拷貝貓區塊鏈翻譯 Crypto Noob | SolanaTW Admin | ฅ^•ﻌ•^ฅ

Profiting with the Tulip Protocol: Part 2 — Shorting

Original: https://thesolanagrapevine.substack.com/p/the-solana-grapevine-11212021?justPublished=true by The Solana Grapevine

Translation: Copycat ฅ^•ﻌ•^ฅ ( Twitter ) | copycat.sol

Strategy #2: Go short

In the first article , you may have noticed that you can short tokens using leveraged liquidity mining (LYF). On the Tulip (Tulip) protocol, you can short tokens (eg: ORCA) in two ways, while earning multiplied interest rates:

1) Open a liquidity mining position of ORCA-stablecoin (eg: USDC) and borrow ORCA with >2x leverage

Sally deposits $10,000 worth of tokens (preferably USDC to minimize swap fees) and borrows $20,000 worth of ORCA (3x leverage). After clicking "Farm", $5,000 ORCA will be exchanged for $5,000 USDC, resulting in a 50:50 mining ratio ($15,000 ORCA + $15,000 USDC). Sally's market exposure will be:

- Long $15,000 in ORCA (LP token)

- Long USDC (LP token) by $15,000

- Short $20,000 in ORCA (borrowed tokens)

Her initial net exposure will be a short $5,000 ORCA. If the price of ORCA falls, Sally will profit; if the price of ORCA rises, she will lose. As a general rule, when mining LYF with <2x leverage, you are shorting the borrowed tokens slightly.

Instead of locking her funds in shorting tokens, Sally earns 3x liquidity mining rate + transaction fees or 1000% APY on her tokens!

2) Open a liquidity mining position of ORCA-encrypted assets (eg: SOL) and borrow ORCA with >2x leverage

Sally deposits $10,000 worth of tokens (preferably SOL to minimize swap fees) and borrows $20,000 worth of ORCA (3x leverage). After clicking "Farm", $5,000 in ORCA will be exchanged for $5,000 in SOL, resulting in a 50:50 mining ratio ($15,000 ORCA + $15,000 SOL). Sally's market exposure will be:

- Long $15,000 in ORCA (LP token)

- Long $15,000 in SOL (LP token)

- Short $20,000 in ORCA (borrowed tokens)

Her initial net exposure will be short $5,000 ORCA and long $15,000 SOL. In order for her to be more profitable than the first example (eg: opening an ORCA-USDC liquidity mining position), she needs to bet that the value of SOL will increase.

During this period, Sally will receive 3x the liquidity mining rate + transaction fee equivalent to 1000% APY!

To summarize, if you want to short a token (eg: ORCA), you can open an ORCA-stablecoin liquidity mining position or an ORCA-crypto asset (SOL) liquidity mining position with > 2x leverage to borrow ORCA. If the encrypted asset (SOL) falls, the first type of liquidity mining will be more profitable; if the encrypted asset (SOL) rises, the second type of liquidity mining position will be more profitable. If you think crypto assets will remain stable (like stablecoins), then just choose a pool with a higher APY.

Simulate assets over time

LPs will rebalance when the price of non-borrowed tokens (USDC or SOL) or borrowed tokens (ORCA) changes. If the value of ORCA rises relative to USDC or SOL, the LP will contain less ORCA and more USDC or SOL. If the value of ORCA falls relative to USDC or SOL, the LP will contain more ORCA and less USDC and SOL.

It's easy to calculate your market exposure anytime the price changes. Just apply the same formula: long tokens in LP + short borrowed tokens. The "Your Position" page of the Tulip protocol will show you how many tokens are in your LP and how many tokens you have borrowed. The first one has an example.

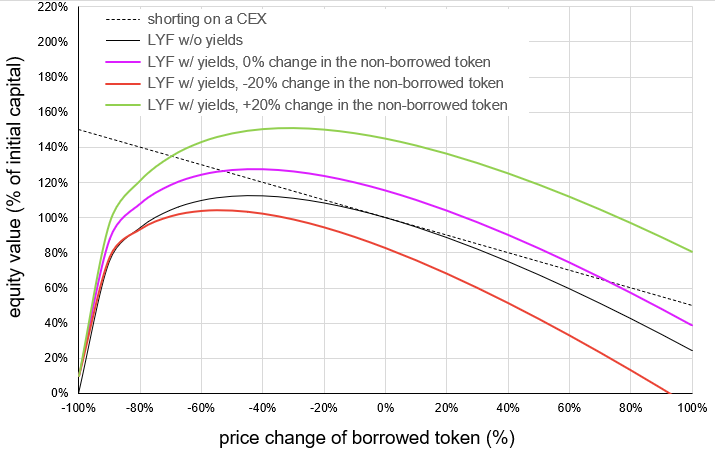

The chart below simulates how your asset value (100% = $10,000) will change when the price of unborrowed and borrowed tokens moves.

Black dotted line - represents Sally's assets if she were to short $5000 of ORCA on CEX.

Black line — represents Sally’s assets, she is using LYF to short ORCA (by mining the ORCA-USDC mining pool and borrowing ORCA with 3x leverage), regardless of the liquidity mining rate. Due to impermanent losses, her assets will always be below the black dotted line.

Purple line — Sally is shorting ORCA using LYF (by mining the ORCA-USDC pool and borrowing ORCA with 3x leverage), including yield. If ORCA stays in the ~[-52%, +72%] range after 30 days, she will make more profit than simply shorting CEX. Note that even if ORCA increases by about 25%, Sally will still make a profit (eg: her asset > 100%), even if she shorts ORCA, because the liquidity mining rate can compensate (2700% APY of the asset). It's also worth noting that when ORCA falls, her LP will rebalance and start holding more ORCA; if ORCA falls over ~-40%, she will hold a net long exposure to ORCA ). Therefore, if ORCA continues to decline by more than ~-40%, her profit will decrease. When this happens, we suggest you that the purple line simulates the change in ORCA-SOL with 3x leverage (borrowing SOL) if SOL remains flat (ie behaves like a stablecoin).

Green line — Sally is shorting ORCA using LYF (by mining the ORCA-SOL pool and borrowing ORCA with 3x leverage), including yield, if SOL goes up 20%. Because she is long $15,000 in SOL, her equity value will be much larger than the purple line.

Red line — Sally is using LYF to short ORCA (by mining the ORCA-SOL pool and borrowing ORCA with 3x leverage), including the yield, if SOL falls by 20%. Because she is long $15,000 in SOL, her equity value will be well below the purple line.

liquidation risk

When going short with LYF, especially when using the first paradigm (staking ORCA-USDC and borrowing ORCA), your liquidation risk is much lower than when you are leveraged long ( first article ). ORCA can move [-95%, 110%] and your equity will still be above 20% (liquidation happens when your equity reaches 15%). However, there are two things to note:

1) If ORCA falls to ~-90%, if ORCA falls again, your assets will drop sharply.

2) If the non-borrowed coin is not a stablecoin (eg: SOL), be vigilant if it drops relative to ORCA, as this situation may cause your assets to drop sharply.

Summarize

You can use LYF on the Tulip protocol to short your bearish tokens while earning multiplied yield rates on your capital.

Please continue to pay attention to more Tulip (Tulip) liquidity mining strategies!

If you think the article is well translated ^ↀᴥↀ^ If you are willing to invite me for a cup of coffee, you can also send it to copycat.sol

Welcome to the unofficial Solana Chinese telegram group Discuss more about the big and small of the Solana ecosystem

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…