馬克解讀金融科技 | MarkReadFintech https://www.instagram.com/markreadfintech/ 轉帳幫 TransferHelper - Co-founder & CEO。 用簡單的方式介紹金融科技,希望大家都能享受金融科技帶來的方便與效率。

A look at Southeast Asia, where e-wallets are rapidly developing

2021 will be hit hard by the epidemic and the situation will be turbulent. It will be an unstable year for all walks of life. However, the home economy such as electronic payment, delivery, e-commerce, logistics, etc., has grown significantly as a dark horse with this wave of epidemic. The article will introduce the trend of e-payment in Southeast Asia, the fastest growing region of mobile e-wallets in the world. How can Southeast Asia become a hotbed of e-payment development? Comparison of industrial projects of the three major Southeast Asian giants Grab, GoTo, and Sea Group, the differences between Southeast Asian electronic payment and Taiwan payment platforms, and the challenges they will face in the future. Through this article, take a look at the electricity branch leaders and market trends in Southeast Asia!

An introduction to the development of new innovations in Southeast Asia

2021 will be full of challenges for startups, but startups in Southeast Asia will not have a brighter future. Witnessing the birth of several unicorns and the listing of major technology companies, all signs show that startups in Southeast Asia are on the verge of success. in the stage of rapid growth.

The outbreak of the epidemic has brought the wave of the home economy and the Internet economy, and the demand for digital payments among Southeast Asian consumers has also risen sharply. The scale of digital payments in Southeast Asia has increased from US$100 billion in 2019 to US$174 billion in 2021. It is estimated that by 2025 will reach $363 billion annually.

According to a 2021 report jointly published by British fintech firm Boku Inc. and market research firm Juniper Research, Southeast Asia is the fastest-growing region for mobile e-wallets in the world, followed by Latin America, Africa and the Middle East.

Looking at the general situation of Southeast Asia, Indonesia is the third fastest growing mobile phone market; Singapore estimates that the penetration rate of mobile e-wallets in Singapore will be close to 95% by 2025; Malaysia's e-payment integration is slower than other regions, but the delayed development has replaced the local Bringing huge potential; Vietnam, Thailand, the Philippines and other places launch 5G services while improving infrastructure, and the growth of electronic payment will become a trend.

How Southeast Asia has become a hotbed for e-payment development

(1) Credit card and banking services are relatively unpopular in Southeast Asia

At present, the electronic wallets in the world are roughly divided into two types - mobile payment and electronic payment. Mobile payment is a mobile wallet that uses mobile devices (such as mobile phones, electronic watches, etc.) to bind credit cards and bank accounts, such as Apple Pay or Google Pay, which is very common in developed countries where credit cards are popular. Electronic payment means that there is an independent electronic payment account that can be traded or transferred, as long as the money is stored in the electronic payment account, such as Jiekou Payment, Line Pay Money, Alipay, Grab Pay, etc. Such wallets are popular in emerging markets where credit card usage is low.

The prosperous electronic payment in Southeast Asia is closely related to the serious shortage of local banking services. On the other hand, e-commerce is booming in Southeast Asia, and electronic payment has also found a market in Southeast Asia.

At present, the electronic wallets in the world are roughly divided into two types - mobile payment and electronic payment. Mobile payment is a wallet that uses a mobile device (such as a mobile phone, electronic watch, etc.) to bind a credit card, such as Apple Pay or Google Pay, which is very common in developed countries where credit cards are popular. Electronic payment means that there is an independent electronic payment account that can be traded or transferred. As long as the money is stored in the electricity payment account, it can be stored in cash through bank account debits or manual counters such as supermarkets. This kind of wallet is stored in credit cards. Emerging markets with lower usage rates are welcome.

The prosperous electronic payment in Southeast Asia is closely related to the serious shortage of local banking services. On the other hand, e-commerce is booming in Southeast Asia, and electronic payment has also found a market in Southeast Asia.

(2) High digital penetration rate and participation

In the whole of Southeast Asia, more than 70% of millennials are highly dependent on the Internet. For example, young people in Thailand, Malaysia, Indonesia and other young people spend more than 4 hours on the Internet every day, and the Internet penetration rate is as high as 75% (about 80% in Taiwan). Familiar with internet and mobile phone operation. In addition, the governments of Southeast Asian countries have also launched a series of policies to support digital development, encouraging merchants and consumers to accept digital financial services (DFS), and promoting the development of electronic payment with policies. Investors are also smelling the growth of the payment sector. As of the first quarter of 2020, 43% of fintech companies in Southeast Asia have invested in digital payment providers.

(3) The leap-forward development of delayed introduction

Relatively developed countries in Southeast Asia are in a period of rapid growth, and their consumption, payment, mobility and transportation needs have also contributed to the implementation of infrastructure, and the "contactless" catalyzed by the epidemic has also increased the demand for digital finance. The Philippines, Vietnam, Thailand and other countries have successively launched 5G services, and the infrastructure is also being completed, which will increase the penetration rate of smartphones and stabilize the development of electronic wallets.

Southeast Asia has delayed the introduction of digital technology, and is now in a mature period of local technology and construction, and the leap-forward development means that start-ups have more choices. They can omit the services and habits of developed countries in the past, and use this as a reference to directly import Technology with higher performance develops with higher efficiency and stability.

Combining the above three reasons, new innovations in logistics, financial technology and e-commerce have strengthened the Southeast Asian economy, and new innovations have skyrocketed. For example, Gojek, which was established in Indonesia in 2010, is a representative of this field. Southeast Asia has also become an emerging market for entrepreneurship. Entrepreneurs can get out of the frame and respond to existing problems with new solutions, allowing them to operate more flexibly in terms of profit and operation. This has also allowed the Southeast Asia region to breed Grab, Sea (East Sea), Carrousell, Bukalapak and other unicorn companies with a valuation of more than one billion US dollars in the past 10 years.

Southeast Asian electronic payment leader and development trend

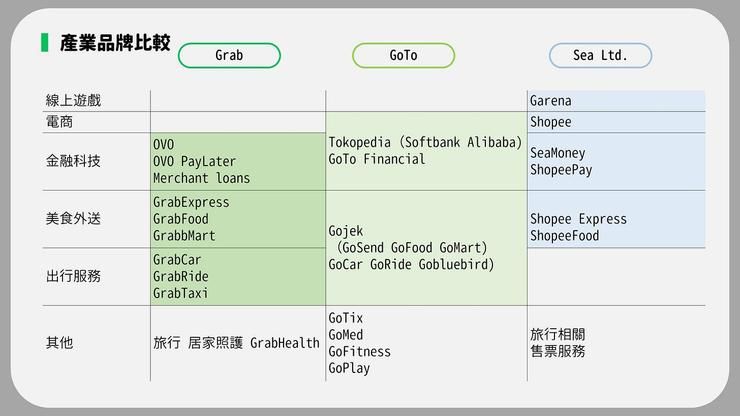

When it comes to e-payment giants serving cross-domain services in Southeast Asia, the most well-known ones are Grab, GoTo and SeaGroup. Grab was founded in Malaysia in 2012 and jumped up as a car-hailing service. According to Euromonitor’s data in 2021, Grab’s market shares in the three major businesses of ride-sharing, delivery and finance all rank first in Southeast Asia, with 72%, 50% and 23%.

Indonesia's largest e-commerce platform Tokopedia and payment giant Gojek will merge into Goto in 2021. The IPO raised $1.1 billion, making it one of the largest IPOs of the year, with a valuation of up to $18 billion. After the merger, services will also include e-commerce, payment, Ride-hailing, delivery, etc.

Founded in Singapore in 2009, Sea has three businesses: Garena, Shopee and SeaMoney. Garena is a global game developer and publisher, while Shopee is a leading e-commerce platform in Taiwan and Southeast Asia. SeaMoney combines e-wallets, payments and financial services, focusing on Shopee to make payments smoother for Shopee users.

(1) Comparing Grab & GoTo & Sea

1. Industrial projects

2. Industrial brand

(2) The development trend of payment in Southeast Asia

1. SPAC listing of special purpose acquisition company

Read Before: SPAC Risks and Conflicts of Interest

In August, Mark wrote an article that clearly introduced SPAC (special purpose acquisition company). Readers who don't know SPAC can read this article first!

In September 2021, Singapore took the lead in introducing the SPAC M&A mechanism, and listed the first SPAC in Asia in January this year. In the next 12 to 18 months, there will be 12 SPAC listings in Singapore, which is related to the relaxation of SPAC listing by the Singapore Exchange: It is stipulated that SPACs must complete mergers and acquisitions within two years after listing, so the initial development is critical. Similarly, in the United States, SPACs also have pressure to acquire mergers within two years. If the mergers and acquisitions cannot be completed within two years as scheduled, they will face the crisis of liquidation and dissolution.

Not only have SPACs sparked a frenzy in Singapore, their leaner approach to listing is also providing opportunities for Southeast Asian startups, especially in the fintech sector, to expand. Southeast Asia's first unicorn Grab was listed in the United States as a SPAC in November last year. Carousell, a Vietnamese second-hand auction site, and VNG, a Vietnamese Internet and technology startup, are also considering a SPAC listing in the United States.

2. BNPL buy first, pay later

Read Before: Buy Now, Pay Later: BNPL: A Blessing or a Bane?

The massive demand for online shopping caused by the epidemic has led to a sharp increase in the demand for BNPL. From Europe and the United States to Asia, the "buy now, pay later" payment method has begun. The industry has also introduced many deferred payment methods that do not require a credit card and are interest-free. Southeast Asia is also following the trend of BNPL. Hoolah, a Singapore-based buy-now-pay-later platform, has seen a 600% increase in transaction volume from 2020 to 2021, which shows the needs of consumers. The car-hailing leader Grab also launched a similar service PayLater as early as 2019, and pays off all fees including sharing and delivery at the end of the month. Indonesia's car-hailing and payment giant Gojek has also launched similar services in the country, which shows that BNPL is gradually being widely adopted in Asia.

3. Super App

Read in advance: SuperApp solves various needs at one time

E-wallets are rapidly gaining popularity in Southeast Asia, and Stephanie Davis, vice president of Google Southeast Asia, predicts that by 2025, e-commerce will remain the largest industry in the Internet economy. In the current growth period, it is expected that new companies in Southeast Asia will continue to grow, and the competition among industry players will become more intense.

Judging from the data, various operators have begun to increase the number of users to increase the use of apps, allowing users to rely on their apps for all their daily lives. In addition to providing users with more functions, the industry is also an important tool to gain insight into consumers. Through this, they can learn information such as consumption habits, scope and budget, and further understand customers.

4. Future improvements

Even though Southeast Asia is the region most willing to adopt mobile payments today, there is still a lot of room for payment integration in Southeast Asia as a whole. According to a survey conducted by Stripe, a global payment integration platform in 2021, although many merchants adjusted their e-commerce pages to make mobile shopping more intuitive, they ultimately lost customers due to errors in the design of the experience process .

The one-click payment experience allows consumers to check out faster, but it is still not used by merchants in Southeast Asia. Another area that can be improved is guest checkout . Many merchants require customers to create an account before making a purchase. 21% in Malaysia and 19% in Singapore Consumers who tried it said they would abandon their carts if they were forced to create an account before checkout.

(3) Similarities and differences with Taiwan's payment platforms

According to the latest statistics from the Financial Regulatory Commission, more than 15 million Taiwanese use mobile payment, and both the utilization rate and transaction volume show the development trend of non-cash payment. At the same time, industry players are also following the trend of BNPL , focusing on the demand for small loans for instant consumption, and launching installment payments with zero interest rate and no credit card tied. Payment providers are expanding from personal finance to corporate financial services, and are cooperating with financial institutions with payment as the core.

The characteristic of digital payment in Taiwan is that the platform will establish its own ecosystem, consumers will use different mobile payment in different scenarios , and have different payment platforms at the same time. For example, Line Pay has the feedback and discount function of Line Points; Jiekou Payment cooperates with night market stalls, and includes functions such as delivery, car-hailing, and donation. Then I expect to pay in the 4.0 scenario and meet consumers' online, offline or cross-border shopping needs with one-click consumption.

Compared with Taiwan, the payment platform business in Southeast Asia is much richer , including e-commerce, logistics, and financial services. Although Taiwan has gradually moved in the direction of e-commerce and transportation, it has not yet emerged as one of the three giants in Southeast Asia. And a stable cross-domain payment platform.

Possible challenges for electricity payments in Southeast Asia

(1) U.S. interest rate hikes cause capital crunch

At the end of July, the United States raised interest rates by 75 basis points, which led to a massive inflow of funds to the United States, and also exposed Asian countries to different risks to resist the risks of capital outflow and currency devaluation. Southeast Asia Recent developments With the Bank of Thailand's interest rates at low levels, the Thai market is the most at risk. Singapore and the Philippines raised interest rates. Central banks in these countries may need to tighten tightening faster, pushing up interest rates to reduce capital outflows.

For telecom operators, the tightening of funds will reduce the strength of expansion, the strategy of using discounts to attract customers in the past will also be reduced, and future growth will inevitably slow down. In addition, some operators that provide BNPL functions will also have the problem of increasing defaults. How to reduce risks is also a challenge that operators are facing.

(2) Human capital issues

Although there are many innovative companies in Southeast Asia, they are relatively inexperienced in practice. Few of them have the experience of co-founding or managing large multinational companies. Therefore, when facing the company's expansion, it may be impacted by decision-making.

This is often encountered in emerging markets. Although it is possible to introduce talents from other mature markets, it often encounters the problem of cultural and language barriers. Therefore, for an emerging industry to grow smoothly, the cultivation of relevant talents is also an important observation indicator. one.

(3) Horizontal competition

Companies such as Apple pay, Paypal, and GrabPay have a large market in the payment field, and other platforms such as Shopee Pay are also trying their best to expand and deeply integrate with shopping platforms. In order to stand out from many electronic payment platforms and cross-domain platforms, new small and medium-sized payment companies must more accurately respond to market demands.

Although the Southeast Asian government encourages more payment providers to join in to further improve inclusive financial services in the banking industry and create a cashless environment, the late payment providers are under a lot of pressure from competition, so they must be more active in service innovation , in order to occupy a place.

(IV) Electronic wallet information security and related crimes

With the increasing popularity of electronic wallets, it also begins to face some obstacles and issues, such as information security, such as password loss, identity theft, information protection, etc. Although it is more and more convenient for the public to use, various types of money laundering, fraud and theft of wallet assets are crimes. It is also increasing day by day, and these hidden concerns are getting more and more attention. Especially if the public is not familiar with the new usage process or the technical principles behind it, these weaknesses are easily exploited by criminal groups.

Mark's thoughts

In the past, Taiwan has discussed whether the penetration rate of electronic payment and mobile payment represents the advanced level of financial technology in this country. Mark believes that the emergence of new payment technology and the change of payment habits may not necessarily happen at the same time. It mainly depends on whether the new payment technology solves the pain points of the original payment, and the other is the support of government policies.

Taking Taiwan as an example, before the popularity of electronic payment, cash, bank transfer and credit card can almost completely meet everyone's payment needs, especially the high-density ATM machines and the issuance of credit cards with new feedback at any time. It is true that people should change their payment habits. It's not easy. Therefore, policy support is still needed later. The Financial Regulatory Commission proposed the electronic payment ratio in 2016, and the goal of doubling it to 52% in five years will make payment industry willing to accelerate the deployment, and the habits of the people will gradually change.

The development of electricity expenditure in Southeast Asia is not the same. The original financial infrastructure is insufficient, resulting in payment problems. Therefore, the willingness of the people to adopt new payment will be quite high. Still solving problems, not pursuing the use of new technologies.

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…