【AUVESTA】Gold, fiat currency and inflation, US unlimited quantitative easing policy, potential risk events will trigger risk aversion

To know more about AUVESTA : https://auvesta.co.uk//?Issuer=94739&h1=996399&h2=0f904bbf-939d-43d9-a9d1-28719f690aca

After the outbreak in the United States at the beginning of the year of 2020, Fed opened the “money printing machine” in March and adopted a similar liquidity injection mechanism during the subprime mortgage crisis in 2008. Its balance sheet has rapidly expanded from US$4.2 trillion in February 2020 to 2021. The US$7.6 trillion in February 2008, during which the expansion of US$3.4 trillion was significantly higher than the US$1.3 trillion expansion in 2008. The unprecedented expansion of the Fed’s balance sheet has resulted in the assets and liabilities scale of February 2021 being more than 10 times that of 2002, while the nominal GDP scale has increased by less than 2 times during the same period, and the gap between financial and real economy has continued to widen.

U.S. quantitative easing policy is a “double-edged sword” for itself. Everything has two sides. The unlimited quantitative easing policy must have its own influence, both positive and negative. Here I will focus on the negative impact of US unlimited quantitative easing policy :

- The international credit of the U.S. dollar has been damaged, and the status of the medium- and long-term international reserve currency has declined

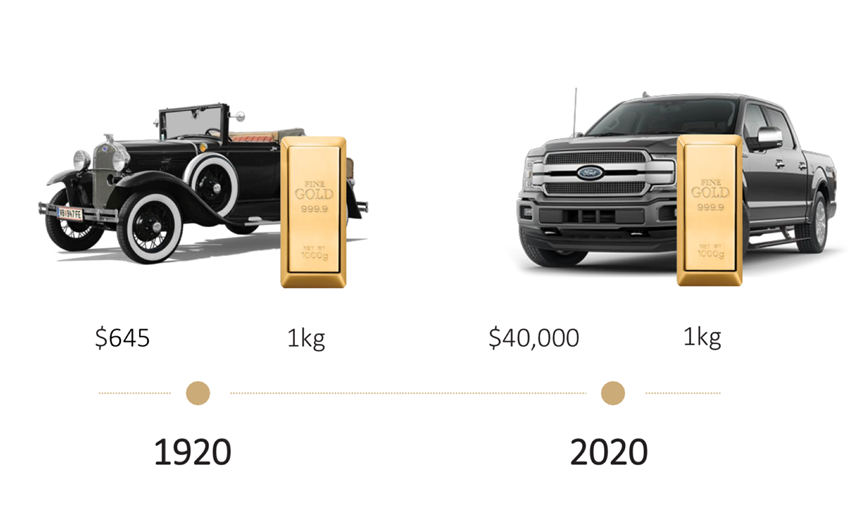

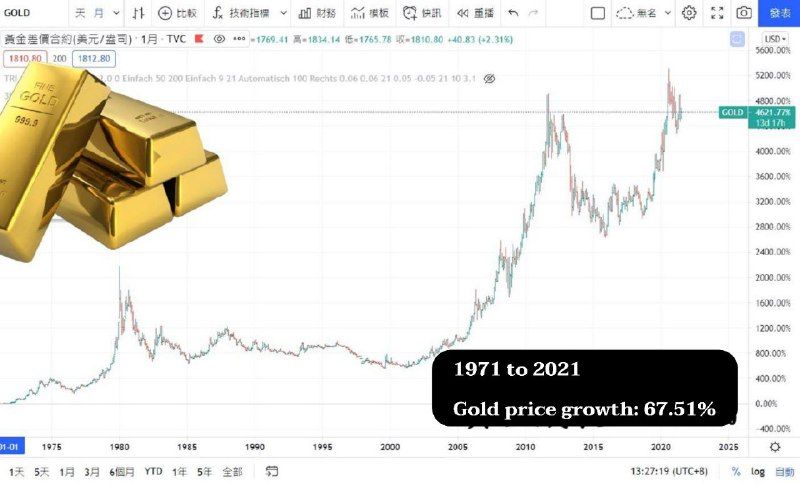

- During the crisis, foreign investors reduced their holdings of U.S. Treasury bonds, which is in stark contrast to the performance during the 2008 financial crisis. In the 100 years since 1920, the dollar denominated in gold has depreciated 100 times, the average depreciation of 1 time per year, unlimited quantitative easing policy will continue to reduce the purchasing power of the dollar.

- The depreciation of the U.S. dollar brings about imported inflation, restricts the policy space for quantitative lenient, and restrains monetary policy

- Boosting the false high of asset prices and increasing financial risks

- Increase macro leverage and debt risk

- The exit risk of the unlimited quantitative easing policy is more worthy of vigilance

- The negative impact of the exit of the quantitative easing policy will affect countries around the world through multiple channels such as cross-border capital flows, asset prices, currency exchange rates, etc., especially emerging economies that are most vulnerable to shocks.

To know more about AUVESTA : https://auvesta.co.uk//?Issuer=94739&h1=996399&h2=0f904bbf-939d-43d9-a9d1-28719f690aca

Various main factors affecting the price of gold:

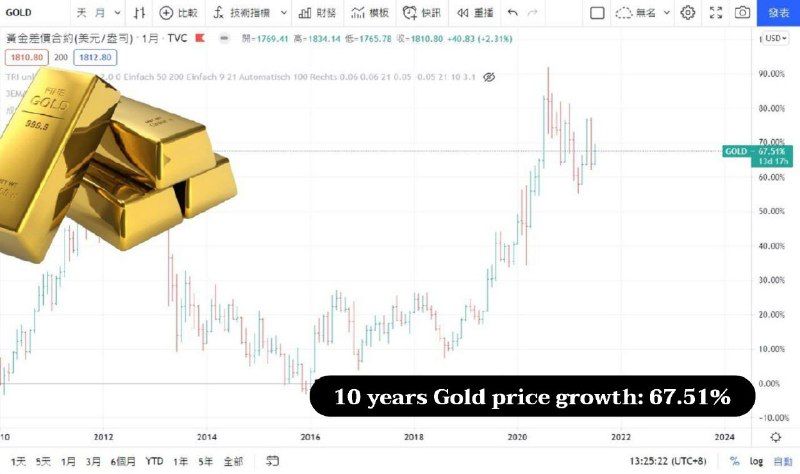

1. Changes in the value of the U.S. dollar are the most important factor affecting the price of gold

In the international market, gold transactions are priced in U.S. dollars. A sharp depreciation of the U.S. dollar will directly promote a substantial increase in international gold prices .

The international financial crisis has directly affected the international community’s confidence in the US financial system and the US dollar. Coupled with the Fed’s continuous quantitative easing policy, the US dollar has continued to weaken and international gold prices have continued to rise as a result.

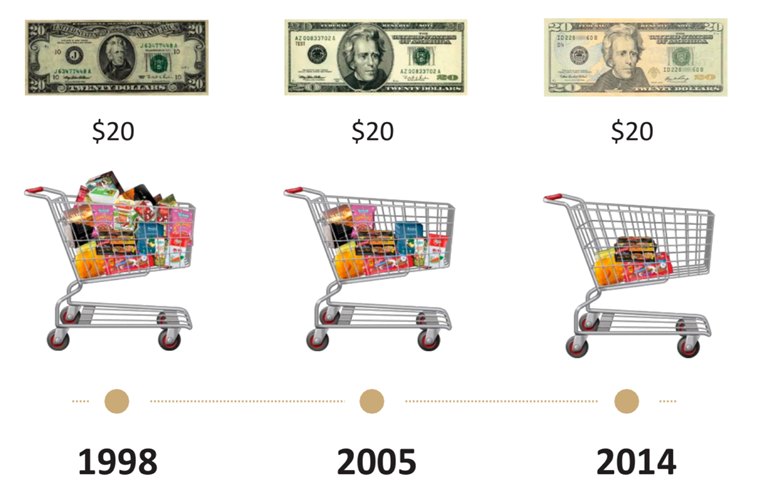

2. Inflation is another important factor that promotes the rise of gold prices. For a long time, gold has been regarded as a means to hedge from inflation

From 1974 to 1975, from 1978 to 1980, due to the severe global inflation, The relative depreciation of the currencies of major countries has shaken people’s confidence in holding currencies. This has set off a wave of buying gold, and the price of gold has risen rapidly. During this period, gold holders have successfully prevented inflation risks.

3. The changes in the supply and demand relationship in the gold market are the underlying reasons that affect the price of gold-changes in

demand and supply will have a certain impact on the trend of international gold prices

- In the context of increasing uncertainty in the world economy, more investors will choose to buy Gold hedging, increasing demand and raising gold prices

- People’s expectations for the US economic outlook are generally pessimistic, and the global economy is therefore full of uncertainty. Gold has attracted many investors due to its characteristics of hedging and value preservation

4. The instability of world geopolitics will also exacerbate price fluctuations in the gold market

To know more about AUVESTA : https://auvesta.co.uk//?Issuer=94739&h1=996399&h2=0f904bbf-939d-43d9-a9d1-28719f690aca

If you are given a choice, will you deposit gold or fiat currency?

Why do you have to hold gold?

1. Gold can provide protection against inflation and currency reforms

2. Gold is the universal cash

3. Gold is a relatively stable investment in times of crisis

4. Gold is limited, cannot be mass-produced, and is highly scarce

5. Global demand for gold is higher than supply

Buying gold is a viable choice for alternative currencies and investment products. Your gold is always your stable reserve and can be changed back to currency at any time

If the price of gold falls, you will get more gold;

If the price of gold rises, you will get less gold and more cash;

In the long run, you will benefit from a better average price.

To know more about AUVESTA : https://auvesta.co.uk//?Issuer=94739&h1=996399&h2=0f904bbf-939d-43d9-a9d1-28719f690aca

AUVESTA is a famous German gold company that has been operating since 2009, specializing in the purchase, sale and storage of physical gold, silver, platinum and palladium

Auvesta is an international company and one of the leading precious metal suppliers. It currently supports 109 countries to ship gold and also has more than 200,000 customers. Using Auvesta Online Depot online warehouse, you can store, buy, sell and store physical precious metals online

AUVESTA is currently one of the projects of Work Your Wealth. It has anti-inflation and value-added asset investment projects. It is a long-term investment and has high stability.

Won DFSI evaluation and praise for many times

Also featured in the famous German business magazine-Focus Money

【Best price】

【Best gold dealer】

【Best transparency】

【Best service】

【Best storage】

Why choose Auvesta to buy precious metals?

1.High credit rating

2. Fixed deposit gold enjoys an extra 1% reward

3. High liquidity

4. The gold held has 100% ownership

5. All alchemy factories are high-quality certification (LBMA)

6. Highly secure third-party Safe storage

7. Periodic audit reports

8. Small gold delivery

9. Gold is very cost-effective

Starting from 1 Euros a month for the family’s gold savings plan

Uses physical precious metals to protect your assets

You own the gold you buy 【100% ownership】

To know more about AUVESTA : https://auvesta.co.uk//?Issuer=94739&h1=996399&h2=0f904bbf-939d-43d9-a9d1-28719f690aca

Like and Follow Facebook Page: Work Your Wealth International Investment Coach

It’s time to grasp the pulse of this rapidly changing era, make the right choice at the critical moment, and get faster progress and a better life.

For more info, welcome to contact Peter Wang : https://peterwang.soci.vip/

©All rights reserved.