分散式出版實踐者 網誌:bchai.cc

It is everyone's responsibility to help the LikeCoin chain defend against attacks!

Appreciate the seventh and ninth proposals just passed by the Citizen's Republic. One of the important purposes is to increase the overall delegation rate to an ideal 67% to strengthen the security of the LikeCoin chain. But why is the security of LikeCoin chain related to the overall commission rate? This starts with the basic consensus mechanism principle of LikeCoin chain operation - Bonded Proof of Stake (BPoS).

Delegating LikeCoin to the validator to get rewards is because the delegator sacrifices 21 days of short-term liquidity to participate in every transaction of the LikeCoin chain. LikeCoin chain does not have an official document explaining the consensus mechanism, but most of the principles are the same as that of Cosmos. If you don't want to see the source code, you can refer to Tendermint's documentation .

Fighting hostile takeovers

The traditional currency ledger is provided by the bank to provide manpower and systems to maintain its accuracy, but in the Citizen Republic, every transaction is jointly maintained by the validator and every LikeCoin delegator. This is the magic of blockchain. Currency circulation and settlement do not depend on accountants, nor do they need to trust any institution; it is enough to trust the network mechanism.

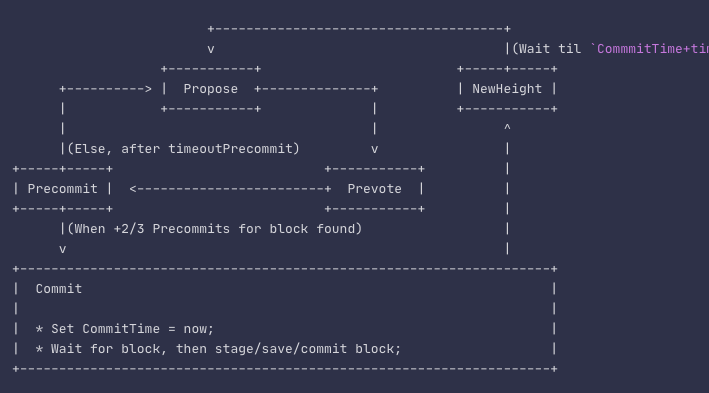

A validator's "voting power" is proportional to the amount of LikeCoin delegated to them. Validators are responsible for operating nodes, and are technically responsible for accounting, voting, and other operations. These on-chain operations are essentially ledger records (transactions). The validator will initiate round after round of voting for each ledger record, expressing whether to agree to write it into the ledger (block). The right to object will not pass. In other words, if someone wants to maliciously paralyze the network, they only need to obtain 1/3 of the online voting rights, and then cast a negative vote for each block to prevent the LikeCoin chain from generating new blocks.

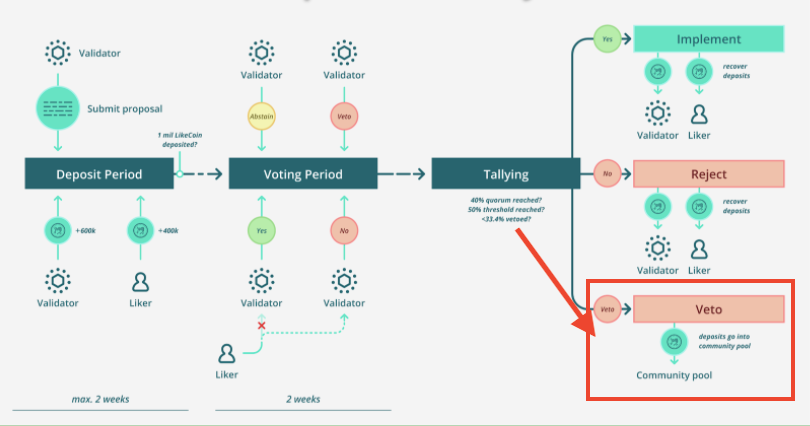

Obtaining 1/3 of the online voting rights can also cast a "veto" (veto) on the governance proposal to paralyze the governance mechanism, because the voting process of LikeCoin chain stipulates that if 1/3 of the voting rights cast a veto on the proposal, the proposal will be pulled down.

Not long ago, the overall delegation rate of LikeCoin was only about 30%. If someone wants to maliciously attack the LikeCoin chain, they only need to purchase 15.01% of the total circulation of LikeCoin in the open market and entrust it to the node they control, and the LikeCoin network can be successfully shut down. The LikeCoins circulating in the market at that time accounted for 70% of the total circulation, that is, only 20% of the LikeCoins in the open market can be purchased to control the LikeCoin chain.

However, if the overall delegation rate is higher than 67%, even if the remaining 33% of LikeCoins in circulation on the market are acquired, it will still not be able to account for more than 1/3 of the online voting rights, which means that the LikeCoin network is immune to malicious takeover attacks. .

In fact, in addition to attacks from the state level, it is hard to imagine that someone will seize control of the network by sweeping goods on the open market, because the cost of doing so is very high: in the process of acquisition, the supply of goods will become less and less, and the price will naturally increase. Being robbed is high, and the cost of attacking is also greatly increased. And even if you can successfully seize 34% of the voting rights, you can only paralyze the network and hurt others and yourself, but you can't "make fake accounts" to send money to yourself (such as double spend), because making fake accounts doesn't work. As long as there is an "absolute veto", it is also necessary to have an "absolute decision" that is higher than 2/3 of the voting power.

The most difficult attack to prevent is actually not a malicious takeover from the outside, but from inside the LikeCoin chain.

Avoid over-concentration

Assuming that some validators do not do well in node security and are maliciously controlled by hackers, they can obtain the voting rights of the node. As long as the total voting power of nodes controlled by hackers exceeds one-third, the network can be paralyzed.

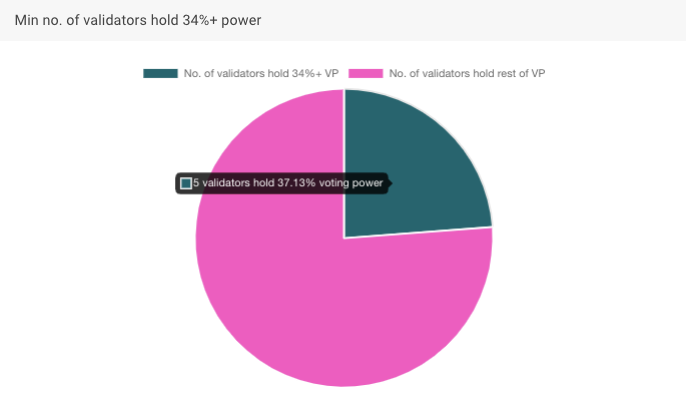

Given the current state of the LikeCoin network, how many nodes does a hacker have to break into to paralyze the network? This data is recorded in real time on the block explorer Big Dipper publicized by the LikeCoin network: the answer is 5 nodes. For the enemy, it seems that anything is more cost-effective than a hostile takeover in the market.

LikeCoin holders, as members of the Republic, the best way to plug this loophole is to try to decentralize LikeCoin to multiple validators to avoid excessive voting power concentrated on a few validators. For the overall long-term benefit, LikeCoin assets should not just follow interest rates. The greater the so-called ability, the greater the responsibility, and the big holders who hold a lot of LikeCoin should pay more attention to this.

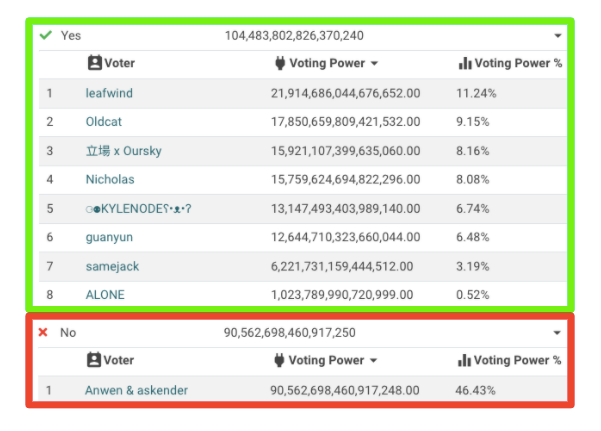

There was an interesting scene of "Three British Wars against Lu Bu" in the recent vote on Motion 9: although only one validator voted against, he had nearly half (46.43%) of the effective voting rights, and 8 others voted in favor. The voting rights of the validators of the votes are evenly matched! If the validator voted veto instead of no, the motion has been rejected. Of course, we can't rule out that the delegator's intention is indeed to vote against this proposal; but the problem reflected is that over-centralized delegation to a single validator will magnify the power of a few and make the network more vulnerable to attack.

Of course, it would be more ideal if all validators actively voted, too few are participating right now. At the very least, I would like to see Zhang Liao or Gao Shun beside Lu Bu.

Diversify investments to reduce risk

In fact, decentralized delegation is also an important principle to protect one's own assets, because LikeCoin chain has a penalty mechanism, if the validator is offline for too long, it will be fined (slashing), and the money will be deducted from the delegator's LikeCoin. There are currently two conditions for being fined: cheating (double spend) and being offline for too long. The former is less likely to happen, while the latter is very common. If the delegator all in to a validator, in case the validator misses and is punished, it will suffer heavy losses.

If you want to know which validator is more reliable and active, and deserves your sacred vote, you may wish to join LikeCoin's Discord channel to browse, speak, exchange and ask questions. During each proposal voting period, you are welcome to ask the validator's voting intentions in the channel to see who is closer to your own. The advantage of liquid democracy is that you can redelegate the voting power to other validators during the voting period. If you find that the validator's intention is to support you, jumping into the boat will cost you zero, and it will take effect immediately.

A republic can become a republic because citizens are the main body of a group, and the establishment of a group depends on the participation of citizens. What kind of country do you want the republic to be? It's up to you how you choose to participate.

Reference article

- Proof of Stake's security model is being dramatically misunderstood

- Cosmos Validator Economics — Bridging the Economic System of Old into the New Age of Blockchains

- Vulnerability: Proof of Work vs. Proof of Stake

- The Proof-of-Stake Guidebook

- Cosmos / ATOM Delegation Guide

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…