軟體工程師,加密貨幣基金管理者,遊戲玩家。 近期興趣是 Elden Ring! https://twitter.com/michael_icwang https://medium.com/@michael_icwang

Crypto Investment Diary 4/3 - Market Watch

Short Squeeze , some people use short squeeze in Chinese, is the theme of the recent investment market:

- Stock market: The stock market rose sharply on the day when the number of people receiving unemployment benefits hit a record 3 million and 6 million was revealed. After confirming that the 2020 Olympics were postponed to 2021, Japanese stocks did not drop in disappointment, but jumped 16% for two consecutive days.

- FOREX: The U.S. dollar index (DXY) turned up in a V-shaped bottom at a time when the U.S. dollar was expected to depreciate rapidly after the U.S. Federal Reserve launched a series of unprecedented money-printing measures to save the market.

- Oil: The pattern in the latter part of March was very weak. When everyone expected to fall below the previous low, the President of the United States called the President of Russia, which is expected to stop the vicious competition of oil prices. The market reversed and rose by more than 25%. Then Trump said The coordination has not yet been completed, and the market has spit back half of the 12% increase.

- Gold: Following the stock market crash in early March, it rose 13% in a V-shaped reversal.

- Bitcoin: After plummeting more than 50% in mid-March, after all experts are unanimously bearish on the cryptocurrency, it has rebounded 90% from the lowest point to yesterday (4/2). Yesterday, it rose more than the psychological level of 7,000 US dollars. After the recent large volume, it flipped and fell by almost 500 US dollars in an hour.

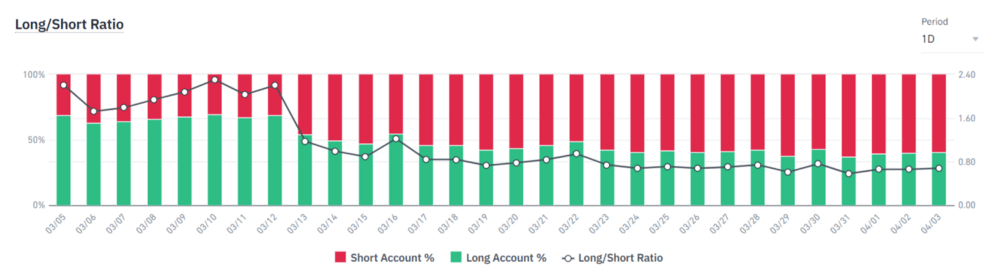

This is a naked display of human greed. Taking Bitcoin as an example, the current maximum trading volume of futures has been transferred to Binance (yes, I choose to believe the data given by Binance), and the long and short positions of futures have increased from 3/10 to a maximum of 70%. 30% empty, 40% over vs 60% empty:

Here is a thorough verification of Mark Ritchie's theme in Chapter 3 of his book My Trading Bible : The crowd is always wrong. 3/10 70% of the long orders in the market are punished by half of the market two days later. Since the end of March, 60% of the empty orders have faced the pressure of the market soaring to the point of doubling in the past week.

When Bitcoin stood at $7,000 for the first time recently, it began to show signs of surrendering to long positions, and was immediately punished by the market flipping downwards.

After years of baptism in the market, I realized a truth: small retail investors have no conditions to play trading. I advise everyone to "don't trade", but I find that no one listens to my advice, including myself.

Science time

A modern investment market looks like this:

- When the company raises funds in the early stage, it is called the primary market . If the company survives, buyers in the primary market will buy the cheapest price.

- The next step for a successful company is usually a public listing, which is the so-called stock market. At this time, the stocks you and I can buy are called the secondary market , because you and I both buy stocks from early primary market buyers. Buy it, and then start a game of gambling between you and me.

- The secondary market has long been unable to satisfy the extremely primitive and strong gambling nature of human beings, so Derivative Financial Commodity (Derivative Financial Commodity) such as leveraged trading (Margin Trading), futures trading (Future Trading) and so on appeared.

- During the 2008 financial crisis, we saw that financial institutions raised the concept of derivative financial products by several levels, invented various heavily packaged products, and bet on these derivative products. For those unfamiliar with this concept, I recommend watching this scene from the Big Short movie.

If the scale of the primary market in the early stage is one million US dollars , the secondary market may grow a hundred times or even a thousand times, reaching one billion US dollars . When it comes to derivative financial products, the scale can be enlarged a hundred times (through leverage) to reach hundreds of billions of dollars . From the experience in 2008, we see that through heavy packaging, the market size can be further enlarged to the scale of tens of trillions of dollars .

If the source of this chain, the million-dollar company goes bankrupt, the original shareholders in the primary market will lose at most one million dollars of investment, and the majority of shareholders in the secondary market will lose one billion dollars. In leverage and futures markets, losses have reached the level of 100 billion. Many people here cannot afford to lose so much money and can only choose to go bankrupt. To the $10 trillion casino at the end of the chain, that's the systemic collapse that 2008 saw.

Looking back at the collapse of cryptocurrencies on 3/12–13, it was mainly due to the liquidity risk of derivative commodities such as leveraged trading and futures. Now, from the perspective of the long-short ratio of Binance futures, the long-short position has been flipped, and the short position has changed.

My interpretation here is that the market has recovered a little bit of rationality, no longer dead long, but a little overly pessimistic. Recently, I have a feeling that when it falls to the price of six or seven thousand, there are not many people in the spot market who are willing to sell their bitcoins at a low price here. At the same time, because the overall market is filled with pessimism, most people are reluctant to actively buy. As a result, the buyer has slightly overwhelmed the seller's spot market, and the price has taken two steps back and slowly increased.

Stuck in waiting for a better rebound price. Those who have no set are now willing to believe that cash is king, and they are eyeing the market and waiting for the market to fall.

To see the trend of the global market in the general direction, we can predict the next trend of cryptocurrency:

- At the end of January, when the news of the epidemic in China continued to spread, I saw that the US stock market was still hitting new highs, and I felt that the changes on both sides were very asymmetrical . At the end of January, I was convinced that the stock market was about to face a correction . At the end of February and early March, the U.S. stock market began to reflect the risk of the epidemic, and there was a historic collapse.

- In mid-March, I believe that the short-term decline in the stock market is about to be satisfied , and a daily-level rebound can be seen. At this stage, cryptocurrency seems to have become a leading indicator. Not only did it take the lead in a 90% rebound, but every day a minute or two before the opening of US stocks, Bitcoin led the rise first, and then US stocks followed. This phenomenon is very strange. I didn't hear a reasonable explanation. (I can only use the analogy of the Go chess king playing chess with a computer AI. After the chess king loses, his mood is affected, and he complains that the AI is playing strange moves that have not been seen in human chess manuals for thousands of years. In today’s era when stylized trading gradually dominates the market, We humans are gradually unable to understand why the program pulls bitcoin first and then Latin American stocks. Maybe the market value of encrypted currency is small and easy to pull, and then the profit from the encrypted currency side is transferred to the stock market. Small!?)

- The time has come to the end of March and the beginning of April. The number of Americans receiving unemployment benefits for two consecutive weeks was 3 million and 6 million respectively. Another serious warning from the real economy (the last time was the epidemic from China), and the US stocks were in There was a big increase in the past two days, and I felt an obvious asymmetry in my heart. I said to myself, is the rebound only here?

- The U.S. dollar index (DXY) fell sharply from the end of March, and began a V-shaped reversal in early April, reflecting the continued global dollar shortage .

The dollar index rose instead of falling, which is the most dangerous signal in the entire market in my opinion . The U.S. is printing money like crazy, but the U.S. dollar index is going up instead. The most reasonable explanation I heard here comes from Brent Johnson's dollar milkshake theory.

Dollar Milkshake Theory

First of all, the US dollar is today's global reserve currency. All countries, whether you are China, Russia, or the European Union, the most important price standard for foreign trade is the US dollar.

Therefore, the U.S. dollar flows between countries at the global level, not mainly in the form of banknotes, but based on credit (Credit Based) . These U.S. dollars outside the United States, although the scale reaches dozens of trillions of dollars, but the collateral behind it is so small that it is completely asymmetric .

The international measure of the economic strength of countries is often measured by foreign exchange reserves , usually referring to the dollar created on the basis of these credits.

These tens of trillions of dollars, in the process of continuous economic growth, can continue to flow in the market through credit mortgages again and again.

However, in the period of economic contraction, everyone chooses to be conservative, no longer accepts credit collateral, or continuously improves the quantity and quality of collateral, the effect of which is that the circulation of this super-large dollar is stagnant.

Taiwan's labor retirement fund invests in a large number of US dollar assets (US stocks, US bonds). If the fund manager decides to sell US stocks/US bonds due to the poor economic outlook, the market needs to generate US dollars for the labor retirement fund.

Now imagine fund managers all over the world doing the same thing, selling assets for cash (dollars).

The source of the dollar, on the US Federal Reserve's (FED) balance sheet , is marked at about $5 trillion. However, the scale of global dollar assets is in the tens of trillions or even hundreds of trillions of dollars. As long as enough assets are sold, you will see a dollar shortage, which will be reflected in the chart, and you will see the dollar index (DXY) soaring.

Regarding the dollar milkshake theory, I thought George Gammon's interview was great:

Brent Johnson gave a very vivid example. When a star in the sky burns out and is about to die, it does not directly turn into ashes (as long as the mass of the star is large enough), but before it dies, it explodes and becomes the brightest star in the sky (supernova), and then gradually fade into a black hole.

The dollar milkshake theory describes exactly how the dollar exploded into a supernova before it lost its status as the world's reserve currency .

In the short term, although the stock market and Bitcoin continue to rally and rise, I am not paying for the overall market direction.

The above asymmetric phenomena have to wait for the market to react:

- The U.S. economy is already in recession, and the stock market rebound is made by institutions to sell. It is said that Wall Street has already come out very clean this time, so this wave of rebound is the process of selling some large funds. My suggestion is to look at the monthly line of the stock market. You will see that in February and March, the U.S. stock market experienced a 100-year historical decline. The decline is as much as the trading volume. The chance of a V-shaped reversal here is really slim.

- If the US dollar index continues to strengthen, it will be bad. The international financial order will gradually go into chaos. The spewed US dollar means that the currencies of all countries will be severely devalued. The United States prints money crazily, but all countries in the world have to pay the bill, and as long as the US military remains alone, countries can only swallow it.

Overall, the most optimistic point of view is that if the 2008 model is followed, the market has a chance to bottom out within a year, and there is no reason to enter the market in a big way now. On a pessimistic point, if we follow the 1929 model, it will take three years to bottom out. Don’t think that you can go all the way, and countries will gradually withdraw the futures market halfway through. If this time is a change that has not been seen in human history (after all, 1929 was still the era of the gold standard, and the concept of unlimited money printing at the global level did not exist), then the most pragmatic investment for you and me is probably to become a farmer...

In the process of this big drama being staged scene by scene, it is a good opportunity to learn. Seeing, listening and thinking more, only make sure transactions. Looking back in the future, this time will be the same as 2008. Good practice.

PS: If I have time, I will disclose the cryptocurrency transaction here . I don’t like to talk and practice. You can also see if my transaction has reference value.

Bitcoin Tip: 3QqoDDrvWNZs6Gf9ZfD2gdbidhcdKs4kxJ

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…