[ACY Securities] A consensus has been reached on the lowest tax rate in the world, and multinational technology companies are facing a disadvantage

In just one weekend, countries threw several blockbusters into financial markets. The domestic central bank unexpectedly cut the reserve ratio, the Federal Reserve promised to continue "strong" easing policy support, and Europe reiterated that the pace of bond purchases will remain unchanged, but said that the meeting on July 22 will have important revisions. In addition, U.S. President Joe Biden signed an executive order on Friday to promote industry competition , tightening scrutiny of mergers and acquisitions by large technology companies, and further limiting the powerful influence of technology giants. Every piece of news is enough to provide strong fundamental support, but ACY Securities believes that the most important news is that the Group of 20 (G20) has reached a preliminary agreement on the lowest tax rate in the world.

The global minimum tax rate was created to prevent multinational corporations from evading tax by setting up companies in low-tax countries. For a country with a high tax rate like the United States, on the one hand, it can increase tax revenue, and on the other hand, it can prevent the outflow of corporate capital. But this is not good news for multinational companies. Taking Ireland as an example, due to its low corporate tax of 12.5%, most large multinational companies have established their European business headquarters in Ireland, including Apple, Google, Facebook and Twitter. Once the global minimum corporate tax of 15% is implemented, these companies will face higher tax pressures, enough to affect their long-term stock prices. Superimposed on Biden's antitrust restrictions on technology giants, the Nasdaq will be subject to short-term news. On the contrary, with the US small business confidence index tonight, the Russell 2000 index has the opportunity to go long.

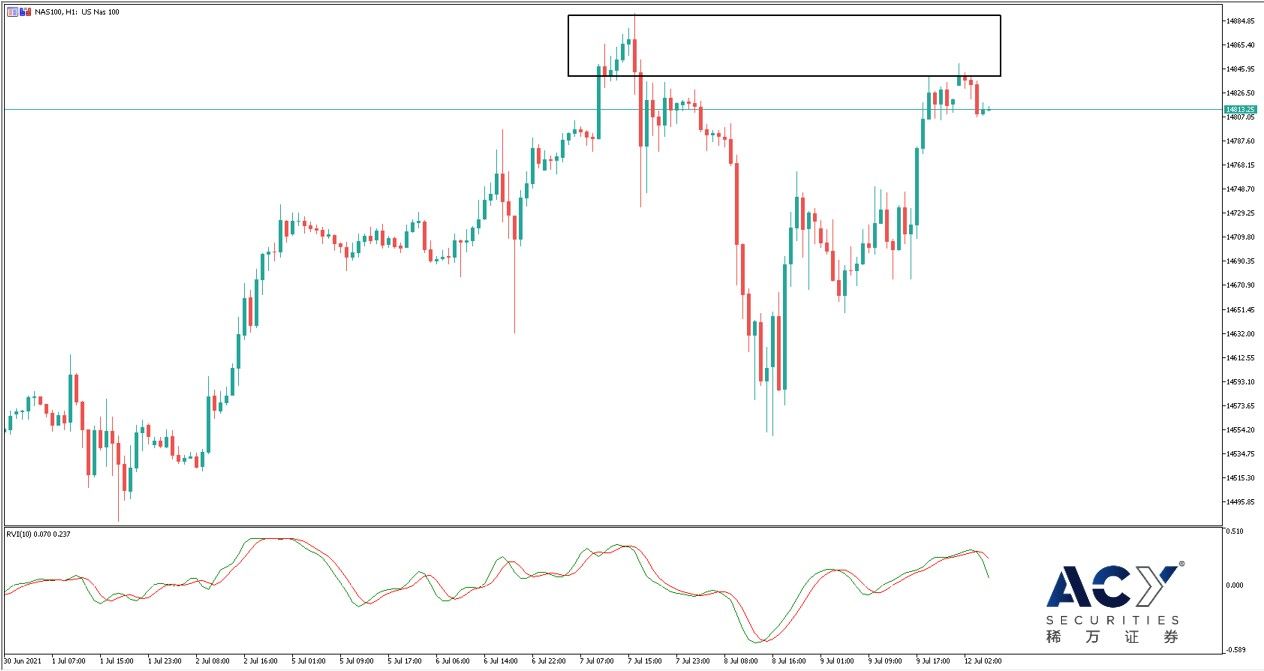

Judging from the daily chart of the Nasdaq, since mid-May, the index has shown a unilateral rise, and there has been no obvious correction. The speed of the K-line going up is similar to the initial stage of the epidemic, which can be said to be a strong upward trend. However, from the perspective of indicators, the MACD column has formed a typical divergence, the column has a tendency to cross the zero line below, and the fast and slow lines may form a high dead cross, triggering a short alarm. Considering that the index has been rising too fast recently, coupled with the strong negative factors of the fundamentals, the Nasdaq has the opportunity to short-term rallies. Since it is an order against the market, traders need to pay attention to setting stop loss and take profit.

Judging from the hourly chart, the upper pressure of the K-line has been released, and it is subject to the first resistance near 14900, forming a price supply area. But it began to fall after touching the supply area again in early trading today, indicating that there is resistance above the bears. Short-term empty order entry time, you can see the position near 14840 above. Or when the K-line entity breaks below the 14800 position, there is a chance to follow the empty order. The entry can be matched with the negative signal of the relative vitality indicator's fast line crossing the zero line. The important resistance position above the current price is the integer mark of the previous high point of 14900, and a small stop loss can be considered to be a large point. The support position below depends on the relay pattern of rising, flat and rising near 14700.

Focus on data today

18:00 US June NFIB Small Business Confidence Index

20:30 US June CPI annual rate

The content of this article is provided by third parties. ACY Securities does not make any representations or warranties for the accuracy and completeness of the content in this article; ACY Securities does not assume any responsibility for investment losses caused by third-party suggestions, forecasts or other information. The content of this article does not constitute any investment advice and is not related to personal investment objectives, financial situation or needs. If in any doubt, please seek independent professional financial or tax advice.

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More