Top 10 DeFi & DeFi 2.0 Tokens and Projects in 2022

Consumers and billionaire investors alike are taking notice of the flourishing peer-to-peer crypto network, which is becoming a typical feature of a broad crypto portfolio. But what precisely is it? What distinguishes DeFi from every other crypto sector you’re familiar with?

Read What To Expect From DeFi 2.0 First:

https://medium.com/@BitYard/defi-2-0-what-to-expect-and-why-it-matters-d2d698d8739d?source=your_stories_page

What is DeFi?

DeFi focuses on offering the convenience of peer-to-peer transactions to investors in an increasingly digitized financial world. DeFi platforms use smart contracts, which are digital contracts that exist on the blockchain, to create a space for lending, borrowing, trading, saving, and earning interest that is free of the normal bureaucracy and minutiae.

The DeFi network’s objectives are straightforward:

1. Ditch the paperwork

No paperwork and no wait time through the bank for transactions to clear.

2. Cut out the middleman

Automating the contract process on the blockchain eliminates the need for human intervention.

The TVL of lending platforms (mostly MakerDAO) was $270 million at the start of 2019. This trend continued in 2020, culminating in the launch of Compound’s governance token, COMP, which sparked the craze and prompted the first request for liquidity mining.

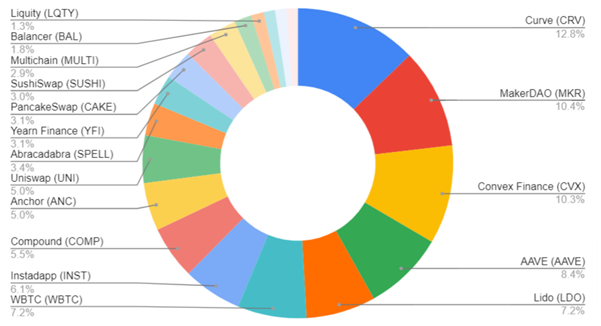

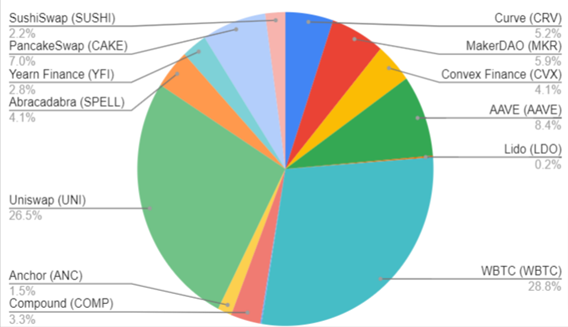

DeFi’s TVL had increased more than 1000x by December 2021, hitting $322.41 billion. You can see the Top 20 coins and projects below.

Hottest DeFi Tokens Picks for 2022

Choose the most promising DeFi token in 2022 based on two factors.

- Arrange the whole locked position TVL

- The market value generated from market transactions (2021/12/28)

Both the full evaluation and screening rankings:

The Market Value of DeFi

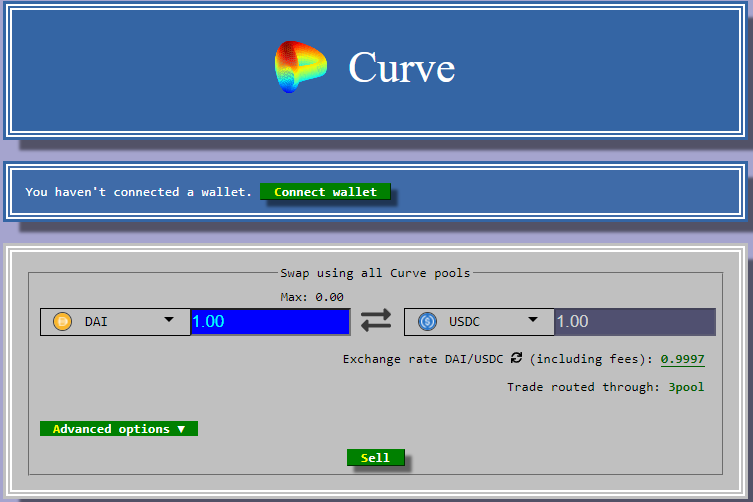

Curve (CRV)

Curve is a decentralized stablecoin exchange with an automated market maker that manages liquidity.

CRV is Curve Finance’s governance token. This protocol created a complicated time-based staking structure to convert CRV to veCRV, where veCRV is a governance token with the ability to claim the network’s cash flows.

Watch & Trade CRV Here

MakerDAO(MKR)

Users can utilize Maker to lock in assets as a form of collateral for loans in exchange for Dai. It was developed in 2015 as an open-source project by the Maker Foundation to provide economic freedom and opportunity to anybody, everywhere. Maker issued its first stablecoin, the Single Collateral Dai (SAI), in late 2017, using Ether (ETH) as collateral.

Watch & Trade MKR Here

AAVE

Users can engage in a non-custodial decentralized money market using AAVE, an Ethereum token. Deposits give liquidity to the market in return for a variable interest rate, while borrowers can borrow bitcoins.

Watch & Trade AAVE Here

WBTC

Wrapped Bitcoin (WBTC) is an Ethereum(ETH) blockchain-based tokenized form of Bitcoin (BTC).

WBTC is compatible with ERC-20, the Ethereum blockchain’s core compatibility standard, allowing it to be fully integrated with the Ethereum blockchain’s ecosystem of decentralized exchanges, crypto lending services, prediction markets, and other DeFi-enabled decentralized apps.

Convex Finance(CVX)- DeFi 2.0

Convex streamlines the Curve boosting process to increase yields. Curve liquidity providers can earn trading fees and claim boosted CRV with Convex without locking CRV. Liquidity providers can easily offer liquidity benefits and increased CRV.

Convex allows users to stake CRV and get trading fees as well as a share of the enhanced CRV received by liquidity providers. It enhances capital efficiency and the balance between liquidity sources and CRV stakeholders.

Watch & Trade CVX Here

Uniswap(UNI)

UniSwap is a decentralized exchange (DEX) that allows users to trade ERC-20 tokens without the involvement of a middleman. Trading tokens on a DEX eliminates the risks associated with centralized exchanges and the need to store tokens on any exchange.

A market maker (AMM) offers liquidity to traders via Liquidity Providers’ token deposits into the Smart Contract (LP). Liquidity providers are compensated with a 0.3 percent trading fee under the protocol.

Watch & Trade UNI Here

Compound(COMP)

On a decentralized blockchain, Compound users can lend or borrow certain cryptocurrencies. As a result, by pooling assets, it determines interest rates based on supply and demand.

Compound users will be able to deposit their crypto assets, which will then be aggregated into a liquidity pool. Users will receive cTokens in exchange for their deposits. Users can earn interest by holding the cTokens.

Watch & Trade COMP Here

PancakeSwap(CAKE)

PancakeSwap is a decentralized exchange powered by Binance Smart Chain (BSC). On BSC, this is the largest AMM-based exchange. The transaction fees on Binance Smart Chain are significantly cheaper than those on Ethereum. PancakeSwap’s governance token is CAKE.

Watch & Trade CAKE Here

Lido (LDO) — DeFi 2.0

The Lido staking solution is Ethereum compatible (ETH). Users can stake ETH while avoiding asset locking constraints by using Lido’s staking solution. Users’ ETH money are currently locked and will remain so until the new mainnet is activated in preparation for ETH 2.0. Because ETH2.0’s release date is constantly being pushed back, this transaction’s release could take years. Users can only stake in multiples of 32 with regular ETH2.0 staking (ETH). The minimum stake amount is $150,000 USD, based on current values. This barrier is removed with Lido.

Watch & Trade LDO Chart Here

Abracadabra(SPELL)-DeFi 2.0

Interest-bearing tokens (ibTKNs) such as yvWETH, yvUSDC, yvYFI, yvUSDT, and others are used as collateral to borrow USD-pegged MIM (Magic Internet Money). MIM functions in the same way as any other stablecoin.

Abracadabra Money has introduced interest-bearing tokens. They had previously been idling. Abracadabra Money allows users to leverage their cash with no risk in order to reach the next level, bringing up a slew of new models and possibilities.

In the Abracadabra Money ecosystem, there are two main tokens:

The governance token is called SPELL.

MIM is a critical component of Abracadabra Money’s lending model’s long-term viability.

Watch & Trade SPELL Chart Here

Other Articles You Might Be Interested:

__________________________

BitYard Exchange: BitYard.com

Customer Support: Support@bityard.exchange

Business Request: levi@bityard.exchange

BitYard Telegram Communities

BitYard News & Events — https://t.me/BITYARDNEWS

English — https://t.me/BityardEnglish

Vietnamese — https://t.me/BitYardVietNamChat

Indonesian — https://t.me/bityardindonesia

Philippines — https://t.me/BityardPhilippines

BitYard Official Social Media

Youtube — https://www.youtube.com/c/BityardOfficial/

Facebook — https://www.facebook.com/Bityardofficial

Twitter — https://twitter.com/Bityard_Global

Medium — https://medium.com/bityard

Platforms BitYard Settled in

Coincodex — https://coincodex.com/exchange/bityard

Coinpaprika — https://coinpaprika.com/exchanges/bityard/

CryptoAdventure — https://cryptoadventure.com/discover/exchanges