ETF Getting Started 3 Key Points: What is an ETF? type? Advantages and disadvantages?

The original text was published on the website of "Bibei Thinking": 3 Key Points for Getting Started with ETFs: What is an ETF? type? Advantages and disadvantages?

How to get started with ETFs? Novice investors often ask this question because ETF has always been a hot topic in the stock market; the reason is that it is highly stable, simple to understand and easy to use, which makes many newbies who don’t know how to “watch the K line” or “select stocks”. Xiaobai has the opportunity to make money in the stock market. In addition, for petty bourgeoisie who have just entered the society and have little funds, they can also easily start with the amount they can afford, and do a good job in the allocation of investment and financial management. Therefore, this article will take you to understand the 3 key points of ETF entry, and help you take root in a solid basic concept!

Getting Started Key Point 1: What is an ETF?

The first point of the ETF entry guide will explain to you what an ETF is? What are the reasons for the popularity? Finally, I will explain the difference between ETFs, mutual funds, and stocks! The details are as follows:

Introduction to ETFs

The full name of ETF is "Exchange Traded Funds", which means index stock funds in Chinese, or exchange-traded funds; its operation mode is exactly the same as that of stocks, but the transaction tax is cheaper (less than one-third of stocks). ).

The key feature of ETFs is that they can buy a "basket" of investment targets to achieve the purpose of diversifying investments; take Taiwan's well-known ETF " Yuanta Taiwan 50 (0050) " as an example, it is to help you buy the top 50 tranches in Taiwan Stocks, including: TSMC, Chunghwa Electric, Hon Hai, MediaTek, CITIC Gold, Fubon Gold, etc., the 50 listed companies with the highest market capitalization in Taiwan.

Why are ETFs popular?

There are three main reasons for the popularity of ETFs:

- Diverse types of ETFs: ETFs cover a very wide range, including global stock markets, bond markets and various industries; their diverse types can diversify risks, which is one of the key reasons why ETFs are popular!

- The first choice for lazy people to invest: Investors can start investing as long as they select potential industry trends; easily save a lot of time and energy in in-depth research on a single stock.

- Start with 1,000 yuan per month: you read that right! ETFs can start investing at a minimum of 1,000 yuan per month, so they are the first choice for many petty bourgeois and students. Currently, many banks provide small capital purchases, such as: Fubon, Cathay Pacific, Yushan, Yuanta, etc.

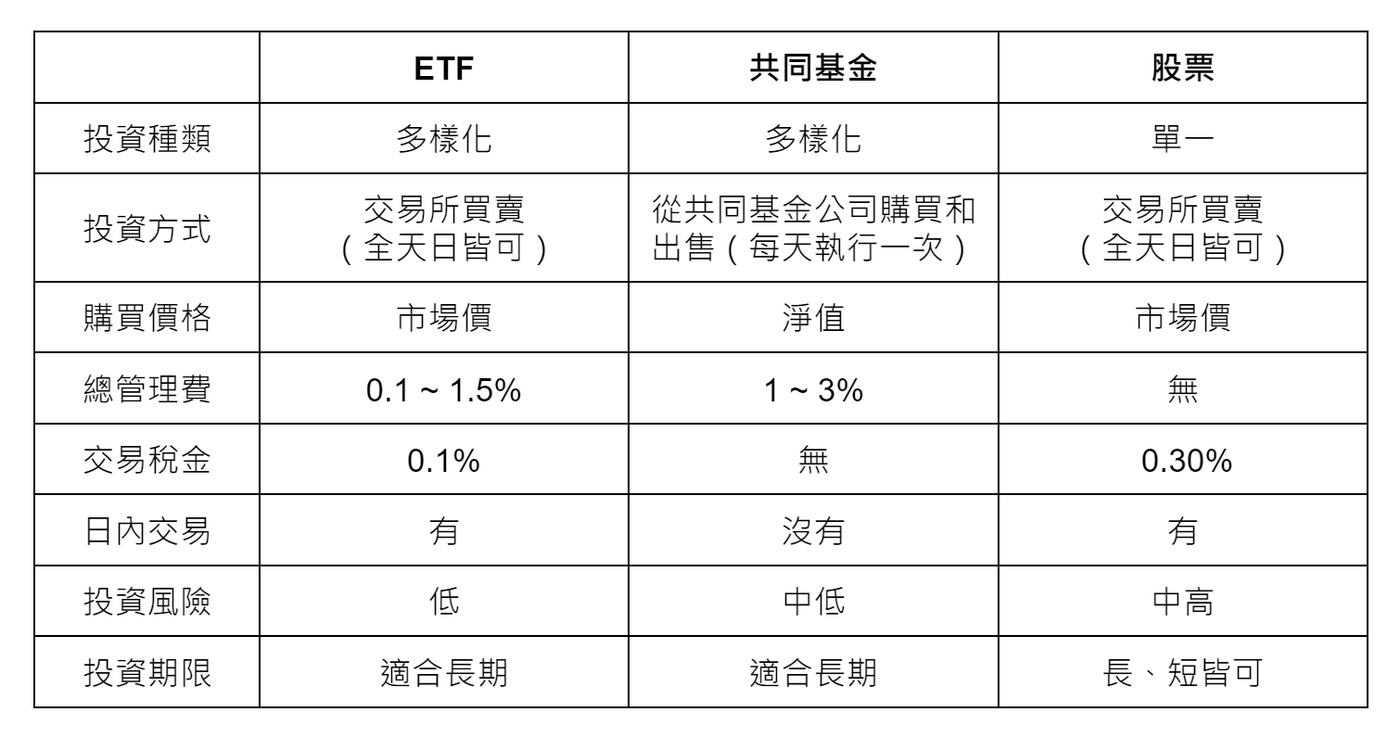

Differences between ETFs and mutual funds and stocks

Many novice investors confuse ETFs with mutual funds, stocks, or do not know the difference? Therefore, I have compiled a chart of the difference between ETFs, mutual funds, and stocks to help you quickly understand:

Extended reading: [Stock Novice Series] 3 stock knowledge that must be read for beginners, and can be understood even with zero foundation!

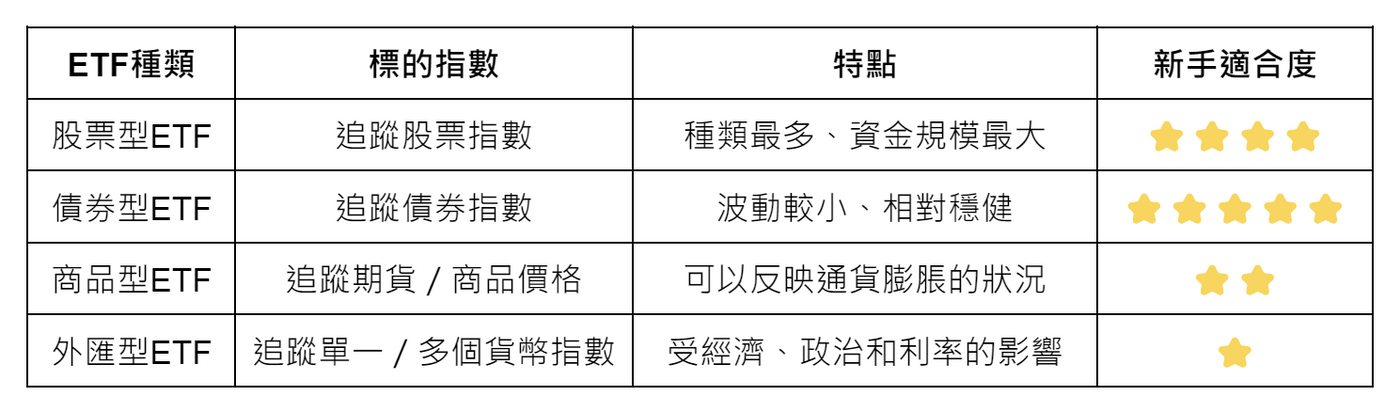

Getting Started Key Point 2: Introduction to ETF Types

The second key point of getting started with ETFs is to understand what types of ETFs are there? The following will introduce four common types of ETFs: stock ETFs, bond ETFs, commodity ETFs, and foreign exchange ETFs.

Equity ETF

A stock ETF is an ETF that tracks a "stock index"; it has the largest variety and largest capital scale among all ETFs. Among them, it is further subdivided into the following three ETFs:

- Market capitalization ETFs: Market capitalization ETFs are classified according to the "size of market capitalization". The "Yuanta Taiwan 50 (0050)" we mentioned earlier is a market capitalization ETF because it buys "the 50 companies with the highest market capitalization in Taiwan."

- National ETFs: Generally, the United States is used as the dividing line, and it is divided into US ETFs and ETFs outside the United States (or international market ETFs).

- Industry-based ETFs: ETFs that diversify risks in a single specific industry, such as: finance, medical care, technology, etc.

Stock ETF recommendation : Yuanta Taiwan 50 (0050) , Yuanta Taiwan High Dividend Fund (0056)

Bond ETFs

A bond ETF is an ETF that tracks a "bond index"; it is a relatively stable investment project among all ETF types and is maintained for a certain duration . Common classifications are: public bonds, corporate bonds, developed market bonds, emerging market bonds, investment grade bond ETFs, etc., high-yield bond ETFs, etc.

Bond ETF recommendation: Yuanta US Bond 20-year ETF (00679B) , Qunyi AAA-AA Corporate Bond (00754B)

Commodity-based ETFs (also known as futures-based ETFs)

Commodity ETF is an ETF that tracks "futures/commodity prices". It is the item that most immediately reflects inflation among all ETFs. Common classifications are: precious metals (gold, silver, etc.), energy (crude oil, natural gas, etc.), agricultural products (corn, wheat, etc.).

Commodity ETF recommendation: Yuan Oil ETF (00642U) , Yuanta S&P Gold (00635U)

Foreign exchange ETF (or currency ETF)

A foreign exchange ETF is an ETF that tracks a "single/multiple currency index". It mainly allows investors to hedge against currency price fluctuations; however, because there are multiple alternatives to foreign exchange ETFs, fewer people invest. Common categories are: USD, EUR, GBP, JPY prices, etc.

Foreign exchange ETF recommendation: Yuanta USD Index (00682U)

Getting Started Point 3: ETF Advantages and Disadvantages

The third key to getting started with ETFs is to understand the advantages and disadvantages of ETFs. Because before you start investing in any project, you can make the best investment judgment and capital allocation by knowing the advantages and disadvantages; therefore, the following will introduce the advantages and disadvantages of 3 ETFs with you, let's take a look!

ETF advantages

- Easy to trade: Same as stocks, it can be traded through brokers (exchanges); and it can be done all day.

- Low management fee: Compared with the active fund management fee of 1-3%, the management fee of ETF is mostly lower than 1%.

- Diversification of risks: Compared to buying only a single stock, ETFs cover a basket of underlying targets, avoiding the risk of a single stock rising and falling, and increasing investment stability.

ETF Disadvantages

- Not suitable for short-term transactions: It is not conducive to short-term operations, and the intensive transaction process will lead to high transaction costs.

- There is a problem of discount and premium: The price of ETF will fluctuate with the stock market, not based on the actual value (net value) of the ETF. Therefore, you need to understand the discount and premium before starting to determine whether the current ETF price is reasonable. .

- There is an internal deduction fee (or hidden fee): During the period of holding the ETF, an internal deduction fee will be paid, and the internal deduction fee may be high or low. It is recommended that newbies pay special attention to this part of the fee before purchasing an ETF.

The first step of novice investment: understand your needs and suitable investment methods

Now that you have learned the basic concepts of ETF entry, let's conduct more in-depth research on the types of ETFs you are interested in! If there is still no direction, it is recommended to start with a stock ETF that tracks the U.S. large market index, or a U.S. government bond medium and long-term bond ETF; because the U.S. stock market and bond market are the largest markets in the world, and the information flow is also relatively transparent. It will be easier for beginners to start, and it is not easy to step on thunder.

Finally, I would like to remind readers:

The first step in investing and financial management is to know and understand yourself well; because there is no absolute good or bad in investing, only by clarifying your own needs and personality can you find the most suitable investment method for you. If the article is helpful to you, please share it with those in need. If you have any questions, please leave a message below and I will definitely reply to you : ))

Further reading:

- What are futures? Super vernacular detailed explanation, it is enough for beginners to read this!

- [Stock Beginners Series] 3 must-see stock knowledge for beginners, even with zero basic knowledge!

- [How to become rich] 5 mentalities that prevent you from becoming rich | Get rich, start now!

- "The Road to Wealth and Freedom" Reading Notes | Teach you to become more valuable, no longer need to sell your time for money!

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More