【G999】Payment giants VISA and MasterCard (MasterCard) join the cryptocurrency "direct payment" war! The absolute trend of encrypted payment systems: GS Lifestyle

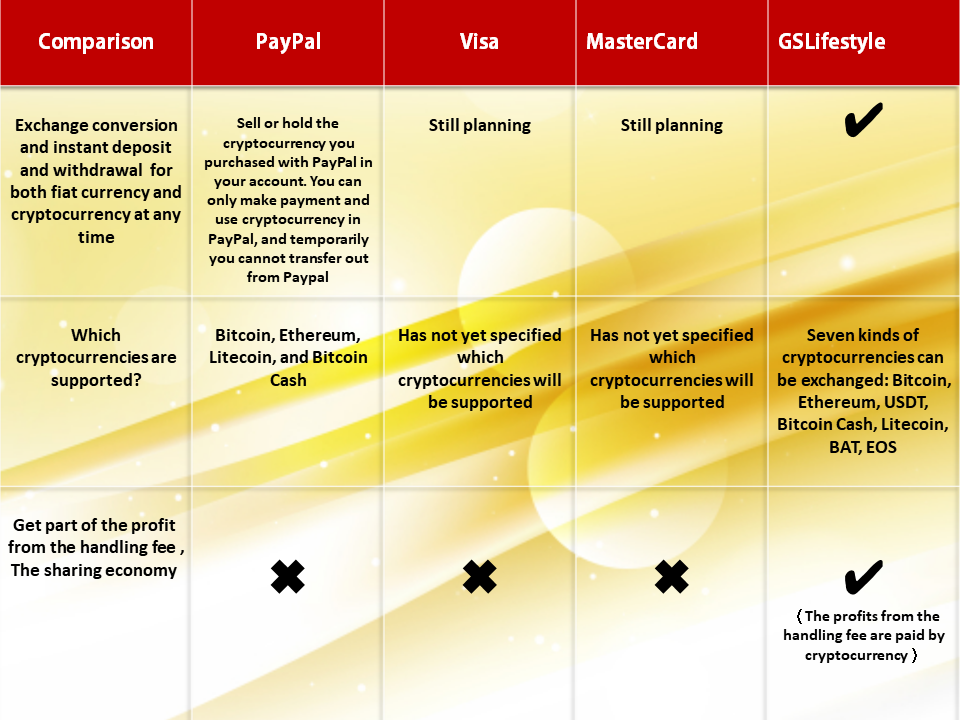

The trend and comparison of GS Lifestyle payment system with other payment systems

Before we start to discuss today’s topic in depth, let us learn about recent major news and events in the cryptocurrency market:

1. Following the purchase of Bitcoin by many listed companies in 2020 as an asset reserve, Tesla, an electric vehicle manufacturer, announced that it “purchased 1.5 billion dollars of Bitcoin (BTC)” and accepted cryptocurrency payments, and BTC hit a record high.

2. Amazon will launch a “digital currency” plan in Mexico, laying out a “global digital payment”

The goal of Amazon “Digital and Emerging Markets Payments” (DEP) department is to allow users to convert fiat currency into digital currency to purchase goods and pay for streaming audio-visual services.

3. Asset scale is 41 trillion! Financial giant “Bank of New York Mellon” announced the launch of Bitcoin custody: digital assets have become mainstream

The oldest bank in the United States and the US$41.1 trillion in assets, BNY Mellon announced on February 11, 2021 that it will cooperate with Bakkt, a Bitcoin futures exchange under the Intercontinental Exchange (ICE).

According to its official statement provides its asset management users with custody, transfer and other services, aiming to become the industry’s first custody platform suitable for both traditional and digital assets.

After announcing the provision of Bitcoin custody to its customers, Roman Regelman, the chief executive of the bank’s asset service department, told foreign media: Digital assets have become mainstream

4.China and SWIFT cooperate to promote digital currency to the world

In business view, cooperation between SWIFT and China is mutually beneficial because China relies on SWIFT to promote cross-border banking and digital renminbi business, and SWIFT wants to win the pie in China’s cross-border market, and draws on the experience of the People’s Bank of China in cross-border development of digital renminbi to predict its relationship with other countries’ digital currencies and have preparation for docking.

Bitcoin, cryptocurrency, and blockchain have long been mainstream and are booming at a high speed. Asset management giant BlackRock,payment giants Square and PayPal have also begun to support cryptocurrency or launch cryptocurrency payment services.

Since last year, in addition to Visa, traditional financial platforms such as payment giant PayPal have announced the addition of Bitcoin, Ethereum and other cryptocurrencies as payment methods. As major institutions have entered the market one after another, the total value of the crypto market led by Bitcoin has also risen. More and more traditional financial platform institutions will openly accept Bitcoin and other cryptocurrencies.

On January 2021, U.S. banks given regulatory green light to safekeep cryptocurrencies and be able to use stablecoins for payments and other activities. The Office of the Comptroller of the Currency said in a new letter that providing custody and safekeeping services for cryptocurrencies, including holding “keys” needed to access cryptocurrency holdings, is a modern version of traditional banking activities and should be allowed.

On10 February 2021 , MasterCard in 210 countries around the world will open up cryptocurrency network payment service to select cryptocurrencies for its more than 20 million cooperative merchants. In addition to effectively improving payment efficiency, it is also regarded as a major milestone in the cryptocurrency field towards mainstream payment. Although MasterCard has cooperated with cryptocurrency payment companies Wirex and BitPay on encrypted debit cards, in fact the company does not have direct access to cryptocurrencies, but this news represents a shift that allows cryptocurrencies to be truly in its transfer network.

And Visa ( Mastercard biggest rival) also said at the end of January 2021 that it would consider adding cryptocurrency to the Visa network. Visa, which was previously responsible for issuing financial cards for crypto companies, mentioned in the first quarter of 2021 financial report meeting that in the future, its users will be allowed to purchase cryptocurrency services, which can be converted into fiat currency for consumption at 70 million cooperative merchants worldwide.

Visa has announced the upcoming launch of a new cryptocurrency API pilot program and will partner with First Boulevard on validating the new resources. The new APIs will allow developers to purchase, trade, and custody cryptocurrencies via Visa’s trading partner Anchorage. This will also be the first time Visa provides cryptographic services to banks. Visa’s financial report for the first quarter of 2021 identified Bitcoin and other cryptocurrency payments as a new development.

This year will be the year when traditional payment giants embrace cryptocurrency

The absolute trend of encrypted payment systems: GSLifestyle

The trend and comparison of GS Lifestyle payment system with other payment systems

GSLifestyle: the only payment system that uses the 【sharing economy】 and connects the 【the world of fiat currency and cryptocurrency】

No matter how the world economy works, we are still consumers in the past, but now you have the opportunity to become a partner. Are you willing to know more about this rare opportunity?

Navayo is one of the main members of MasterCard and cooperates with MasterCard. Nvayo and GSPartners collaborated to launch GSLifestyle. GSPartners is part of the Gold Standard Banking AG group with a huge ecosystem.

Under the operation of a powerful blockchain ecosystem, your assets will have the ability to hedge from inflation, avoid the risk of depreciation, and avoid the interference of market fluctuations. Super liquidity, you can bring the card easily to swipe it, deposit and withdraw the money at anytime, all in GSLifestyle!

The most important thing is that you can also participate in becoming a partner in the banking and crypto industry! For more details, please read 【G999 + GSPartners】Cryptocurrency Super Solution: GSLifestyle

GSPartners link: https://gspartners.global/register?sponsor=qqwealth

For more details, ask Peter Wang : https://peterwang.soci.vip/

Under the operation of a powerful blockchain ecosystem, your assets will have the ability to hedge from inflation, avoid the risk of depreciation, and avoid the interference of market fluctuations. Super liquidity, you can bring the card easily to swipe it, deposit and withdraw the money at anytime, all in GSLifestyle!

No matter how the world economy works, we are still consumers in the past, but now you have the opportunity to become a partner. Are you willing to know more about this rare opportunity?

It’s time to grasp the pulse of this rapidly changing era, make the right choice at the critical moment, and get faster progress and a better life.

GSPartners link: https://gspartners.global/register?sponsor=qqwealth

For more details, ask Peter Wang : https://peterwang.soci.vip/

©All rights reserved.

喜欢我的作品吗?别忘了给予支持与赞赏,让我知道在创作的路上有你陪伴,一起延续这份热忱!

- 来自作者

- 相关推荐