Study Notes|Inflation X Interest Rate Rise X Deposit Reserve

This month, I participated in the online forum on the influence of the global general manager held by MacroMicro Finance M square .

Because the amount of information in the forum is quite large, it is really difficult to absorb and organize it into one's own knowledge in a short period of time.

Originally wanted to write an article to share as a note, but there are too many projects. I think I should deal with them one by one, and organize the output while inputting.

In addition to arranging for myself, I also share with those who are interested.

📈Inflation X rate hike

Since the US announced on the 10th of this month, the annual growth rate of the consumer price index (CPI) in May has soared to 8.6%, a new high in nearly 40 years.

In order to curb inflation, the US Federal Reserve (Fed) raised interest rates by 3 yards in its meeting on the 15th of this month (1 code is 0.25%, 3 yards totaling 0.75%),

And significantly raised the number of interest rate hikes this year, according to the rolling adjustment forecast at least 13 yards (3.25%) by the end of the year, but compared with the 8.6% CPI

Even if the interest rate rises to 3.25%, there is still a gap of 5.35% between the two, that is, the money deposited in the bank every year,

Still part of it will be eroded away by the impact of inflation.

There are three main reasons why the annual rate of inflation has soared so high:

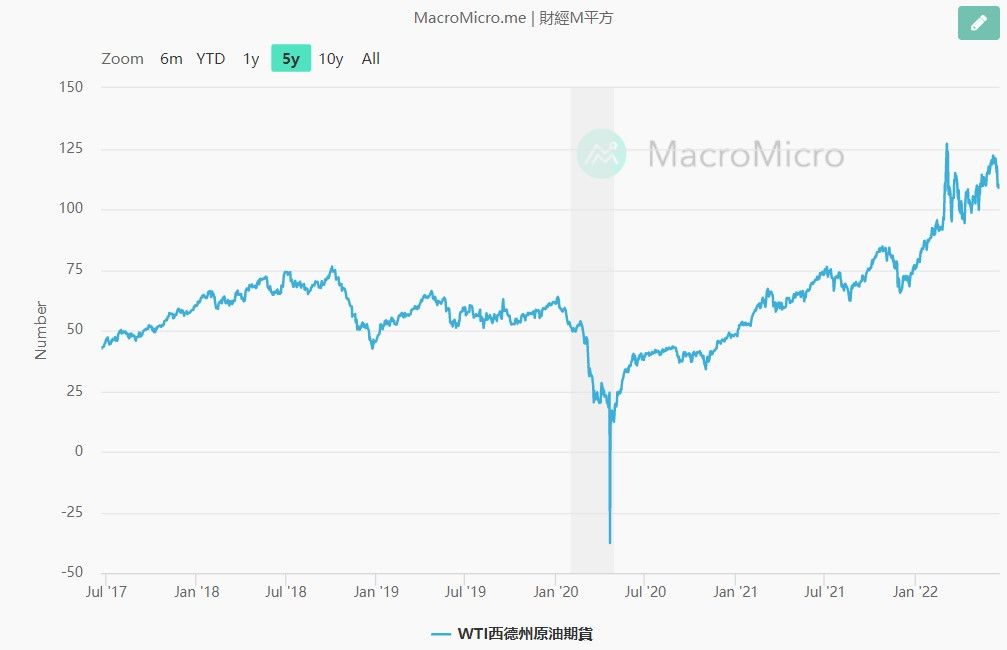

- The Ukrainian-Russian war has led to high crude oil prices . (On 6/20, West German crude oil price: $109.51/barrel).

- Supply chain bottlenecks continue . (Logistics congestion in ports and China's city closure have caused production and supply of some key components to be blocked)

- Domestic demand has increased rapidly . (Under the shortage of supply, the price is pushed up)

The Fed's interest rate hike policy is mainly aimed at suppressing domestic demand in item 3, but the supply chain and crude oil price issues,"

The Fed is powerless and powerless.

To keep inflation down to a healthy 2% (appropriate inflation is good for economic growth),

There is still nearly 6% (8.6%-2.5%) of room to work hard. If the three factors are divided into inflation,

Each factor has 2% inflation to be resolved, so according to the data, the Fed will raise interest rates by 13 yards at the end of the year.

The theory should be enough, what about the remaining two?

Supply Chain Bottleneck➡️ It will take some time for China to return to normal after the epidemic slows down and the lockdown is lifted (Q3).

High crude oil prices ➡️ It is impossible to know when the Ukrainian war will end, so we can only find another way,

Whether U.S. oil producers can significantly increase production to lower prices depends on what U.S. President Joe Biden decides to do.

💰 Deposit reserve

After the Fed announced a 3-yard rate hike on June 15, the Central Bank of Taiwan also announced a half-yard (0.125%) rate hike on the 16th the next day.

It is lower than market expectations. Although it seems to be a small move, the real big move is to increase the deposit reserve ratio by 1 yard (0.25%).

The current head of the central bank, Yang Jinlong , explained that "Considering the domestic epidemic relief and policy loan interest, the rate hike should not be too large.

, to adjust the deposit reserve ratio, this practice helps to ease the burden of vulnerable labor and business loan interest. "

Due to the economic impact caused by the epidemic in Taiwan in March 2020, only one rate cut was made at that time, unlike the emergency rate cut by the United States at that time.

It remains to be seen how the actual effect of suppressing inflation will be after the US has raised interest rates by 3 yards.

This time, Taiwan's half-size rate hike is also for the follow-up inflation suppression if it is not as good as expected, there is still room for adjustment.

It also avoids the burden of lending to vulnerable workers and private enterprises.

🤔 What is the deposit reserve ratio? What's the effect of raising 1 yard?

Deposit reserve refers to the time when financial institutions need to ensure that customers/depositors withdraw deposits and clear funds between banks.

Instead, it is necessary to prepare the amount of deposits held in the central bank.

The ratio of the deposit reserve required by the central bank to its total deposits is the deposit reserve ratio .

Example: Assuming that the deposit reserve ratio is 5%, and today Xiaoming deposits 100,000 yuan in Bank A, the bank must deliver 100,000 * 5% = 5,000 yuan to the central bank (the central bank will still pay interest to Bank A), then The remaining 95,000 yuan is what Bank A can use for lending.

The purpose of deposit reserve :

Suppressing banks' blind lending, resulting in banks not having sufficient funds for users to receive their own deposits, can avoid the occurrence of bank credit crises and the risk of financial problems.

The impact of the increase in the deposit reserve ratio:

The increase in the deposit reserve ratio means that the amount of money that the bank can release from the deposit is reduced, which directly affects the money supply in the market, and at the same time, it can increase the purchasing power of money to achieve the effect of curbing inflation.

For banks: the reduction of funds available for lending will affect the source of profits. In order to strengthen the profitability of banks, interest rates are generally increased to attract deposits. At the same time, banks will be more cautious about lending objects to reduce the risk of bad debts and bad credit.

For enterprises: Due to the prudent selection of loan objects by banks, enterprises with small scale and insufficient profitability that must rely on loans and financing will face considerable operational challenges (increased interest costs for financing and scheduling).

Overall:

For the general public, even if the interest rate is raised directly, they are reluctant to increase the deposit limit (the interest rate is still too low),

However, it will greatly affect the willingness to purchase high-value durable goods (cars, houses, etc.), which can be regarded as an immediate effect to curb inflation and raise interest rates by half a yard.

The increase in the deposit reserve ratio directly affects the financial industry, which has shrunk the funds that can earn profits. However, in order to achieve stable profits, the lending rate will definitely increase. It also indirectly and slowly curbs domestic demand and achieves a way to reduce inflation.

Taiwan's CPI in May this year was 3.39%, far lower than the staggering 8.6% in the United States, and the rise in inflation in Taiwan was mainly caused by the supply side (supply chain problems), and the non-demand side pushed up, and the short-term inflationary pressure was relatively small.

However, the impact of global inflation is comprehensive (only the severity varies from country to country), and the economic bear market cannot escape in the short term. How to allocate assets must also be carefully studied. Maybe it will be a rare opportunity to redistribute assets.

I am a Talf house, sharing my life experience, learning, reading and other experiences through text. Keep it for yourself and for those who are interested, thank you for reading.

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More