【AUVESTA Chinese】Which event is a turning point for gold? Why is gold in the spotlight today?

Learn more about AUVESTA Precious Metals International Chinese website: https://sites.google.com/view/auvestaglobal/

classical gold standard

The gold standard is a system under which all countries tie the value of their currency to a certain amount of gold, or peg their currency to another country's currency that is already pegged to a certain amount of gold. Domestic currency can be freely exchanged for gold at a fixed price, and the import and export of gold is not restricted. Gold coins are circulated as domestic currency along with other metal coins and banknotes, and the composition of gold coins varies from country to country. Since the value of each currency is determined by a certain amount of gold, the exchange rate between the various currencies participating in this system is also determined.

Gold dollar standard - Bretton Woods monetary system established in 1945

The post-World War II world needed an entirely new international system to replace the gold standard, as was evident during World War II. The blueprint for the system was drawn up at the Bretton Woods Conference in the United States in 1944. The political and economic position that the United States possesses puts the dollar at the heart of the system naturally. Having survived the chaos between the two world wars, countries longed for stability, as fixed exchange rates were seen as important to trade, but also for greater flexibility than the traditional gold standard. The system established by the meeting pegged the US dollar to gold at the then gold parity of US$35 an ounce, while the currencies of other countries were pegged to the US dollar, but the exchange rate could be adjusted. Unlike the classical gold standard, this system allows countries to impose capital controls to stimulate their economies without financial market penalties.

In 1945, the IMF (International Monetary Fund) was born and established the "gold dollar standard", using gold, which has international value, and the US dollar, the currency of the United States with the strongest economic strength at that time, as a settlement method. It is stipulated that the United States can exchange gold for $35 per ounce at any time, and it also determines the exchange rate of the U.S. dollar against the currencies of various countries. This is called "Bretton Woods (fixed exchange rate)".

Learn more about AUVESTA Precious Metals International Chinese website: https://sites.google.com/view/auvestaglobal/

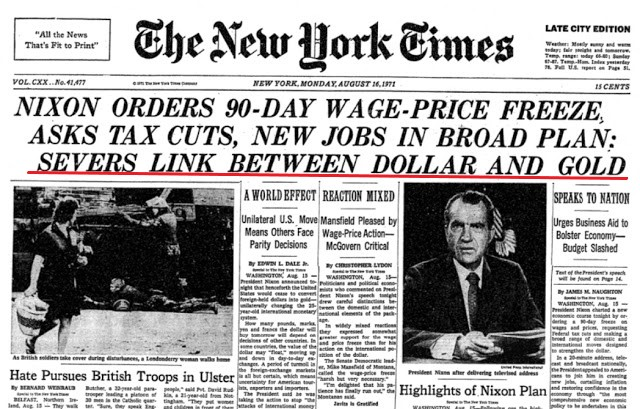

The 1971 Nixon Shock was an important turning point

The Nixon incident in 1971 was an important turning point for gold and the world economy. Announced the abandonment of the exchange between the US dollar and gold, abolished the gold price of $35 per ounce set by the Bretton Woods system in 1945, and then determined the price according to demand and supply. In addition, the currencies of major countries changed from fixed to floating exchange rates.

Confidence in the U.S. dollar has fallen, and the gold dollar standard has collapsed

The exchange of dollars and gold stipulated by the "Bretton Woods System" was suddenly abandoned, which was called the Nixon shock. After the 1960s, because of the Vietnam War, America's overseas debt increased and its finances deteriorated. "Can the exchange with gold be guaranteed?", "Is it okay to continue to hold the dollar?" Out of such anxiety, there has been an active trend of selling the dollar for gold. Germany, France, Switzerland, etc. exchanged a large amount of US dollars for gold, and the gold scoops held by the United States were repeatedly empty. At its peak, the United States had 20,000 tons of the 30,000 tons of gold in the world, but only 8,134 tons were left when Nexen announced the cessation of exchange. Although it is stipulated that the issuance of US dollar banknotes exceeding the gold reserves is not allowed, the reduction of gold has lost the balance with the issuance of the US dollar, and the exchange with gold can no longer be guaranteed.

Learn more about AUVESTA Precious Metals International Chinese website: https://sites.google.com/view/auvestaglobal/

The era when the price of gold is determined by supply and demand

The Nixon shock caused gold to disassociate from the dollar, and the price of gold became freely determined by supply and demand. At the same time, after the Nixon shock, the "Smithsonian Agreement" was reached on the currencies of various countries to readjust the foreign exchange market, intending to maintain a fixed exchange rate system, but it ended in failure. Since 1973, it has been transformed into a floating exchange rate, and the exchange rate is determined according to the economic strength of each country and the supply and demand of currencies, until today.

Buying gold in troubled times causes gold prices to soar

After the price of gold becomes determined by supply and demand, gold is largely affected by world economic trends. Wars, economic booms, and economic depressions all lead to changes in the price of gold. As we entered the 21st century, general unease about the world economy led to a rise in the price of gold.

In recent years, the relaxation of financial policies in various countries is the most important factor for the rise of gold prices. Loosening finance means that central banks must provide a steady stream of funds, real interest rates are negative, and capital originally used for equipment investment and consumption flows into the gold market. Gold prices continued to rise as the easing of financial policy progressed. In addition, excessive liquidity may become a hotbed of inflation, which will push the rush to buy gold even more to a climax.

In 2020, in order to stimulate the economy hit by the epidemic, the Federal Reserve (FED) restarted quantitative easing (QE), hoping to release a large amount of funds to activate the market, and the result of a large number of bond purchases also lowered bond yields and increased investment. People's willingness to hold gold in uncertain situations. Therefore, the safe-haven demand generated by the impact of the epidemic, coupled with the weakening of confidence in the US dollar , and the continued easing of the Federal Reserve's low interest rate environment, have increased investors' willingness to hold gold, which has become a boost to the international gold price in the post-epidemic era.

Learn more about AUVESTA Precious Metals International Chinese website: https://sites.google.com/view/auvestaglobal/

Why is gold in the spotlight today?

After entering the 21st century, the price of gold has been rising all the way. Throughout the ages, gold jewelry has been a symbol of wealth, and gold has also been used as currency. After entering the era of paper money, gold once relegated to a supporting role, but now it has returned to the arena with an unparalleled sense of presence.

As an asset, gold's value has skyrocketed

Where does the money go? The first thing that comes to your mind is the bank, right? However, the interest rate of the bank is relatively low, and it is difficult to increase the value of money through bank deposits.

What about stocks? Although the interest rate is higher than that of the bank, there is also the risk of depreciation. Judging from the data of the past 20 years, there are periods of great rise and periods of trough.

Learn more about AUVESTA Precious Metals International Chinese website: https://sites.google.com/view/auvestaglobal/

Unlike currency, gold is stateless. Unlike printed paper money, gold does exist as a "physical object". From ancient times to the present, when there is a crisis, people will focus on gold and buy in large quantities. Romance may be lacking, but gold is in the spotlight as an asset that keeps its value just in case.

Learn more about AUVESTA Precious Metals International Chinese website: https://sites.google.com/view/auvestaglobal/

Distrust of money causes money to flock to gold

Especially around 2010 and in recent years, people's trust in the US dollar, the base currency, has declined. The euro crisis has caused anxiety about the European economy, and the stock prices of various countries have fallen. Investors are extremely worried about existing financial products. And gold does not carry the label risk of "currency, bonds, stocks issued by a certain country and a certain company", which makes the pace of capital flow to gold faster. In addition, in response to the economic crisis, governments and financial institutions have adopted financial easing policies, which actually dilutes the value of financial assets and increases the value of gold as a "physical" representation.

This distrust of money led to a steady flow of money into gold. After entering the 21st century, gold, which has been singing all the way, continues to surge in value due to explosive buying.

Learn more about AUVESTA Precious Metals International Chinese website: https://sites.google.com/view/auvestaglobal/

AUVESTA is currently one of the projects of Work Your Wealth. It has anti-inflation and value-added asset investment projects. It is a long-term investment and has high stability.

AUVESTA is a well-known German gold company that has been operating since 2009, specializing in the purchase, sale and storage of precious metals

Why choose Auvesta to buy precious metals?

1. High credit rating

2. Time deposit gold enjoys an extra 1% rebate

3. High liquidity

4. 100% ownership of gold held

5. Alchemy manufacturing plants are all high quality certification (LBMA)

6. Highly secure third-party safe deposit

7. Regular audit reports

8. Small gold delivery

9. Gold is very cost-effective

Learn more about AUVESTA Precious Metals International Chinese website: https://sites.google.com/view/auvestaglobal/

Won the DFSI evaluation and praise for many times

Also listed in the famous German business magazine-Focus Money

"Best Price"

"Best Gold Dealer"

"Best Transparency"

"Best Service"

"The Best Cellar"

From as little as 1 euro per month

Family Gold Savings Plan

Protect your assets with physical precious metals

You own the gold you buy [100% ownership]

Learn more about AUVESTA Precious Metals International Chinese website: https://sites.google.com/view/auvestaglobal/

Find out the pulse of this ever-changing era, make the right choice at the critical moment, and don't let yourself go from poor to old!

For more details, ask Peter Wang: https://peterwang.soci.vip/

© All rights reserved, reprint must be investigated

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More