Block D Weekly Report - PoolTogether sued? The first lawsuit that directly pointed to the core principles of DeFi was supported by celebrities and the community

At the end of 2021, PoolTogether, a well-known “savings lotto” project in the DeFi field, was accused. The complainant, Joseph Kent, is the former technical chief of U.S. Senator Elizabeth Warren, who has made clear his opposition to cryptocurrencies, causing an uproar in the cryptocurrency circle.

PoolTogether is advertised as a "no-stake lotto". Those who want to participate can participate in the lottery draw as long as they go to the website and deposit the cryptocurrency in the wallet into the fund pool. The lottery bonus comes from the interest earned by automatically depositing the funds in the prize pool into other DeFi protocols through smart contracts. That is to say, the bonus of each period (currently, the lottery is drawn every day) comes from everyone's interest income, and everyone's principal will not suffer any loss. As long as you don't withdraw funds from PoolTogether, you can always participate in the lottery.

As a decentralized protocol, PoolTogether's smart contracts are all audited by professional and well-known third-party companies (Audits) , such as OpenZeppelin and Code4rena.

The plaintiff, Joseph Kent, invested about $10 into the agreement last October, allegedly knowingly using it to qualify for a class-action lawsuit in federal court in New York. Kent questioned the legality of PoolTogether, alleging that the app is essentially a lottery ticket and is prohibited by New York law. The lawsuit in the New York Federal Court also described Kent's extreme concern for the development of cryptocurrencies, believing that it will consume a lot of electricity, affect the climate, and provide criminals to evade legal responsibilities, and finally raised a big question for DeFi applications: decentralized When something goes wrong with the agreement, who is responsible?

DeFi "decentralizes" and "de-trusts" financial transactions in the real world

The emergence of smart contracts allows people to create various financial agreements on the blockchain, and to carry out financial cooperation that the human world could not do in the past (or can only be done under many conditions).

The "standard meeting" commonly seen in Taiwan's traditional society is actually a financial agreement. A group of people who are already acquainted with each other or have weak connections (friends of friends, relatives of neighbors...) get together every month for a cooperation similar to modern P2P credit loans. Those in dire need can get a big loan at once but have to pay interest, others can earn interest but have to take risks: if there are 20 participants, they have to trust each other for 20 months, in case someone falls in the middle (no paid), or they will flee with the money, or they will lose everything. Because there is such a risk, most of the bid meetings happen among acquaintances, because the trust is strong enough, and people can be found if something goes wrong.

Meeting heads and feet need to "trust" each other, banks need to "trust" your repayment ability, P2P borrowers and lenders need to trust the platform... All kinds of financial activities that can only be carried out because of trust are now becoming more and more popular because of the emergence of blockchain. changed. Using smart contracts on the blockchain, everyone can carry out various loans without trusting each other (Trustless), and there is no need to go through a third party in the middle. Those who have funds on hand and want to earn interest can deposit stablecoins into a "decentralized lending platform", such as Compound, at any time. Those who want to borrow money will come to the platform to mortgage cryptocurrencies and lend stablecoins for other applications.

Just a little digression, you may be wondering why would anyone want to mortgage “cryptocurrency” and then pay interest to lend out stablecoins? For example: If you are very optimistic about Ether (ETH), then you can mortgage your Ether to Compound to lend USDC (USD stable currency), and then exchange USDC for ETH, or use USDC to leverage / The contract trades to buy more ETH and earn profits from rising ether. (Of course, if the price of ether fluctuates in the other direction, you will also lose a lot. Do your homework and do your best with any financial transactions. )

DeFi protocols use blockchain and smart contracts to eliminate possible fraud and trust problems of middlemen, improve efficiency through program automation, and release more possibilities for financial transactions. By the end of 2021, the total assets on all DeFi platforms have exceeded $110 billion. There may still be many problems, but it is undoubtedly an important development direction in the future.

Big coffee and community support

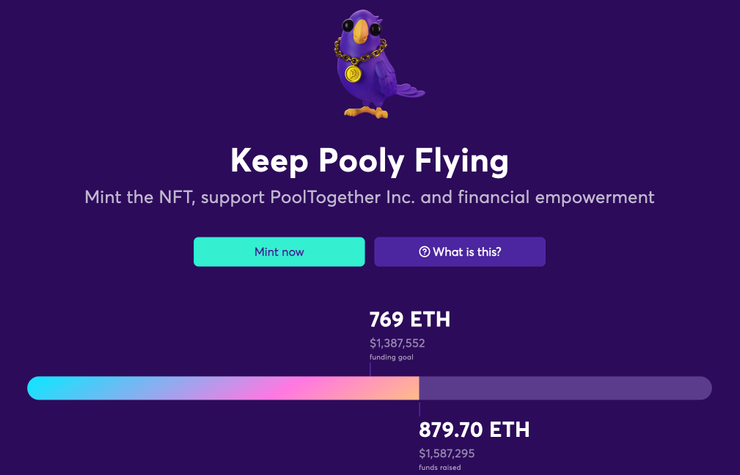

At the end of May 2022, PoolTogether’s co-founder and defendant Leighton Cusack tweeted an announcement of the “Pooly” NFT fundraising plan website, which was used to raise fees to pay for the lawsuit. Interested sponsors can go to the website to choose any of the three schemes, and purchase NFT after deciding the number to complete the sponsorship.

As soon as the website was launched, it has received strong support from the community and DeFi industry leaders. As of this writing, it has exceeded the team's original target of 769 ETH, reaching nearly 880 ETH, or about NT$47 million. In addition to the support of more than 5,000 independent wallets, it has also attracted many big-name supporters. For example, Ryan Sean Adams, founder of the well-known blockchain media Bankless , tweeted "Stand With Us!", and Chris Dixon, a partner of the world's top venture capital A16Z, He also directly publicly stated that he has sponsored the 75ETH plan (the big guy is the big guy).

The team has "expressed" on the website that there will be an airdrop for NFT holders. I heard that Mint has a time limit. If you are interested in supporting, please participate as soon as possible.

This incident will trigger a strong statement from the DeFi community. In addition to the politically motivated discussion behind the complainant’s special identity, as reported by the Wall Street Journal, this complaint can be regarded as the “first” involving illegal or illegal DeFi protocols. A lawsuit over who is legally liable when an actionable injury is caused to a user (...could be among the first to squarely address the question of who is legally accountable when a DeFi application—known as a “protocol”—is at odds with the law or causes actionable harm to a user.). It can be said that this lawsuit challenges the core tenets of DeFi:

Whether a DeFi protocol is really "self-governed" and "autonomous", especially when it comes to legal responsibilities.

Regardless of whether they are engaged in the blockchain industry, including the financial industry and the legal community, they are all paying attention to this incident. Although it is still in the early stage of the lawsuit, with the arguments and judgments put forward by the two parties in the court, it is bound to have a negative impact on the incident. The subsequent development of DeFi has a profound impact.

The important progress of mankind is always accompanied by some turbulent flow at the beginning. This is true of the industrial revolution and the Internet, and blockchain and DeFi are no exception. In the process of development, there will definitely be unscrupulous elements, but if you try to prevent crime The slogan, not embracing new challenges, or even punishing the innovators who are upright and brave in pioneering, is undoubtedly driving the backward car of human progress.

The above is the content of this week. I wonder if you have any other thoughts on the development of DeFi or this lawsuit. Please leave a message below to share with me.

If you are also curious about what impact the blockchain will have on the world in the future , leave an email subscription in the "Block D Weekly Newsletter" subscription area , and you can receive news worthy of attention in your mailbox every week!

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More