What is financial freedom? Does wealth equal money?

Two days ago, I wrote an article "Thinking about the Life Pattern Behind Money" , and a reader commented on a question to me:

"When your wealth is not free, how do you get rid of distractions?"

This question is very good. I believe that this problem is not just for this friend. Most people will be deeply troubled by this problem. Today, I will continue to focus on the topic of wealth and talk about my thoughts on money and wealth.

It just so happened that I just finished chatting about making money with my good friend on the Void Podcast today. The initiator of the topic is me, and the background is very simple. The layoffs of large factories and the impact of the epidemic will make life difficult for everyone, and even face an existential crisis. , then how can we improve our ability to make money and resist the risks brought about by external crises? Then you can listen to the next podcast.

1

A consultant came to me two days ago. In the consultation document, I saw a sentence that evoked my memory:

"Compared with the closed concept of "just use a little money, you can achieve a self-sufficient and comfortable life", I need to learn to make money, maintain physical and mental health, reduce the probability of major decision-making mistakes, and be able to discover what really needs to be done. "

Her mentality was almost the same as my mentality before and after college.

My salary starting point is much higher than that of many fresh graduates. The first salary after graduation is close to tens of thousands. At that time, the first room I rented in Beijing was changed from "two bedrooms and one living room " to "four bedrooms and one bathroom". For the 5-person shared house in "No Hall" , I chose the master bedroom, which is 2,500 yuan a month.

And what was life like then?

Faced with the embarrassing situation of queuing for the toilet every morning and evening;

When I turn on the washing machine, I often see the picture of the next-door brother's panties and socks being mixed with the clothes;

At two o'clock in the morning, the girl in the other room didn't bring the key, and knocked on the door frantically to open the door while I was sleeping;

Go to the kitchen to cook and find Bawang shampoo next to the seasoning;

The cramped and dim toilets are piled with toilet paper;

There are always unclean yellow stains on the toilet seat;

The sound of a couple in the other room talking in the bathroom...

Even after five or six years, I can still remember every detail about my first rental house in my life, and then I couldn't stand it and decided to move out after living there for 2 months. He took out half of his salary and smashed it on a 100-square-meter house with a good decoration and a large space in Shuangjing, Beijing.

At that time, I had the same idea as the girl, "use a little money to realize your own comfortable life" . I would spend half of the money on rent, while the rest was brainwashed by consumerist propaganda, and I always felt that I should have CBD. For the girls' luxury backpacks, the rest of the money is spent on traveling abroad, so there is no so-called deposit, or even basic insurance awareness.

I had a real understanding of money, maybe later than many people.

Although I have been thinking about making money since college and I have made some small money through actions, I don't understand what "money" means to me, what is its relationship with me, and what is "wealth".

At that time, I simply regarded "wealth" as "money".

In short, I don’t understand the so-called need to arrange insurance for myself, I don’t know how to spend money to invest in myself, and I don’t know how to invest. The money I get will basically be squandered by me. I don’t buy clothes and bags, or just play around.

Ironically, I've found that apart from things like accommodation (to get better rest and access to peripheral services), regular travel (to see the world), and electronics (to increase productivity), I don't have a thing for things like wearing name tags. too much feeling.

My first Gucci slub bag with nearly 10,000 bags, I only carried it a few times before I stopped carrying it, because I found that its existence did not bring me the slightest joy, and I did not feel that I was a girl who just graduated carrying this bag. , and appear more noble and powerful.

As for some expensive accessories, they are often put in boxes, and I rarely think of bringing them. I later realized that these things that most people are after, do not make a fuss in my heart.

I am thankful that money has given me them, and I have seen my true inner needs. And after that, I didn't spend much money on expensive accessories and clothes. Most of the time, when I saw my friends, it was either sportswear or casual clothes bought on pdd.

Without the external desire for social comparison, at that moment I felt that I was instantly free and relaxed a lot. Instead of fueling my desires, money has reduced my desires in some places.

However, I don’t know if there are people who, like me who graduated, have fun in a timely manner and think that a self-sufficient and comfortable life can be achieved with just a little money. Those who think about making money will be dismissive.

So, when did my thinking begin to change, I became no longer naive and profligate, and began to seriously think about the question of "what is the meaning of money and wealth to my life"?

2

In 2016, I was dissatisfied with the boasting and impetuousness of the Internet industry at that time, so I decided to go to Japan to study and change my way of life.

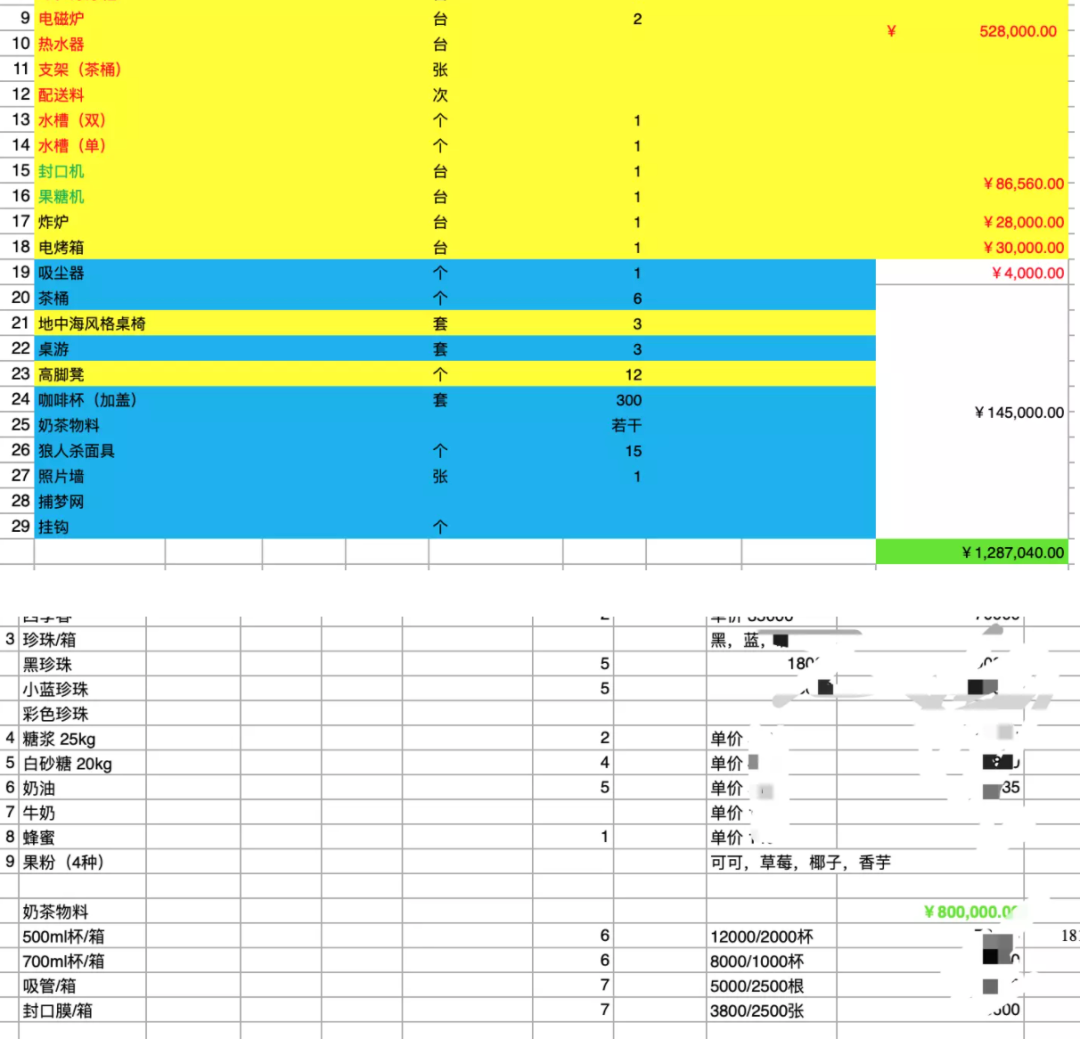

When I was doing business in the local area, I learned how to count money, from rent, water, electricity, gas, tax, shop equipment, air conditioning, decoration... to the length of a straw, a poke of a plastic cover, a point card, etc. , these details to the cost that can no longer be detailed, pull the table to calculate the cost and the corresponding purchase inventory.

It was also at that time that I clearly realized the importance of "cash flow", "account savings", "responsibility awareness" , and that experience made me come into contact with all kinds of people, and made me realize that some things are higher than making money Something beyond that can give me meaning and thinking. To this day, I am more or less grateful for that seemingly painful experience.

Apart from the business time in that year, I have been freelancing for almost 4 years since I returned to China, and I have lived a pretty good life overall.

In the past few years, I have basically realized the life I want one after another, doing what I want to do, spending a lot of time reading, visiting and talking with friends from all walks of life, talking and learning with them, During the epidemic, I also went to different places in China to see the scenery, eat food, and travel alone.

Now, in order to meet an online lover whom I haven't seen for more than two years , I have gone to the farthest southern hemisphere by myself. This is my life in recent years——

There is no pressure of promotion in big factories, no fear of being laid off and dismissed, and no so-called overtime, no time to socialize and read books.

Whether it is wealth, career, love, etc., they are all in an orderly manner. In their spare time, they can post clips of their thinking and life on social platforms, public accounts, etc.

I know that many people are envious, but what I want to say is that since I came back in 2018, I haven’t been able to find my ideal education company, and since the day I was forced to work as a freelancer, my life just took the initiative to accept it before more people. risk".

During that year, I went through a long period of painful, anxious moments, and I wasn't even willing to bow down to a job that offered me a high-paying job that didn't meet my expectations.

When a person is separated from the stable salary provided by the company and a barrier against external risks, he may face huge risks, pressures and challenges, but opportunities and growth will also grow rapidly in the crisis.

What was in my mind then?

I need to make money to satisfy survival;

I need active income, I need passive income;

I need to make meaningful and loving things into my own cash flow;

I need to increase my time usage and avoid earning income from repetitive, non-growth work;

I need to free up my time as much as possible and let money make money for me;

I need to create as much multi-channel revenue as possible to get cash flow;

I need to master a lot of information channels and key people about making money;

I need to know how other people make money and how they make money;

...

Perhaps it was because I couldn't see the entry and exits and jobs I wanted from the company that I had to find another way to find some more niche income from divestitures.

Fortunately, after more than a year of writing Internet analysis manuscripts for other platforms to get paid income, I had some accumulation, and then decided to start a set of content in my mind, and opened my own knowledge planet and WeChat community service (I wrote before how to start from 0 to 1) .

At the same time, I launched my own paid consultation. The price at that time was 500 yuan per hour. I wanted to verify whether this model was feasible. I did not expect that after more than half a year of exploration, it did receive more and more support from friends.

And by coincidence, after learning that "there is a way to make money", it is even more out of control when it comes to making money.

I checked a large number of real case databases for making money, and shared some of my thoughts and mental journeys on making money, so I was able to enter the Dragon Ball group, and then I met some accomplished but relatively low-key friends hidden in making money in the community.

The people of that world, to a certain extent, have reshaped my thinking about "making money", and they have shown me many ways to make money that I can't even imagine.

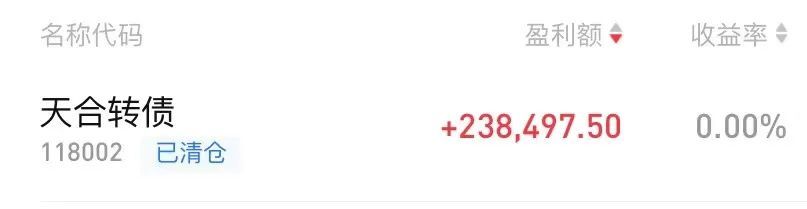

I remember my friend Rouge Wang, whom Shengcai knew, once introduced me to an investor who managed his own private equity fund. He wrote a book on the category of "convertible bonds".

At that time, I was not long into investing, and that was the first time I heard about "convertible bonds" . I was very surprised by this risk-free arbitrage variety, so I asked him:

"Since this product is so profitable, why are there so few people who know about it? Everyone knows about stocks, so why only a small percentage of people know about "convertible bonds"? "

He said something to me, which I still vividly remember: " You must know that there are often a lot of unknown tools and categories hidden in the cracks of this world. Not everyone can get this information, and not everyone can Willing to believe that this arbitrage weapon exists. ”

I think, whether it is an investment tool or other ways of making money, this sentence is very tried. There is always information about making money that few people know about, and there are always people who know it but don’t want to believe it.

Later, some friends around me and I earned 8 points in less than a month in the offline convertible bond project, and there were also 18 points. Later, we started a new project in the Hong Kong stock market. We were lucky. In a very bad situation, I still got some meat, and this is just the profit of my arbitrage part of these investment categories.

Of course, I would like to thank my enlightenment teacher, who is undoubtedly a good friend Rouge King. If there is no absolute trust, I will not take hundreds of thousands of funds into convertible bonds, and I will not earn corresponding passive income.

The above is about my new understanding of money, the building of earning skills, and the experience of opening arbitrage and investment. Next, I will talk about "investment".

3

On the basis of cash flow and arbitrage, I began to explore and try to invest by myself.

In this step, I will respond to the question from the readers at the beginning: "When your wealth is not free, how do you get rid of distractions?"

I think the answer to this question is precisely because I have a deep understanding after getting in touch with "investment".

In my eyes, investing is not simply buying and selling, otherwise it is no different from "gambling". Investment is not an investment in a narrow sense, otherwise you will not be able to balance the relationship between wealth and distractions.

After coming into contact with "investment", I realized one thing clearly:

"How do I allocate the money in my hand to maintain the life I want to the greatest extent and resist potential external risks?"

In my eyes, the definition of the concept of "wealth freedom" is very vague, and everyone has their own set of financial freedom data standards.

If I ask 100 people, what is financial freedom for you? How much money can you earn for financial freedom?

Trust me, you will get at least 50 kinds of answers.

Therefore, there is a need for strategic consideration behind the freedom of wealth. If you don't know how to allocate your funds, if you don't know the meaning of the word "wealth" to you, then no matter how much you earn, you will feel "unfree." ”, after all, human desires and changes in the external environment are the biggest uncertainties in the evaluation criteria.

After getting into investing in person, I started to think hard about the relationship between the words money, wealth and my desires .

I think the ability to "invest" is a very important skill. It is not purely to help you gain profits from the market, but to allow you to clearly see yourself and your commitment to money and wealth in the process. Understand, see clearly your desires and distractions, and see how your emotions will react and respond when money fluctuates greatly.

Let me give you a few examples:

- Insurance investment

When I graduated from college, the money basically flowed into rent, travel, and luxury goods. I didn't even think about buying an insurance such as critical illness insurance for myself, not to mention configuring one for my parents. Insurance, I didn’t even think about getting the nine-valent vaccine in the past, and I didn’t even want to pay for social security.

What is the consequence of this?

If my parents were told one day that they had any major illness and that the medical bills were in excess, once their savings were depleted, I would have to take a huge risk without insurance.

In the same way, if I don't buy insurance for myself, if something goes wrong, I and even my family will have to bear the cost.

In the past two years, I have successively provided myself with critical illness, social insurance, accident insurance (especially aviation insurance coverage), and related cancer insurance for my mother.

This is the awareness of "investment" . What does every money you spend mean to you? Where to save? Where must be willing? What value and return can it bring you? All should think clearly.

- Stock market / real estate investment

There is a lot of financial opportunity in the world, and maybe you've all heard stories about how some people's assets skyrocketed to seven or eight figures in a short period of time.

These are not ordinary phenomena in nature, and most of us will never turn a little money into hundreds of millions in less than a year, but that does not mean that we cannot Get rich in time.

While most assets have appreciated in value over the last century, purchasing power has not. Of course, wages are up, and so is inflation, so if you don't learn simple investing, you could face long-term losses.

There are not many phenomena such as rising vegetable prices and daily necessities in China. A major impact of inflation on ordinary people is that daily prices will rise. Data from the Ministry of Agriculture and Rural Affairs showed that the average wholesale price of the 28 kinds of vegetables monitored in October last year was 5.25 yuan per kilogram, an increase of 11.7% year-on-year.

As an ordinary person, he often earns wages through labor, and most of the rich own assets such as real estate and factories, and most of these assets use leverage.

Ordinary people originally made money from salary income and could live a prosperous life, but after inflation occurs, ordinary people have to continue to work hard to make money, because the purchasing power of money of the same denomination is reduced, and the debt of the rich will be diluted.

Ordinary people lack assets that can resist inflation. At this time, they can only wait for higher wages or state subsidies. However, under the epidemic, how many people are facing layoffs and salary cuts, and it is not easy to maintain the original.

Therefore, you can let your cash flow into the leading companies on the big track, or you can buy high-quality core real estate with population flowing into the city, or rare precious metals (this part has relatively high investment ability in people), in short, whether it is Either way, you will re-open your own learning and understanding of wealth, and it is really important to take this step.

4

After briefly talking about the inspiration of investment, I would like to talk about the understanding of "wealth".

In a general sense, I do not have financial freedom, but in a narrow sense, I think I am quite free. The essence is that I no longer equate the word "wealth" with simply "money".

I regard all "people, knowledge, and products" that can inspire, grow, and change for me as wealth. Wealth itself is not the same as "money", because "money" is only an equivalent exchange for obtaining a certain product. A means, not an end. Otherwise, I may not be able to create an experience that will make me feel happy while sitting on a golden mountain.

But I have feelings for money, because for me, it is not only a tool to satisfy me to realize certain experiences, to help me validate some business ideas, but also a tool to help me practice in this world.

When money flows in me, when my emotions provoke me again and again, when I go through countless ups and downs, I clearly see my desires and my occasionally greedy self, such as those who sell low and buy high. Operation, there will be moments of mental collapse.

The management of emotions and the control of desires are not so easy. If you want to test yourself, the best way is to invest in actual combat, and at this time, you will gain insight into yourself.

However, I also want to remind one thing that there is no successful investor in this world who does not lose money. Most investors' strategies are determined by their losses. Some people's success is often after failure. This is the establishment of The key concept of wealth.

You can allow yourself to lose, allow an investment to fail, risk your own money, and take the risk, but when you invest, do your best not to lose more than 10% of your investment. In the process, go and slowly build your strategy. Even me, there were times when I lost 20%, and I was still learning.

Finally, I know some people who get addicted to trading stocks as a game and only care about the payoff of winning, but I don't think I'm this type of style compared to watching the market all day, because wealth is not the same as money, much less Equivalent to these numbers on the account.

Our lives are inseparable from money, but that doesn't mean we have to be controlled by money. It's all about the word "balance" .

For me, spending money on people, things, and experiences that are valuable to me is an asset. Saving and investing are important, but don't let it get in the way of your life right now.

Time is my most valuable commodity, and when I'm getting old, or seriously ill and possibly dying, how much more money on the books does it matter?

Instead, investing in people, learning new things, and paying for experiences that open your mind is what I think money has created for me as a means. Otherwise money will only turn you into a horrible, thrifty, lifeless miser for you.

Before you die, you don't want to tell the story of how you made a precise decision to buy low and sell high, or how you stepped on the right spot to escape the top of the cryptocurrency crash, but all you can think of are good memories and Life is a meaningful experience to buffer your impending death.

Therefore, if you learn to re-examine money and understand the meaning of wealth, you will be able to balance the relationship between money and you better.

As for "freedom of wealth", this is my answer and understanding.

And this answer, you can keep thinking about it.

What is wealth?

What is freedom?

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More