After tracking the sales of "plant meat" for 2 years, researchers came to several interesting conclusions

Plant meat, also known as future meat or artificial meat, has been frying up in recent years. The full name is "plant-based meat alternative" (or "PBMA" for short, plant-based meat alternative), trying to use high-tech gold plating on the name. In addition to some new food start-ups that have won the favor of top-level capital, plant meat is also called for a more environmentally friendly and more humane, trying to change the human habit of eating meat for thousands of years on the one hand, and kick it on the other hand. The oldest industry of mankind - animal husbandry.

Whether plant-based meat can replace traditional edible meat and reduce the impact of meat consumption on health and the environment ultimately depends on the market's acceptance. Have the wishful thinking of these food startups and capital bosses started? A recent research report published in the journal Nature provides the answer.

The demand for plant-based meat is imagined

In recent years, there has been a growing focus on the health and environmental impacts of meat consumption, so much so that initiatives to encourage vegetable-based diets have become popular, educating people to eat more plant-based in order to reduce greenhouse gas emissions.

In addition, from a public health perspective, in a modern society where high-calorie diets are prevalent, plant-based dietary replacement may reduce the risk of chronic disease and mortality.

While well-intentioned, it's actually hard to change most people's eating habits, and consumer demand for meat remains high and growing. Furthermore, keeping food prices affordable is a government's fundamental responsibility, and there is little public support for policies that tax food based on health or environmental outcomes. The best potential solution, then, is to invest in innovative plant-based meat alternatives (PBMAs) to entice consumers to switch from animal-based diets to plant-based diets.

Plant-based meat uses ingredients like beans, wheat, and heme to mimic the texture and nutritional profile of meat.

Another benefit of plant-based meat is the potential environmental benefit. Several studies have shown that reducing meat consumption reduces greenhouse gas (GHG) emissions, land use, and water use by reducing traditional livestock farming by raising animals (especially cattle).

However, in order to achieve the above benefits, consumers must be willing to pay for it. At this point, there is still much unknown about consumer buying behavior surrounding PBMAs.

Two researchers from the Department of Agricultural Economics at Purdue University in Indiana, USA, Zachary Newhofer and Jason Lusk, collected retail sales data for the two-year period from November 2018 to November 2020, giving The first market research basis for PBMA consumer analysis in the market.

1. Market share of plant meat

During the two-year study period, plant-based alternatives had an average market share of 5.91% of all ground meat product sales, from 4.22% at the beginning to a peak of 8.4% in October 2020 . But not too crowded .

2. The purchase behavior of plant meat in general households

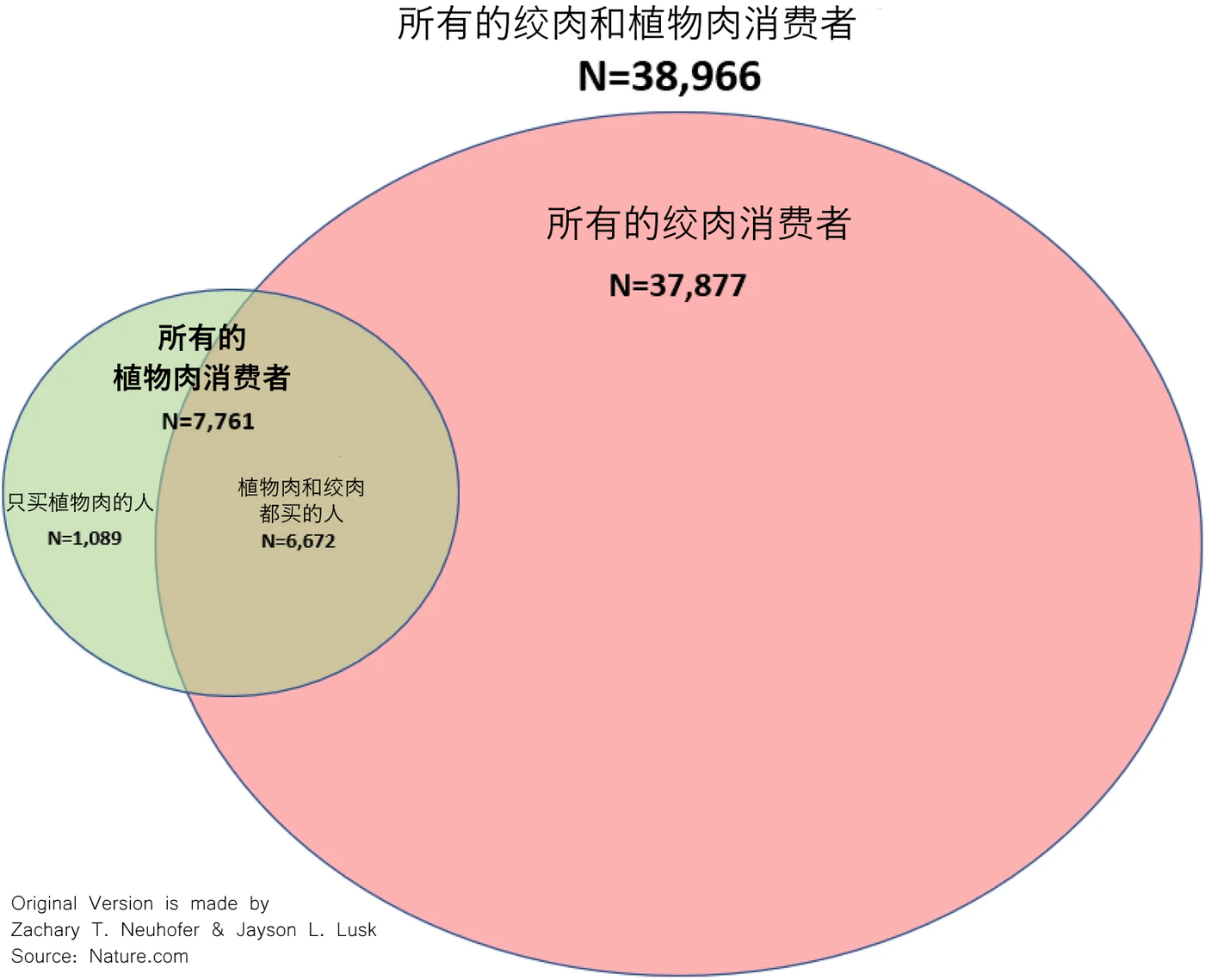

During the two-year period, 7,761 households (19.92%) purchased plant-based meat at least once, and 31,205 (80.08%) households did not purchase plant-based meat during this period (below).

Among all consumers of plant-based meat, 12.03% of households became repeat consumers of plant-based meat, and 86% of plant-based meat buyers purchased ground meat at the same time. Only 2.79% of households completely replaced traditional meat with plant-based meat. (In addition, 39.85% of consumers who have ever bought plant-based meat have only bought it once.)

An interesting phenomenon is that households who buy plant-based meat for the first time also buy the ground meat they need, and the purchase volume has not declined because of the purchase of plant-based meat. This means that although consumers are willing to try it for the first time, they are still skeptical about the acceptance of plant-based meat, so they still buy traditional meat, just in case.

Demographic and market analysis of household behavior

According to the analysis of the demographic characteristics of consumers, young families under the age of 35 and single female families purchase plant meat significantly more than people. In addition, employed or college-educated households are more likely to purchase a PBMA. Households with incomes of $100,000 or more were more likely to purchase a PBMA than middle-income ($45,000-$99,999) or low-income (<$45,000) households.

A larger percentage of African American and other minority families purchased PBMA than white families. Additionally, households with children purchased PBMA at a greater rate than households without children.

In the full sample, households that purchased the most PBMA units and spent the most were young (< 35), single male, college educated, employed, high income (> $100,000), and African American.

Bottom line: Most consumers are not buying PBMAs at all. Non-PBMA buyers are more likely to be older (65+), married or single male, uneducated, unemployed, lower income (< 45,000), white and childless than young (< 35) Or middle-aged (35-64 years old), single female, college educated, employed, middle income ($45,000-99,999) or high income (>$100,000), non-white ethnicity, no children.

Identifying the consumer groups of plant meat through behavior, it can be found that the vast majority of households who buy plant meat also buy ground meat at the same time, but the cost on ground meat will be less.

The above evidence suggests that plant-based alternatives are not deterring households from buying ground meat, and that a rising market share of plant-based meat is not necessarily a sign that the market is expanding, as most buyers of the product also buy regular meat.

The final finding is that the plant-based alternative meat did not impress vegan consumption, but caused some meat consumers to buy early, and only a very small number of consumers became loyal customers.

- The original content of this article was first published in Global News in Simplified (Internet Press Release Service Provider - China, Japan, Korea)

- The original research data report was published on natural.com by Neuhofer, ZT, Lusk, JL Most plant-based meat alternative buyers also buy meat: an analysis of household demographics, habit formation, and buying behavior among meat alternative buyers. Sci Rep 12 , 13062 (2022). https://doi.org/10.1038/s41598-022-16996-5

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!