初心者,把自己眼光看的世界,一字一句描繪出來,用影像、用文字。

Private stock analysis record — PCB 6251 Dynamic

At present, I want to record the records of some companies and industries I have seen, and then I will look back after I have become more sophisticated, and maybe I can cross and understand it again.

This year, the 5G industry has become popular. Whether it is the communication industry or the manufacture of 5G components, as long as it is on the side, it is almost always hot, and PCB circuit board manufacturers are an example. There are many kinds of PCB subdivisions, single-layer board, multi-layer board, soft board, hard board, HDI board, etc., skip the industry details first. This is some of my observation records for Dingying, and I am not sure if the views are correct. I will check back later for confirmation. The following analysis is just some personal observations, and it is not recommended to follow the buying and selling.

. Plant location and contribution. Is selling a factory a bad thing?

. 19' The secret behind the Q3 financial report. Is there something called a high-tech enterprise?

. Calculation for 19' Q4. Uncertainty of capital increase. Future observation focus

. Plant location and contribution

Dingying has three factories in 2019: Taoyuan factory, Huangshi factory, and Kunshan factory. Among the three factories, the Taoyuan factory has always been a loss-making factory, and the technology has basically been transferred to the Huangshi and Kunshan factories. At the same time, the Huangshi factory is an automated factory with four phases. The production capacity has only been opened to the first phase. The news seems that because it is an automated factory, the gross profit margin of a single factory has reached 20%. Huangshi Plant is also the main profit-making plant of Dingying. Huangshi Plant is responsible for photovoltaic panels, while Kunshan Plant is for automotive panels. In terms of future prospects, Huangshi Plant’s photovoltaic panels correspond to 5G applications. Profits are expected to rise.

. Is selling a factory a bad thing?

After the Taoyuan plant was announced to be sold in August 2019, it laid off staff and sold 700 million yuan through bidding at the end of October. From a normal point of view, the sale of the plant should be negative, which means that the company believes that the production capacity is oversupplied. But Dynamic's case is slightly different, because the Taoyuan factory has always been a loss-making factory. If the process of the loss-making factory is transferred to an automated factory, the order will turn into a profit if the gross profit margin is higher. At the same time, selling a factory is equivalent to a one-time recognition of income. According to the income of 700 million yuan, it is about at least 1 yuan in EPS.

. 19' The secret behind the Q3 earnings report

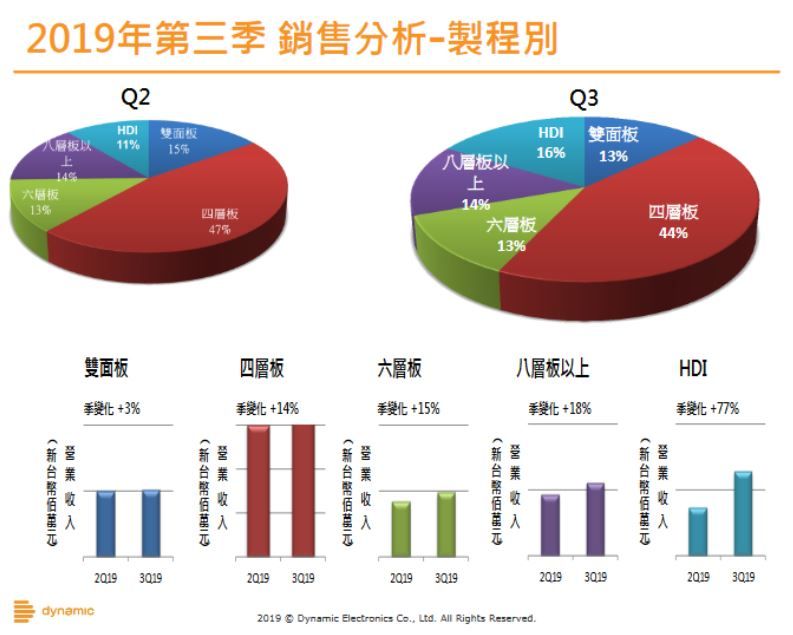

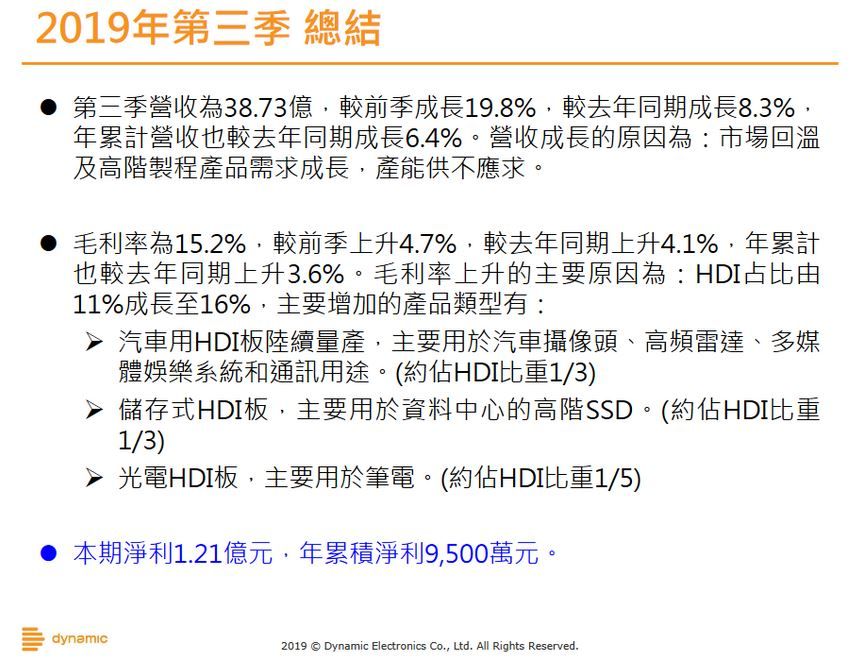

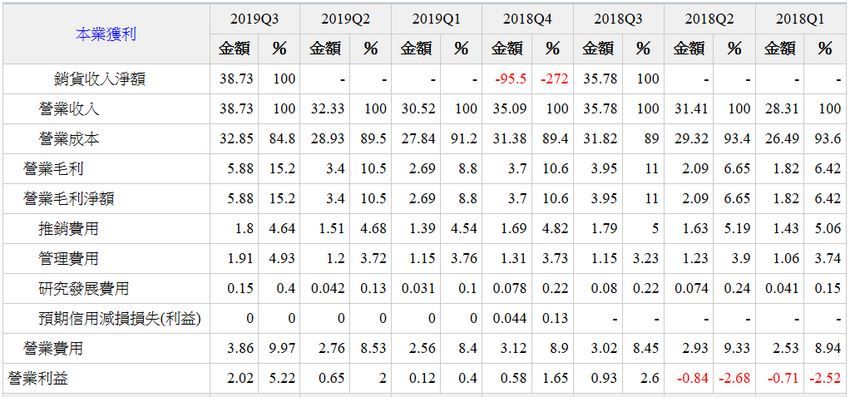

In addition to the news of the factory sale, Dingying's profit in Q3 also rose sharply. Looking at the financial report, it can be seen that the gross profit margin increased sharply (10.5%→15.2%). The company law meeting report pointed out that the HDI board of Huangshi factory accounted for The ratio increase is the main reason, from 11% in Q2 to 16% in Q3, which is a relatively high gross profit product. Following the turnaround of EPS in Q2, the EPS rose sharply to RMB 0.43 in Q3. In addition to this obvious highlight, there is a small secret.

Observing the administrative expenses in the regular quarter, we can see that the administrative expenses in the 2019 Q3 have increased by 70 million yuan (the unit in the table below is 100 million), which directly affects the final operating interests. Why is the management fee more than 70 million yuan in Q3? Let's take a look at the definition of administrative expenses: various expenses incurred by the company's organizational management operations, such as personnel wages and benefits. Then Lenovo's Q3 has laid off the Taoyuan plant staff, it can be clearly judged that this is most likely a one-time layoff expenditure.

. Is there something called a high-tech enterprise?

Dingying's current factories are all in China. In recent years, China has a policy called high-tech enterprises. He has a drag-and-drop library review conditions. It is similar to high-tech technology development, the proportion of research and development expenses, and the proportion of technology research and development personnel. and many more. What is the benefit of this identification? The general income tax in China is 25%. If the high-tech enterprise can be approved, the income tax can be reduced to 15%. Dingying filed an application in 2019. If you check the relevant websites in China carefully, you can find that 6251 has been announced in mid-November at the Kunshan factory in Jiangsu and the Huangshi factory in Hubei. This also means that the tax revenue of these two factories in China can be reduced a lot.

. Calculation for 19' Q4

According to the law, the company mentioned that the Q4 revenue should remain at the same level as last year. If there is no accident, the gross profit margin should be able to continue the Q3 level. Given that loss-making factories have been sold in Q3, and the proportion of HDI boards has increased, even if the part recognized by the one-time sale of factories is ignored, it is estimated that there should be a chance to maintain the Q3 EPS level. Even because Q4 lacks the 70 million manpower expenditure, there is a chance to surpass it.

In addition, it is understood that after the high-tech enterprise is recognized, the tax rate is revised for the whole year, which also means that the tax rate revision from Q1 to Q3 should be repaid to the annual report at one time. It's just that I'm still groping about the taxation methods in China and Taiwan... I have no idea how much I can contribute in detail, 囧.

. Uncertainty about capital increase

At the end of 2019, Dingying announced that it would increase its capital. The reason for the capital increase was a bit lousy. It was actually to repay the debt. Of course, its own debt ratio was too high and unhealthy. After the news came out, it fell. Later, the company said that the capital increase amount is expected to be acquired at 16 yuan. According to past experience, if the stock price does not differ greatly from 16 yuan, I guess no one wants to subscribe. Therefore, it seems that 16 yuan will be a great deal. defensive price. Even 10% calculation, 17.6 yuan. In theory, the company shouldn't let him fall below... well, haha.

. Future observation focus

Looking at the stock price, it can be seen that a lot of bullishness has been fermented. The current stock price corresponds to the company's Q1~Q3 EPS. In fact, the price-earnings ratio is already too high. The attitude of the market is still unclear, and they are mainly still waiting for the annual report (Q4 quarterly report).

As mentioned above, the follow-up observation of 6251 should focus on the revenue of each month. In theory, the 5G base station will gradually increase the volume, and the revenue should increase compared with the beginning of 2019. In addition, the announcement of the annual report before 3/31 is also a key point. Are these rumors true? Recently, China and the United States have eased, but China still has the spread of Wuhan pneumonia. After all, the two factories are in China, and the situation in China will also affect the company's clarity in the future.

Hold shares for the New Year and wait for the annual report to come out. When that time comes, I will look back at this article and make a verification. For the first long-term band fundamental analysis, I still hope that my vision is not wrong, haha.

If you think the content is good, please help by clicking the clap below. Please feel free to correct me if I am wrong.

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…