Some Thoughts For Tide Trust Network (2)

This is a follow up article from the previous one "Some Thoughts For Tide Trust Network". Recently after taking a deep look into GMX.io I feel that it is possible to borrow their "casino model" and implement it into Tide Trust Network. Here I am not going to explain how GMX.io works. For those who needs to have some background knowledge please refer to the following information sources:

For those who are interested in Tide Trust Network please click the following link:

White Paper: http://new.tide.ooo/white-paper/

A few months ago I post my thoughts on Discord channel about how TTN can possibly work. Trust, confidence, meeting criteria, these kinds of stuff can never be free. It has to be a paid network. People need to pay some premium in order to enjoy the benefits of using services within it.

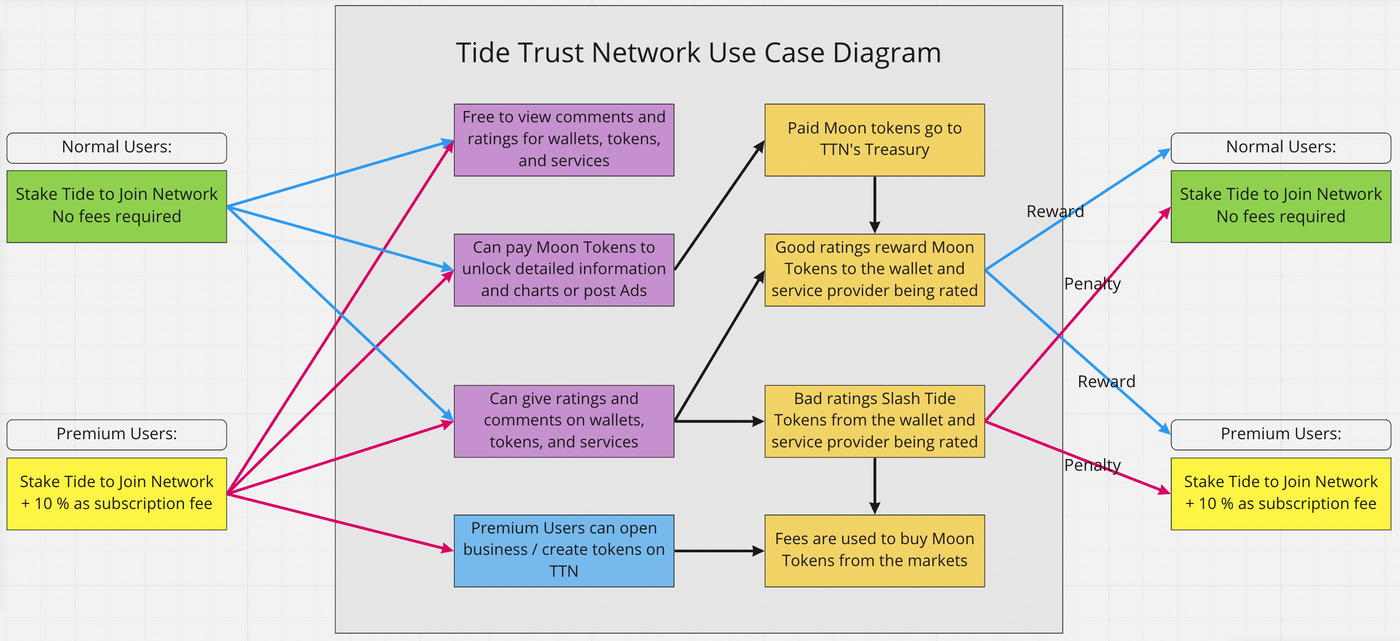

It's similar to buying a car. You don't want to buy cars from manufactures without an ISO/TS16949 certificate. Applying for that certificate takes money. Eventually that cost will need to be shared by everyone to ensure the safety of customers and to establish the reputation of manufactures. Below is the original use case diagram I drew.

There are two types of users, normal ones and premium ones. Normal users only stake Tide tokens to join TTN, while premium users need to stake Tide tokens and pay a 10% premium fee. Premium users can open business or issue tokens within the TTN. Premium fee will be used to buy Moon tokens from the market. All users can pay Moon tokens to use toolkit provided by TTN to access information about wallets and businesses within TTN. People can also give ratings and comments on wallets, tokens, and services to earn Moon tokens. Good ratings reward Moon tokens to wallet and service provider being rated, while bad ratings will result in penalty, where staked Tide tokens can be slashed.

In the above scenario, Moon tokens can only be earned when you get good ratings from others, thus it become a "Proof of Trust" token. The current distribution mechanism where you vote for Moon/Tide pair with Aqua will be obsolete. And the use case for this "Proof of Trust" token is "Doubt", which is to examine other participants behavior using various data offered by toolkit.

The above example uses a subscription model, where TTN is a platform on which many tokens and wallets are listed by staking Tide tokens. Basic liquidity for Tide tokens comes from premium users who pay some fee to build their business within the TTN, while most people do not need to pay anything apart from staking their Tide tokens. Slashing penalty is introduced to address the "Nothing At Stake Problem" for bad actors. Slashed tokens will be used to buy Moon tokens, which will be distributed to participants with good ratings as rewards. So bad actors are paying while good actors are earning within TTN.

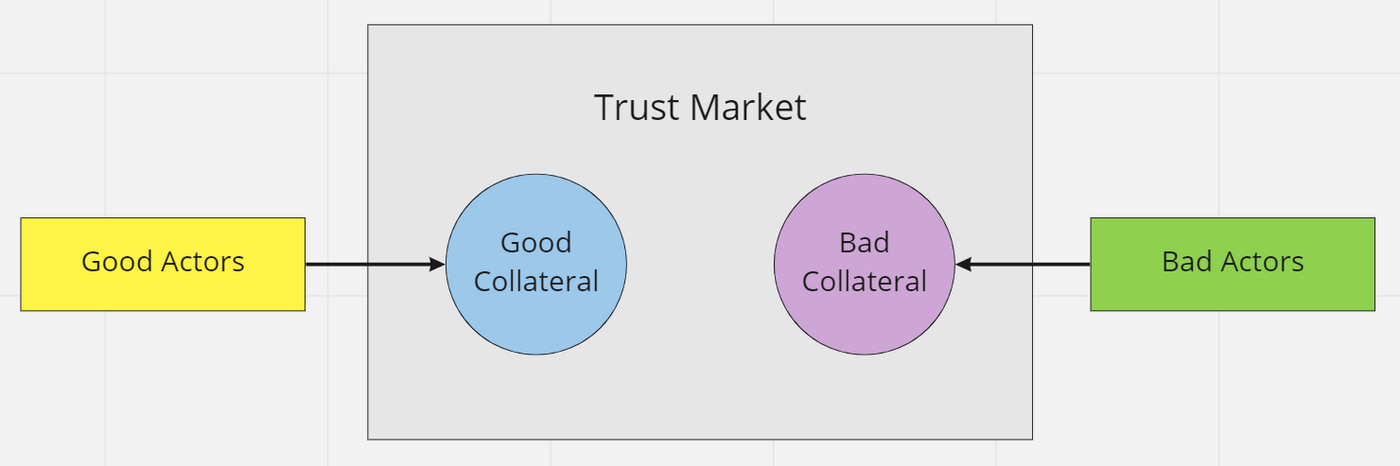

Another model I think how TTN can be built is through the use of market force. It's similar to people buying and selling assets based on their projection of price. If we can build a market in which people can either get or lose assets based on their projection of "Degree of Trust" in a token or wallet, then that "Degree of Trust" should give people sufficient information on how trust worthy that token or wallet is. The market will take care of the rest. Honest participants get rewards while bad actors suffer from losses.

The question is, how do we define "Degree of Trust"? Also how do we measure and quantify that? How do we build that market? In my opinion there isn't a simple answer to these questions. My idea is that "Degree of Trust" can be represented by the level of liquidity and buying power a token holds. If a token is constantly losing value and the size of liquidity pool is shrinking, that token is not trust worthy.

With regard to the "Market of Trust", two elements are important and should be used to define the rules followed by all participants, Collateral and Liquidation. Collateral is needed to avoid the "Nothing At Stake Problem", liquidation is what happens to people when they misbehave. Everyone who joins the TTN is basically taking on a long position on themselves believing they are good actors. So businesses and token holders are longing on the collateral they provide. If a collateral is losing on the level of liquidity, that collateral will face liquidation and removal from TTN.

When bad collaterals are liquidated, they can be sold against XLM. A portion of liquidated amount can be transferred to Good Actors as reward, with the remaining amount being used to buy Tide tokens from the markets which go to the TTN treasury.

And in fact we are creating this Trust Market by opening a casino just like GMX. Participants need to pay funding fees in Moon tokens to reserve their seats. Moon tokens are the bargaining chips in this casino. People can use Moon tokens to long or short the level of liquidity and buying power a token holds. If they succeeded in getting rid of bad actors, they will also have a share of liquidated collateral as rewards. However if their projection of the level of liquidity and buying power of a token is wrong, they will lose part or all of their collateral. All moon tokens used in the betting will be burned. The use case of moon tokens in this case is to obtain liquidated collaterals from others.

There can be other utilities for Tide and Moon tokens, like getting back a percentage of funding fee or liquidated collateral in the trust market by staking or locking in claimable balances. If enough liquidity is present in this Trust Market, DEX function like swaps and lending is also possible.