RE: Will Yuanta 0050 Positive 2 (00631L) go off the market like Crude Oil Positive 2?

This article is a reply to the article by Da Renge, the author who talked about the concept of insurance, will Yuanta 0050 Zheng 2 (00631L) go off the market like crude oil Zheng 2? @ Talking about the concept of insurance:: Ruffian State:: (pixnet.net) ( https://bit.ly/3xEgYda)

First of all, I am very grateful to Daren for taking the time and effort to write a long article to reply to my idiots speech. As a colleague, I have been reading your articles since I first started. In order to express my respect for you, I also wrote a formal article. respond to you

Question 1: Will (00631L) be easily delisted?

A: Most likely not. As 0050 is the largest prototype ETF in Taiwan, the exposure is not very high if it is simply twice leveraged, so the risk of delisting is not high.

Question 2: In various articles, Brother Daren puts the investment risk of 0050 approximately equal to the investment risk of 00631L, and has made various examples to show that if 00631L blows up, 0050 will not die, so is there a possibility that 00631L is dead but 0050 is seriously injured, but still?

A: There is a possibility, this is a mathematical problem, according to the second page of the prospectus (https://bit.ly/3zWoJxF) posted on the official website of Yuanta Investment Trust: This fund has a positive leverage operation and pursuit The underlying index (that is, the FTSE Taiwan Stock Exchange Taiwan 50 Index, hereinafter referred to as the Taiwan 50 Index) has the product characteristics of a positive 2 times return in a single day, so investors should pay attention to the following matters and risks when trading this fund: 1. This fund is a The indexation strategy is adopted to track the single-day positive 2x return of the underlying index as the investment objective. Investors should understand that the fund's pursuit of the underlying index's positive 2x return is limited to "single-day" operation purposes.

There are too many words in the back, so I won’t quote them first. Double positive in a single day means that his leverage effect is limited to a single day. I will use two extreme cases that will not happen as examples:

1. If the prices of 0050 and 00631L are both 100 today, 0050 drops 49% today, and rises 96% tomorrow to return to the original 100 yuan, how much will 00631L be? According to the mathematical algorithm, it is (100*0.02 )*3.92=7.84

2. If the prices of 0050 and 00631L are both 100 today, 0050 doubled today, and halved back to the original point of 100 yuan tomorrow, how much will 00631L be? According to the mathematical algorithm (100*4)*0=0

Of course, neither of these two things will happen, because Taiwan stocks have a maximum price limit of 10%, so 0050 will not fall that much on the day, but the problem I want to express is: under the effect of beautiful mathematics, 00631L It not only magnifies the return of the increase, but also magnifies the return of the decline. Using twice the ETF in a single day will usher in the moment of tracking inaccuracy.

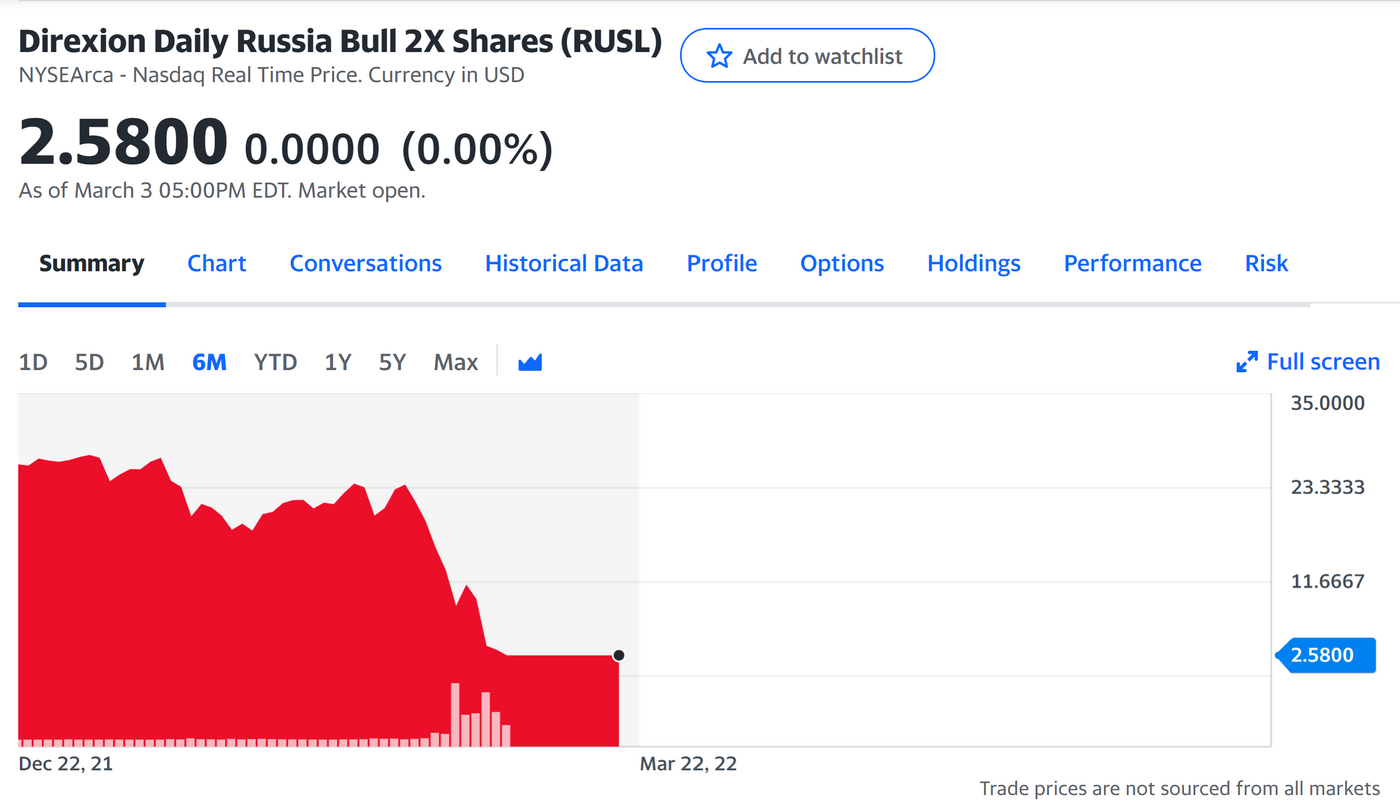

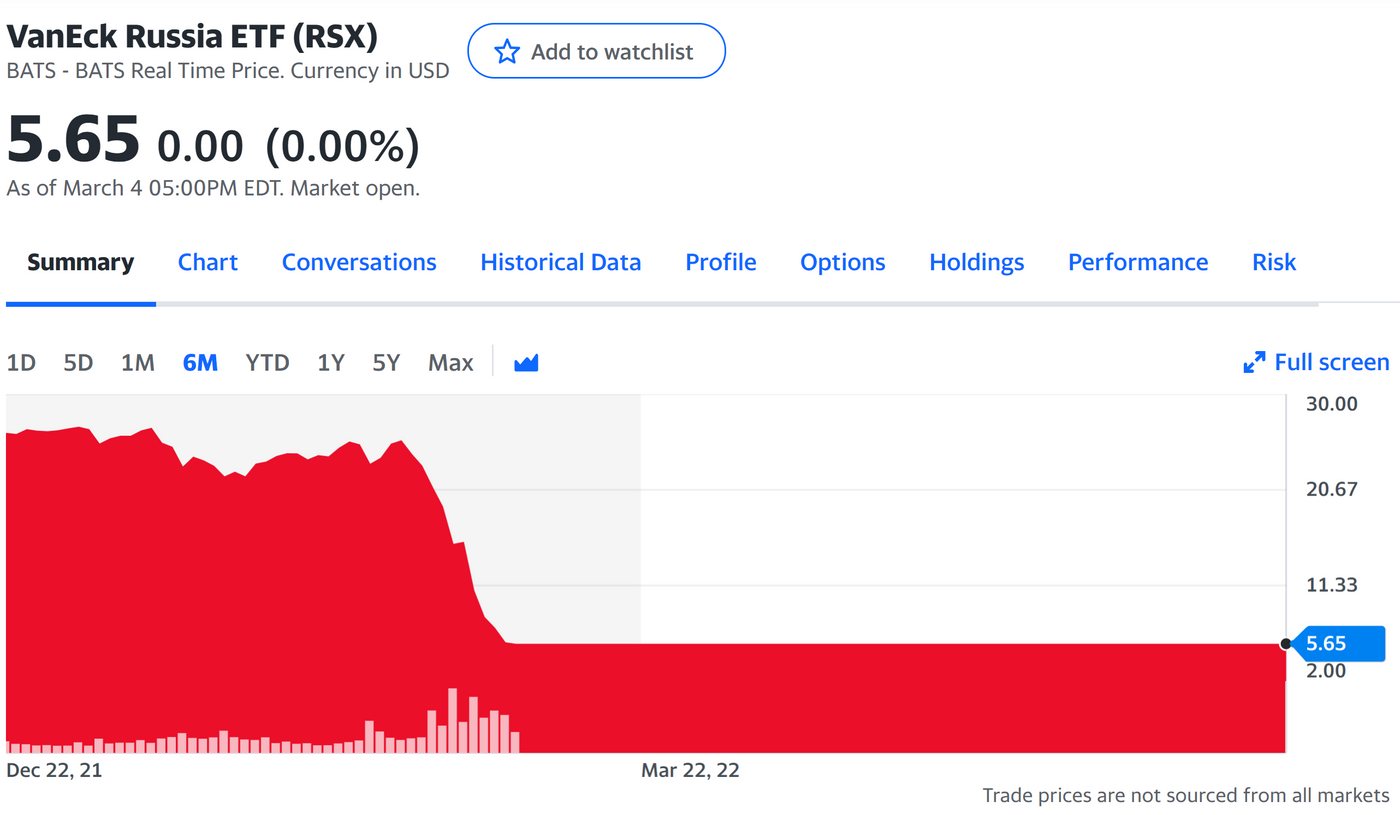

Taking the example that Daren gave in her article, the Russian ETF RSX and RUSL seem to have dropped -76.69% and -89.12% respectively after the war. It seems that there is not much difference in percentage, but if you use mathematics to calculate Knowing the difference. Suppose both held 1 million RSX and RUSL before the war. After the war, the remaining net assets of the suspension were 203,100 yuan and 108,800 yuan. One day, the war ended, and the stock listing and trading resumed. How long does it take for poor performance to come back?

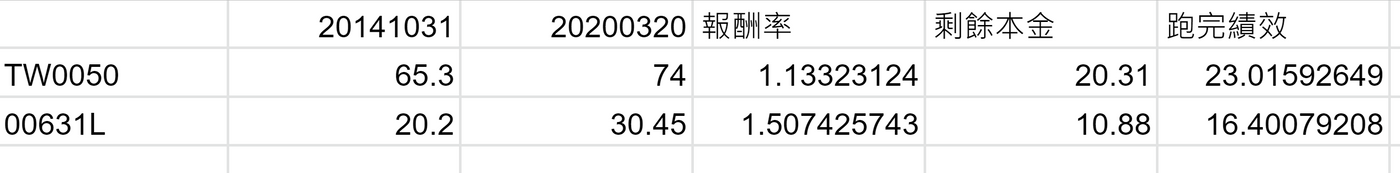

If you encounter a slow bull instead of a fierce bull, let's try it according to the backtest numbers of Taiwan stocks

I went directly to the trial balance, the period compensation of 0050 and 00631L

It seems that the rate of return of 00631L is better, the previous principal has already fallen to rot, and it can't catch up at all.

Of course I can say that I pick a range that is good for my thesis, but who knows if each future 10-year range is a crazy bull market or a slow bull or a depression?

My conclusion is: 00631L is not a rotten commodity, it is a leveraged commodity. Through backtesting, we know that the winning rate is not 100%. Of course, it can perform better during the long bull period, but if Taiwan stocks are like the 30 years before 2016 or The Nikkei 225 has been sluggish for many years? Therefore, leveraged commodities need to be used with caution, but "brainless" investments cannot be purchased "brainless". The range time point of buying will determine the long-term return.

There are profits and losses in investment and financial management. Please read the previous prospectus in detail. For example, you can read it in detail from the end of page 26.

(4) Calculate the compound interest effect of cumulative return: The Fund aims to track the single-day positive 2 times return performance of the underlying index. The cumulative return rate of the Fund for more than two consecutive days and long-term will be affected by the compound interest effect of calculating the cumulative return However, if the cumulative return performance of the underlying index in the same period is 2 times positive, the difference in the compound interest effect may be positive or negative, and as the time interval is longer, the difference in the compound interest effect may be larger.

There are a lot more in the back, those who are interested remember to go through

https://t.me/wiwi995

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More