Heavy cryptocurrency aficionado. Follow every cryptocurrency technology revolution and learn a new knowledge every day.

ETH Soaring? Expert Forecasts Ethereum Price Surge in 2023 and Beyond

Ethereum Price Prediction Overview: According to our analysis, ETH coin is expected to reach a maximum price of $2,469 in 2023, $4,615 in 2025, and $14,088 in 2030.

Ethereum (ETH), the second-largest crypto after Bitcoin, has skyrocketed in value since its creation. The ETH price has increased from $0.311 at its 2015 launch to around $4,800 at its highest late 2021, and dropped to its current level of around $1,820 — with plenty of volatility along the way.

While the crypto market has misbehaved throughout 2022, with rivalries and other factors contributing to the continuous instability, it is crucial to know where the forerunner of altcoins, Ethereum, is headed towards the new year and beyond. There is broad confidence that the first smart contract blockchain will survive this period of trials.

As is widely known, US (and global) banking sectors have got into trouble since the shutdown of Silvergate and the authorities’ seizure of Signature Bank and Silicon Valley Bank. This seems to have marked a key shift in the macro narratives driving traditional asset classes and cryptocurrencies that could have a big impact on Ether’s outlook for 2023.

As the financial crisis highlights the value of digital assets, more people are turning to cryptocurrencies, thus driving the upward trend of crypto industry. Crypto is benefitting from safe-haven flows, with investors seemingly finally starting to view blue-chip cryptos as a viable alternative to the mainstream, fiat-based financial system.

Thus, in this article, we’ll dive into the Ethereum price prediction for 2023, 2025, and 2030, exploring some of the most stunning ETH price predictions from top analysts in the field. We will try to answer these frequently asked questions: Is Ethereum a good investment? How much will Ethereum be worth in 2025/2030 or what will Ethereum be worth in 5 years?

Before we start with the Ether price prediction, let’s dive into the coin’s overview.

ETH Overview

CryptocurrencyEthereumTicker SymbolETHRank2Price$1,820.69 Price Change 24H+0.52%Market Cap$218,997,118,042Circulating Supply120,282,200.8 ETHTrading Volume$5,200,567,455All Time High$4,878.26All Time Low$0.432979

Download App for AndroidDownload App for iOSWhat is Ethereum (ETH)?

Ethereum, alongside Bitcoin and Dogecoin, is one of those cryptocurrencies that are well-known even outside of the crypto community. It is the biggest altcoin and the second-largest cryptocurrency by market capitalization.

Launched by Vitalik Buterin in 2015, Ethereum is one of the most feature-rich and interesting decentralized blockchains that enable the programmability of smart contract, a revolutionary idea designed to increase transaction security, reduce costs, and maybe decentralize the entire planet. Ethereum’s innovations have made it the first choice of most developers and enterprises with its strong fundamentals.

Ethereum is considered as the world’s dominant blockchain in terms of the size of its associated ecosystem of decentralized applications, making it essential in the crypto market. Without it, many of the top applications and services that have risen to popularity in the last few years would not be here today.

Ethereum’s innovations gave a start to such trends as fundraising on the blockchain (ICO), decentralized apps (DApps), decentralized finance (DeFi) and non-fungible tokens (NFTs).

Besides being an incredibly innovative technology, Ethereum (ETH) is also a great asset for investment, one of the most successful and reliable cryptos in the space. Ethereum has a ton of cool features and plans for the future — this is why this cryptocurrency is as popular among crypto investors as it is.

At the end of the day, what sets ETH apart from other coins is its variety of use cases, and the list keeps on growing every year. ETH isn’t just a speculative asset; it has actual value. As long as the coin’s team continues to develop the blockchain and introduce new innovative features, Ethereum will likely continue to grow and prosper.

Ethereum vs Bitcoin

If you want to invest in cryptocurrencies, financial experts suggest that it’s a good idea to start with the two most well-known cryptos on the market right now: Bitcoin and Ethereum.

But it’s important to note that they not only have technical differences, but also offer two completely different value propositions for investors.

Many investors see Bitcoin as a store of value, also characterized as “digital gold,” that can be used as a guard against inflation. Bitcoin was the first cryptocurrency, and is much more pricey. The current price of Bitcoin is around $27,017.

Ethereum, on the other hand, is a software platform that allows developers to build other crypto-oriented apps on it. Unlike Bitcoin, Ethereum has an uncapped supply. Many investors buying ETH believe that the network will continue to be used and expanded upon by developers.

Some investors believe that the second-largest crypto has beaten the king of crypto (BTC) to become the most in-demand crypto. A quick division of volume by market cap of both cryptos has revealed Ethereum’s relative volume is in fact greater than that of Bitcoin. Ether spot market activity has also increased, with the cryptocurrency surpassing Bitcoin as the most traded coin on Coinbase a while back.

Overall, high returns often involve high risks – both cryptos are highly speculative assets and you should always be cautious when investing.

Download App for Android

Ethereum Merge and Everything in Between

One thing must be mentioned about this popular crypto is the Ethereum Merge (Ethereum 2.0). Eberhardt had previously referred to The Merge, which was finally completed at around 7.45am on 15 September 2022, as “one of the most influential events in the history of crypto by impacting Ethereum both technically and economically”.

The transition from proof-of-work (PoW) to the proof-of-stake (PoS) consensus mechanism has changed the way the Ethereum blockchain verifies transactions. Rather than using miners who consume vast amounts of computing power to validate and create new blocks, validators now stake the native ethereum coin ETH to the network, therefore ultimately reducing Ethereum’s energy consumption by around 99.95%.

PoS will also improve the Ether tokenomics, as under PoW, Ethereum issued 5.4 million ETH to miners annually, but it will only issue around 500,000 ETH to stakers. This shift could reduce inflation and make Ether more deflationary, as a portion of the fees for each transaction will be burned, lowering ETH’s overall supply and increasing its rising momentum in the future.

Although the markets and many ETH holders have been supportive of The Merge, there has been some concern among the blockchain’s miners, since they stand to lose a fair amount of potential income after the switch to PoS.

As a result, some miners got together to create something called PoW-Ethereum (ETHW), which is a version of Ethereum that will operate with a proof-of-work consensus mechanism. On 12 September 2022, the group – calling itself ETHW Core – tweeted that its mainnet would go live within 24 hours of The Merge. And this came to pass, with the new coin worth about $13.45 at one point early on 16 September.

You can check here for our ultimate guide for ETHW.

While this is not be the first time that ETH has gone through a fork – for instance, one such fork helped create the Ethereum Classic (ETC) crypto – it’s worth keeping an eye out for any developments on that front.

Overall, even though newer and more environmentally friendly technologies have been developed, analysts frequently claim that Ethereum’s “first mover advantage” has positioned it for long-term success, despite new competition. With investors diving back into decentralized finance (DeFi) amid improved market sentiment, Ethereum network activity levels are expected to continue rising. Many analysts think that ETH may see significant increase this year and could be one of 2023’s big winners.

ETH Price History

After a protracted period of stagnation in 2018 and 2019, Ethereum gained traction and had a relatively strong performance in late 2020 and 2021. It increased by 200% from its 2017 highs by the end of 2021, primarily driven by the explosive rise of NFTs and DeFi. Early investors have tripled their investments yearly, thanks to its high ROI.

However, the current price level is about a staggering 61% down from its all-time high of $4,878.26 recorded in early November 2021. Despite this, Ethereum remains a significant player in NFTs, DeFi, and even metaverse ecosystems.

After approaching the $5,000 price peg in 2021, Ethereum struggled for most of 2022. ETH price dropped sharply in the first half of the year despite the approach of The Merge, as crypto markets turned bearish, especially following the collapse of Terra LUNA and UST in May.

ETH price around The Merge (Source: CoinMarketCap)

The ETH price started the year 2022 at $3,683.05 and moved up to $3,876.79 on 4 January 2022. It then turned lower, dropping to $2,308.91 on 24 February 2022 as crypto markets sold off.

The market again attempted to stage a recovery, trading up to $3,573.96 by 3 April 2022, but ETH was unable to sustain the gains, again turning lower. With the Terra Luna crash, the ETH price dropped below the $2,000 level to $1,748.30 on 12 May.

A further sell-off brought the price down to $896.11 on 18 June 2022, its lowest level since late 2020. The price then rallied, and on 15 September, the Ethereum Merge date, it was traded at around $1,640. In the 24 hours after that, though, the price dropped sharply, and on 16 September, it was worth about $1,450.

The fall continued before it rebounded to a high of 1,661.33 on 4 November, which mainly due to a series of positive Ethereum news such as Google node hosting service, new roadmap for The Scourge phase launched by Vitalik Buterin, coupled with an overall boost to the crypto market – triggered at least partially by crypto enthusiast Elon Musk’s takeover of Twitter.

It was a brief spike as everyone knew what happened next week – the collapse of FTX exchange. The news saw ETH plunge from a daily high of $1,574.80 on 8 November to a low of $1,083.29 the following day. Its price has been volatile since then and ended 2022 at $1,196.77.

Download App for Android

Ethereum Price Analysis

2023 is a relatively positive year for Ethereum, with ETH having been in a good uptrend since the beginning of the year.

The Ethereum price experienced a brief spike just after the Shapella upgrade, almost hitting the $2,000 mark. However, the price was not maintained and followed by a correction.

At the time of writing, ETH is trading at $1,820.69 with a market capitalization of $218,997,118,042, making it the 2nd largest crypto by that metric. In the last 24 hours, Ethereum’s price has increased by 0.52% with a trading volume of $5,200,567,455.

The altcoin’s recent ups and downs are also reflected in its average volatility, with the BitMex Weekly Ether Volatility index more than doubling since the start of April, as well as rising from 1.8 to 5.44 since the start of the year.

This implies that further movements (either up or down) are likelier now than at any other period in its recent history.

And given how strong Ethereum’s fundamentals have grown following its recent updates, it’s arguably only a matter of time before the cryptocurrency experiences some substantial gains.

So, with huge volatility coming in, where will ETH head next? Let’s examine it.

Despite ETH has lost 1% in a week and 13% in the past month, it remains up by 52% since the beginning of the year.

ETH’s chart has very recently turned interesting, with its indicators reaching a point where a breakout rally is suggested.

Source: TradingView

For one, ETH’s 30-day moving average (yellow) has just climbed above its 200-day (blue), forming a ‘golden cross’ that tends to signal rallies.

Similarly, the coin’s relative strength index (purple) just surpassed 50 this morning, another indicator of growing momentum.

And if that weren’t enough, ETH’s chart has also formed a pennant, with its support (green) and resistance (red) levels converging in on each other, something which indicates that the coin is consolidating a little after recent falls and will have to make a move to a new level soon.

This change in ETH’s technical indicators comes just as Lido opens up withdrawals for its Ethereum staking platform, enabling users to take out their locked ETH and potentially sell it.

This means that Lido users can return the Lido Staked Ether (stETH) they hold for the ETH they’ve previously staked with the platform, and given that 32% of all Ethereum stakers use Lido, such a feature could result in a massive glut of Ethereum entering the market and have a big impact on ETH’s price.

There are around 6.6 million ETH staked via Lido, although it needs to be remembered that ETH withdrawals cannot all happen at once, with withdrawal requests joining a queue that would take months to be fulfilled if all stakers chose to withdraw.

And on the other hand, the successful introduction of withdrawals is likely to encourage more users towards Lido and Ethereum staking in general, an effect that could help push ETH’s price further upwards.

Indeed, data from Dune Analytics reveals that the ratio of staked ETH to non-staked ETH is now at 16.6%, up from 10% a year ago.

This ratio will almost certainly rise in the coming months as the market adapts to being able to withdraw staked ETH, a change that will take more ETH out of circulation.

With a big reduction in ETH’s circulating supply and the fact that ETH has become a semi-deflationary token ever since the Merge and EIP 1559, the market could see steady increases in the altcoin’s price.

And looking at the bigger picture, it’s worth noting that Ethereum continues to enjoy more significant adoption than most other layer-one networks.

Recent examples include major French bank Société Générale trialing a euro-denominated stablecoin on the Ethereum blockchain, as well as Visa testing USDC payments and Microsoft piloting an Ethereum wallet in its Edge browser.

This is a massive endorsement for Ethereum, which suggest that the biggest enterprises may lean towards Ethereum whenever delving further into the blockchain. And all these good signs point towards a rising price for ETH.

Given such interest in Ethereum and given that it continues to account for 58% of the entire DeFi sector, ETH is more than well-placed to ride further rallies in the near and more distant future, something which is supported by its fundamentals, which arguably remain the strongest of any altcoin.

Assuming more positive investor and market sentiment, it could easily return to $2,000 in the next few weeks, while the latter half of the year could see it near $2,500 or even $3,000, particularly if it continues to attract more adoption.

Can ETH Recover to All-Time High in 2023?

While it can certainly be said that ETH has a positive medium-to-long-term technical outlook, betting on the cryptocurrency to return to all-time highs this year is another thing.

Activity on the Ethereum blockchain, as per on-chain data presented by The Block, is yet to show the kind of pickup that has historically been needed for an ETH bull market to really get going. The number of daily active and new addresses and the number of daily transfers continue to languish within moderate ranges.

If Ether is to hit new all-time highs, these will likely need to see substantial improvement.

But with ETH’s rising supply deflation rate making up for weak on-chain activity, ETH could still get a lift.

Ether hitting fresh all-time highs this year would require it to rally 168% from current levels.

But this is the crypto market. ETH is already up 103% from last year’s lows in the $800s.

And between the months of November 2020 and April 2021, Ether gained 600%.

A 168% rally this year should thus by no means be ruled out as a possibility.

Download App for Android

Can ETH Hit $10,000 in 2023?

If ETH hit $10,000 in 2023 that would mark a roughly 5.5x return from current levels. Given the cryptocurrency’s more than 50x return from its 2020 lows under $100 to its 2021 record highs near $4,900, such a move shouldn’t be discounted as impossible. However, things would need to go perfectly this year if ETH is to post such massive returns.

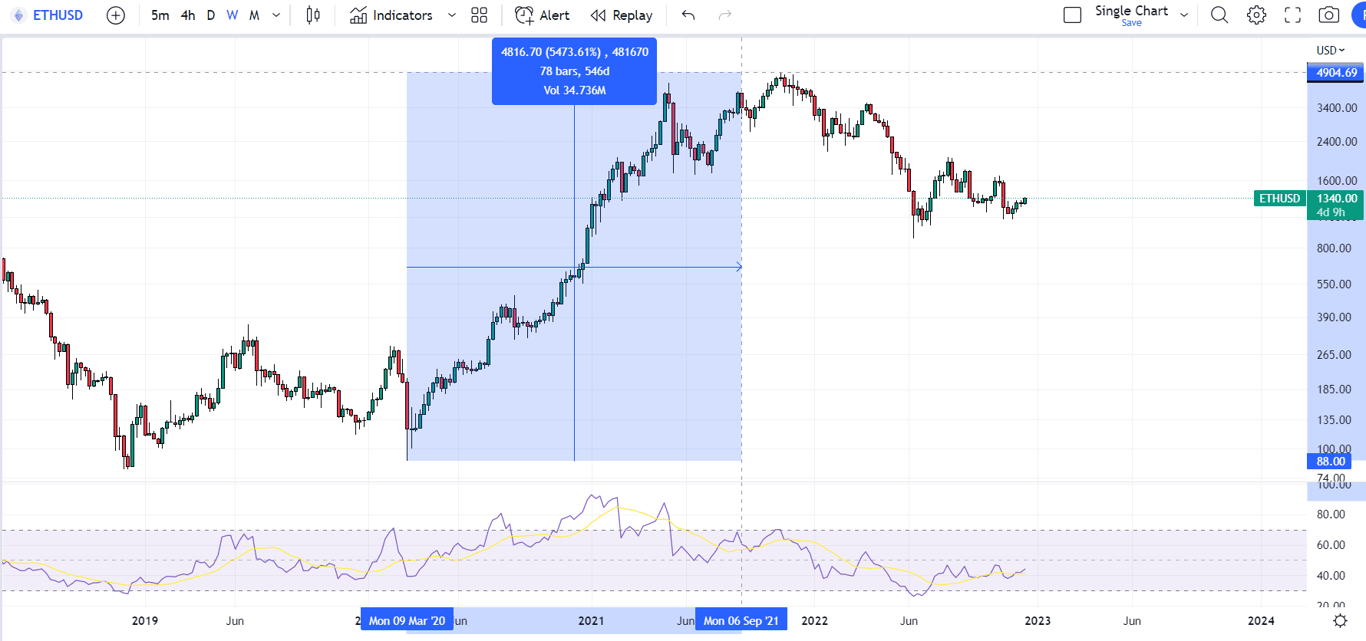

ETH posts more than 50x returns from 2020 lows to 2021 highs (Source: TradingView)

Ethereum’s string of expected key upgrades will all also need to go smoothly like the Merge did back in September. Meanwhile, for ETH to rally beyond record highs and towards $10,000, the Ethereum Decentralized Finance (DeFi) ecosystem is going to need to come back to life.

According to DeFi Llama, there is only about $27 billion in crypto locked in Ethereum-based smart contracts at the moment, down from more than $150 billion in late 2021/early 2022. That is likely going to need to rise about 10x from current levels if ETH is going to hit $10,000.

ETH Price Prediction 2023, 2025 and 2030

We’ve covered most of the important things you need to know about Ethereum before considering its price prediction, including the ETH price history, technical analysis and potential impacts from the network upgrade. If you are really interested in investing in the coin, this is the time to be more attentive.

To help you decide whether Ethereum is a good crypto to buy today, here are some key targets it may reach before the end of 2030:

YEARMINIMUM PRICEMAXIMUM PRICE2023$1,988$2,4692025$3,796$4,6152030$9,392$14,088

Please keep in mind that the crypto market is very volatile and this Ethereum price prediction does not account for extreme wild swings in price.

Download App for Android

Ethereum Price Prediction 2023

Our ETH price prediction for 2023 suggests it could be trading between $1,988 and $2,469 by the end of 2023. The estimated average price is around $2,043.

An industry expert also shares his forecast, which is much more bullish.

Twitter user and renowned analyst under the pseudonym Wolf predicts that Ethereum could hit $3,500 by the end of Summer 2023.

He cites the increasing demand for decentralized applications (dApps) and Ethereum’s dominance in the DeFi and NFT spaces as reasons for this bullish prediction.

Ethereum Price Prediction 2025

Ethereum has shown immense potential as a platform for decentralized applications, DeFi, and NFTs.

As per our Ethereum price prediction 2025, the coin is set to rise as Ethereum network sees more partnerships and integration in the near future. ETH is expected to reach a minimum and maximum price levels of $3,796 and $4,615 in 2025, with an average price trading at $3,965.

Download App for Android

Ethereum Price Prediction 2030

The future of Ethereum looks very promising for the long term based on our analysis. Our ETH price prediction 2030 indicated the coin may record a significant high of $14,088 by the end of 2030. At the same time, the minimum and average ETH value for the year may be around $9,392 and $11,740.

Ethereum Price Prediction | Market Say

Even though it can be difficult to forecast the price of a volatile cryptocurrency, a majority of crypto influencers and experts concur that ETH may eventually move back to its record highs as 1) macro-economic conditions improve, 2) crypto adoption and development continues to grow and 3) the crypto regulatory landscape becomes clearer, paving the way for greater levels of crypto projects into the space.

This section will dive into some of the well-known platforms’ most eye-catching Ether price prediction for 2023 and beyond.

Finder

ETH is expected to close out 2023 at $2,184, according to the average prediction provided by Finder‘s panel of fintech specialists. These specialists also predict ETH will hit $6,033 by 2025 and $14,316 by 2030.

Gov Capital

According to Gov Capital’s Ethereum ETH price prediction, the coin is expected to reach a maximum price of $2,553 by 2023, $5,013 by 2024, and $7,297 by 2025.

DigitalCoinPrice

It projected that ETH could average at $3,745.86 in 2023 and $4,260.07 in 2024. By the end of 2025, the maximum ETH price could be $5,684.22.

PricePrediction

The website maintained a bullish long-term Ethereum price forecast. Based on its artificial intelligence-assisted technical analysis, ETH is expected to be worth around $2,157.83 in 2023, $3,135.40 in 2024 and $4,556.27 in 2025.

Changelly

According to Changelly, by the end of 2023, ETH is expected to reach a maximum price of $2,928.20, and the minimum price could be $2,447.29. The Ethereum price should be worth at least $5,122.19 by 2025 and $35,894.89 by 2030.

Coin Price Forecast

The popular price prediction website Coin Price Forecast forecasts that Ethereum could reach around $7,000 by the end of 2024, based on the historical data, technical analysis, and overall market trends.

In general, most predictions indicate that ETH can anticipate tremendous growth over the ensuing years.

Download App for Android

How to Prepare for Future ETH Price Fluctuations?

While these Ethereum price predictions are certainly exciting, it’s essential to remember that the crypto market is highly volatile and unpredictable. To prepare for future price fluctuations:

Diversify Your Investments

Diversify your investment portfolio to mitigate risks. Instead of putting all your money into Ethereum, consider investing in other cryptocurrencies, stocks, or bonds to spread out potential losses.

If you’re interested, check out our articles for more cryptocurrency price predictions of the latest and most popular coins.

Staying Updated on Ethereum News and Industry Trends

Stay informed about Ethereum and the broader crypto market by following industry news at BTCC, joining online communities, and engaging with experts in the field. This will help you make better-informed investment decisions. And always cautiously approach price predictions.

Ethereum Price Prediction: Is It a Good Time to Buy ETH?

Many investors are wondering whether they should wait for new bear market lows to be printed,or jump in now so as not to miss out on further upside. Well, ETH’s history of long-term price appreciation suggests the buy and hold strategy is likely to be more profitable in the long term. Investors taking a long-term time horizon won’t be overly bothered whether they bought ETH at $800, $1,300 or $1,800 during the bear market, if Ethereum is above $5,000 in a few years.

Please know that BTCC does not dispense financial advice. Experts’ opinions are not a substitute for your own research and due diligence.

Download App for Android

Ethereum Price Prediction: Conclusion

Overall, most experts have a positive outlook on Ethereum’s future. This coin’s functionality established a reputation, and significant updates instill a lot of faith in it. There’s hardly any other crypto project out there that has all these qualities. Even if the crypto market gets affected by strict regulation, Ethereum will still have the potential to remain relevant and a worthwhile investment.

Bullish predictions suggest that in the event of another bull market (most likely coming next year), ETH could easily break its current all-time high of $4,878. Our Ethereum forecasts also show solid growth potential for ETH price.

However, please also know the figures are generated using our price prediction tool and in that matter, not a guarantee, that the actual price action will follow what we mentioned. Forecasts are not immune to changing circumstances and will be updated with new developments.

Just as a majority of investors anticipated in early 2022 that Ethereum would bottom out at $3500, but the currency moved lower to show them incorrect. In fact, ETH briefly fell below the terrifying $1000 threshold in the year due to the market crash. So, always do your own research and evaluate all necessary factors before you decide to sell or buy ETH. Never make investments you cannot risk losing. Happy investing!

FAQs

What factors can influence Ethereum price forecast?

Factors such as market demand, regulatory developments, technological advancements, and macroeconomic trends can all influence Ethereum’s price.

What is the role of DeFi and NFTs in Ethereum’s price?

DeFi and NFTs have gained widespread popularity and have contributed to Ethereum’s value and demand. Both DeFi and NFTs rely heavily on Ethereum’s smart contract functionality, making Ether indispensable in these markets.

Where can I buy Ethereum (ETH)?

BTCC is one of the best exchanges as it witnesses a large trading volume of ETH. Other exchanges for buying ETH include Binance and Coinbase. Check the links below to create an account on BTCC and start trading now.

What are BTCC’s specs?

Sometimes, users feel more comfortable working with an exchange if they know that the exchange has a footprint in the industry. BTCC has over 1.6 million registered users, and it has a trade volume (24H) of $9.94 billion.

BTCC is one of the best known exchange with over 12 years of stable and secure operating history focused on the Bitcoin and Ethereum, offering trading service in US, Canada, and many other countries in Europe. BTCC also supports tokenized futures service, allowing users to trade stocks and commodities futures with USDT as the margin.

Trading on BTCC begins with registration and log in, which only takes 30 seconds. New customers can now sign up here to get a welcome bonus of 10 USDT, and complete the KYC verification process to access all BTCC’s features and BTCC bonus. Once verified, you can start trading ETH now.

Claim your BTCC 10 USDT Bonus

Receive a welcome bonus when you sign up for BTCC crypto trading platform.

Read More:

PulseChain (PLS) Launch: Everything You Need to Know

PulseChain Mainnet Finally Goes Live – What Exactly is PulseChain?

Pepe Price Prediction 2023, 2025, 2030

Will Pi Network Ever Launch? What Stage is Pi Network Now?

Is Pi Network Legit Or Scam: Pi Cryptocurrency Real or Fake?

Pi Coin Price Prediction: Will Pi Ever Be Worth Money?

XRP Price Prediction $500: Can XRP Reach $500 Dollars?

Luna Classic Price Prediction: Will Luna Classic Reach $1?

Gold Price Predictions for Next 5 Years

Silver Price Predictions for Next 5 Years

Milady Meme Coin (LADYS) Price Prediction 2023, 2025, 2030

Cardano (ADA) Price Prediction 2023, 2025, 2030

Core DAO Airdrop is Now Available, How to Claim It?

Core DAO (CORE) Price Prediction 2023, 2025, 2030

Gala (GALA) Price Prediction 2023, 2025, 2030

Arbitrum (ARB) Price Prediction 2023, 2025, 2030

Sui (SUI) Price Prediction 2023, 2025, 2030

Stellar Lumens (XLM) Price Prediction 2023, 2025, 2030

Litecoin (LTC) Price Prediction 2023, 2025, 2030

HBAR Price Prediction 2025, 2030

Turbo (TURBO) Price Prediction 2023, 2025, 2030

Sponge (SPONGE) Price Prediction 2023, 2025, 2030

JasmyCoin (JASMY) Price Prediction

The Sandbox Price Prediction 2025, 2030

Can Solana Reach $1,000? Solana Price Prediction

VeChain (VET) Price Prediction 2023, 2025, 2030

Avalanche (AVAX) Price Prediction 2022,2025,2030

Chainlink (LINK) Price Prediction 2023, 2025, 2030

Dogecoin (DOGE) Price Prediction 2023, 2025, 2030

Bitcoin (BTC) Price Prediction 2023, 2025, 2030

Yearn.Finance (YFI) Price Prediction 2023, 2025, 2030

Tron (TRX) Price Prediction 2023, 2025, 2030

喜欢我的文章吗?

别忘了给点支持与赞赏,让我知道创作的路上有你陪伴。

发布评论…