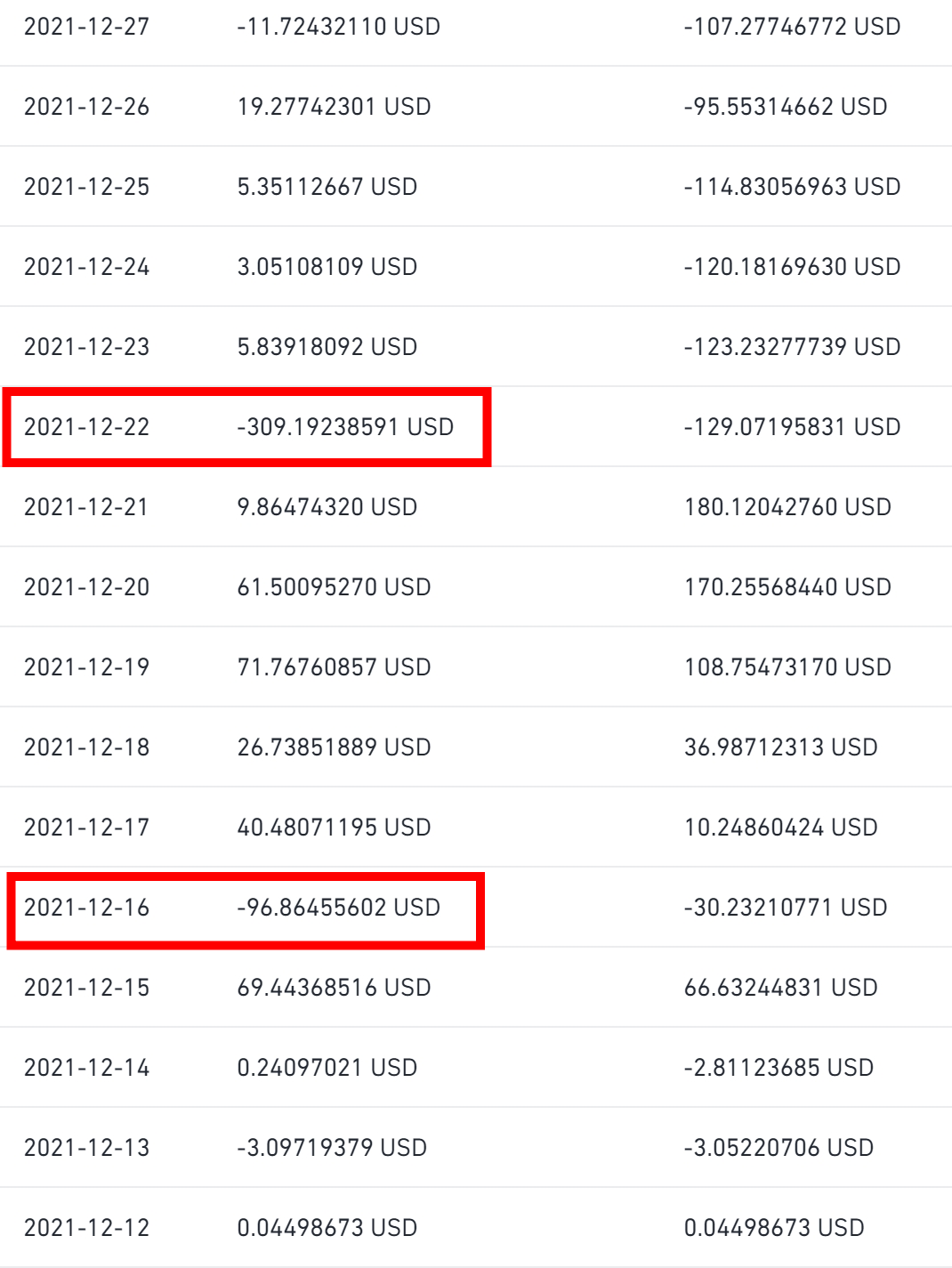

Doing Contracts – Experience of Uncle’s 2 Bankruptcies in 11 Days

I earned $70 on the 4th day of playing the contract, and the entry amount was $30, which means that I earned 2 times the principal in one day. When I was addicted to being a "contract trading genius", it exploded on the 5th day. warehouse bankruptcy.

Fortunately, I am the author of Matters. I make full use of the LikeCoin I have and invest the "virtual currency" I earn from writing, so I exchanged USDT and put it in my contract wallet.

I worked as a "Contract Genius" for a few days. This time, I earned 200 USDT in 5 days, which is also twice the principal. Then on the 11th day of contract trading, I liquidated my position again.

This time, I lost more than 300 USDT, which is probably the concept of more than 8,000 Taiwan dollars. During the transaction, I learned some things and shared them with you.

Reflections on Heartache, Flesh and Money Tears –

- The most important thing in trading is the "trend" - when it goes up, you can make money by buying with your eyes closed.

- The second most important thing is "items" - some coins, don't touch them, especially the small coins that you don't understand.

- Then there is the "stop loss" - don't want to lose a small amount of money, one day you will lose a lot of money.

- Please use funds that "disappear" will not hurt. Never use living expenses or borrow money to play.

- [Likecoin Exchange] 3-minute teaching from wallet to ZB exchange to Taiwan bank

- [Matters to make money] If you can't make money, you may do less of these 5 things. The platform's earnings are public

- [Likecoin Exchange] 3-minute teaching from wallet to ZB exchange to Taiwan bank

Binance Futures Teaching – Uncle’s commonly used five-character formula contract strategy ( intimate link recommended ID – “T3TWUI2E” online up to 20% rebate)

Next, the uncle will share his strategies with a relatively high win rate after using it, and help newbies to have a chance to make money on the way of contract trading.

- pick the opposite side

- Look at the moving average

- no warehouse

- waiting for admission

- set stop loss

Precautions before use –

- Contract trading is a personal trading behavior, there is profit and loss, just have fun.

- Please pay attention to money management, All IN generally only appears in Xing Ye's movies, and you only play for a long time according to your ability.

- When you are not in a beautiful mood, please don't make a contract, it will only make you less beautiful.

1️⃣ Choose the right side

Lei Jun, the founder of Xiaomi, once said, "When you stand on the tuyere, pigs can fly."

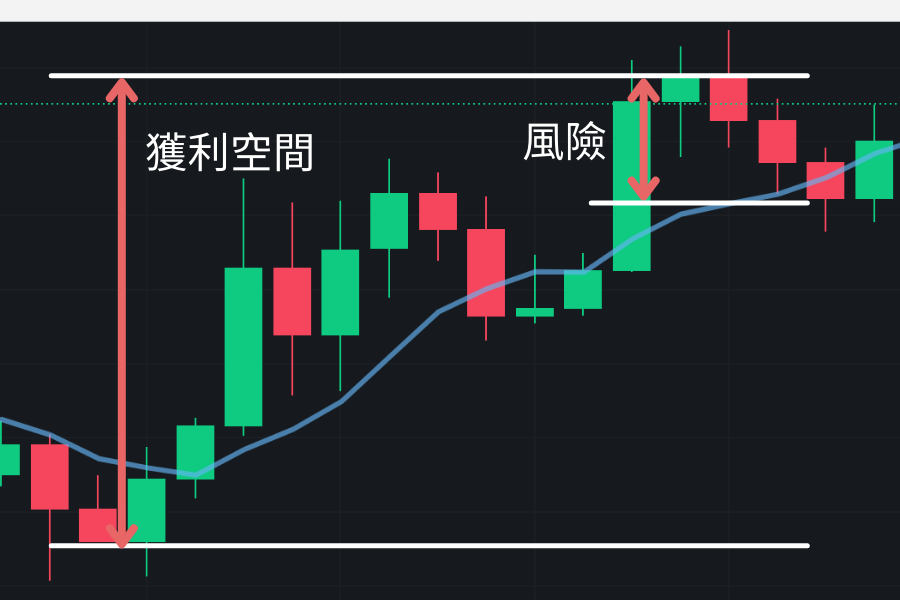

If the overall trend of the currency circle is rising, then when you enter the market is not too important, you can make a profit in the long run. If you want to do a short-term, it is very important to "choose the right side", which is related to your risk. and profit margins.

Therefore, choosing the right direction can create profit space and reduce risk –

- Profitability – Upside (go long)

- Risk – Downside (go long)

▼ Select the opposite side

▼ Pick the wrong side

Remember the story of aunt buying stocks and making a lot of money? When the market is overheated, if you just buy and make money regardless of the price, then you should be careful that shorts may come.

The flying pig will still fall down one day because it has no wings.

Even if you are short-term, don't forget to look at the "daily line", otherwise you can only use it as a collection if you buy it at a high point? That's right! This is not a spot, it will only be liquidated! If you liquidated, you will have nothing.

2️⃣ Look at the moving average

Why is looking at moving averages useful? Moving averages are good indicators as a driving force reference, for example – ETH in 2021 has been revised down in the last month.

However, in terms of MA99 (99-day Moving Average 99), the overall trend is still very strong, which is why most people are still optimistic about the future development of Ethereum.

▼ Binance Futures Tutorial – Ethereum MA99

If you want to do short-term contracts, you can look at the 5-minute K bars. Each bar represents the trading behavior in each 5-minute period, including the opening price, the highest price, the lowest price and the closing price. The most important thing is that there are This 5 minute gain.

Therefore, when choosing below MA99 (quarter line), MA30 (monthly line) and MA7 (weekly line), find a time point to enter, and finally sell when the three lines are above.

This is a simple reference method. The advantage is that it is simple and easy to operate. The disadvantage is that if your K bar is too short and you put too much money, you cannot bear the risk of sudden large fluctuations, or the stop loss is too small. was swept out.

Looking at the moving averages – the advantages

- easy to learn

- good operation

Look at the moving averages – disadvantages

- Strict management of funds

- Strategies that are not suitable for too short-term

▼ Binance Futures Tutorial – 5-minute K bar chart for Ethereum

▼ Binance Futures Teaching – Watch the Moving Average

3️⃣ Do not leave a position

Due to the great changes in the currency circle, if you can't sleep well at night if you stay in the position, please make sure to settle the position at a certain time.

For example – my friend is not me. One day he saw an opportunity to buy an ether contract at a low price. He didn’t expect it to collapse soon. He wanted to say that the decline was temporary, so he flattened it to reduce the cost.

Originally, after buying 300 USDT, 500 USDT, then 1000 USDT, and finally 2000 USDT was added with the margin. For large investors, flattening is a layout, and for retail investors, flattening is a concave order. Finally, the strong friends 1. Can't sleep at 2 o'clock.

Sometimes, you make money before going to bed at night, but you lose money when you wake up in the morning; when the changes are too big, please keep the same in order to cope with the changes, so "stop profits" and "don't keep positions" to give yourself a healthy life .

If you see an opportunity, set a stop loss order and then go to sleep! It takes physical strength to play contracts!

4️⃣ Wait for admission

If you are a novice like me, one of the most common questions is when to enter the market to place an order. Entering the market is an art. Just mentioned in "selecting the right side", the distance from the low point to the high point is this. Our profit margin.

Of course, the bigger the profit margin, the better, so it is very important to choose the price of entry. The question is, how should we choose?

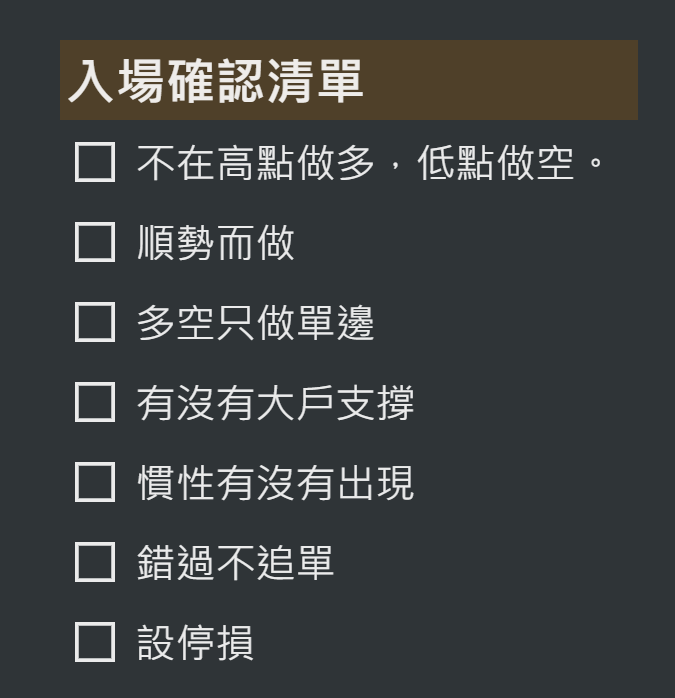

Before starting to enter, please write down your admission confirmation list (it varies from person to person, the list of sharing uncle is as follows) –

Admission Confirmation Checklist

- [ ] Don't go long at highs, go short at lows.

- [ ] follow the trend

- [ ] Long and short only do one-sided

- [ ] Are there any big players to support

- [ ] Does inertia appear?

- [ ] Missed do not chase orders

- [ ] Set stop loss

For example, in the following example, a cryptocurrency has reached a recent high point, first look at the "1-hour line", and find that when the price is at a high point, it may not go up, and the profit space is limited. At this time, it can be used as a waiting entry. signal of.

The next step is to wait for the trend to occur, and then enter the market. Taking "ONEUSDT 2022-01-03 noon time" as an example, it has been rising for many days and has reached a recent high. ****

There is someone defending at the top high now, so be prepared to "blank" and bet it will fall.

▼ Binance Futures Teaching – See if anyone is protecting the front line

▼ Binance Futures Teaching – When you see a "trend happening", you are ready to place an order. After placing the order, go bye!

5️⃣ Set stop loss

How to do stop loss? I believe this is also a common problem for leeks newbies like uncles.

The "entry price" determines your "stop loss price", so the uncle's stop loss point is set at the defensive line, and the distance down is your profit margin.

To protect your "money", be a disciplined trader.

Make a contract while writing, this is a sharing article that makes money by writing, sharing the record of ordering today, trading is a personal behavior, even if you lose it. 😈

Binance Futures Fees, Leverage

If you have a half-and-half win rate and you make $100 every time you win, and you lose $100 every time you lose, you think - "Great, it's mine to live on."

But after many transactions, the principal is getting less and less, it turns out that you forgot to calculate the "handling fee".

In trading, not making money is actually losing money, and life is not like this, not making progress is regressing.

According to Binance's contract fee table ( intimate link ), the pending order is 0.02% and the taker is 0.04%. If you hold BNB, you can enjoy a 10% discount on the handling fee.

It is recommended that you buy a little and put it in your wallet, the uncle will count it as a one-time handling fee for everyone to see.

Taking "NEARUSDT" as an example, I bought 16.4552 USDT and used BNB to pay the handling fee.

So the calculation formula is 16.4552(USDT) X 0.036 (market order) X 0.01 = 0.0059238 (USDT) , which is converted into BNB (about 510 blocks) and the result is about 0.0000116.

Interestingly, if you buy 100 USDT of cryptocurrency, the fee is about 0.036 USDT. In addition, if you have leveraged 10 times, it means that the principal is only 10 USDT.

After one in and one out, the handling fee is multiplied by 2 times, so the basic transaction fixed fee is about 0.036 X2 USDT, as shown in the table below –

To sum up, if you open 10x leverage, and you don't earn 0.72% of the low sales per transaction, you are losing money, so the handling fee is very important, especially for friends like uncle who love to open leverage . 😈😈😈😈😈

So be sure to use the uncle's exclusive recommendation code with high rebates – "T3TWUI2E" ( intimate link )

Binance Futures Tutorial – Binance Futures Fees

Contract experience

"Small bets on happiness, big bets on sadness", the longer people live, the more they feel that they must work hard.

Binance Exchange Further Reading

- [Binance Exchange Teaching] Get back 20% of the handling fee before investing | Deposit and withdraw at one time

- [Is Binance Exchange Safe] 3 minutes to understand and join the digital investment life today

- [How to calculate Binance fees] Fee reduction plus 20% commission rebate code

- [Binance Contracts Teaching] Reflection on the five-character formula contract strategy commonly used by uncles after going bankrupt twice

Binance Exchange FAQ

- What is Real Name Authentication (KYC)? If you have opened an account with a cryptocurrency exchange , there is a good chance that you will have to complete a real-name verification (KYC) review. Real-name authentication (KYC) requires financial service providers to collect and verify information about the identity of their customers. For example, this can be done via official identification or a bank statement. Like anti- money laundering regulations , real-name authentication (KYC) policies help combat money laundering, terrorist financing, fraud, and the illegal transfer of funds. Real-name authentication (KYC) is generally an active method, not a passive one. Most financial service providers obtain customer details as part of the registration process before the customer conducts a financial transaction. In some cases, it is possible to set up an account without real-name verification (KYC), but its functionality is limited. Binance, for example, allows users to open accounts but restricts transactions until real-name verification (KYC) is complete . When completing KYC, you may be asked to provide your:

- Government-issued ID

- driver's license

- In addition to verifying the identity of customers, passports are also important to confirm their location and address. Your ID will provide basic information such as your name and date of birth, but more information is required to determine your tax residence. You may need to complete more than one real-name verification (KYC) stage. Financial service providers are also often required to periodically re-verify their customers' identities.

- What are the benefits of real-name authentication (KYC)? The benefits of real-name authentication (KYC) are not all obvious. However, it does more than fight fraud and improves the entire financial system:

- By establishing a customer's identity and financial history, lenders can more easily assess their risk. This process leads to more responsible lending and risk management.

- Fight identity theft and other types of financial fraud.

- As a proactive measure, it reduces the risk of money laundering in the first place.

- Improve the trust, security and accountability of financial service providers. This reputation can have ripple effects across the financial industry and can incentivize investment.

- What is cryptocurrency contract trading? Cryptocurrency contracts are contracts that represent the value of a specific cryptocurrency. When you buy a futures contract, you do not own the underlying cryptocurrency. What you have is a contract that you agree to buy or sell a specific cryptocurrency at some point in the future.

- What is cryptocurrency spot trading? In the spot market, you buy and sell cryptocurrencies like Bitcoin and Ethereum with instant delivery. In other words, cryptocurrencies are transferred directly between market participants (buyers and sellers). In the spot market, you own the cryptocurrency directly and are entitled to financial benefits, such as voting for major forks or participating in staking.

Binance Exchange T3TWUI2E (Intimate Link)

More content related to "How to Calculate Binance Fees" are all in subtraction

Link to the original text [Subtraction Life Proposal] Your Uncle Subtraction - Laxi

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…