90後,經濟系出身,去數位金融&FMCG通路走了一遭,發現舊愛還是最美,擁有金融與零售電商的混血血液,喜歡ETF帶來的大道至簡。現在在金融業擔任數位金融產品PM,迷戀支付與金融創新帶來的有趣世界 ↓ 我有在用且推薦的服務推薦碼在這↓ https://portaly.cc/elenawu

"Index Revolution" - the passive investment method that Warren Buffett agrees with, let time be your best friend

The author who wrote the ultimate investment battle is also the Yale school fund trader Charles. Another new book by Ellis, Exponential Revolution is finally out! Investing in the ultimate battle is also a must! Reading two books together doubles the effect

Index investing buy here:

Exponential Revolution: Buffett Certification! The best way to invest in the future

Title: Exponential Revolution: The Buffett Certification! The best investment method that can really make a profit in the future, original title: The Index Revolution: Why Investors Should Join It… www.books.com.tw

The same scene plus screening, the ultimate investment battle

The ultimate investment battle: Yale traders tell you that investing in this way is the only way to make money

Book Title: The Ultimate Battle of Investing: Yale Traders Tell You That Investing in This Way Makes You Safe (Second Edition), original title: Winning the Loser's Game (6th… www.books.com.tw

If you can only buy five books this year, this one is a must. Ellis offers ten good reasons why you should invest in indexation. It is already an index investor who can buy it, read it repeatedly every year, and firmly believe in it. Buy a few more books to give to friends around you. Investment and wealth management is the simplest way. Follow the market, take the initiative to invest in your business, and invest passively. Let time be your best friend.

Warren Buffett has talked about index funds many times, and believes that index funds are one of the best investment strategies right now. Investors can now invest in the entire stock market with low-fee index funds and enjoy the effect of compound interest. The seemingly “do nothing” approach to investing can be confusing, but holding stocks across the entire market for a long time is one of the best investment strategies right now.

Share three Charles. Ellis put forward a few good reasons for you to invest in indexation. I personally decided to use indexation investment as a life-long investment criterion for these three reasons. For further reading, please see

Why do I use index-based ETFs as my life-long investment principle?

Some words should be said first, the following two points should be recognized first, and then it is easier to accept medium.com

Okay, jump back and talk about which three good reasons made me consider index investing my life partner at the age of 24 (Huh?!

1. Indexed investing outperforms active investing

Tell the story of Buffett's decade-long bet with hedge funds

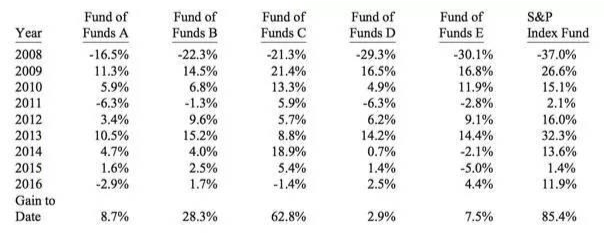

In 2007, Buffett predicted that the S&P 500 index of the US stock market would outperform hedge funds and invited fund managers to bet against him. There is only one bet with Buffett, and this person is Ted Seides, a former co-manager of investment firm protégé partners.

Buffett chose Vanguard 1 fund (symbol VFINX ) that reflects the performance of the S&P 500, and Seiders tied his bet to a series of actively managed mutual funds. The bet was officially closed in December 2017, with Buffett's chosen fund returning 94% over 10 years, and Syders's returning 24%.

When the bet is about to enter its 10th year, Buffett's selected S&P 500 index fund has risen 85.4%, while the opponent's five hedge funds have only returned 22% during the same period. Such a huge gap makes co-managers Saids announced his surrender and said that he would perform the donation action according to the bet.

2. Reduce investment costs and save tax

Where is the client's yacht? All right. It can also be called "uncovering the true face of Wall Street"

Title: Where is the client's yacht? All right. It can also be called "Uncovering the True Face of Wall Street", the original name: Where Are the Customers'Yachts? or A Good Hard Look at Wall… www.books.com.tw

Buffett once said, "Professional managers on Wall Street manage trillions of dollars of funds and charge exorbitant fees, but it is usually the fund managers who get the most benefit, not the clients." If you want to know how dark Wall Street is, you can read the above book.

There are four different targets in the picture above. Among them, the VTI from vanguard and Taiwan 0050, the only one I recommend in Taiwan. The total cost is less than 1%. Don't ignore the difference between 1% and 3%. The daily fee, you will know why the brokerage asks you to eat Haagen-Dazs every month~

3. Don't dance with Mr. Market and take back control of time

In the end, it is also what I attach more importance to. The financial market cannot be predicted, and there is no need to be led by Mr. Market. The only thing that pays attention to time is the cost, rethinking the meaning of time, living in the moment, living a minimalist life, I personally feel that the index This school of investors has a taste of Zen. It seems that passively following the market is very contradictory. From childhood to adulthood, you have to make a lot of efforts to get the fruits, but through the accumulation of time and principal, as time goes on, you will thank yourself for that year. made an important decision.

This book is consistent with the central vision of our financial management practice notes in the promotion. We hope that more people can embark on this solid index investment road and enjoy the returns brought by Mr. Market, no matter whether Mr. Market is drunk or rocketing this year. God, earning reasonable market remuneration, returning time to yourself, and experiencing life, I think index investment brings the greatest return!

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…