Three Arrows Capital Bankruptcy: Arbitrage, Leverage and the Domino Effect

The cryptocurrency market has been quite deserted recently. In addition to the global economic situation, investors in the currency circle may have to worry about the news of the bankruptcy of the venture capital firm Three Arrow Capital ( Three Arrow Capital ) and the possible domino effect.

Entrepreneurs in the currency circle are certainly no strangers to the resounding name of Three Arrows Capital. Its investment map covers mountains and seas , and its footprints cover public blockchains, decentralized applications and centralized lending services. At its peak, Three Arrows Capital managed assets of up to US$18 billion, was also the largest holder of Grayscale Bitcoin Trust Fund (GBTC), and was voted by the community as the most trustworthy venture capital in the currency circle in 2021.

But in recent months, the market has changed. Two weeks ago, it was reported that Three Arrows Capital was liquidated in large quantities because of its insolvency. The founder briefly appeared on June 15 to confirm the rumors and said he was trying his best to save it. However, every few days, new victims jump out to accuse Three Arrows Capital of not paying back the money, including Voyager Digital, a US-listed company.

Arrow Capital formally filed for bankruptcy protection with the U.S. government last Wednesday, and the whereabouts of the two founders remain a mystery. This article discusses how Three Arrows Capital became a venture capitalist in the coin circle, and why did it declare bankruptcy in just a few weeks?

Arbitrage started

The two founders of Three Arrows Capital, Su Zhu and Kyle Davies, are classmates in an aristocratic high school in the United States. After graduating from college in 2008, they worked for several years at Credit Suisse, Flow Traders and Deutsche Bank before co-founding Three Arrows Capital in 2012. They were all under 30 at the time.

After the establishment of Three Arrows Capital, they did not enter the currency circle with one foot, but started from their best foreign exchange arbitrage. According to Arthur Hayes, founder of cryptocurrency exchange BitMEX :

At that time, the investment banking circles in Hong Kong, Singapore and Tokyo were very closely connected. Although I only met them directly in the currency circle a few years later, we had a common circle of friends. Su Zhu and Kyle Davies started out as arbitrage traders. They are good at profiting from tiny spreads. Just do it a few more times and the money will roll in more and more. They initially did arbitrage for non-delivery forward foreign exchange (Non-Delivery Forward), which was also a way of making money for Three Arrows Capital.

Although "non-deliverable forward foreign exchange" sounds stinky and long, to put it bluntly, it is a futures that can bet on the future rise and fall of foreign exchange without having to prepare principal.

For example, there will be a slight price difference when exchanging Japanese yen at different banks. Even the spot has a price difference, and futures are transactions that will occur in the future, and the price difference of each bank will be more obvious. Three Arrows Capital is arbitrage through the spread of foreign exchange futures of different banks.

Three Arrows Capital specializes in trading emerging market currencies with poor market efficiency and more arbitrage opportunities. Even if the spread does not appear until a few decimal places, you can still make a lot of money as long as the transaction amount is large enough and the buying and selling are frequent enough. So far, Three Arrows Capital has nothing to do with cryptocurrencies.

However, the founder Su Zhu is quite optimistic that the blockchain will promote the paradigm shift like the Internet, so he began to buy cryptocurrencies in large quantities during the bear market of the currency circle in 2018. In the eyes of Three Arrows Capital, BTC and ETH are like another "emerging market currency" with low market efficiency, and there are arbitrage opportunities everywhere.

Take BTC as an example. In the past few years, many investment institutions have wanted to buy BTC, but they cannot directly buy BTC through exchanges such as registered Binance like ordinary investors. way to invest in bitcoin indirectly.

This puts GBTC at a long-term premium ranging from 10% to 30% until 2021. In the eyes of investment institutions such as Three Arrows Capital, these premiums are cash in vain. They will buy GBTC from Grayscale with the BTC spot, and then sell the GBTC to the second-hand market at a premium for profit.

In addition to BTC, another arbitrage tool of Three Arrows Capital is the UST USD stablecoin.

Leverage

Three Arrows Capital is one of the big sponsors of the Terra ecosystem. In February this year, it invested an additional US$200 million in Luna Foundation Guard, in exchange for a large amount of LUNA coins that were unlocked in batches.

Everyone knows what happened next. Before Three Arrows Capital could wait for the tokens to be unlocked, the prices of UST and LUNA collapsed2. The LUNA coins exchanged for 200 million US dollars also fell to only a few hundred dollars. This investment can be said to be wiped out.

But before that, Three Arrows Capital had already made a lot of money using Anchor Protocol3's 20% annual interest rate arbitrage. Also according to Arthur Hayes:

All the critical thinking of the so-called fund managers would be left behind by the lure of Anchor's 20% annual interest rate. This is especially true for traders like Su Zhu and Kyle Davies who started out as arbitrage.

Their arbitrage method is also very simple, as long as they borrow USD with an annual interest rate of less than 20% from the market and exchange it for UST, and then deposit UST into Anchor to get 20% interest. Just take the 20% interest minus the borrowing cost and that's their unrealized gain. In order to realize the income, Three Arrows Capital only needs to take back the UST from Anchor in reverse, and then exchange the UST into US dollars to repay the loan. The rest of the money is profit.

To put it simply, the deposit income minus the borrowing cost is the money earned by Three Arrows Capital. Many investors will borrow money to earn interest spreads, but Three Arrows Capital is not that smart. The difference is that the principal they borrow through mortgages and credit leverage is much higher than that of ordinary investors, and of course they can make more money in the end.

If you want to maximize profits, you need to find ways to borrow more principal, lower borrowing rates, and the less collateral the better. However, in the DeFi market, Three Arrows Capital, like other investors, is an "address" and cannot receive special benefits. Therefore, Three Arrows Capital prefers to borrow money from the CeFi market.

The centralized lending service BlockFi “ recognizes ” that Three Arrows Capital is their investor, and will naturally provide better borrowing conditions. Voyager Digital, a US-listed company, was even bolder, lending 15,000 BTC and $350 million to Three Arrows without asking for any collateral.

After all, how could Three Arrows Capital, which manages 18 billion US dollars of funds and calls for wind and rain in the currency circle, still not give out a "mere" hundreds of millions of dollars? Even if there are concerns, the fierce competition in the market makes these CeFi lending companies choose to ignore the potential risks. After all, there is no way to provide depositors with higher yields on their deposits without lending the money to “work.”

The average investor only sees the yield figures of deposits, and it is difficult to distinguish what investment opportunities and risks behind the high yields represent. Only internal employees will know where the yield is "squeezed" out.

What's more, the borrower this time is Three Arrows Capital. Su Zhu has 560,000 followers on Twitter and has proven his community influence by the end of 2021. At that time, he published an article criticizing Ethereum for betraying users and letting go of the high gas fee. Then he made a big move to transfer the ETH held by Three Arrows Capital to the exchange, and he wanted to sell it.

As soon as the news came out, the price of ETH fell. Unexpectedly, a few days later, Su Zhu actually bought 660 million US dollars of ETH. Cut a wave of leeks. Retail investors, of course, hate Three Arrows Capital. However, in the eyes of centralized lending companies, this incident has become the "medal" of influence of Three Arrows Capital, and they are more willing to borrow money for them to leverage.

However, Three Arrows Capital did not expect that the price of the UST stablecoin, which was strongly supported at the beginning, was decoupled significantly in early May. Wanted to make a profit but lost the principal. Moreover, the principal is also borrowed from others by means of mortgage and credit leverage.

Although you can earn faster by borrowing money and investing, you are most afraid of losing money. After the collapse of LUNA and UST, the overall market was stagnant. In addition to investment losses, Three Arrows Capital is also insolvent due to the falling price of its collateral. Three Arrows Capital watched its investment evaporate while being urged to make up money. Can be said to be burning both ends of the candle.

If Three Arrows Capital does not immediately fill the funding gap, the collateral may be "decapitated". They had to start selling their property.

Domino effect

Although Three Arrows Capital managed as much as $18 billion in assets at its peak, the vast majority may be seen but not eaten.

Taking LUNA as an example, Three Arrows Capital spent hundreds of millions of dollars to buy coins, but it must comply with the regulations of the lock-up period, and cannot directly throw it into the market to realize firefighting in an emergency. Even if the token has been unlocked, if the liquidity in the market is insufficient to support an instant large-scale sell order, the token will only get cheaper and cheaper.

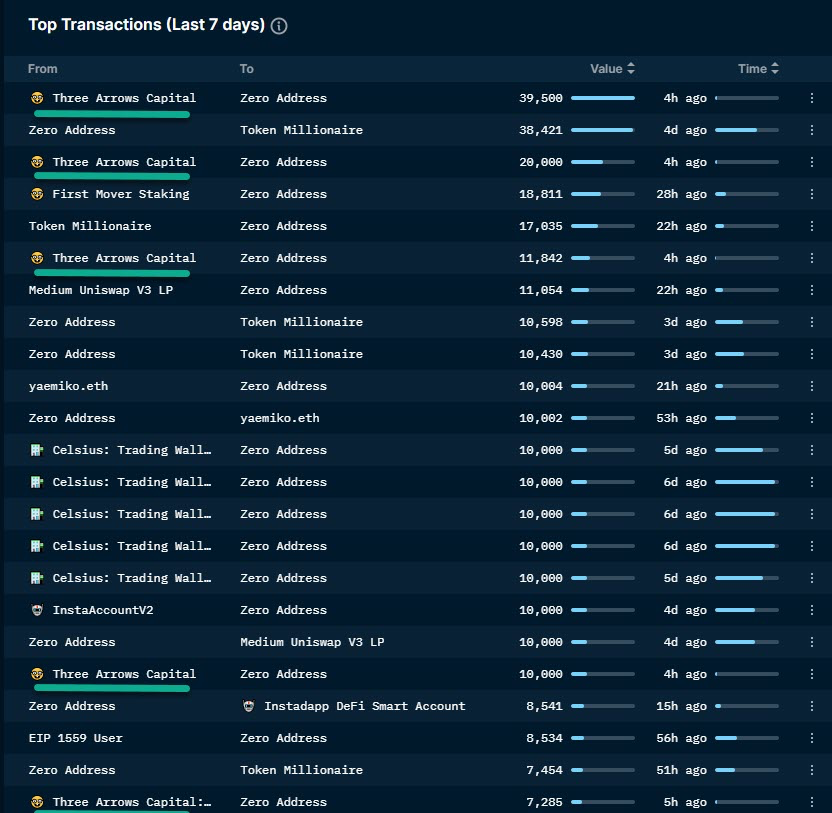

Celsius, which was discussed by the block potential last month, is eager to sell stETH in his hands to cope with user runs, and the more he sells, the more losses he loses. At that time, there was another seller in the market - Three Arrows Capital - who sold more stETH than Celsius, more urgently, and suffered a bigger loss.

In order to survive, Three Arrows Capital did not care about morality or the law, and privately misappropriated the funds deposited by investors to put out fires. Even more anxious are those centralized lending companies that lent money to Three Arrows Capital but couldn’t get it back. Because the money lent is the funds that customers temporarily put aside to generate interest, not their own money.

Once the news leaks and users start panic-running, I am afraid they will have to follow the footsteps of Celsius4.

Paper can't wrap fire. Voyager Digital, which “naked” 15,000 BTC and $350 million to Three Arrows Capital last week, has announced that it has temporarily closed user withdrawals, and the company’s stock price has plummeted by nearly 90%. BlockFi eventually lost about $80 million. Although the withdrawal has not been closed yet, it has negotiated credit loans and acquisition conditions with FTX in a preventive manner to cope with the run on users.

Three Arrows Capital formally filed for bankruptcy protection with the U.S. government last week, and it was determined that it would be difficult to save. What everyone is worried about now is that the bankruptcy and liquidation of Three Arrows Capital is bound to sell a large number of tokens they exchanged for through investment. This is like a dark cloud for investors, as long as the liquidation lasts for a day, they have to worry that the market may fall sharply at any time. It is impossible to predict which other companies will be in trouble.

The bankruptcy of Three Arrows Capital can be said to be the second tsunami triggered by the collapse of LUNA and UST.

The first wave of tsunami 5 caused the DeFi quotation machine to fail, stETH to have a negative premium, or investors to liquidate their positions. This is a mechanism loophole or just a short-term market change. In the future, as long as the mechanism is corrected, it can be prevented in advance. Moreover, investors can also know the real-time situation from the public on-chain data at the first time, and there will be no "surprise".

However, the CeFi bankruptcy crisis triggered by the second wave of tsunami not only highlights the insufficient risk management of various lending institutions, but also the greater problem is the opaque information.

The news of the bankruptcy of Three Arrows Capital spread from two weeks ago to the confirmation a few days ago. During the process, everyone could only rely on the revelations of the victims to piece together the information. No one really knows who Three Arrows borrowed from, on what terms, how much it lost, and what unexploded bombs were left.

In the past, whenever DeFi was hacked or there were loopholes in the mechanism, investors would quickly transfer funds to the relatively “safe” CeFi for safe haven. But after this incident, everyone will find that CeFi and DeFi are not safer, but the security mechanisms are different.

The security of DeFi is built on open and transparent mechanisms, while the security of CeFi is built on trust that is not public and difficult to measure. Although it is more efficient to build trust than to build a mechanism, a sound mechanism can stand the test more than trust.

Block Potential is an independent media that is maintained by readers' paid subscriptions, and the content does not accept factory or commercial distribution. If you think the block potential article is good, please share it. If the bank has spare capacity, it can also support the block potential operation with a regular quota. To view the content of past publications, you can refer to the article list .

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More