[US Stock Investment ~ Offshore Account] Exchange USD and Firstrade Deposit Process

The original text was simultaneously published on my blog " Uncle Savings Guide " , which is a blog with the theme of saving money and preferential information. Welcome to visit when you have time. ლ(´Д`ლ)

The last time I introduced how to open an account with Firstrade , this time I will introduce how to transfer money into the Firstrade account. Since the Firstrade account is in the United States, we must first buy USD before we can transfer USD to the Firstrade account. But there are two things to pay attention to before sending money, that is, the exchange rate and the handling fee. The following will explain to you immediately!

Buy dollar exchange rate

We usually buy U.S. dollars at banks, but each bank has different exchange rates for U.S. dollars. If you want to exchange large amounts of U.S. dollars, the exchange rate may have a big impact, so be careful to compare the bank's exchange rate before exchanging. exchange rate. But if you are a big account, I suggest you open an IB (Interactive Brokers, Interactive Brokers) account, because this securities company also has branches in Hong Kong and the United States, you can buy US dollars directly with Hong Kong dollars and transfer to the Firstrade account, and the exchange rate is better than that of banks in Hong Kong . For example, if you compare the exchange rate of Hong Kong dollars to US dollars between IB and HSBC, for every 10,000 US dollars, HSBC is about HK$300 more expensive than IB. However, IB also has a disadvantage, that is, its minimum account balance must be US$100,000 (about HK$780,000), otherwise it will charge US$10 management fee every month, so this method is not suitable for petty bourgeoisie.

In the following, I will use HSBC as an example. First, because its personal wealth management account already contains a variety of foreign currency accounts, you can directly buy US dollars through online banking, and second, because its US dollar exchange rate is also better than other banks. Also, please note that if a single purchase is less than US$25,000, the exchange rate will be poor, and if a single purchase is US$25,000 or more, the exchange rate will be better.

remittance fee

The traditional method is to queue up in person at a bank branch, buy US dollars and then fill in the wire transfer form to remit, but this is not only a waste of time, but also the remittance fee is relatively expensive, ranging from HK$120 to HK$240, unless you have a million deposit The valued wealth management users of , remittance can be free of charge. In addition, Citibank 's newly opened Citi Plus digital wealth management service also requires no handling fee for remittance, and there is no minimum account balance requirement. Interested friends can study it. The most convenient way is to use online banking to remit money. I use HSBC online banking , which is very convenient and the handling fee is only HK$50 per transaction (but friends from Taiwan seem to have to go to the bank for remittances to the United States. Please correct). In addition to the bank charging you a handling fee when you remit, the overseas receiving bank will also charge you a fee of US$25 per transaction. This US$25 will be deducted directly from the US dollar you remit to the United States, so don't wonder why the money After arriving in your Firstrade account, you will lose US$25. Below, I use HSBC HSBC Internet Banking to transfer money to my Firstrade account as an example. The total remittance fee is HK$50 + US$25.

Buying USD from HSBC

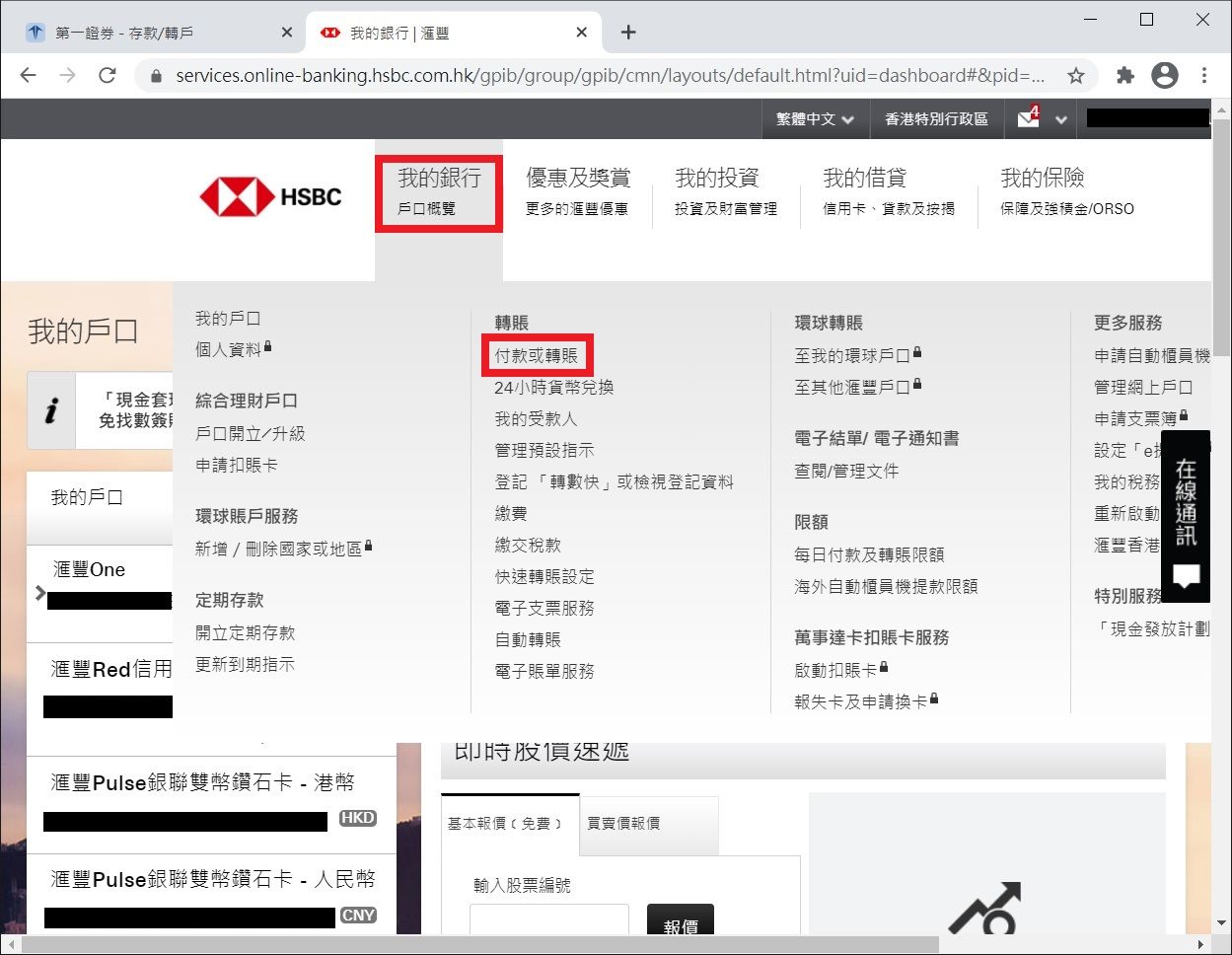

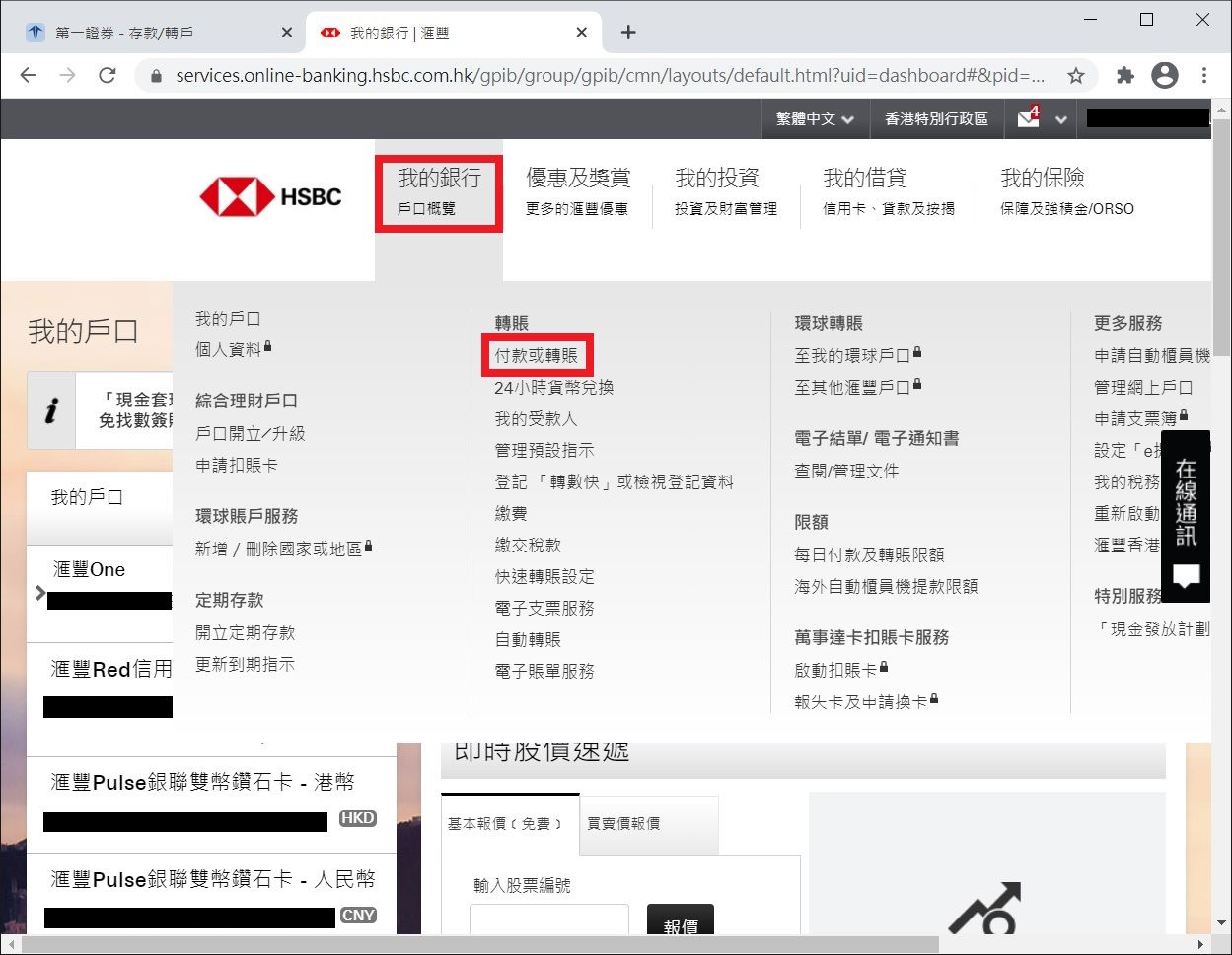

Step 1 <br class="smart">Log in to your HSBC Internet Banking account and click "My Bank" > "Pay or Transfer".

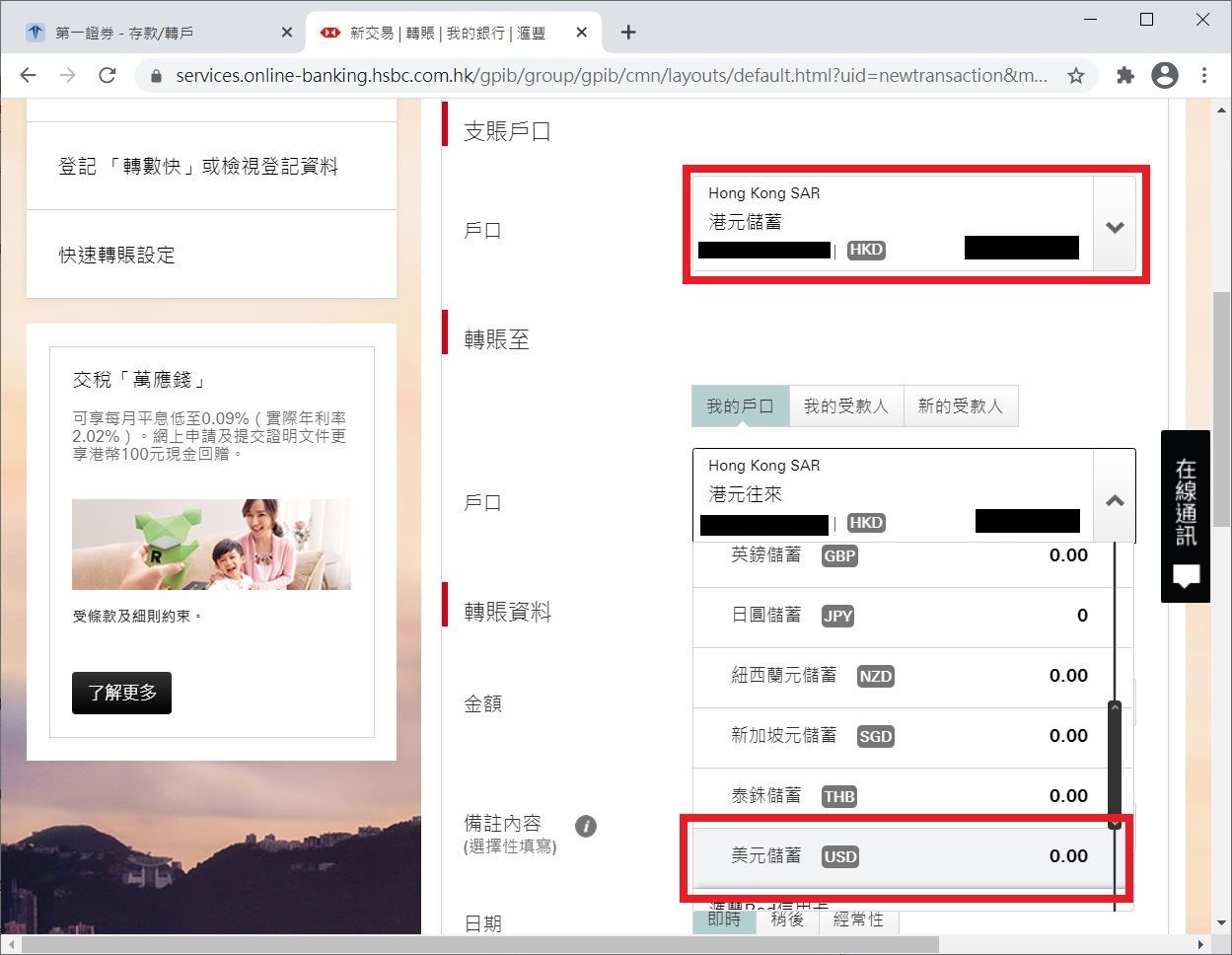

Step 2 "Debit Account" select your HKD account, and "Transfer to" select your USD savings account.

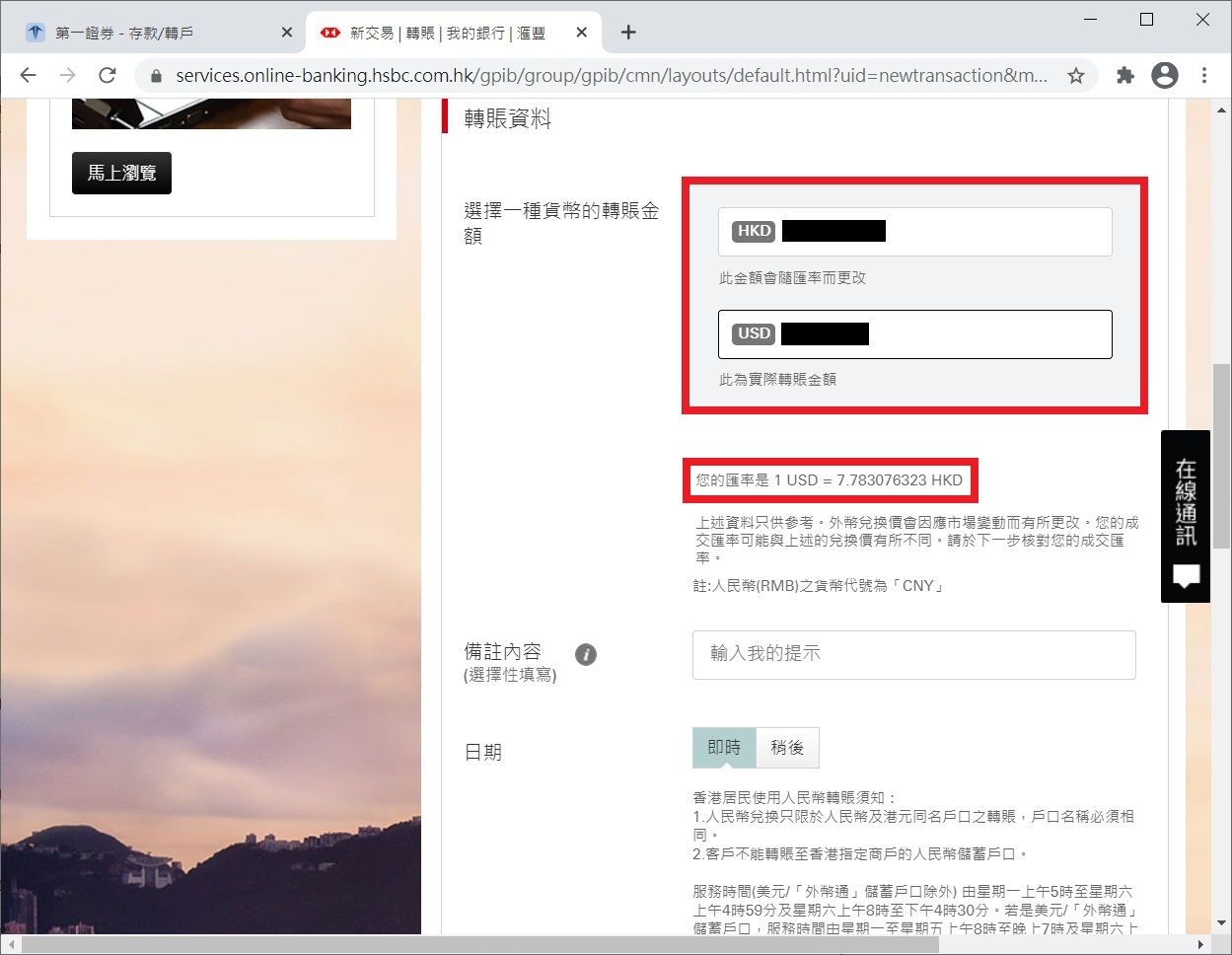

Step 3 <br class="smart">In "Select a Currency Transfer Amount", enter the amount in Hong Kong dollars, and the relative dollar amount will be automatically displayed below. You can also do the reverse operation and enter the amount of dollars you need to exchange. The above will show the amount of Hong Kong dollars you need to pay. The exchange rate will be displayed below, please note that if you exchange less than US$25,000, the exchange rate will be higher, so pay attention to this. Then click "Continue".

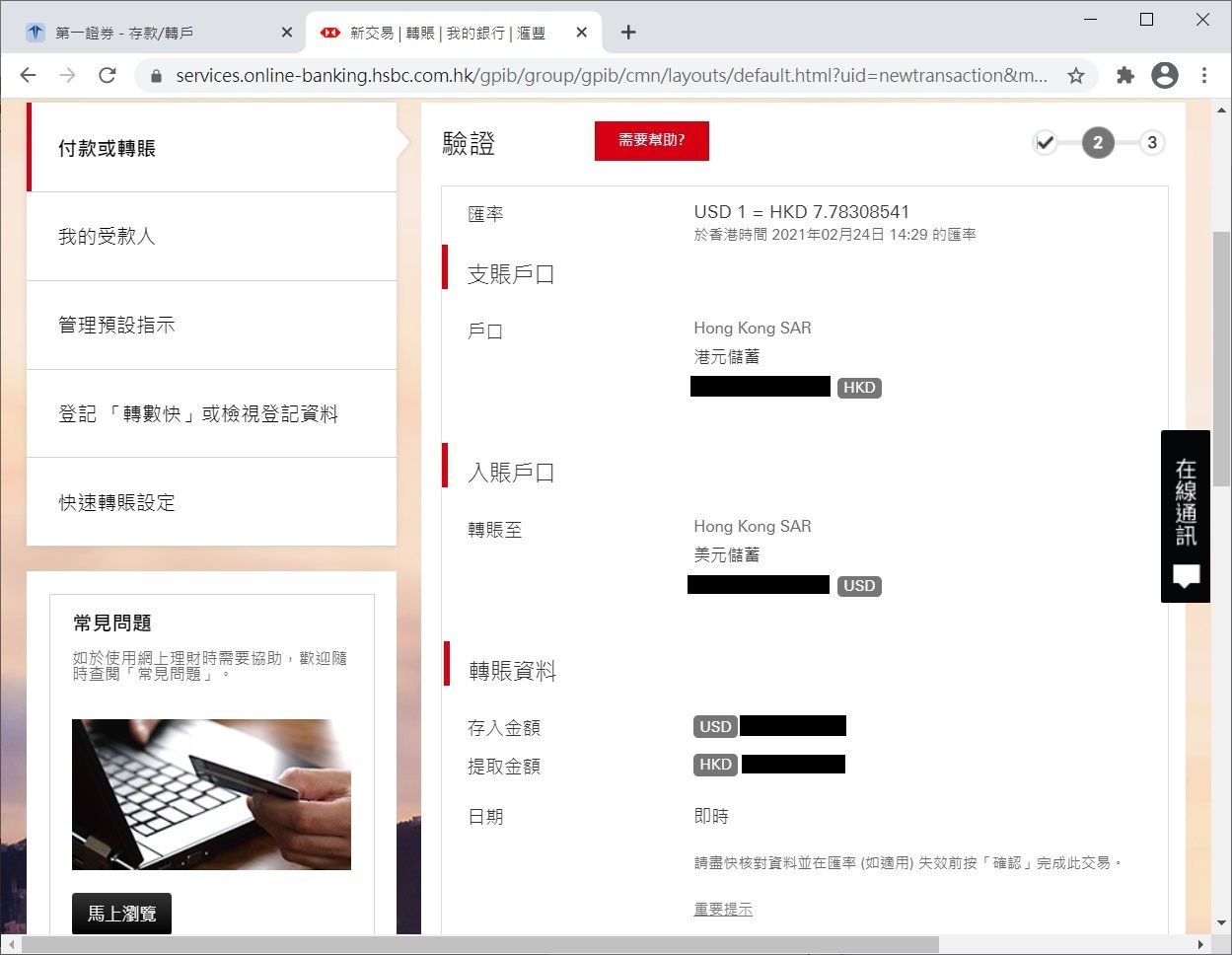

Step 4 <br class="smart">Check the exchange information once, and click "Confirm" after confirmation.

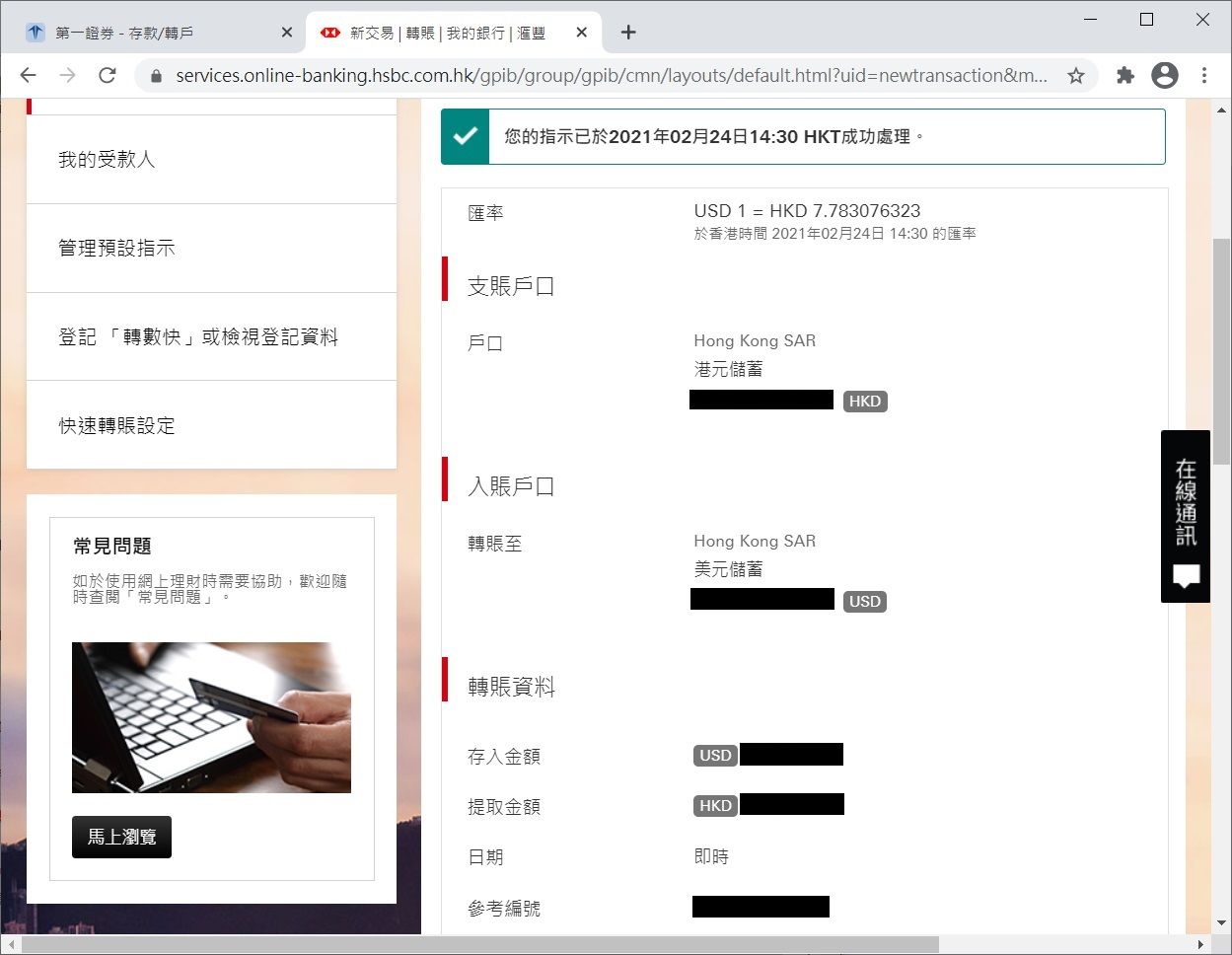

Step 5 <br class="smart">When you see the following screen, it means that you have successfully transferred and the USD has been deposited into your USD savings account.

Transfer USD to Firstrade account

When you already have USD in your account, you can transfer USD to your Firstrade account. It should be noted that if you transfer a large amount of USD for the first time, your daily transfer limit may be limited and you cannot transfer USD. To avoid transfer failure, it is recommended that you increase the daily transfer limit first. After logging in to Internet Banking, you can select "My Bank" > "Daily Payment and Transfer Limit" to increase the maximum daily limit for transfers to non-registered accounts to the HKD equivalent of the USD amount you want to transfer , and then do the following operations.

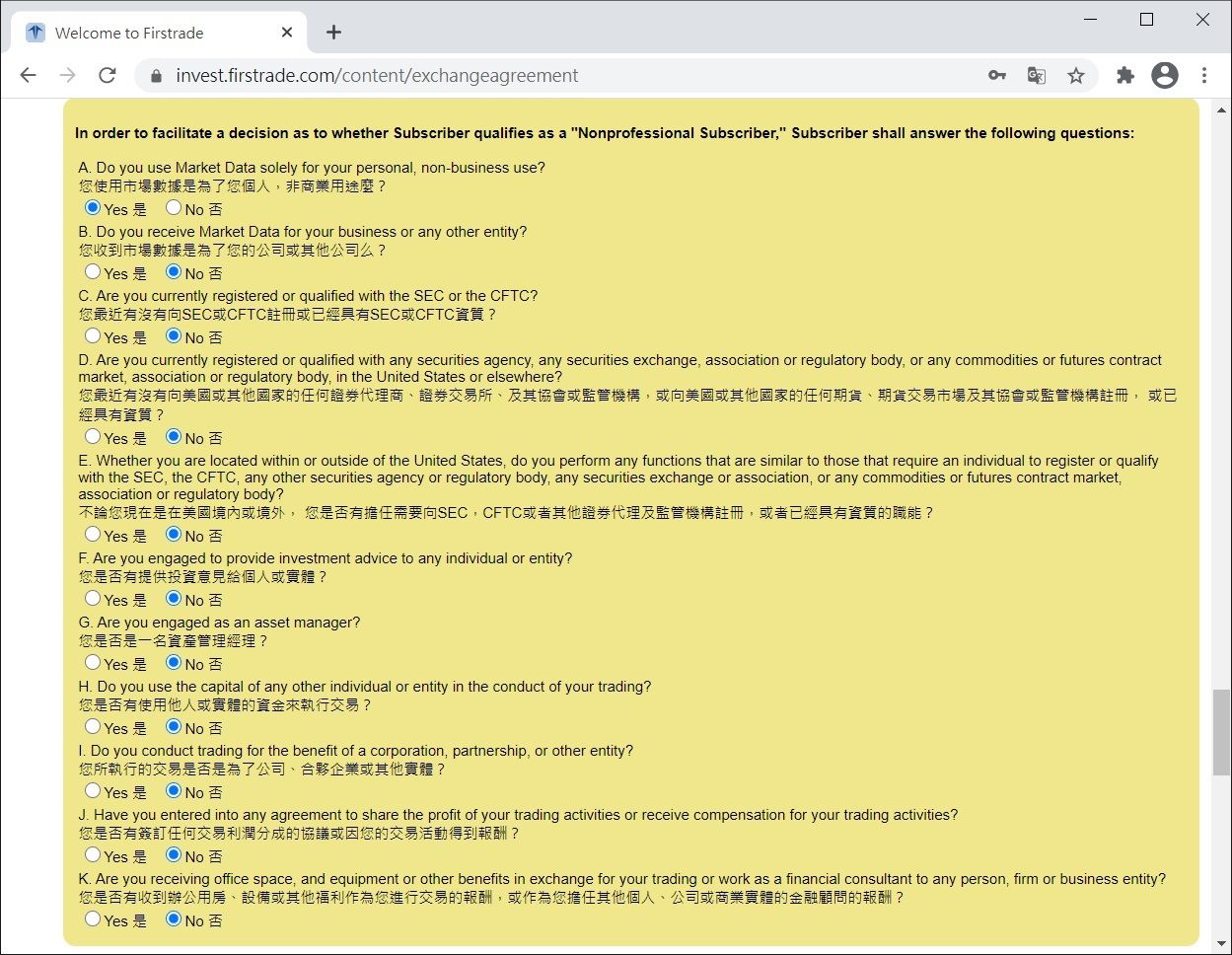

Step 1 <br class="smart">If you log in to your Firstrade account for the first time after registration, you will see the following screen, as long as you select Yes for the first item, and No for all others.

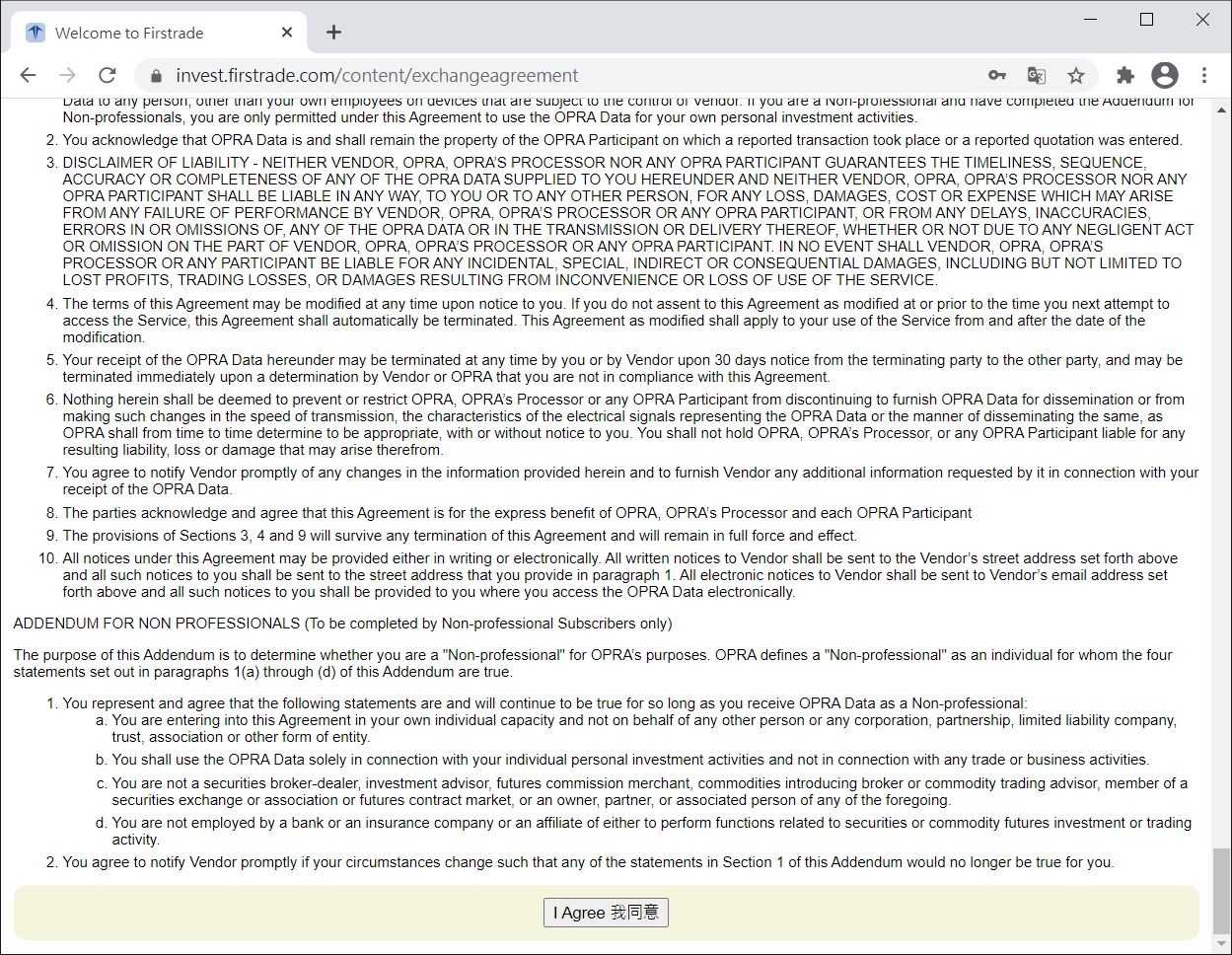

Step 2 <br class="smart">Click "I Agree".

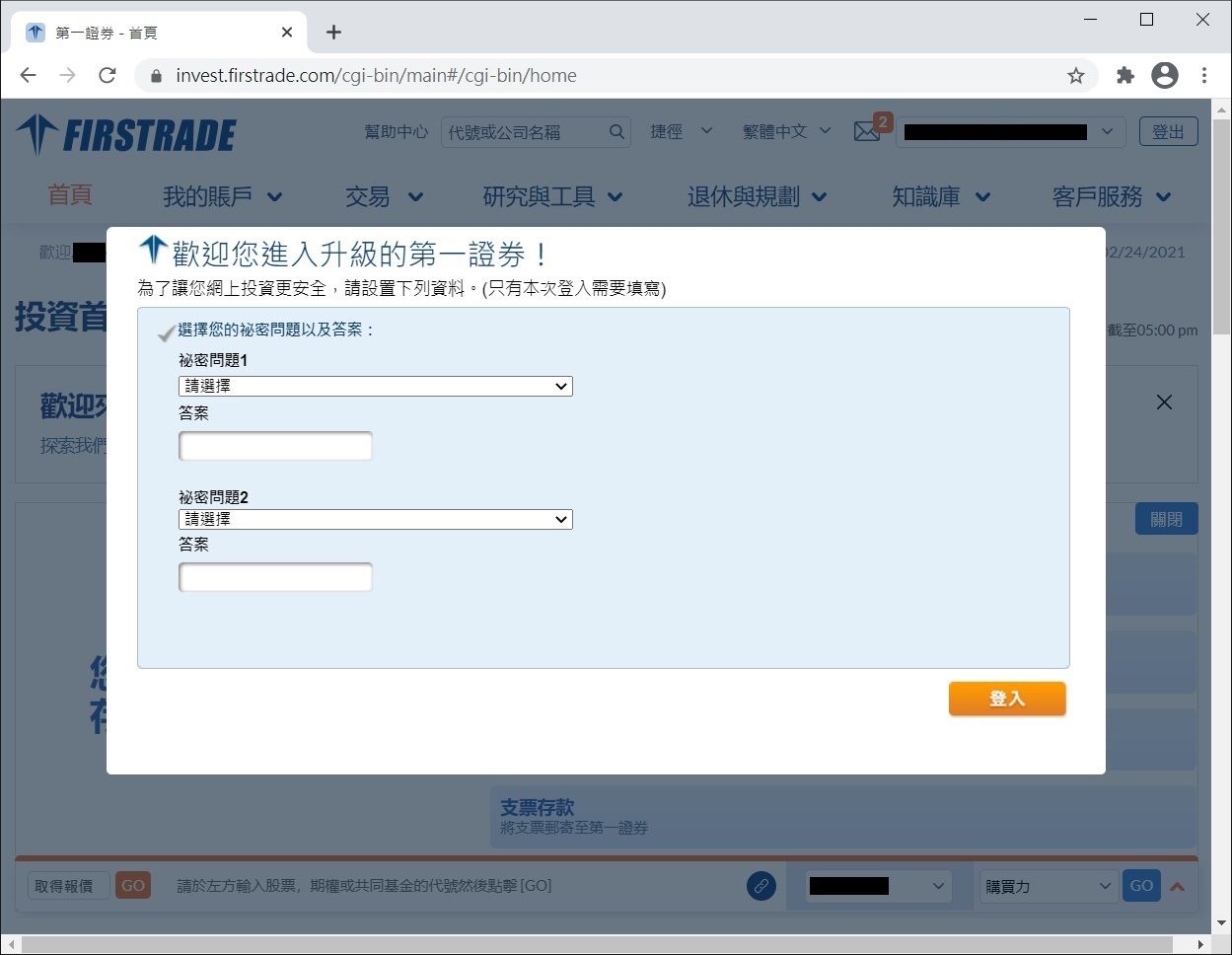

Step 3 <br class="smart">Set up your secret question and answer, this is used to recover your account if you forget your account number in the future, so choose carefully and put your answer keep it carefully.

Step 4 <br class="smart">Click "Enter New Platform".

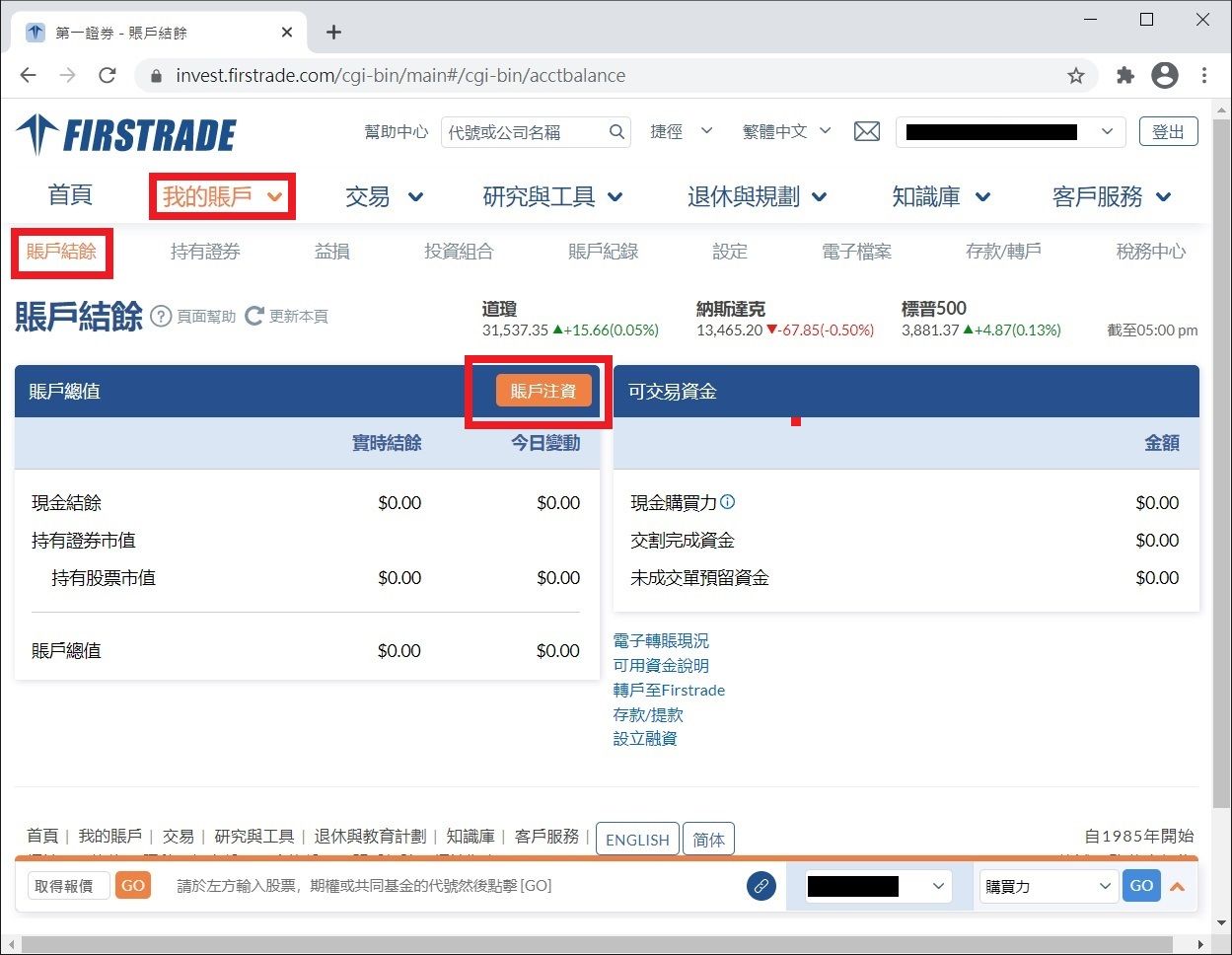

Step 5 <br class="smart">Click "My Account" > "Account Balance" > "Account Funding".

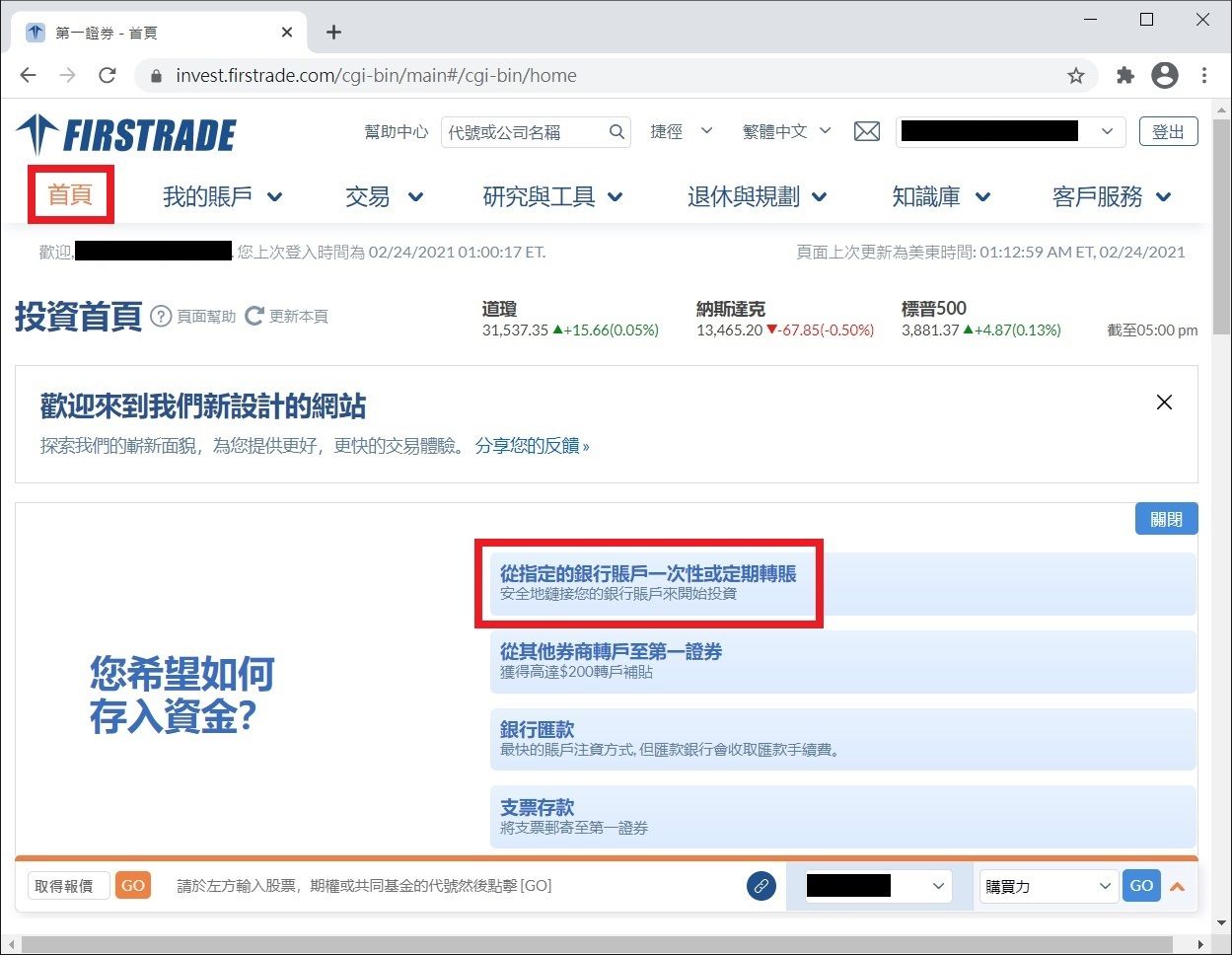

Or you can also click "Home" > "One-time or recurring transfer from a designated bank account".

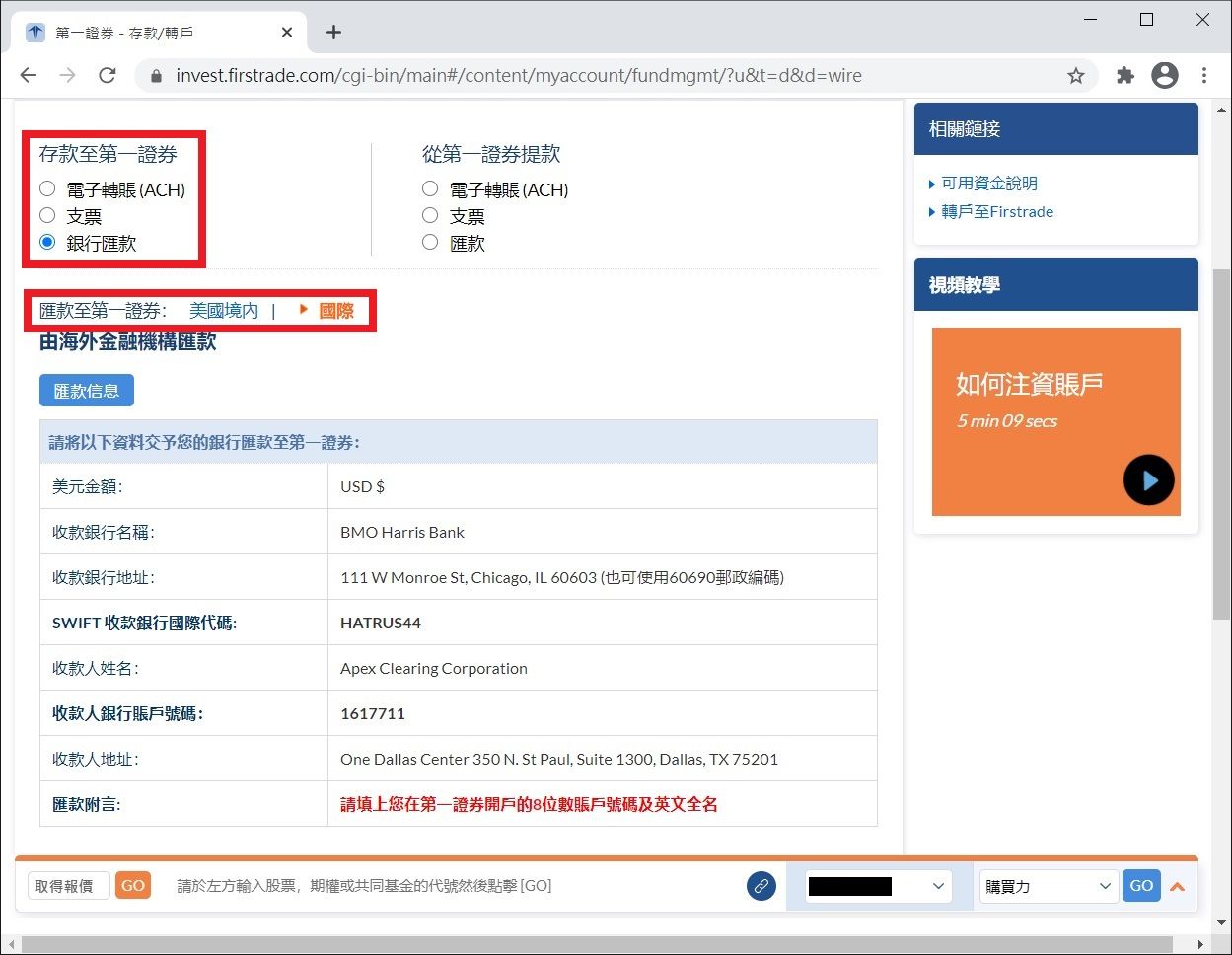

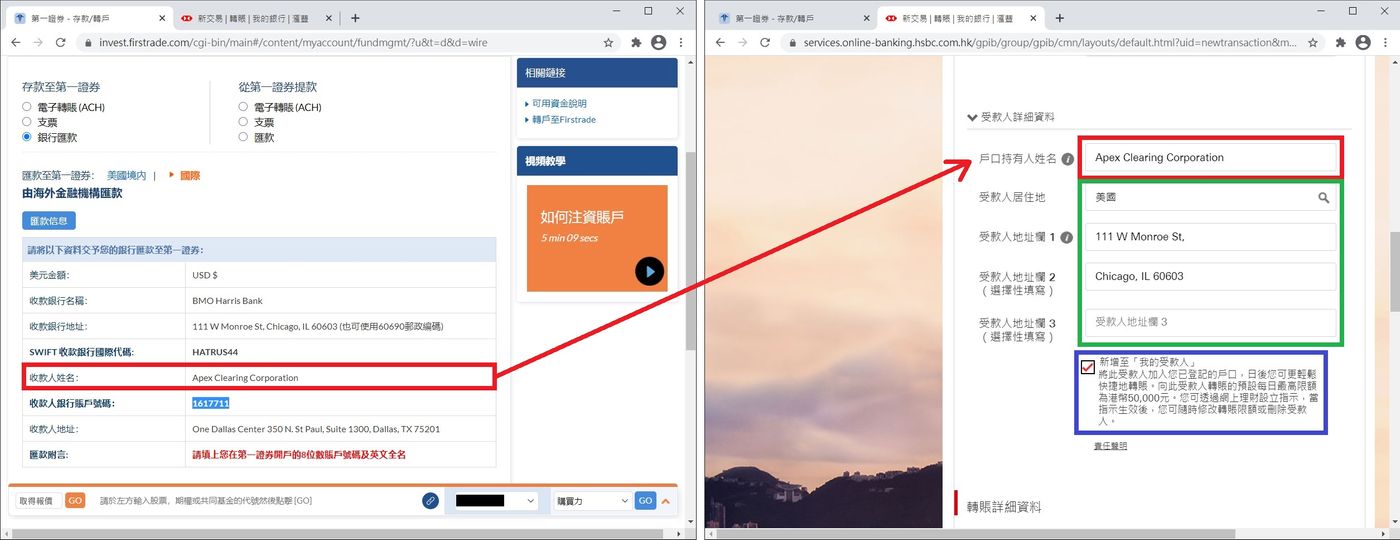

Step 6 "Deposit to Firstrade" select "Bank Transfer", "Remittance to Firstrade" select "International", you will see the following remittance message.

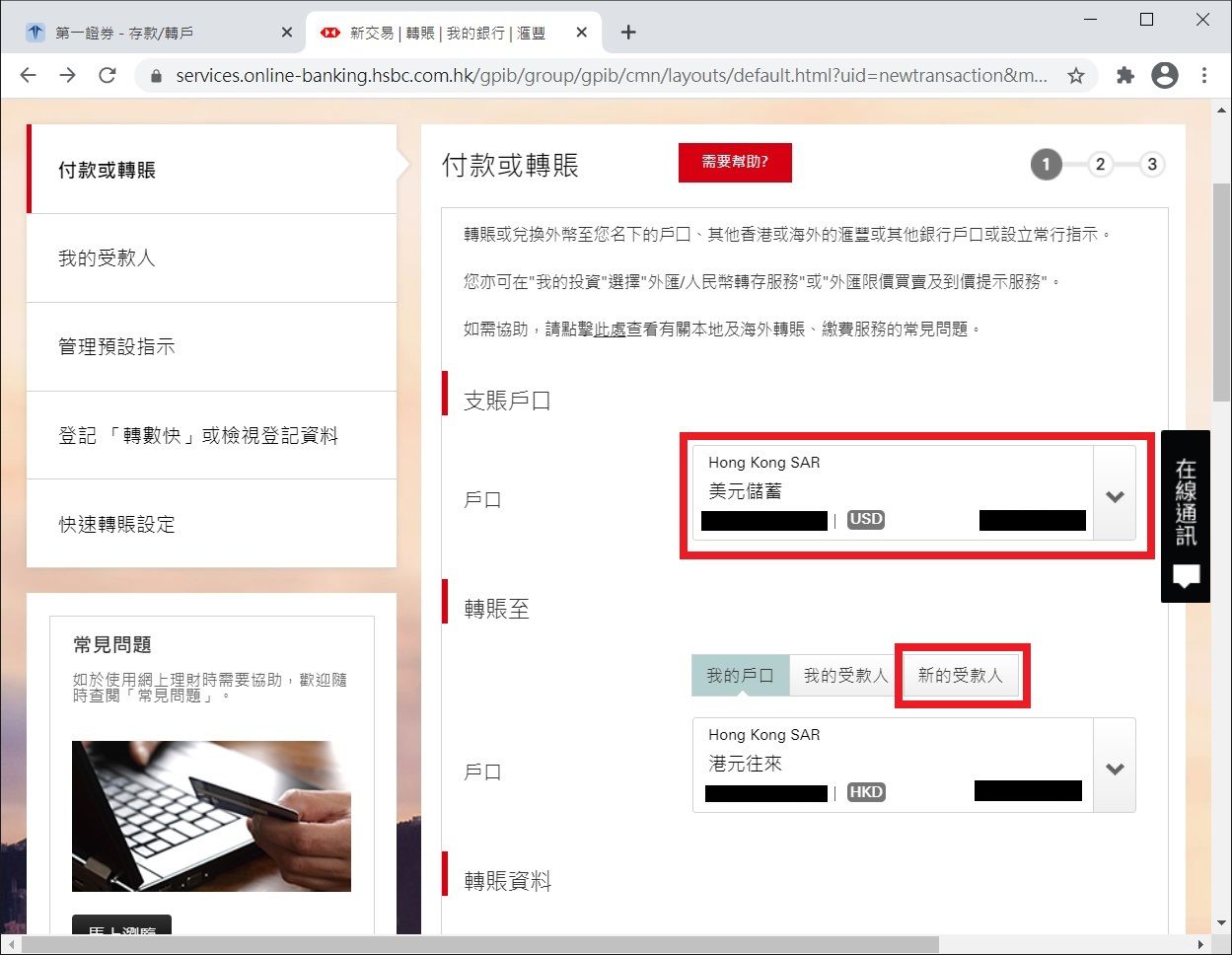

Step 7 <br class="smart">Log in to your HSBC Internet Banking account and click "My Bank" > "Pay or Transfer".

Step 8 "Debit Account" select your Hong Kong dollar savings account, and "Transfer to" select a new beneficiary.

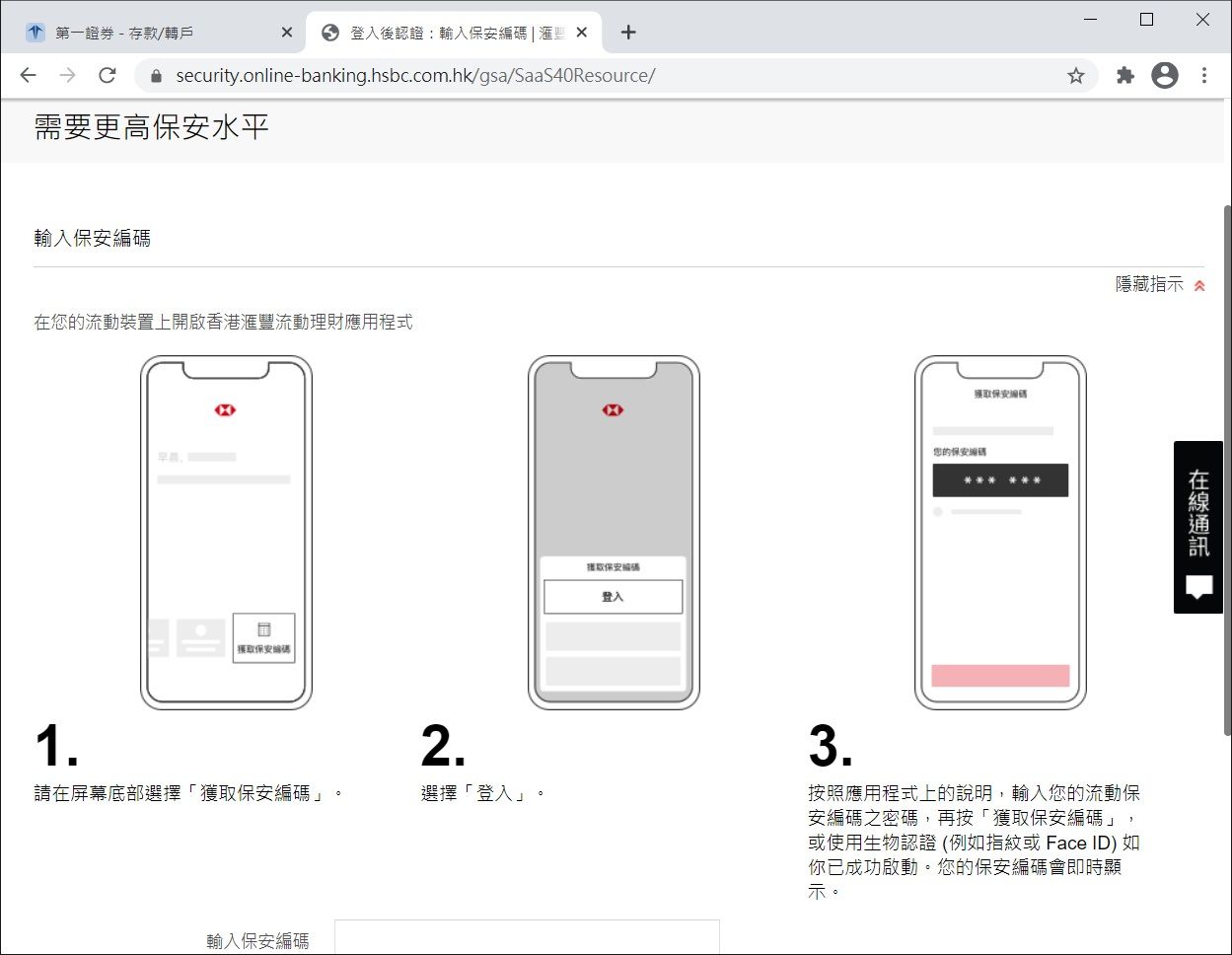

Step 9 <br class="smart">At this point, the website will ask you to enter your security code, open the HSBC Hong Kong mobile banking app on your mobile phone, and follow the instructions.

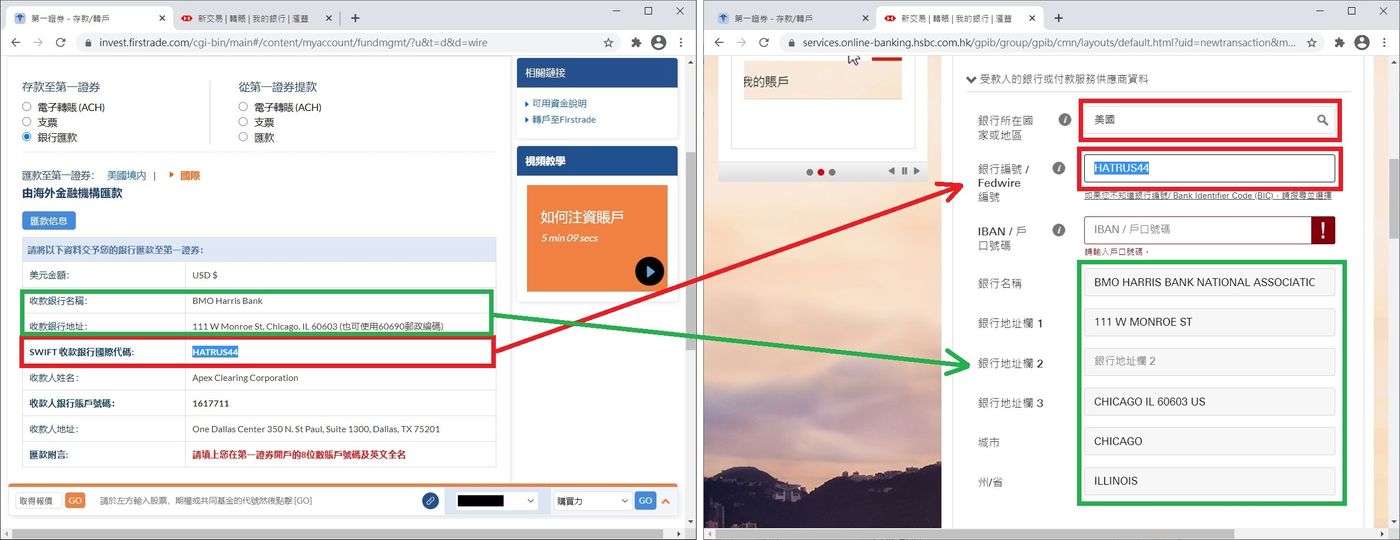

Step 10 <br class="smart">After that, the website will ask you to fill in the "Payee's Bank or Payment Service Provider Information", first select the United States in the "Bank Country or Region", and then go back to step 6 above Go to the Firstrade page, copy the "SWIFT Receiving Bank International Code", go back to the bank page, paste it in the "Bank ID/Fedwire ID", then the bank name and bank address fields below should have been automatically filled in for you, You can go back to the Firstrade page and check to make sure the information is correct.

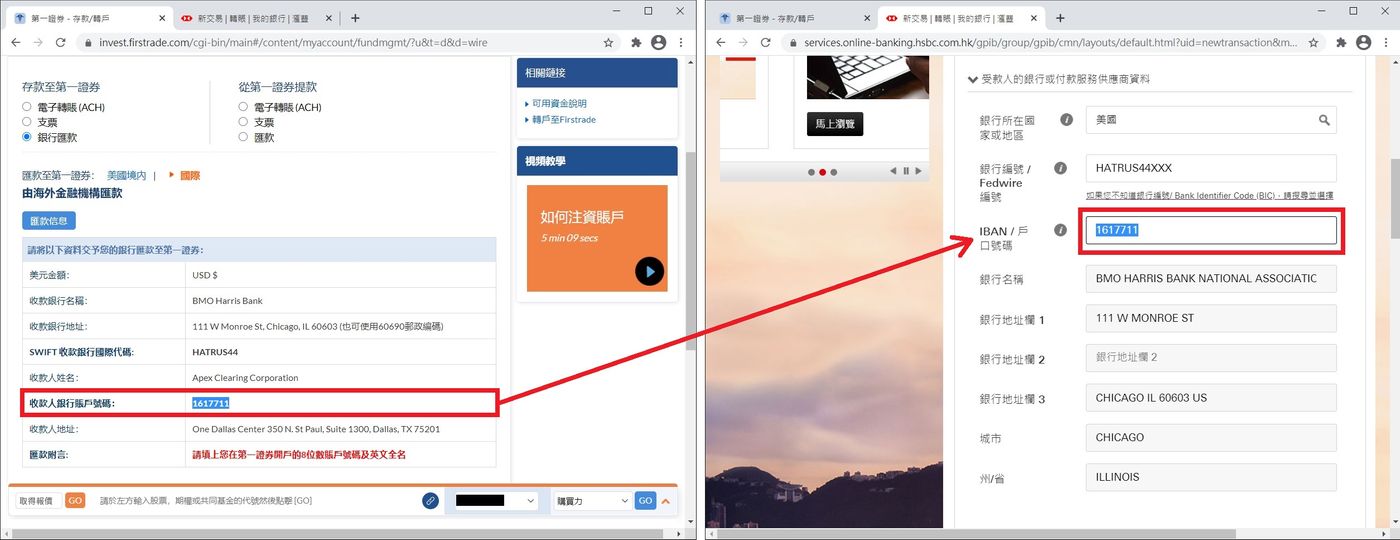

Step 11 <br class="smart">Copy the “Payee Bank Account Number” on the Firstrade page and paste it on the “IBAN/Account Number” on the bank page.

Step 12 <br class="smart">Fill in the "Payee Details", copy the "Payee Name" on the Firstrade page, and paste it on the "Account Holder Name" on the bank page, "Payee" "Place of Residence" select the United States, and the address in the "Payee's Address Field" is the same as the address in the "Bank Address Field" above. Remember to tick the option to add it to "My Payee", and you don't need to fill in these information again when you send money next time!

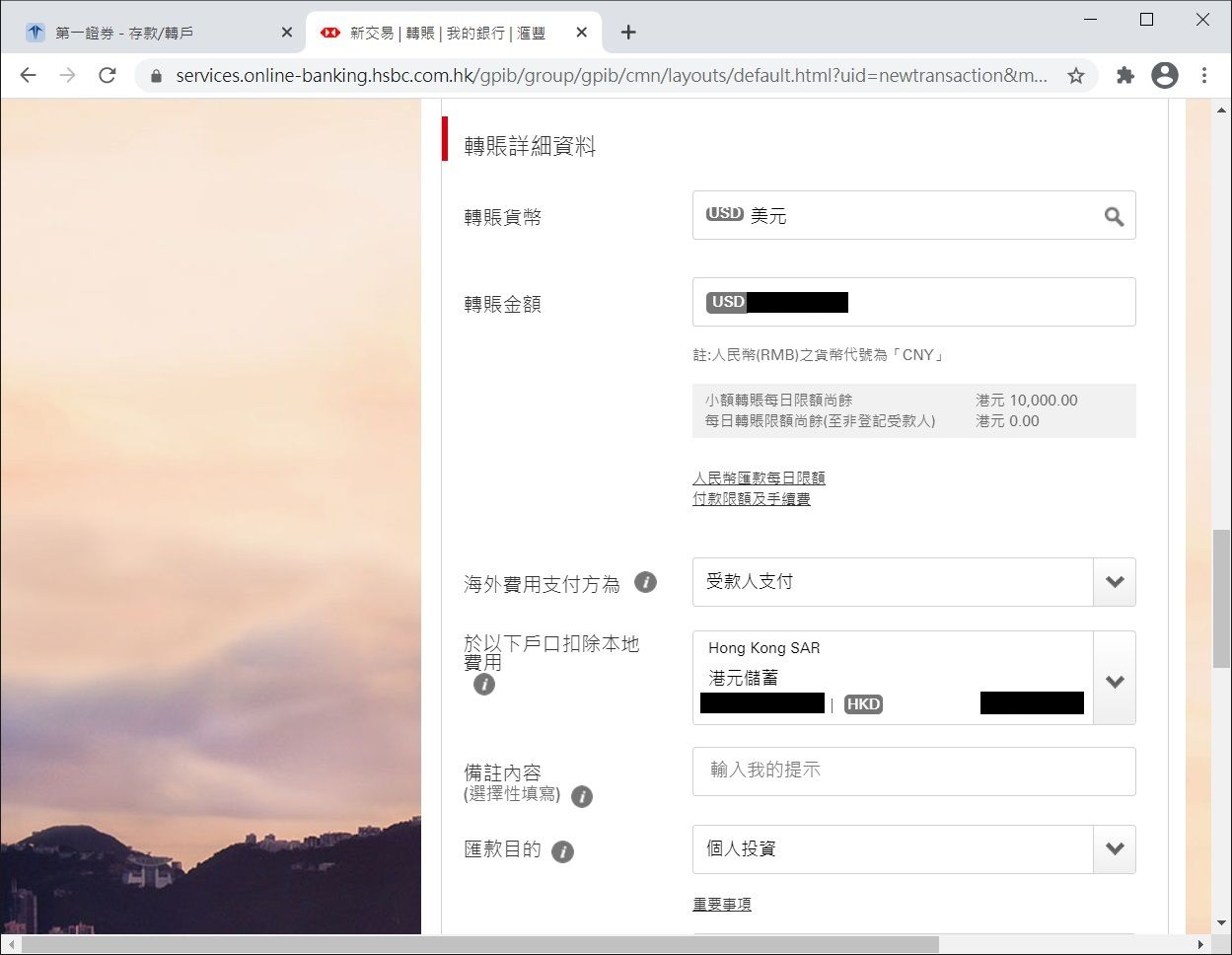

Step 13 <br class="smart">Fill in "Transfer Details", select USD for "Transfer Currency", and enter the USD amount you want to transfer to Firstrade for "Transfer Amount". Note that the overseas receiving bank will charge you There is a US$25 fee per transaction, so this dollar amount will be US$25 less after it is credited. "Overseas Fee Payer" select the payee to pay, "Deduct local fee from the following account" means that the bank will deduct HK$50 remittance fee from this account, just select your HKD account.

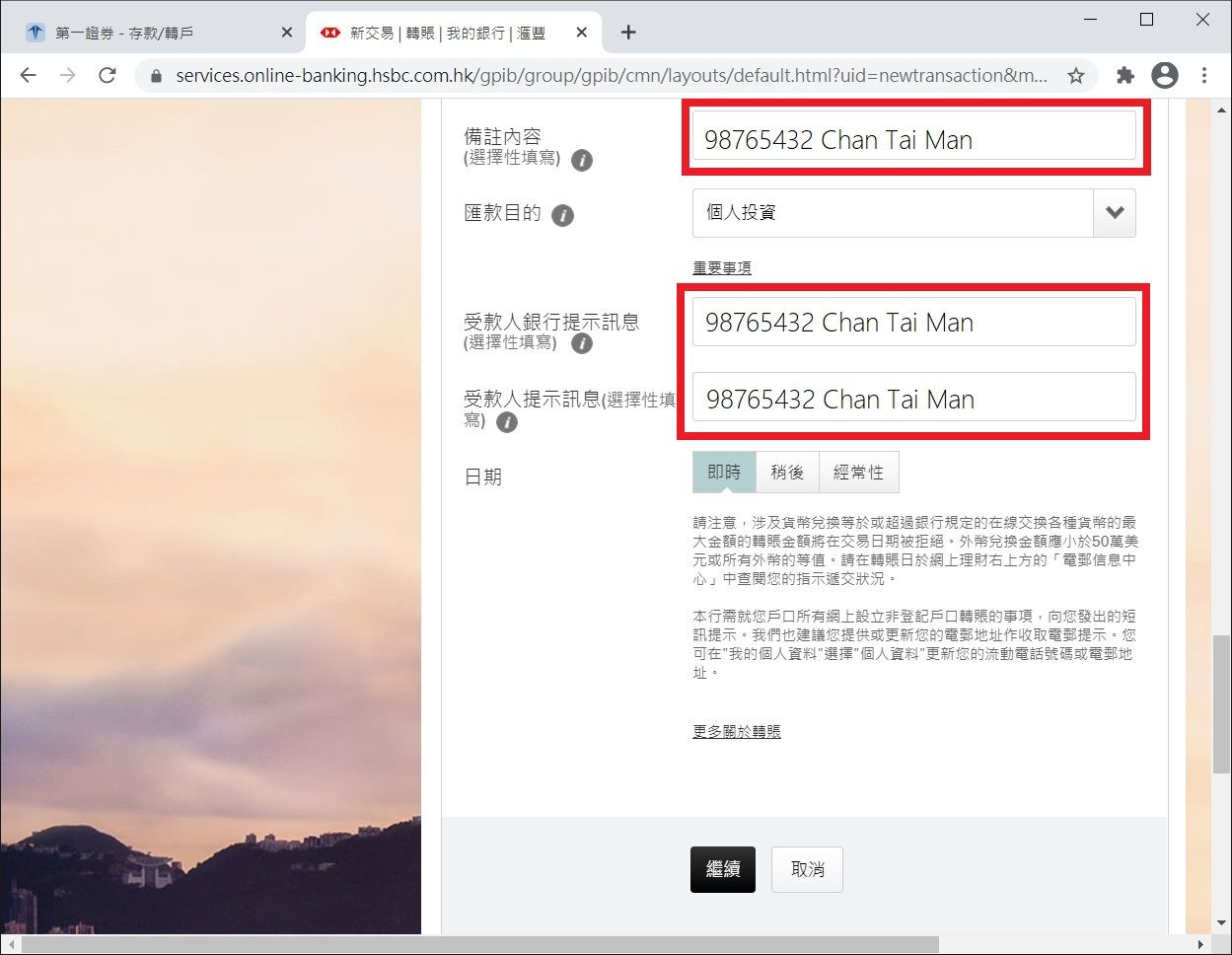

Step 14 is important! In "Remarks", you need to fill in your Firstrade 8-digit account number and your full name in English when you opened an account in Firstrade . Please make sure not to fill in the wrong information. If the information is wrong, the remittance will fail. "Remittance Purpose" select personal investment, for safety reasons I also filled in my Firstrade account number and full name . Then click "Continue".

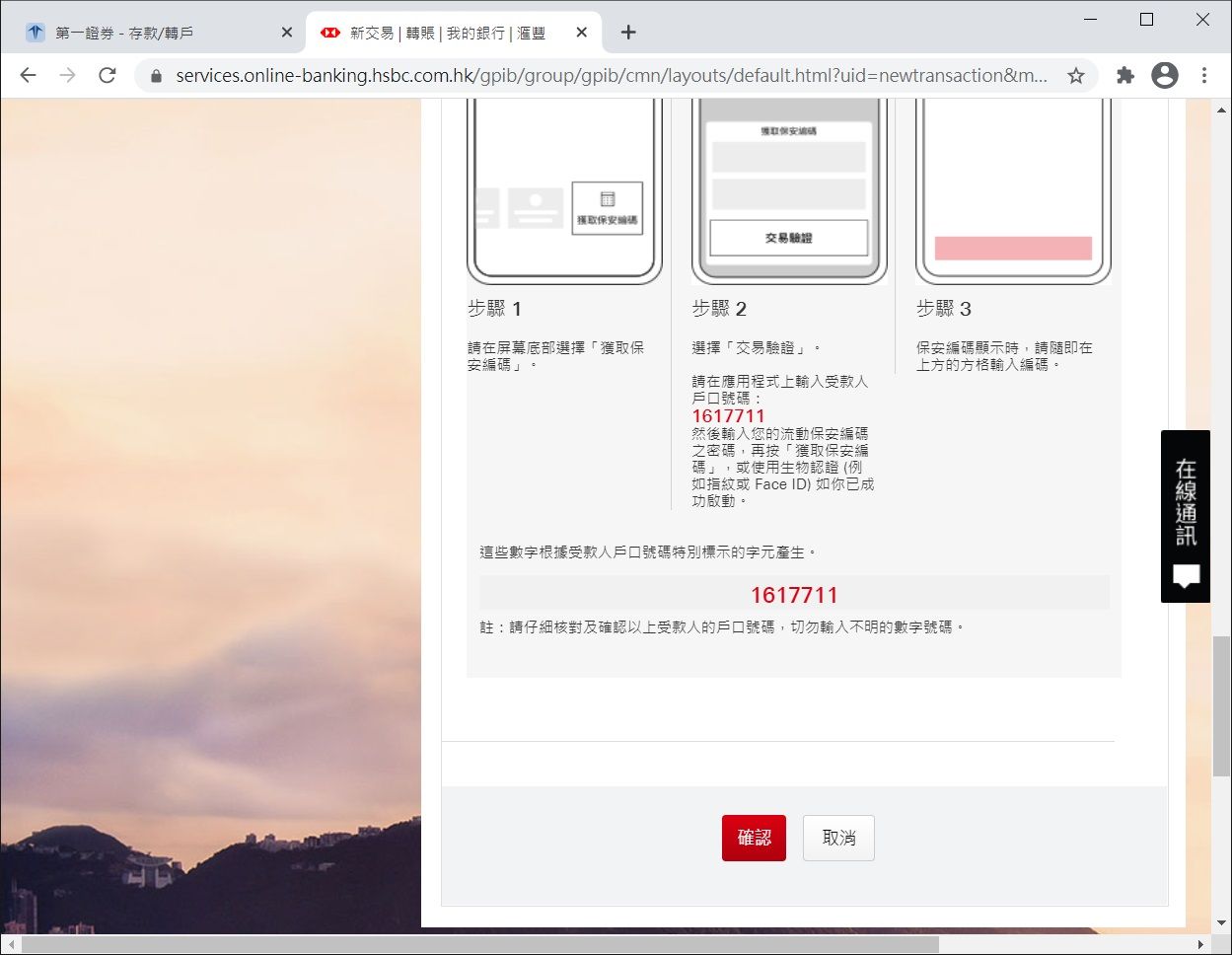

Step 15 <br class="smart">After checking the information again and confirming that it is correct, follow the instructions to open the HSBC Hong Kong mobile banking app on your mobile phone, get the security code, and press "Confirm" after entering it.

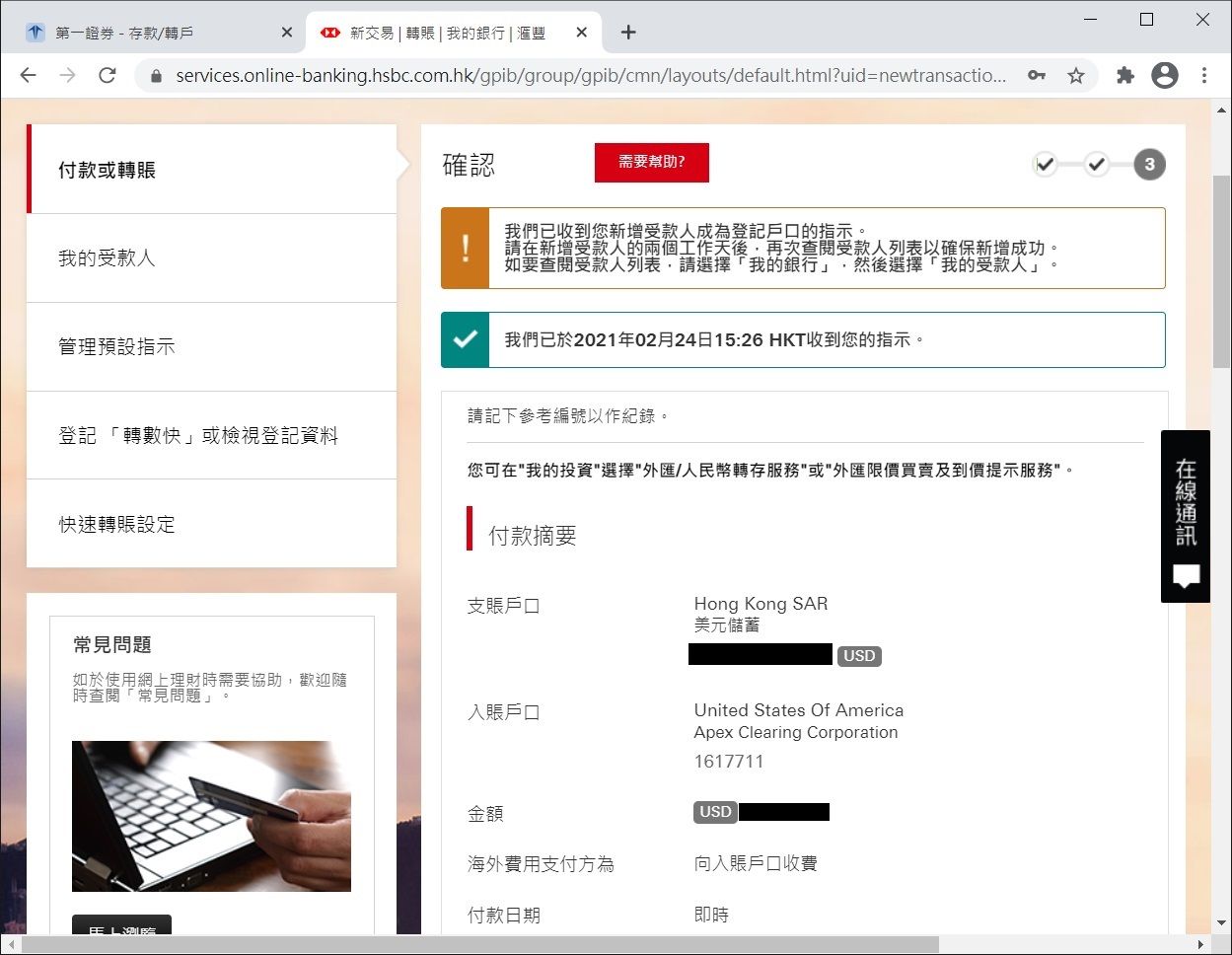

Step 16 <br class="smart">When you see the following screen, it means that the bank has received your remittance instruction. I made the remittance at about 3:30 pm on weekdays, and I saw the account in about 20 minutes later. The U.S. dollar has been remitted, and then wait for Firstrade to confirm that the money has been received and credited to your Firstrade account. Generally, Firstrade needs one working day to process your remittance, and I found out that the remittance had entered me the next morning. Firstrade account now! It only took more than half a day from remittance to account!

Next, you can buy and sell stocks in Firstrade for investment, or keep the funds as an offshore account, because Firstrade has no minimum deposit, no management fee, and Firstrade is protected by SIPC US investors, which is Similar to the deposit protection in Hong Kong, if Firstrade goes bankrupt, you can also get a maximum compensation of US$500,000 , so your funds can be said to be very safe!

Next time I will share how to use Firstrade to quote and buy US stocks, so stay tuned!

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More