CoinEx Research Institute | Liquidity Staking Solution in Multi-Chain Ecosystem

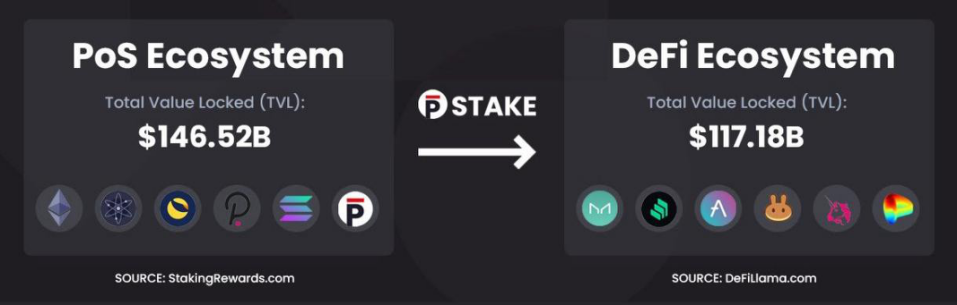

As mentioned last time, the current Proof-of-Stake and global pledge value is 217.94 billion US dollars, but the market value of pledge tokens in the liquidity Staking protocol accounts for a small proportion of it, the penetration rate is only 7.9%, but the growth rate is obvious. In view of the prosperity and development of multi-chain and the disadvantages of staking under the traditional POS mechanism, there is still a large market value space in the liquid staking market. And in the last article, we introduced three liquidity staking solutions for the 2.0 stage of the Ethereum public chain: Lido, Rocket Pool and Stakewise.

In addition to the huge demand for the liquidity pledge of ETH2.0, the ecological prosperity of public chains such as Polkadot, Terra, Cosmos, Polygon, Solana, etc., nodes and verification nodes, as participants in the base layer of the public chain, also have considerable block rewards And fee income, also attracted the attention and participation of many node operators and users. In this article, we will focus on the liquid staking solutions born in Polkadot, Cosmos, Solana, and Terra.

1. Stader (Terra)

TVL: $804.42m (about 839m LUNA)

As of February 12, approximately 30,000+ independent wallets have minted LunaX on Stader's liquid staking contract.

Support: Terra chain, follow-up support for Solana/Fantom/Near/Hedera chain

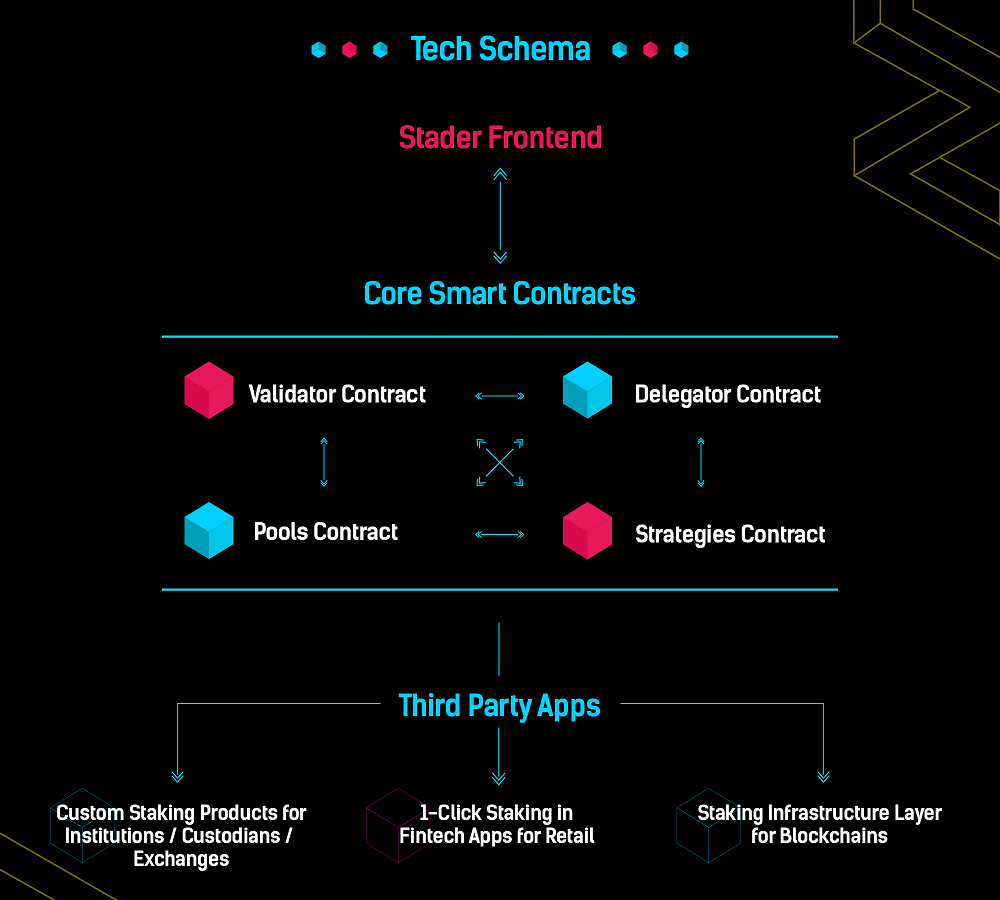

Stader is creating a modular smart contract infrastructure for staking across PoS chains, and Stader's modular smart contracts and policy contracts are built to allow third parties to leverage their components and integrate custom solutions. Stader currently launched two staking products on Terra - simplified staking (Stake Pools) and liquid staking (LunaX), as well as Stake+ for small stakers, and will soon launch Degen Vaults, similar to the yearn platform using LunaX for yield-farming strategic benefit.

Stader improves delegators' UX/UI by customizing products, tools, and interfaces for smart delegation, governance, and reward management. By providing access to cross-chain lending protocols, liquid staking derivatives, gamified staking pools and future reward swaps, users can generate the best risk-parity returns on staking rewards and staking asset liquidity.

As mentioned last time, the current Proof-of-Stake and global pledge value is 217.94 billion US dollars, but the market value of pledge tokens in the liquidity Staking protocol accounts for a small proportion of it, the penetration rate is only 7.9%, but the growth rate is obvious. In view of the prosperity and development of multi-chain and the disadvantages of staking under the traditional POS mechanism, there is still a large market value space in the liquid staking market. And in the last article, we introduced three liquidity staking solutions for the 2.0 stage of the Ethereum public chain: Lido, Rocket Pool and Stakewise.

In addition to the huge demand for the liquidity pledge of ETH2.0, the ecological prosperity of public chains such as Polkadot, Terra, Cosmos, Polygon, Solana, etc., nodes and verification nodes, as participants in the base layer of the public chain, also have considerable block rewards And fee income, also attracted the attention and participation of many node operators and users. In this article, we will focus on the liquid staking solutions born in Polkadot, Cosmos, Solana, and Terra.

1. Stader (Terra)

TVL: $804.42m (about 839m LUNA)

As of February 12, approximately 30,000+ independent wallets have minted LunaX on Stader's liquid staking contract.

Support: Terra chain, follow-up support for Solana/Fantom/Near/Hedera chain

Stader is creating a modular smart contract infrastructure for staking across PoS chains, and Stader's modular smart contracts and policy contracts are built to allow third parties to leverage their components and integrate custom solutions. Stader currently launched two staking products on Terra - simplified staking (Stake Pools) and liquid staking (LunaX), as well as Stake+ for small stakers, and will soon launch Degen Vaults, similar to the yearn platform using LunaX for yield-farming strategic benefit.

Stader improves delegators' UX/UI by customizing products, tools, and interfaces for smart delegation, governance, and reward management. By providing access to cross-chain lending protocols, liquid staking derivatives, gamified staking pools and future reward swaps, users can generate the best risk-parity returns on staking rewards and staking asset liquidity.

SD token

Value Capture: Stader charges a percentage of rewards as fees, and these fees are the main source of revenue for the Stader platform. Depending on the type of solution, the fee charged will be in the range of 3%-10% of the reward, and part of the protocol fee will be paid to SD token stakers.

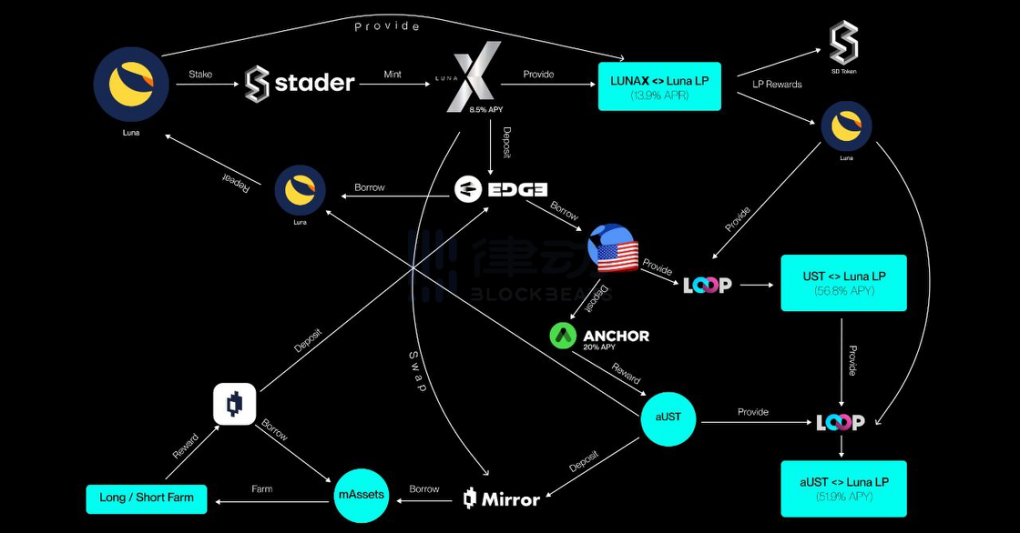

LunaX

It is a liquid staking token for Stader that instantly unlocks staking Luna and opens up the possibility of cross-DeFi protocols. For users, its role is not only liquid staking: the LP income composed of LunaX-Luna can automatically synthesize Luna and stablecoins (after conversion to Luna); LunaX can also earn Stader platform airdrops (based on weekly random Snapshots taken) and the opportunity to gain instant liquidity and improve yields.

LunaX is an auto-compounding accrual token, which can be minted when users stake on Stader using a liquid staking pool, and the rewards generated by staked Luna (including stablecoins) will be re-stakes periodically (starting from 24 hours).

As the reward accumulates, the LunaX supply does not increase, so the price of LunaX increases relative to Luna; in the case of a cut, the LunaX supply remains the same, but the price decreases as the amount of Luna staked decreases.

2. pSTAKE (Cosmos)

TVL: $52.01m; Stakeholders: 5107

pSTAKE supports the native tokens of the Cosmos and Persistence networks with a view to supporting more chains and assets in the future.

pSTAKE wraps the issuance of mainstream POS tokens through a custom “pBridge” cross-chain bridge designed to leverage the growth of the Cosmos ecosystem while gaining the liquidity and composability of Ethereum. Users can either hold these tokens in the form of ERC20s to maintain the liquidity of their pledged assets, or use them to discover the benefits offered by other DeFi protocols.

Dual token design :

Users can utilize the pBridge component to deposit pSTAKE-backed ATOMs into pSTAKE for minting and receive pATOMs, which are 1:1 pegged ERC-20 wrapped (wrapped) unstakes tokens representing unstaken tokens on the PoS network . Users can choose to use pATOM in Ethereum’s vast DeFi ecosystem. In the future, the pSTAKE platform will support more POS network tokens.

On the other hand, users can burn pATOM to mint and receive 1:1 pegged ERC-20 tokens, stkATOM, which represent collateral tokens on the underlying backed Cosmos PoS network. When users mint stkATOM, the same amount of native PoS token ATOM deposited into pSTAKE will be staked on the network (delegated to multiple well-known validators). ATOM holders can use pSTAKE to earn staking rewards, while being able to use stkATOM to provide liquidity to DEXs on Ethereum for additional benefits.

With the launch of Gravity DEX and Osmosis, pSTAKE users will also be able to leverage the IBC (Inter-Blockchain Communication) protocol to provide liquidity to these DEXs within the Cosmos ecosystem using stkATOM published on the Persistence Core chain.

node validator

The Persistence team, the developers of pSTAKE, was one of the early adopters of PoS, and Persistence continues to expand its participation in the PoS space through its validator fork, AUDIT.one. AUDIT.one launched in 2020 and currently supports over 20 networks.

3. StaFi (Polkadot, Cosmos)

TVL: $51.56m Supports: Ethereum/Polkadot/Cosmos/Solana/Polygon/Kusama

The bottom layer of Stafi is mainly based on the blockchain system established by Substrate (this is the blockchain architecture developed by Parity. The entire architecture integrates many development modules, including consensus modules, P2P modules, Staking modules, etc.). The contract layer supports the creation of a variety of Staking contracts, namely the Staking contracts of XTZ, Atom and Dot.

rToken is a redeemable token for pledged assets issued by the StaFi protocol. The native token is pledged through StaFi's Staking Contract: the amount of rToken (Qr) will be determined according to the amount of native tokens pledged by the user (Qs) and the rToken exchange rate (Cr). After minting, it will be sent to the wallet address specified by the user, so:

Qr=Qs/Cr

At present, the platform supports the pledged public chain network Token and replaces it with rToken, which can be roughly divided into four categories:

1) rETH: rToken after the launch of Ethereum 2.0 Staking.

2) Polkadot's rToken: rFIS, rDOT, rKSM and rToken for other Substrate-based projects.

3) rTokens of the Cosmos ecosystem: rATOM, rKAVA, etc.

4) Others, such as rXTZ, rEOS, etc.

4. Marinade (Solana)

TVL: $644.27m (approximately 733m SOL) Validators: 451

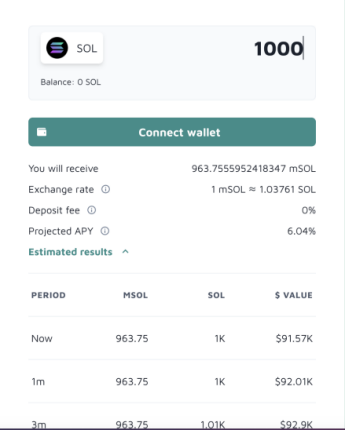

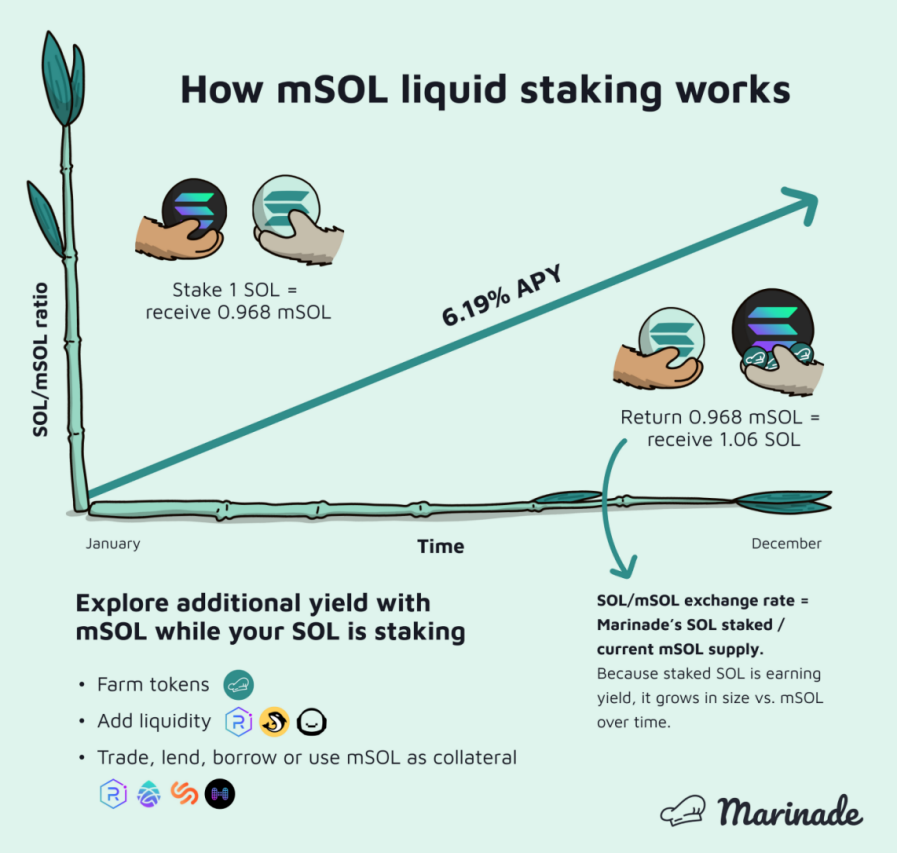

Marinade.Finance is a non-custodial liquid staking protocol based on Solana. Using an automatic staking strategy to stake users' SOL tokens in Marinade, the staked SOL is distributed among more than 450 validators, excluding the so-called "security group" (the first 19 validators), the user will receive a reward that can be used for decentralization DeFi's "Marinade SOL" token (mSOL), currently mSOL can be used and obtained in the main Dex and DeFi protocols (Saber/Raydium/Solend/Mercurial/Serum/Port/Orca/Parrot, etc.) Farming related rewards.

The price of mSOL increases relative to the SOL in each epoch, and the reward accumulates into the base staked SOL. The way to withdraw back to SOL is to withdraw your SOL at any time by unstaking and waiting for the unlock period or immediately for a small fee.

The formula for calculating the price of mSOL is as follows: Price of mSOL = total_staked / tokens_minted

This means that as long as staking rewards are allocated for SOL staked in the protocol, the price of mSOL is rising relative to SOL every epoch. If users keep mSOL for one year, its value to SOL will increase by 6.19% (APY officially disclosed by Marinade).

Governance Token MNDE

35% - DAO allocation. Used as a proposal by token holders as they see fit, initially for liquidity mining.

35% - DAO treasury. This is the treasury reserve for operations, grant programs and strategic partnerships.

30% - Team. This is an assignment to current and future contributors. The distribution has not yet begun, and the funds are currently controlled by Marinade's multisig.

Notably, there are no token sales behind Marinade, no private investors, and no venture capital funds.

In conclusion, with the continuous development of major public chains and ecosystems, the staking liquidity solution project born in the public chain, in addition to the development of the Staking service solution of this chain, is bound to develop into a multi-chain ecosystem, which is compatible with the pledge on other public chains. The ecology and even the ETH2.0 pledge plan project competes on the same stage. In the future, the pledge liquidity scheme may also have a situation where one superpower is more powerful. In addition to competing for the inherent advantages of pledged assets, everyone must also compete for the security technology of node pledge and the ability to operate multi-chain nodes. For users, a good user experience, simpler pledge operations and lower learning costs on the pledge platform will also be one of the conditions for everyone to choose a platform.

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More