半導體外商的小小螺絲釘,遊走於廢青與社畜之間。熱愛閱讀,喜歡透過書本探索外在、內化自我。希望藉由書寫打開與世界交流的一扇窗。 個人部落格:https://maxjamesread.com/

"Black Swan Effect": "What you don't know" is more important than what you know!

Imagine a turkey, because it is fed every day, it gradually believes that the good days of being raised by well-meaning people will of course continue until it is slaughtered on the Wednesday afternoon before Thanksgiving.

Damn, turkeys have a "black swan event" .

The "Black Swan Effect" I'm going to talk about today, the author Taleb is a well-known thinker, famous for his "uncertain series". This book is also the last book I plan to reread in 2021 . At the end of the year, I will use this tome, which has inspired me a lot, to help everyone wrap up.

This experience will start with the black swan event, a concept you may have heard of but not very clear about; then talk about how black swan events affect the world we live in; and then explain why many "forecasts" are human hallucinations; finally, it will tell you how to find a way to survive in this random world.

【Black Swan Event】

In the past, people always thought that swans were white, until explorers discovered a black strange species in the New World, and the past cognition was completely broken. And that's where the name "black swan event" comes from.

So what's the point of this story?

Crucially, it reminds us that past observations and experiences are severely limited, and that a single observation (a black swan) can invalidate an inference that has been confirmed in the past (full of white swans).

So why is this concept important? Let's move on.

【Black Swan Effect】

Then we discuss the impact of black swan events in detail.

(It's what you don't know that counts)

First of all, black swan events lead to a concept: what you don't know may be far more important than what you know.

Many negative black swans happen because people expected them to be unlikely , with irreversibly deteriorating consequences for the world. Such as 9/11, the financial tsunami or this pneumonia; and those positive black swans, such as the Internet and the community, also change the course of human beings in unexpected ways.

Or to put it this way, our lives are accumulated by these rare but significant events, but before they happen, most people know nothing about them.

[Black swans cause extreme inequality]

Imagine you randomly ask 1000 people to measure their average weight. Then you add the fattest person in Taiwan to the sample, which doesn't have much effect on average weight; however, if you swap weight for net worth, the results are quite different. The wealth of the richest man in Taiwan may exceed the sum of the first 1,000 people.

Therefore, Taleb divides our environment into two kinds of randomness, the mediocre world and the extreme world . Weight belongs to the mediocre world, where the contribution of special events is far less important than the overall; and assets belong to the extreme world, where a single point of view can disproportionately affect the whole.

The extreme world is so uneven because it is extremely affected by black swan events. So another effect of a black swan event is that it creates extreme inequality.

If you're a doctor, it's hard to scale up your services because of the limited number of patients you can see; but if you're a writer, writing a single book has the potential to spread enormously (if it sells). Taleb called this situation "variable scale," where the service you provide can be leveraged . And it is often the black swan event that determines the degree of amplification.

This is especially serious in certain industries, in addition to the publishing industry mentioned above, there is also the film industry. Economist Art. Divani 's research points out that most of the success of a movie comes from unpredictable randomness, which is simply luck.

Inequality is also associated with the so-called "preference linkage effect" . Take English as an example, everyone loves to use English not because it is the best language in the world, but it was used by some people as a common language in the beginning. As more people use it, the use of other languages is excluded. Snowballing, English became the common language on earth.

Under the addition of randomness and diffusion, huge inequality is created, which is the so-called "winner effect". The winner gets almost all the pie. The world is extreme M-type, you are either a giant, or you can only be a dwarf.

Such injustice can be said to be even more obvious in this society with developed networks and communities. For example, YT video views or IG post heart counts belong to the extreme world category. Think of the recent incidents that disproportionately sucked all the traffic.

【Black Swan Blindness】

Although the black swan has a great influence on us, the bias in human hearts makes us tend to turn a blind eye to it, and even think that everything is predictable. Taleb jokingly calls this black swan blindness. Here are three common examples:

(confirmation bias)

The turkey story at the beginning is the standard confirmation bias. A reverse observation overturns all previous confirmations and conjectures.

Take your own example. A few days ago, I started a fan club. At first, I would see how many tracks were added every day, and figured out how many people would be added in a month. It was not until my post "I graduated five years ago, I made 4 million with ETFs" was reposted by the original author, and the tracking doubled directly within two days. I realized that I fell into the misunderstanding of the mediocre world. The tracking numbers obviously belong to the extreme world and are extremely affected by black swan events.

(narrative fallacy)

We love stories and we prefer narratives. for example:

Joey is happily married. He killed his wife.

and

Joey is happily married. He killed his wife to get an inheritance.

At first glance, the second statement might seem plausible, but the first statement contains more possibilities, which are more probable in terms of probability.

People prefer narratives with complete narratives and clear "cause and effect". But this often affects our judgment of probability and underestimates the possibility of black swans. For example, during the First World War, almost everyone thought that the war would end soon, no need to worry, and gave various "reasonable" reasons. As a result, the battle was fought for more than four years and more than 16 million people were killed.

(silent evidence)

Silent evidence refers to the fact that the dead do not speak, whereas the surviving will give various reasons for their survival. It has a more commonly heard name: survivorship bias .

Taleb sternly pointed out that many success studies on the market are very problematic, because there are many people who do the same things as successful people and fail. However, they will not enter everyone's field of vision.

This echoes the winner effect mentioned above. Many times, some people can stand out, not only by strength but also by "luck". Many equally capable people were unfortunately washed out. But we will look for various explanations for their success, ignoring the role played by the black swans.

【Prediction Fantasy】

Okay, since we always underestimate the possibility and impact of black swans, you may be thinking, how do you "correctly" predict black swans? Unfortunately, we "can't" predict black swans. In fact, it wouldn't be a black swan event if it could be predicted.

Unfortunately, many of the world's "experts" love to predict. This is especially evident in the political and economic fields. Physics is probably a few near-accurate fields, but this has also led to many people preferring to use the "mathematical" model of the dazzling gun to physicalize their theories, which seem to be well-founded.

In the book, the failure of human predictions is discussed at great length. Here are two points to share.

[Bell Curve]

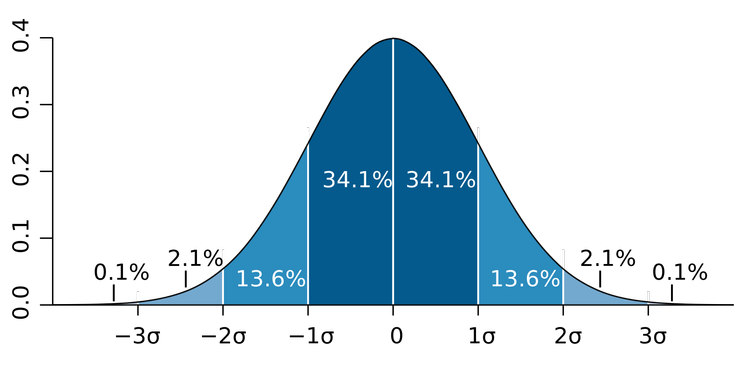

Let’s start with the Gaussian distribution, or bell curve. A typical Gaussian distribution looks like this:

Most observations of the Gaussian distribution fall near the center, and the probability of occurrence of extreme values farther from the mean drops sharply. Consider the weight example above, it is unlikely that there are people in the world who weigh more than 1000kg. That said, if you use a bell curve to estimate weight distribution, it's roughly fine.

However, this is not the case in the extreme world. Although there are not many billionaires in the world, there are definitely not many. That is, if we used the bell curve to estimate those rare extremes, we would produce false estimates.

Taleb believes that many financial and economist forecasts are based on fragile models based on the bell curve. It may work in a mediocre world, but when it comes to a black swan, it's completely lost. Paradoxically, they often revise their models after a disaster to tell you that everything is "predictable".

Most traders are just “picking up change in front of the steamroller,” exposing themselves to rare and powerful events, and yet sleeping peacefully without knowing it.

- "Black Swan Effect"

(complex world)

Let's think about why the real world is so unpredictable from another angle. The pool metaphor in the book is very interesting. It is briefly described as follows:

If we have a set of basic parameters of a stationary sphere, table resistance, and impact force, then we can roughly estimate the first impact of the pool ball. By the ninth impact, you have to take into account the gravitational force of the person standing at the table to make an accurate estimate. And if you were to predict the fifty-sixth impact, every elementary particle in the universe would have to be factored into your hypothesis.

It's just pool balls, imagine if these particles had free will, like humans, and you'd see why you want to predict where the stock market will go or where the economy will go, it's basically a fantasy. There are no simple answers in a complex world.

Black swan events are mostly the result of people putting too much faith in the wrong outcome, using methods far beyond what they know.

- "Black Swan Effect"

【Facing the Black Swan】

When you see this, you may think that although black swans are very important, since they cannot be predicted, what is the use of knowing them?

Not also. We can actually take advantage of this randomness to act. As Taleb said, we don't need to predict black swans, but we don't need to be "turkeys" when making decisions. Let's start with how to deal with a positive black swan.

[Frontal Black Swan: Overexposure of Opportunities]

To encounter a positive black swan, you must expose yourself to as many opportunities as possible. Keep searching and collecting the possibility of hitting a frontal black swan. Especially when the loss is limited, it is necessary to be as active and speculative as possible. Because failure is painless, and only one good luck can turn over completely.

A casual chat over a cocktail can often lead to a major breakthrough—not a tedious back-and-forth letter or phone conversation.

- "Black Swan Effect"

[Negative Black Swan: Avoid Nerds]

In the face of negative black swans, you must be as conservative as possible. Because as long as one accident, it may make you doomed forever. Like the book, it is extremely against debt. I thought of the recent example of watching "Tea Gold". In the play, Ji Sang is constantly borrowing and investing, but when he encounters a black swan of "forty thousand for one yuan", he almost collapses.

Also, watch out for top-down, formulaic, normative discussions. Taleb called this kind of thinking "Platonic thinking," fragile and vulnerable to black swans. He thinks we need to do the other way around and focus on building bottom-up, non-Platonic systems that value experience and remain skeptical.

It seems to me that the semiconductor industry I am in is a non-Platonic field. It is always full of all kinds of unreasonable empirical knowledge, which most of the time cannot be explained by beautiful theories. And the same method applied to different processes and machines may not be applicable at all. The whole system is the know-how accumulated by every sweaty engineer, which is very bottom-up and relies on practical experience. And this is why it is difficult for Taiwan's semiconductor industry to be copied and replaced.

【Summarize】

Come to summary time. A black swan event refers to an event that is extremely rare but has a huge impact; and people's biased mentality often makes us ignore the black swan and use a plausible narrative and a fragile bell-shaped model to make wrong predictions; correct The way to face a black swan is not to predict it, to immerse yourself in the chances of encountering a positive black swan as much as possible, and conservatively face the field where you may encounter a negative black swan to avoid being hurt by it.

This book is informative and insightful, with plenty of stories, case studies, and research, making it an enjoyable read. Some people say that Taleb's book is very radio-eating, because its narrative style is very casual, a story may come suddenly, and the arguments will sometimes be repeated in circles, which is not orderly. However, I think Taleb would be delighted to see such a comment. After all, he directly states in the book his preference for essay narratives and his opposition to the "normalization" of his own thinking.

Symbols and stories are far more beneficial (woohoo) than ideas; they're easier to remember and more fun to read.

- "Black Swan Effect"

In my words, it was a lot of fun to read, especially this time it was the second brush, I could enjoy the content even more, and am amused by his sarcastic remarks from time to time. Although it is a bit sour (especially for economics), it is really advanced, and there are no dirty words at all.

Animals with the largest cortex, the most intelligent — we humans have the largest cortex, followed by bank executives, dolphins, and our cousins: the orangutan.

- "Black Swan Effect"

【postscript】

Finally, I would like to talk about some of the inspirations this second brush has given me.

A while ago, I used to think about my tribal position, worrying that the books I shared were too messy and lacking in features. But when I read this book again, I realized that running blogs and fan clubs belong to the extreme world category, and whether it can be seen that there are many random factors. So I decided to go ahead and introduce my favorite books. After all, going to work is already boring enough, so choose what you love to write!

Of course, I still hope that more people will read these books because of my sharing. So another point of consideration is probably to be more active in creating opportunities to encounter positive black swans.

What I can think of at the moment is to try different modes of posting on the community. In addition, I should also try to build more connections with others, and this should be considered my weak area. I am not active in the community or on the writing platform, and I may need to improve in the new year.

Off topic, if you like my article, please share more, maybe you are my black swan, my brother would like to thank you in advance (laughs).

In the end, the most important thing I learned from this book is probably: recognize my ignorance , after all, there are many things in the world that I don't know. May I always remain curious about the world, be flexible to face different ideas, and explore more possibilities widely!

↓↓You are also welcome to follow the Facebook and mourning of "Mrs's Reading Space"↓↓

James' reading space FB

James' reading space IG

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…