Mun Is Writing • 生活事 #品食嚐鮮 #行走發現 #旅行探索 #觀影觀劇 #閱書讀文

Osmosis Workshop|He said "The faster the world is, the slower the heart is"

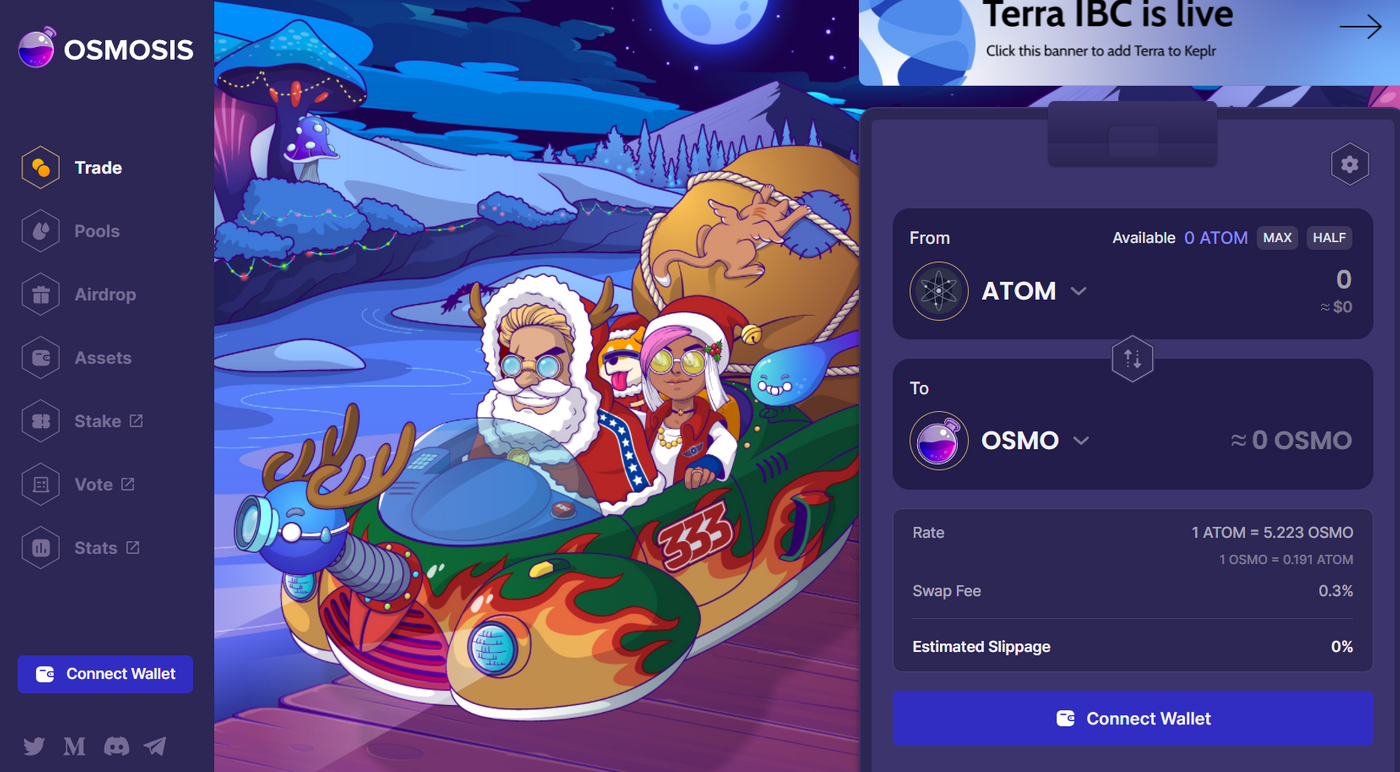

Earlier in Matt City creator Daisy's " LikeCoin Liquidity Mining | Osmosis LIKE-ATOM, LIKE-OSMO mining rewards have finally arrived! ", read the article " Participating in LikeCoin Liquidity Mining Experience Sharing through Keplr Wallet " article, I learned how to conduct liquid mining operations on Osmosis exchange, and the two wrote an almost hands-on teaching process, the content is straightforward and simple Clear, as long as the implementation process is carried out step by step, there will be basically no major problems.

And by chance "opportunity", I read this article from Cat Travel [Erica] , and I accidentally found out that there is an Osmosis exchange workshop, so I signed up according to the situation, thinking about whether I could have more in-depth learning by taking this opportunity to actually participate. .

Consciously, this harvest focuses on (1) the understanding of the operation of liquidity mining, and (2) the operation of the Osmosis exchange interface.

(1) Understanding of the operation of liquidity mining

- free loss

"Usually generated from one of the coins, the increase is greater than the other, so that you increase the liquidity but the value of the coins is lower than if you simply hold the coins"

Illustrate with course examples

1. Liquidity mining requires at least two coins, assuming that the two coins are Token A and Token B;

2. The original value of Token A = $1, the original value of Token B = $0.5, currently holding 500 Token A worth $500 and 1000 Token B worth $500;

3. In the future, if Token A rises to value = $2 and Token B value remains = $0.5, then the value of Token A currently held in hand = $1000 (=500*$2), and the current value of Token B remains = $500 (=1000 *$0.5);

4. In the case of not investing in the mining pool , the total value of the two = $1500 (=$1000+$500).

5. In the case of investing in the mining pool , it is assumed that after the investment, the adjustment of Token A in the pool = 353, and the adjustment of Token B = 1414; although the number of Tokens increases = 1767 (353 + 1414), but two The total decrease in the value of Tokens = $1413 (Token A=353*$2=$706, Token B=1414*$0.5=$707);

6. Summary: Not investing in the mining pool and investing in the mining pool, the former value = $1500, the latter value = $1413.

- The APR in the mining pool is not fixed (the APR is high in the initial stage, and gradually decreases in the later stage)

This part is a personal curiosity; when I started investing in a certain mining pool, I was really attracted by its APR of more than 100%. However, when I held it for a long time without unbundling it, when I checked the income of the mining pool from time to time, I was actually attracted by it. It is found that APR is gradually reduced, and the reduction ratio is relatively high compared to the mining pools currently invested.

& the answer is...

The main sources of liquidity mining revenue are (1) handling fees and (2) additional rewards in the platform; the two are related, and it is understood that the handling fees derived from currency exchange in the mining pool will be returned to the mining pool. Therefore, the more people exchange coins in the pool, the more follow-up fees will be generated, and the higher the income will be. Although there are additional rewards in the platform, they are fixed values/amounts, so the more people who invest in this pool, the more There will be the possibility of diversifying the income, thus reducing the original APR.

However, this is a normal phenomenon (interest rate) that will eventually evolve as a stable mining pool.

(2) Operation of Osmosis Exchange Interface

- Actual operation (unbinding)

This part of the personal focus is on learning the operation and concept of unbinding; if the host shares, when the mining pool becomes stable, the interest rate will be relatively reduced by a lot, and if you adjust the unbinding in a timely manner, you will be able to reinvest the income you get into other APRs in higher mining pools.

For liquidity unbundling, please refer to this article without going into details. - Actual operation (Stake)

Since I have never conducted a Stake operation at Osmosis, I started participating immediately after the course was over by hosting a demonstration. The process is the same as the commissioning process in Liker Land. After entering the Osmosis exchange page, click on the Stake option in the left column. After switching the page, you can start to choose who you want to stake. - Confirmation of Osmosis website

The small reminder hosted in the course is very important to confirm the website of Osmosis. It is recommended to click on the link of the decentralized exchange you want to enter through the CoinGecko website.

Go to the web page (CoinGecko), click "DeFi" in the upper options, find Osmosis, and follow the content of the information bar on the right to find the Osmosis website.

I would like to thank the workshop hosted by Cat Travel [Erica] and the creators of Matt City who participated in this time. Thanks.

Ps: Please correct me if I misunderstood the content of my experience sharing, thank you.

A note on the same scene:

Reading the liquid mining operation process, or the content of articles introduced by various exchange platforms, in addition to wanting to gain additional income, I really want to know more about blockchain and other new knowledge at this stage, especially in Matt city. Creators write and share about this field, and feel that the future world is indeed "Everything is Possible" .

However, in the face of such a huge, constantly refreshed (such as from NFT to the recent Noise.cash), and in the face of a wealth of various information, reading often unknowingly evolves into "passive" acceptance, but less "active" thinking ...for fear of not being able to keep up with the ever-changing pace of the blockchain world.

At that time, he said in the advertisement that "the faster the world is, the slower the heart", which can be used as an alternative reminder for learning.

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…