"Dictionary of Choice" explains the top 20 terms you will definitely use (with video description)

If you want to understand the right of choice, you must first know the explanations and concepts of the terms in the right of choice to help you take a steady first step in the learning process!

call

Buying the right to call is the BC (meaning Buy Call) that everyone is abbreviated as in clubs, Line groups or discussion threads. Common abbreviations in Taiwan include BC, Buy Call, C, Long Call, but I haven’t seen many people who really say buy the right to buy. . If you are bullish, you can buy CALL. If you are bullish, you can sell CALL. Everyone who sells CALL is commonly known as SC (Sell Call).

Put

Buying and selling rights, we usually say BP (meaning Buy Put), common abbreviations are BP, Buy Put, Long Put, P, and I have never heard of people talking about buying and selling rights... Bearish and bearish can buy PUT, bearish If you do not break a certain support, you can sell PUT.

To learn more about the buying and selling operation of CALL and PUT, you can refer to "Introductory Options Teaching" What is a call right? Basic Operation and Strategy Application of Option

Premium

Buy CALL or buy PUT, the buyer must pay the seller points. The number in the transaction price column that we see on the T-quote of the option represents the transaction points of an option, which is the premium.

The Taiwan option is $50 per point, and if you buy a 20-point CALL, 20x$50=$1000 will be deducted from the account.

Margin

The option seller is required to pay a security deposit (deposit), which will be used to compensate the buyer in the future if the buyer wins. When trading, the system will first check whether there is enough margin in the account. If there is, it will be deducted first, and it will be returned to the account when the position is closed.

When the margin in the account is insufficient, the salesperson will call us to make up the money into the account, which is what everyone calls Margin Call. But now it's just a text message notification, unless you have to make up tens of millions to receive a phone call, right?

Regarding the calculation method of the seller's margin, you can refer to what is the option spread order? Understand the concept and purpose of the spread order, and break the risk myth!

Strike/Exercise Price

Everyone said "17300 Call", "16900 Put", "My Call is sold at 17500", and "My BP16800". The numbers mentioned above are the exercise price of the option, and it is also the middle column of the option T-word report.

We can calculate the loss leveling point of an option through the strike price and premium. For example, if you buy 17300 Call for 20 points, the loss leveling point is 17300+20=17320, which means that buying this call is to see that the market will rise to at least 17320.

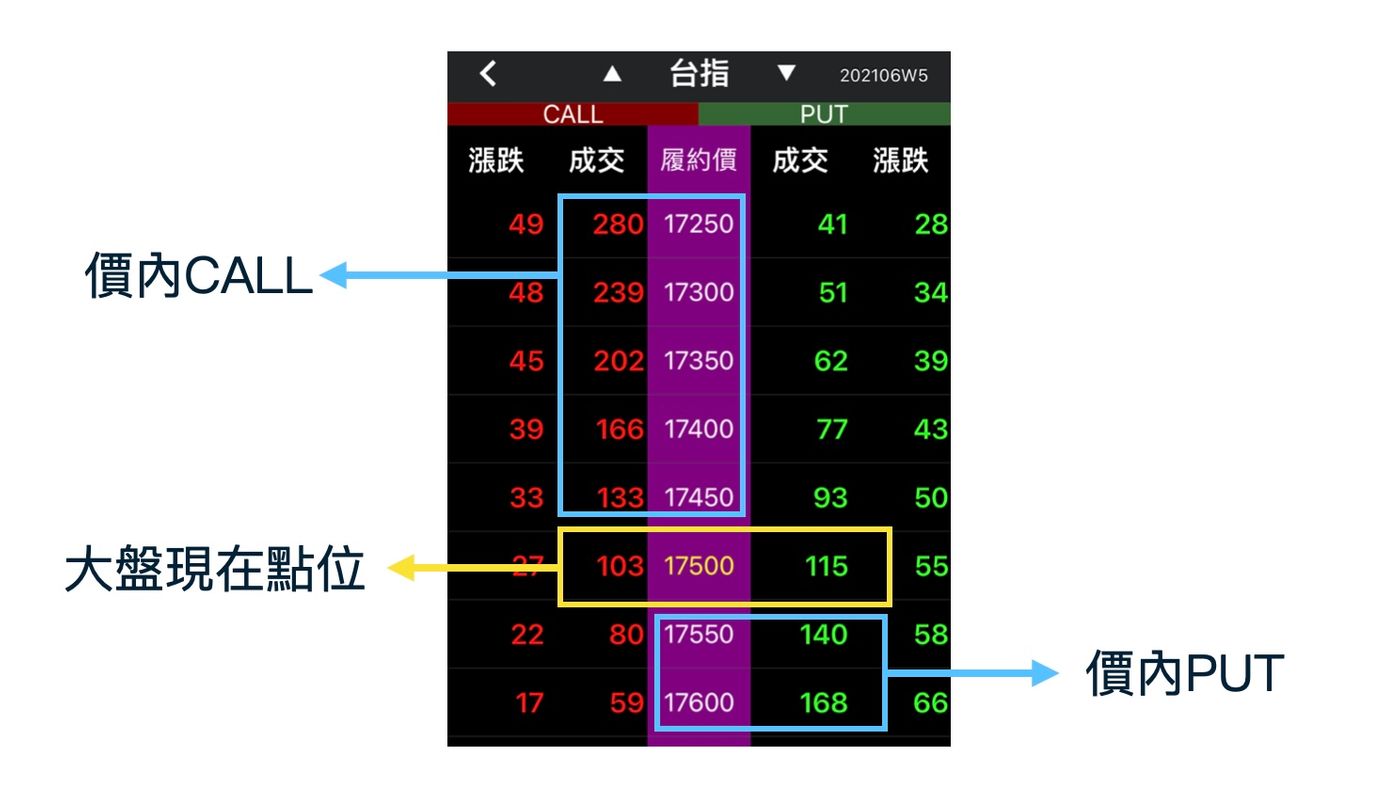

In the Money

For a call option, the option with the strike price lower than the current market point is an in-the-money call; for a put PUT, the option with a strike price higher than the current market point is an in-the-money PUT.

At the Money

The strike price that the stock count falls on, the strike price is the price level; use 24 or 26 to distinguish. For example: if the stock price is 17424, then 17400 is the price level; if the stock price is 17426, then 17450 is the price level. However, this matter is not important or used in transactions, just know it.

Out of the Money

Either in-price or price-parity options or out-of-price, think for yourself...

Just kidding, for a call option, the option with the strike price higher than the current stock price is an out-of-the-money call; for a put option, the option with the strike price lower than the stock price is an out-of-the-money PUT. Example:

- Strike price 16400Call : Buying Call is bullish. 16400Call believes that the market will rise to 16400. Now the market is at 16200. It can be imagined that 16400 is "outside" waiting for the market to meet, so what hasn't risen is "out-of-price CALL" ".

- Strike price 16400Put : Buying Put is bearish, 16400Put believes that the market will fall below 16400, and the market is now below 16400 at 16200, which has fallen below the Put strike price, so this 16400Put is "in-price Put".

Intrinsic Value

Only in-price options have intrinsic value, which is calculated as the difference between the general inventory level and the option exercise price. For example, a CALL with a stock price of 17500 and a strike price of 17300 is an in-the-money CALL, and the embedded value is equal to 17500-17300=200. The embedded value of an out-of-the-money option is 0.

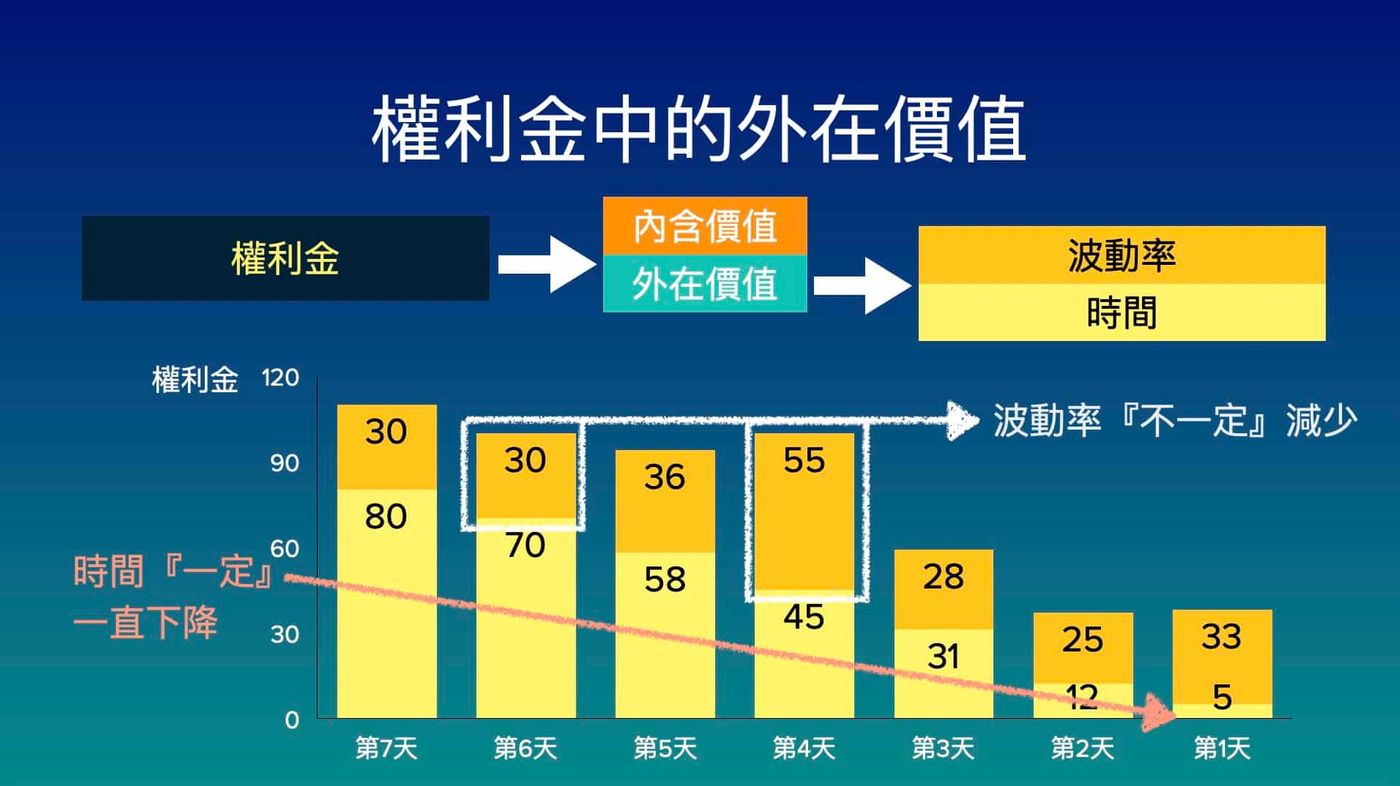

Extrinsic Value

Each bite option has extrinsic value until settlement. The extrinsic value includes " time value " and " volatility value ".

The external value is the part that the buyer and the seller do. The farther away from the settlement date, the higher the external value will be, which means that the buyer and the seller still have time to win or lose; and as the settlement date approaches, the result will be revealed soon, and you will know who wins and who loses. , the external value will be lower and lower.

A sip of the option premium minus the built-in value is its extrinsic value.

Time Value

The closer the time value is to the settlement date, the lower the time value will be. The time value is calculated by the pricing formula and cannot be directly observed.

The point is that the time value of 1 second under the option must be lower than the current time value, and the time value of the buyer who buys the option will continue to pass from the first second, which is an invisible loss but many people ignore it.

On the other hand, the seller sells the option and starts to earn time value from the first second.

Listen to the fog sasa? I made a 50-second video description. Through sound and animation, it can help you understand the concepts of in-price and out- of-the-money, embedded value and extrinsic value more quickly:

If you want to learn more details, you can refer to the option exercise price, in-price, out-of-price, embedded value, and external value

European Options

Taiwan is using the European option.

Opening

The trading time of Taiwan option is 8:45-13:45 on business days. The opening time is 15 minutes earlier than the Taipei stock market, and the closing time is 15 minutes slower than the stock market. The morning trading time is 5 hours in total.

morning, night

The option can be traded in the morning and evening, with a 1 hour and 15 minute break in between. The morning trading time is 8:45-13:45, the afternoon is from 15:00 to 05:00 am the next day, and the afternoon trading is the night trading.

The two trading modes are the same. The benefits of opening the night trading market are: If the foreign market fluctuates violently, we can directly close positions and avoid risks in the night trading.

Weekly, Monthly

Option contracts are divided into "week option" and "month option" . Weekly options are billed weekly, and monthly options are billed monthly. The new contract of Taiwan stock weekly option is open for trading at 8:45 every Wednesday, and will be settled at 13:25 every other Wednesday, and new and old contracts will be available for trading on Wednesday.

"Monthly Option" contracts are settled on the third Wednesday of the month. Brokers will use W1 for the weekly selection contract in the first week, and W2 in the second week, but there is no W3. Because the third week is the monthly selection contract settlement, of course, there is no W3.

Settlement (Expiration)

The option is settled on the settlement day, all extrinsic values are reset to 0, and embedded values are settled. See who wins, who loses, who loses, and who laughs at the buyer and seller. The weekly contract is settled every Wednesday at 13:25.

Option Seller (Writer/Seller)

The seller of the option transaction, sells the option and receives the premium from the buyer. When the seller in Taiwan is commonly known as the dealer, the rent collector.

Regarding the seller's profit-making methods and risks, you can refer to this article explaining the three profit-making conditions of option sellers, taking selling PUT as an example .

Market Maker

Proprietors in Taiwan are market makers. If you want to buy options, they must sell them to you. When you want to sell options, they must buy them, which is to satisfy the role of market operation. For the characteristics of proprietors, market-making methods, and hedging methods, you can refer to this chip teaching article (from the hedging actions of proprietors in market-making, it can be inferred that they are bullish or bearish!) "2021 Option Chip Analysis" Starting from the trading motive, read the market trend!

Multiple IOCs

Multiple IOC is a must-use function for trading options. It is a super easy-to-use function, but there are not many brokers that provide this function. IOC (Immediate or Cancel) stands for immediate transaction or cancellation, and many times IOC is to use the price you set to find a way to complete the transaction, which is to wash the order !

For example, I set 13.5 points to sell PUT, hang IOC many times, as long as the price arrives, I will place an order to sell, if it fails, I will do it again, again, again...until the transaction or close.

I once put up a sale, and it took more than 300 IOC attempts before the transaction was completed. Practical hands-on teaching:

close the position

To clear the existing position, there are 2 ways to close the position:

- write off. Buying options can be offset by selling; selling options can be offset by buying back.

- Leave it to settlement. Leave it until settlement (Wednesday 13:25), the system will automatically reverse, and the profit will automatically enter the margin account.

Option open positions

A buy option or a sell option is an open position. In general discussion, say: "How does your body grow? ' usually refers to open positions.

Volatility

Volatility cannot be directly observed, and market sentiment is usually judged by observing the "Volatility Index". Through the option volatility index, you can feel the market's views on the volatility of the broader market in the next 30 days, as a reference for trading and hedging operation strategies.

Generally speaking, when the volatility index is higher, it shows that people expect the volatility of the broader market in the next 30 days to be more intense; on the contrary, when the volatility index decreases, it shows that everyone expects that the changes in the broader market will tend to be moderate. For the calculation method of the volatility index, please refer to the instructions of the Futures Exchange .

* Note : An increase in volatility means that it is relatively bullish or relatively bearish, not necessarily a decrease. Many people have misunderstood this matter.

Option Delta

The change in the strike price option price when the general inventory points change by 1 point. For example, the strike price of 17200 CALL delta=0.3, the market rose 1 point, and the 17200 Call premium rose 0.3 points.

Delta has another super useful feature that tells us what the odds are of a bite being in the money, or in other words, what our winrate is. You can refer to "Learn 1 move in 50 seconds with the option" option to open a position with a high winning rate, and Delta clearly writes the seller's winning rate .

Option Gamma

It is used to measure the sensitivity of Delta, that is, when the price of the underlying object changes, the magnitude of the change in Delta value.

Option Theta

Theta is used to measure the rate at which the time value of options is lost. For example, 16900 PUT theta= -20, which means that tomorrow (one day closer to the expiration date) the premium of 16900 PUT will be reduced by 20 points.

The original text was published on the official website "Dictionary of Choice" to explain the top 20 terms you will definitely use (with video description)

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More