嗨 大家好 透過這個平台我希望我能分享我的生活及有趣的事物給大家 我不談論政治議題‼️ 喜歡我的可以追蹤 ig: karen.y_

A week of international events🌏《1/17~1/21》

■ Bubble stock market is about to burst, says chief hedge manager

It's going to be a tough year for the stock market this year. The market is gradually starting to correct. The Nasdaq is down more than 10%. Experts point out that this is just the beginning.

Grantham, a senior investment expert, pointed out that it is currently in a super bubble, but the market will not have a good outcome, "Many investors don't want to believe that the market should correct as early as March 2020 when the new crown begins, but they still don't want to believe it. , because no one wants to hear it's in a bear market right now," Grantham said, adding that this bubble will be an unforgettable experience because it's a super bubble

Figure 1 shows the changes in the Nasdaq index during the financial tsunami in 2008, from 2803 points to 1268 points, which took less than 2 years, which also means that investors need to plan the next avoidance. risk method

■ Inflation strikes, will there be any news from the FED?

After 2018, the FED has not raised interest rates, and even after the outbreak of the new coronavirus in 2020, the FED lowered its interest rates to close to zero

Investors predict that the Fed will gradually raise interest rates in March this year to fight inflation. Too much action will hurt the economy and lead to turmoil in the stock market. Hedge fund manager Bill tweeted that the Fed may raise interest rates by 0.5 percentage points. to "restore its credibility as an inflation fighter" as it would be a precursor to a big move by the Fed

However, the market has many different expectations for rate hikes. World economist Speranza estimates that the central bank is unlikely to stop raising half a percentage point in March. He believes that the central bank will move more frequently.

Showing naval strength in the U.S. and Japan increases tensions between China and Taiwan

China sent 39 military planes into Taiwan waters on Sunday, the largest in recent times

Recently, the United States and China conducted a large-scale military exercise in the Philippine waters, including two aircraft carriers, two amphibious assault ships, and a helicopter destroyer. The U.S. Navy claimed that the military exercise was training how to protect the Indo-Pacific region.

■ China's zero policy and spring break have doubled the pressure on the supply chain

Covid-19 lockdowns, quarantines, restrictions lead to chaos at China's main ports, 50% increase in air freight rates

Ocean freight prices have risen by 4%, and air freight has risen more significantly, however some shipping companies have suspended operations, making the market more nervous, supply chain experts: "Although ports are open, 21-28 days of quarantine, and PCR testing continue This has caused inefficiencies, leading to hoarding and chaos in ports.”

■ A major medical company moved its headquarters to Thailand

AZ headquarters moved to Thailand

In 2020, Thailand voted as the top 10 medical regions in the world

In addition to providing world-class cosmetic surgery, open heart surgery and cancer surgery, Thailand is also currently committed to medical research and development

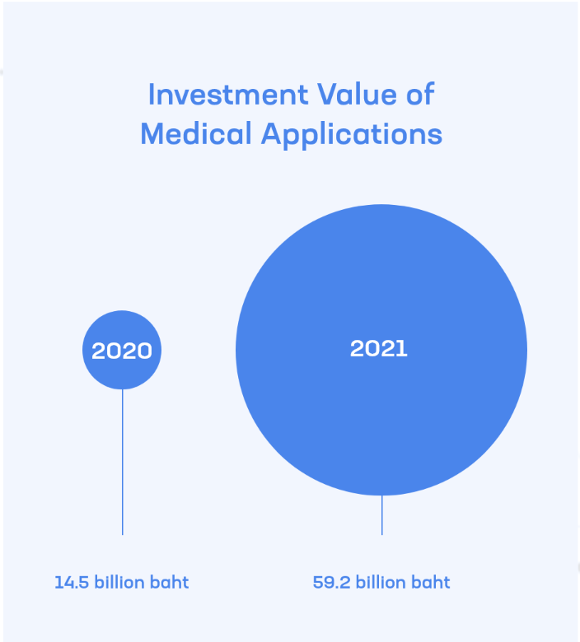

Figure 2 shows that Thailand has raised an investment of 59.2 billion baht in 2021, equivalent to 49.64 billion Taiwan dollars, which shows that Thailand is very likely to become the next Asian medical center

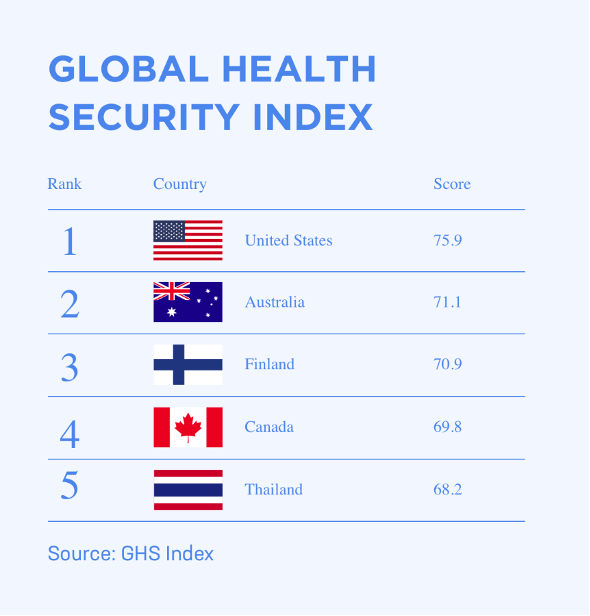

Figure 3 shows the World Medical Security Index, with Thailand ranking fifth, followed by the United States, Australia, Finland, and Canada.

This is the second time this month to share the international one-week event. Friends who like it are welcome to tip and clap. If you have any questions or need to improve, please leave a message below and tell me ❤️

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…