大家好,我是老陳,我講話很老成,大家可能看過我另一個筆名:良藥苦口(@grootsaywhat )這邊會和大家分享我獨創的文章,我將結合時事,美劇以及書籍。 我的文章名符其實,可能會讓你覺得不舒服,就像吃藥完的苦澀。

Let's talk about my two worst deals of October

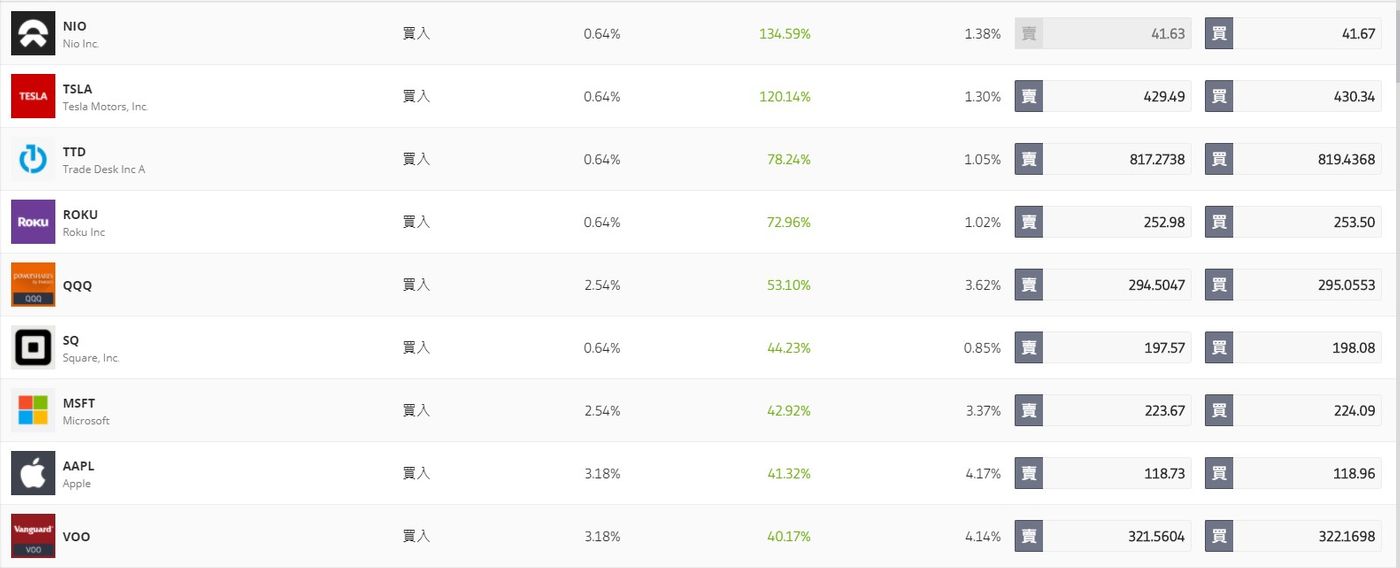

I found that many investors like to talk about their successful transactions, and I will continue to do the opposite this time to review my two major mistakes in October. It is shameful for people to fail. It is shameful to keep repeating the same mistakes. My current stock holdings are enough, there is not much to say, it just depends on stock selection and time. (See attached image below)

The trend in October is believed to have caused many investors to fall from heaven to hell, and I can see from the previous article that I did the same, but it took less than a week for me to return to glory.

Let's take a look at what happened in the past two weeks:

The last week of October was the biggest drop for stocks since the big crash in March.

The first week of November was the biggest gain since the rebound in April.

Ask yourself: Are you chasing the high and killing the low again?

Why is the trend like this? I think it has something to do with the listing of Ant Financial. If you scrutinize the entire timeline carefully, you will find that there is a lot of context in it. Of course, we will never know what actually happened, but I just support going long. , when the pressure area is reached, the position is closed or shorted.

Before the settlement in October, I not only ALL IN, but even added funds, but the market only started to rebound in November, so the performance in October was a loss, and most of my asset allocations still follow the world, so when there is a systematic pullback , my assets will definitely shrink, and this is the time when you should believe me. In fact, if you copy me on the last trading day of October, your current performance is about 9% (the average annual return of the stock market for one year). rate of 7%)

Here is a breakdown of my current >40% holdings:

What I did on the last trading week of October:

1. The stocks with the collapse layout: PG/LUV/MGM...

2. Blue-chip stocks whose layout was killed by mistake: DIS, BYND, AMAT, SAP, BRK.B, V, JNJ, CRM, FISV (adjusted price)

What I did on the first week of trading in November:

1. Unwind stuck stocks: LMT, NOC (Biden is coming)

2. Layout: JD, CRON, AAL

After reviewing, let's review my two biggest mistakes in October: SPCE/FSLY. I just recently re-read Charlie Munger's book and let me recognize one thing:

Hold on to what you know within your competence, don't try to seize every opportunity or invest in areas you don't know.

1. SPCE (Virgin Galactic):

I'm too eager to catch a falling knife before the last week of October's pullback, but the stakes in this stock are so spread out that I should wait for them to fall, and this stock is all about selling dreams, and it's definitely not going to be any more. The things I know in my ability circle, I just watched "Story Economics" recently, and I understand that I have fallen into a trap.

2.FSLY:

Here is ETORO's introduction to the company:

Fastly Inc. is a cloud computing company founded in 2011 and headquartered in San Francisco, California. The company has branches in Japan, the UK, the US and other regions. The company's products include the Edge cloud platform, Edge computing technology, content delivery networks, image optimization, video and streaming tools, cloud security, load balancing solutions, and more.

Fastly works with a variety of industries, including digital publishing, e-commerce, online video and audio, software-as-a-service, travel and hospitality, financial services, and more. Fastly's clients include Airbnb, GitHub, Alaska Airlines, Pinterest, Vimeo, The Guardian, and The New York Times, as well as leading companies in various fields. The company currently has 60 nodes (POPs) worldwide, spread across six continents. Fastly currently has a total edge capacity of 45 Tbps. In September 2015, Google announced a partnership with Fastly to provide better content delivery network services to users around the world.

I admit that I don't understand a few words at all! I just saw that ARK ETF kept buying when the stock price fell, and many bloggers including MIULA said it was just a pullback, so I bought it , This is not a normal trade I would do, and in fact I backhanded and shorted on the day the earnings fell short of expectations, and I don't sit still when things don't go as expected.

This is the trade I regret the most in October, I shouldn't invest in things I don't understand, and even bet on earnings, it's a hard lesson, I've let myself fall into all kinds of logical fallacies, of course it may go up in the future, But I have absolutely no idea how to value this company, so I stop tracking (holding), especially with a lot of people stuck on it.

That's why I started investing in SAAS stocks so late (by the way, TTD rose +30% on Friday, I actually don't fully understand what he does), because I'm a pharmacist and I'm not very familiar with many of these things , but what do we really know?

Take a pharmaceutical company as an example. As a pharmacist, I should know more about pharmaceutical companies. In fact, part of the reason for the final loss in October was because the European stock market crashed, and most of the pharmaceutical companies I invested in belong to the European system. I am very puzzled. I believe you are also wondering how the company that is producing the antidote (vaccine) has fallen so badly. The only bad news is that the number of confirmed diagnoses has been breaking new highs (depending on the gradual availability of diagnostic reagents), doesn’t this mean that it is more time to bet on pharmaceutical companies? ?

When emotions outweigh reason, fundamentals are just for reference, so European stocks were panic-sold at the end of October, but with the bullish news from BIIB (the Alzheimer's drug may be approved in March next year), the whole The industry rebounded immediately, and I will continue to discuss the relevant content with you in another article. These examples show us the importance of understanding the overall economics. You have to control the entire capital flow and small changes in the market. Of course, these pharmaceutical companies will not fail. , so I will continue to hold, the moat advantage of pharmaceutical companies cannot be easily crossed.

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…