Exploration and discussion of DEFI principle of OHM system

This is not a teaching article. The rules of the OHM department are not difficult to understand, but the market is unpredictable. By reading the official documents, you can have a certain understanding of the rules, but it is difficult to predict whether there will be excess under different market sentiments. In addition to reading the official DOCS, it is recommended to invest only the amount you can afford before investing.

https://reurl.cc/EZeL3n

Re:[Chat] Where does the interest payment for Defi pledge come from?

Because many people want to see the DEFI of the OHM department, I wrote an article to describe the successor to the above. This article describes the two forms of lending and liquidity pools in the early days of DEFI, but with the release and progress of various new projects. Each project party has found a fatal problem:

A large number of users live for APY, and they are extremely unbelieving. They dig and sell the project’s tokens for free. When the token price collapses and stinks, the liquidity will be transferred to the next DEFI project, and users with belief usually only Stay in leading projects such as CURVE, UNI, PANCAKE.

For the project side, these users are sometimes like vultures, selling the governance tokens badly, but even more deadly is taking away the LP liquidity pool. For a liquidity pool DEFI project, liquidity is the foundation for them to settle down. . After the liquidity pool was drained, no users were willing to trade on the platform, resulting in a shrinking of SWAP FEE revenue, so more people drained the pool. Stuck in a loop of death OHM intends to improve this problem by tweaking the design of the mechanics. I am following the WONDERLAND on the Avalanche Chain

Outline the rules of the game with an example. (Mainnet is too expensive to play)

There are only two simple functions in WONDERLAND, which are relatively friendly to users

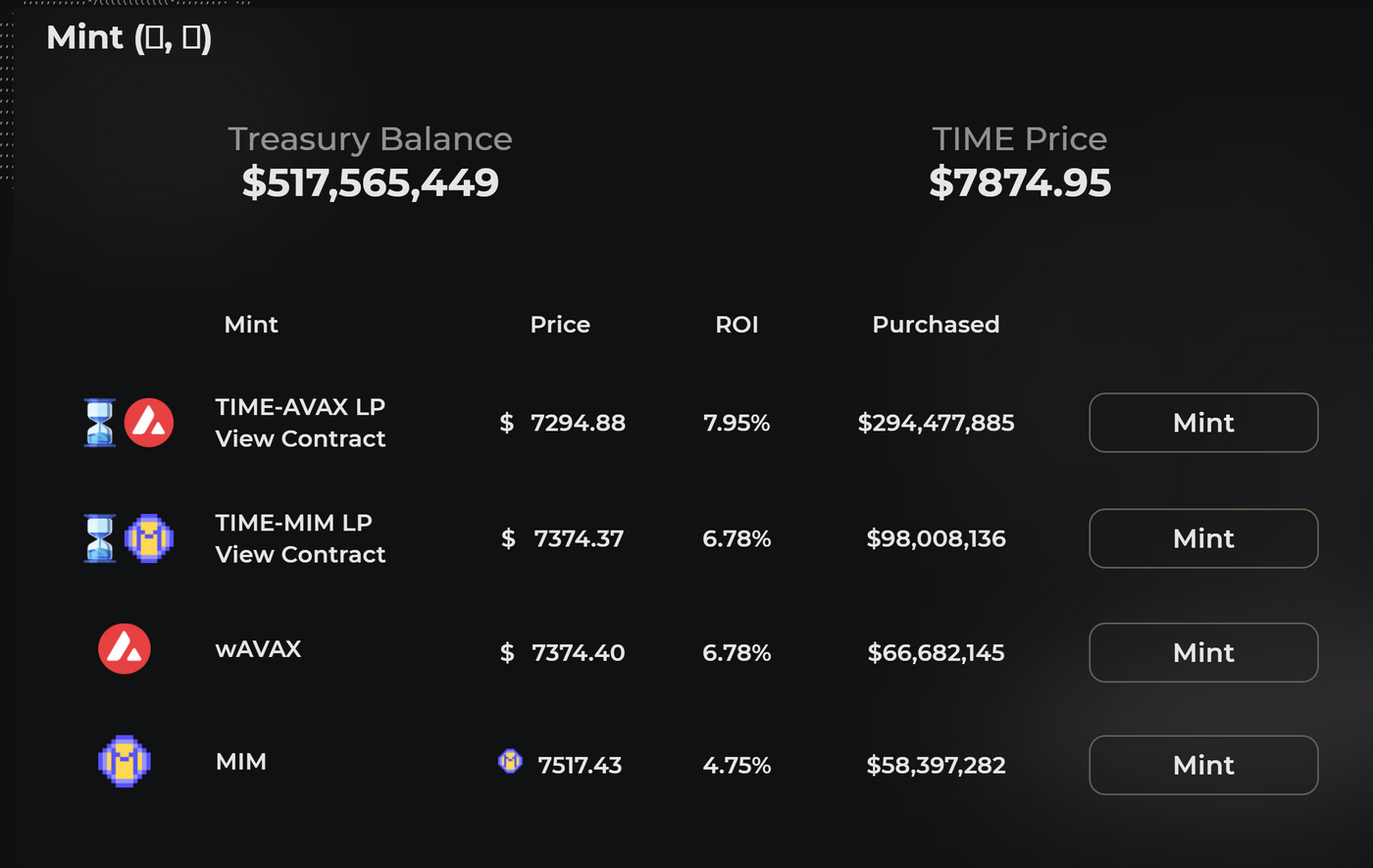

1. MINT

Printing and issuing, usually users can sell the assets in the picture to the project party in this interface, while TIME’s tokens are linearly unlocked in a five-day period, because they are discounted by McDonnell Douglas, it is profitable for users to sell in the market . For the project party, single-currency assets will enter the reserve vault, while LP assets are the project party's own liquidity. Therefore, users are not afraid of pooling, the project party has its own liquidity, and SWAP FEE is of course also attributed to TIME token holders. In this page, the risk that the user needs to take is the price risk within these five days. If the price falls within these five days, it is possible to lose money. Otherwise, earn more

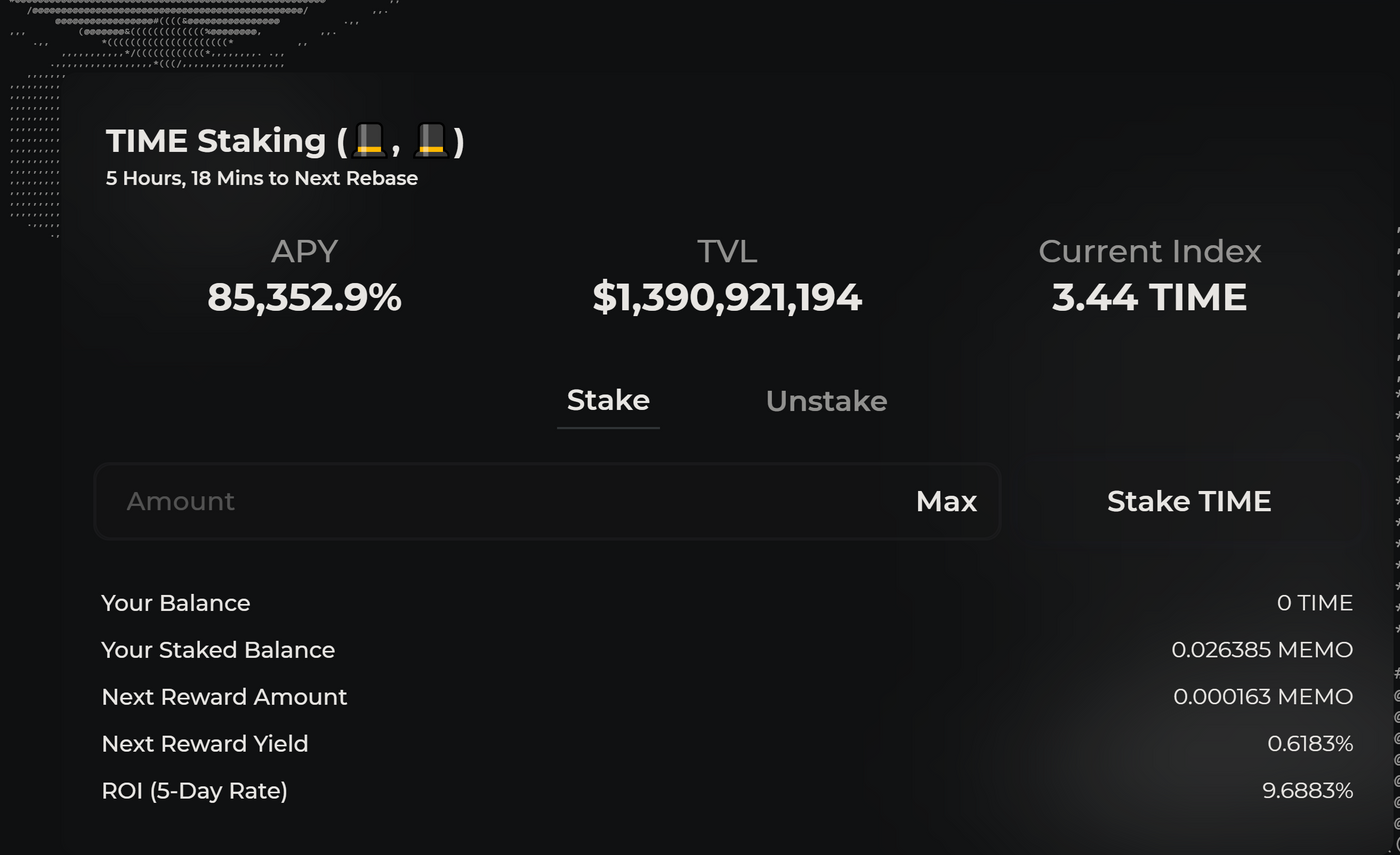

2. STAKE

pledge. This function is simpler. Users can use the above-mentioned MINT function or buy them in the market by themselves, and pledge them into the single-coin pool, and it is visible to the naked eye that this pool has tens of thousands of APYs. Therefore, the number of people who pledged is very large. In the case of WONDERLAND, about 80 or more tokens are in the pledge pool, so the chips are almost locked. Even if the official APY is so high, it seems that the inflation rate is very high, but the price is maintained very well. for this reason.

The above are the functions that users commonly see. Let's discuss the mechanism behind it.

https://docs.wonderland.money/basics/faq

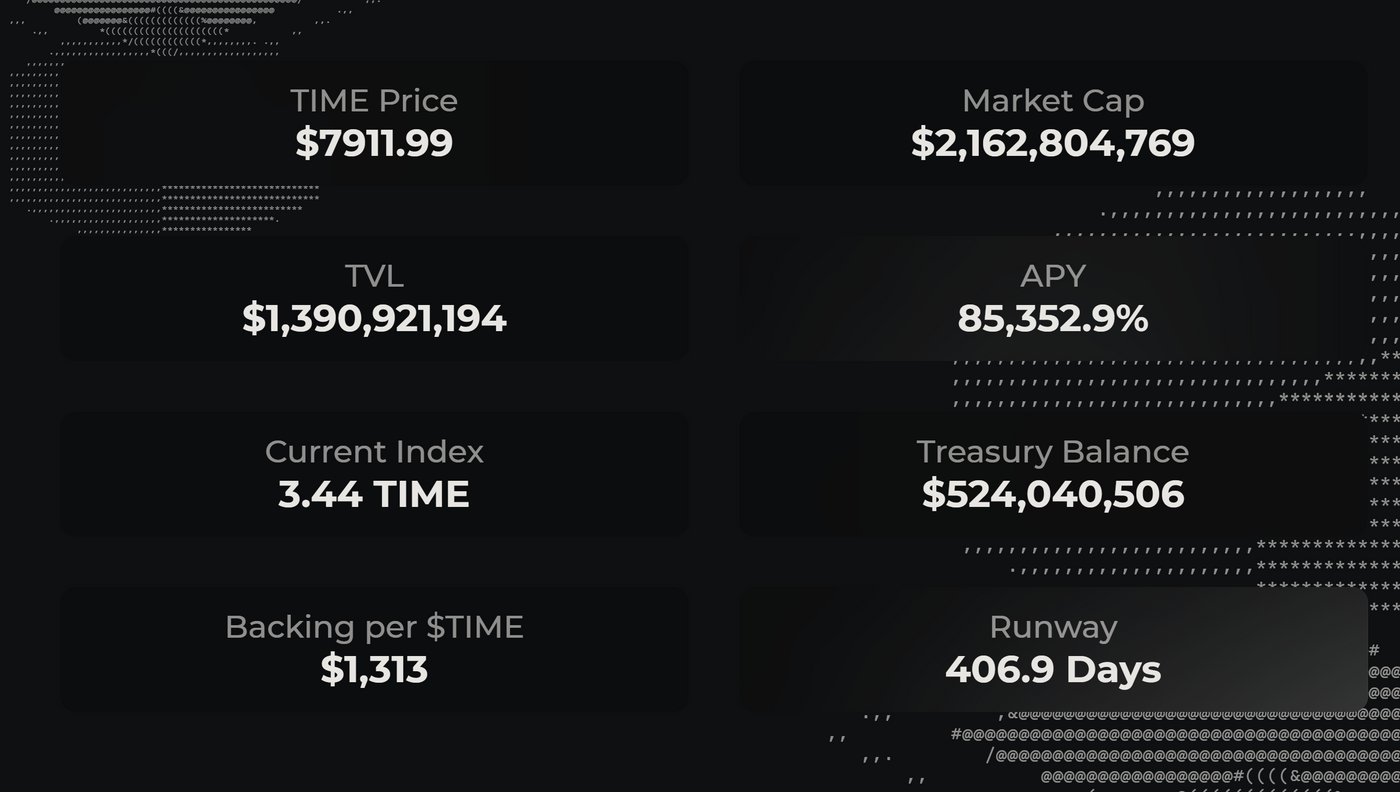

According to the official documentation, each TIME is backed by at least one MIM (a stable currency)

From the official panel in the picture above, you can see that there are 1313 MIMs behind each TIME.

It should be noted here that support does not mean pegging. The official does not want to tie the currency price to its intrinsic value, so a large number of issuances can only say that the intrinsic value of a TIME is 1313MIM.

From the documentation, we can see that when TIME has a large premium relative to its intrinsic value, those who mint tokens through the MINT function actually only get a very small part of the premium, and most of them will be minted to the pledger. Tokens held.

According to the description of the protocol, when TIME is discounted relative to its intrinsic value, the protocol will repurchase TIME in the market. Because it is a discounted repurchase, it is also beneficial to the pledger, so as to ensure that TIME is at least equal to his intrinsic value or premium. .

Taking the situation in the picture as an example, suppose I mint a TIME at the price of 7517 MIM today, and relatively speaking, I will get a premium compensation of 4.75 square meters. But out of my sight, more TIME will be minted and put into the hands of stakers within these five days.

in conclusion:

The focus of the OHM series is to let the white prostitute bear some time risks, and then the project party has its own liquidity, and a large amount of the agreement income is returned to the pledger.

At present, the first focus of the OHM system is belief. Pledgers do not step on each other. If they only enter and exit the market in an orderly manner, even if the TVL stagnates or decreases slightly, the impact on the price and the system is very limited (same as the banking system). Again, a run can be deadly)

The second key point is ecology. A sufficiently large ecology or diversified treasury assets can resist fluctuations. In addition, the agreement income can also ensure that this is a valuable project. The relationship between value and price is determined by the market.

In the OHM system, I think WONDERLAND is what I like. In addition to the relatively cheap gas on AVAX, his founder also established SPELL + popsicles. The three are not small agreements. Under the trinity, I feel that they can compete with the AC universe.

KLIMA is what I think is very interesting. BCT carbon emission token, the main environmental protection, may gather a group of people who have faith in environmental protection to join (but I will not vote)

The last question is whether OMH is a Ponzi scheme. According to Wikipedia's definition of a Ponzi scheme, there is no valuable production activity in the system, and 100% of the interest income of all predecessors comes from the principal of future generations.

If you look at it this way, OHM is not a Ponzi scheme, because he protocol has real money income. That price may be at a substantial premium to its intrinsic value, but that's not something I can judge, it's the market. Just like in the Taiwan stock market, the price-earnings ratio evaluation of technology stocks is better than that of traditional production. But tech stocks may be overvalued but not a Ponzi scheme. (You will still lose money if you are not Pang-style. Be careful.) The writing of this article does not involve any trading recommendation. Investment and financial management can make or lose money. Please read the white paper or official documents carefully before purchasing.

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More