Fintech Knowledge Sharing (Part 1)

During this period of isolation, I wanted to improve myself on a whim, so I went to the website Coursera to search for courses on fintech. Why do I want to learn fintech? I think now that technology is getting more and more advanced, and more and more things can be done online, I decided to update myself to keep up with the changes in this era. I found this fintech course on Coursera. Let me briefly introduce that Coursera is an online learning platform with courses from well-known universities around the world, including Yale University, University of California, Wharton Business School...etc., This time I want to share the fintech course of Wharton Business School. Wharton Business School is the No. 1 business school in the United States. It is unbelievable! But after this online course, their professors are really, really good at explaining some very boring data in a very interesting and careful way. Let’s get back to the point. Next is the focus of my course on financial technology. share

What is Fintech?

Fintech companies are businesses that use new technologies to create new and better financial services for consumers and businesses. It includes a variety of companies that may be in the business of personal financial management, insurance, payments, asset management, and more.

What does fintech include?

- blockchain

- Big Data

- AI (Artificial Intelligence)

- Automated CRM (Customer Relationship Management)

- robo-advisory

- Insurtech

- Payment

- cash management technology

- Lending platform

and many other fields

What are the main goals of FinTech?

- Reduce transaction and service costs

- Entering uneconomical market segments (where the opportunity cost is too high)

- Create with economies of scale

- Improve customer experience

- Market segments

There is a concept mentioned in the course - Robo-advisor, which is simply a tool made with an algorithm that can replace people's work. Their work includes

- Automatically capture client financial information, goals and risk tolerance

- Output of a proposed portfolio allocation (or set of allocation options)

- Automatic Balance and Tax Collection

- Automatically report to clients

The two largest robo-advisors at the moment are Wealthfornt and Betterment in the US.

market size

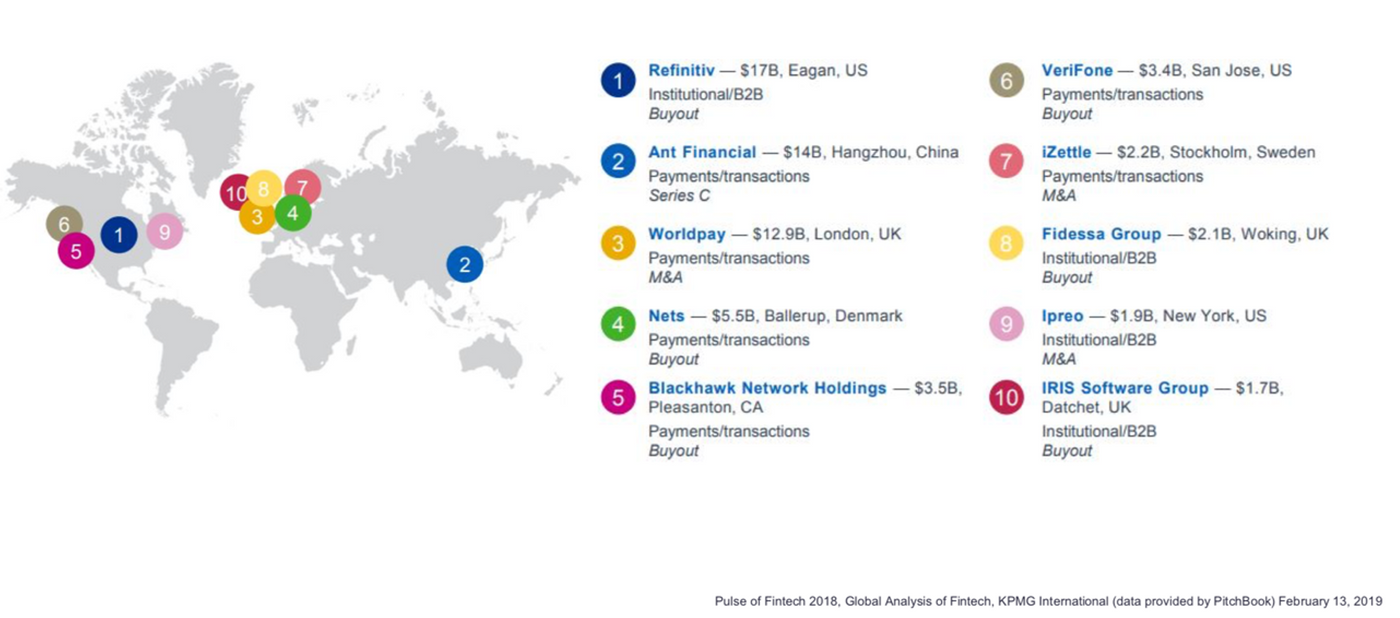

Global fintech funds reached $111.8 billion in 2018, according to KPMG Pulse of Fintech report

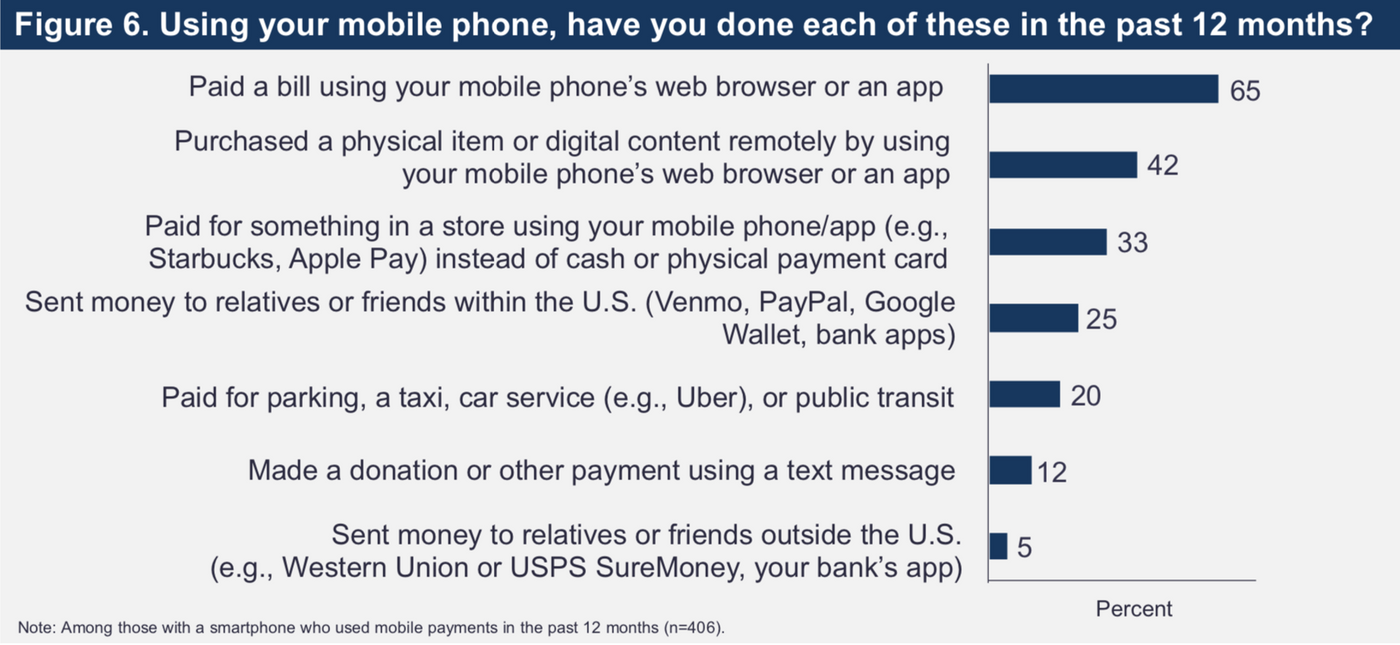

Current percentage of financial programs used (US data)

It can be seen that currently 65% of US citizens will use the Internet to pay, 42% will use the Internet to shop, 33% will pay with a mobile phone instead of a traditional new card or cash, and 25% will 20% of people will use their mobile phones to pay for parking, taxi, etc., 12% of them will donate money by SMS, and 5% of people will transfer money to friends outside the United States

Fintech deal distribution

The US accounts for the largest volume, with 40% of fintech deals in the US and the rest in northern Europe and China

<The following is mainly about Milennials, because Millennials account for 40% of the world's population and have the most influence on the future>

What are Millennials

Millennials, also known as Generation Y, are people born between 1977-1995, the following are their characteristics

- No hope for future superannuation income

- See their investment decisions as an expression of social, political or environmental issues

- They have the lowest level of trust in people compared to older adults

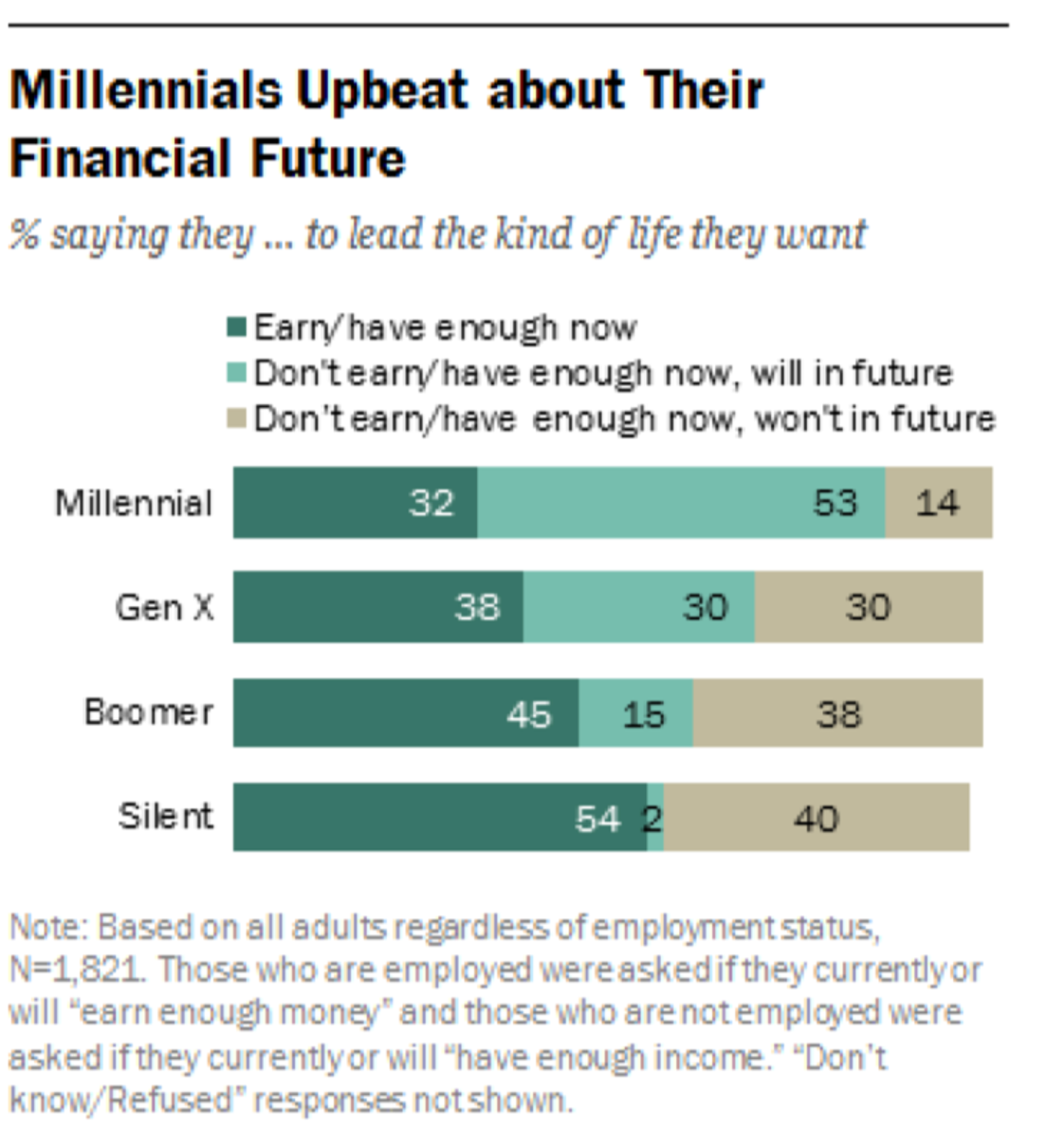

53% of Millennials feel they don’t have enough money now, but they will in the future, echoing that they are hopeful and most optimistic about the future

(Gen X: around 35-44; Boomers: 44-64; Silent: 65+)

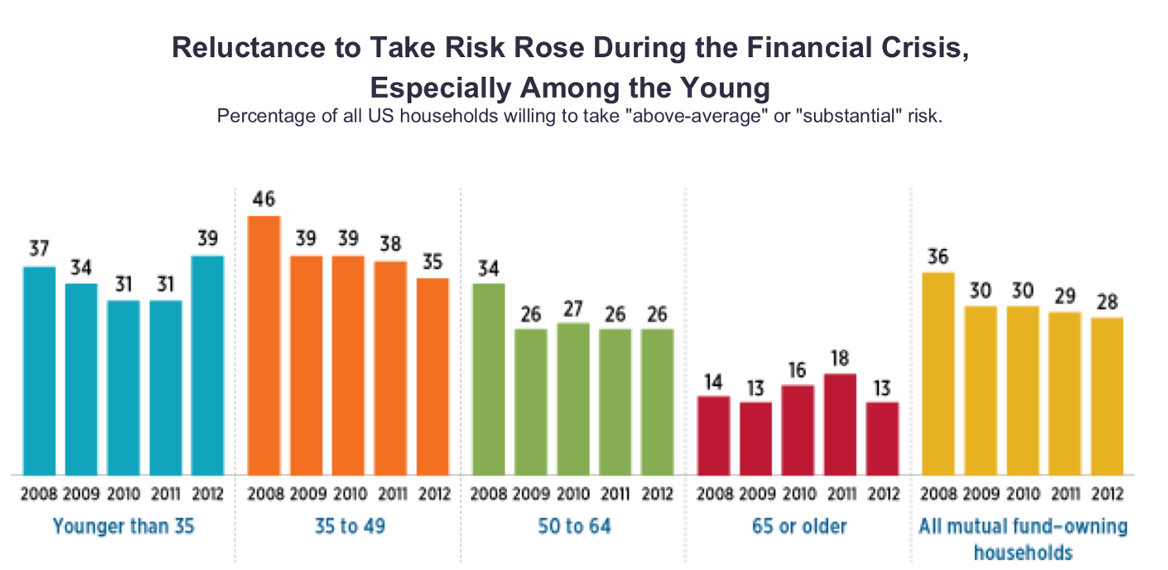

Depression Baby Effect

(This concept is mentioned to echo the acceptance of risk by various age groups in the following)

Depression Baby Effect refers to the effects of people or children who experienced the Great Depression of 1929-1939

- Weak risk-taking ability

- save more money

- more introverted

The figure below shows that older people generally have a lower risk-taking ability, but the Depression Baby Effect also indirectly causes the age distribution of people's risk-taking. To my surprise, it is 35 to 49 years old. The risk tolerance (on average) is the highest

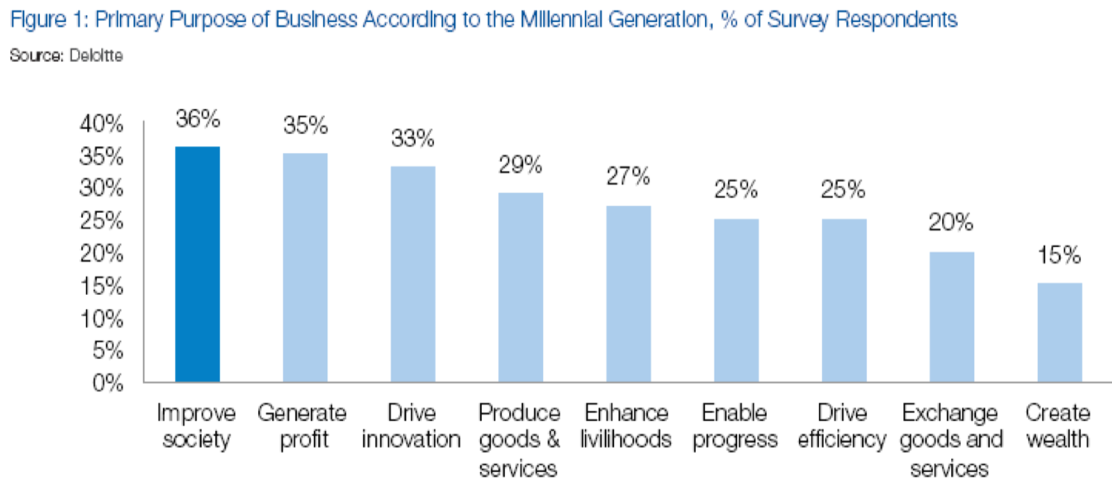

Millennials Investment Purpose

This also surprised me. Research shows that their biggest investment purpose is to make social progress! ! I used to think that most people invest to create passive income. I have grown knowledge (Source: World Economic Forum)

<The above is my key sharing of the Fintech course, I will add the rest soon, I hope you will like it~>

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More