When Is It A Good Time To “Buy The Dip”?

“Take a belt, buy the dip Is one of the most common memes when bringing up fine strategies among stock and crypto investors. The approach of Buy the dip is on the eventuality for “ buy low, vend high” capital appreciation.

Different to chasing the low price to buy, investors use the buy the dip strategy to make plutocrat by copping at gemstone bottom and selling when the request rises. To put it another way, it’s a possible way to help getting wedged at a lower price.

Reading this composition will educate you how to buy the dip while also learning ways to minimize the threat, and others information about it.

What Is “Buy the Dip?:

Buy on dip or Buy the dip means copping means after the decline in price. This thesis works when people invest coins at their smallest projected price, with the strong expectation of dealing them latterly when the request recovers during a bullish request phase.

Buy the dip is important proper than it sounds for investors who are patient enough to stay for a request correction ─ when the price drops vastly from its former peak.

How to Buy the Dip?

The fashion of Buy the dip requires the critical analysis of a crypto’s support and resistance situations to identify the right dip to buy.

The introductory means to buy the dip is to take a near look at crypto pointers; Exponential Moving Average (EMA) is the great one to talk about.

Still, it means that the price is still advanced than the once resistance situations, If the current price is above the EMA line. As a matter of fact, now isn’t the time to buy because prices may fall in the near future.

Vice versa, If the price is formerly below the EMA situations or at the previous resistance, it’s the stylish time to buy, with a lesser lucre from Buy the Dip strategy.

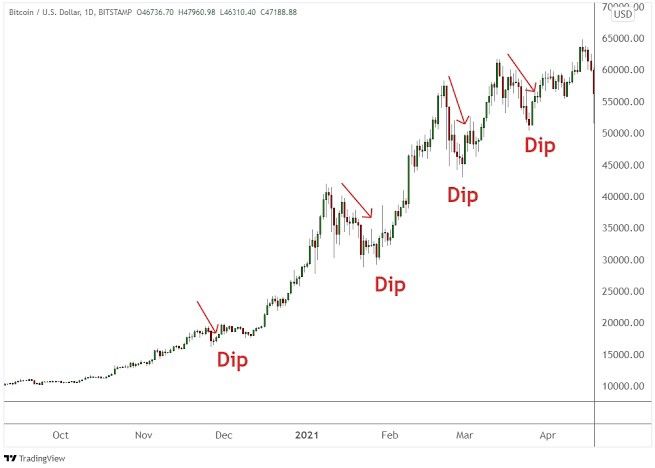

Illustration of Buy the Dip

The “ Buy the dip” visual above teaches us when to reap the benefits of the request’s drop. As in circles, the stylish time to buy is when the request is at its smallest price before it rebounds latterly on.

What to Do When Buying a Dip Becomes a “Fasle”?

There are two indispensable results when you inaptly buy the dip.

The request is likely to rebound if the selling volume drops and is replaced by buying volume, which is a signal to buy the dip again.

Still, several signs might negatively affect the valuation; therefore, this strategy remains a high- threat association.

Altcoin and Buy the Dip:

The conception of Buy the Dip can be applied with some Altcoins. As a resistance position and request capitalization size affect the coin valuation volatility, the altcoins with strong resistance situations tend to be more stable and good for investment.

At the moment, one of the stylish Altcoin to use the Buy the Dip strategy is Solana (SOL). It lately hit it’s All- time-high with 260 USD on November 6, 2021. Also, the elevation of Proof-of- History (PoH) and Subcaste-1 blockchain technology are rocking the crypto communities. As numerous inventors started their DApps systems on the chain, Solana’s fashionability exploded and potentially created a big answer.

Difference between Buy on Dip and Catch the falling cutter

Buy the Dip is executed when we invest in a bear request with the eventuality to go bullish soon. Be patient for the price to fall near the range of resistance position firsts. That will be the right moment to trade cost-effective crypto. Also we can, latterly on, vend them for gains.

While “ buying the dip” may sound like a good strategy, it may fleetly transubstantiate into “ catch the falling cutter” if a dealer tries to buy at the bottom of a downtrend, and also it still falls harder.

That said, the way dealers invest but rather lose plutocrat is similar to how we try to snare a falling cutter and also get wounded at the end.

Benefits of Buy the Dip Strategy:

Applying to EMA Analysis, Buy the Dip gets you buying underpriced on downtrend and also making ultraexpensive gains when requests turn uptrend again

• Buy the Dip, generally, doesn’t enter the request while the request is bullish. Therefore, dealers are less likely to be trapped up in a high price.

• With the principle of buying at the smallest possible price and dealing at the loftiest possible price, the fashion can maximize profit from price differences while the request is on the rise.

Pitfalls of Buy the Dip to Avoid:

Wrong timing is a agony for the Buy the Dip strategy. Dealers could maybe dodge losses if they misinterpret the buying zone or invest at the wrong dip.

As a practical matter, a stop- loss order, a form of order to leave the sale at a destined price, is suggested. It can be executed to limit the chance of loss from valuation if the request moves against you.

It’s true in the sense that we ’ve each been shamefaced of undervaluing the power of some currencies. Some Altcoins’ prices can so snappily rise from their smallest point that we miss the occasion to catch the gradational train and go to the moon.

In short, Buy the dip is a strategic approach to buying low-priced cryptos during the request down for profit maximization latterly on. When dealing with a request as unpredictable as cryptocurrency, threat operation is critical to this strategy’s success.

Buy the dip on the world’s leading cryptocurrency exchange, Bityard.com

__________________________

BitYard Exchange: BitYard.com

Customer Support: Support@bityard.exchange

Business Request: levi@bityard.exchange

BitYard Telegram Communities

BitYard News & Events — https://t.me/BITYARDNEWS

English — https://t.me/BityardEnglish

Vietnamese — https://t.me/BitYardVietNamChat

Indonesian — https://t.me/bityardindonesia

Philippines — https://t.me/BityardPhilippines

BitYard Official Social Media

Youtube — https://www.youtube.com/c/BityardOfficial/

Facebook — https://www.facebook.com/Bityardofficial

Twitter — https://twitter.com/Bityard_Global

Medium — https://medium.com/bityard

Platforms BitYard Settled in

Coincodex — https://coincodex.com/exchange/bityard

Coinpaprika — https://coinpaprika.com/exchanges/bityard/

CryptoAdventure — https://cryptoadventure.com/discover/exchanges

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!