How to buy and sell precious metals? Four ways to achieve high profits!

Spot precious metal products can be traded in both directions, and can be traded on margin. The rules are flexible and the returns are high. It is a very good investment option. Many investors want to enter the spot precious metal market to take a share, but due to lack of experience in this area, they do not know how to trade. Let me tell you how to buy and sell precious metals? It is important to master these four methods!

Method 1: Learn analytical methods and seize profit opportunities

Although precious metal investment objects are relatively single, which saves us a lot of energy in selection, this does not mean that investors can seize profit opportunities by rushing into the market, but must continue to learn various analysis methods in order to be successful in trading. How to buy and sell precious metals? It is recommended to fully master the fundamental analysis method and technical analysis method, study the fundamental changes affecting precious metal prices, and determine the general trend of precious metal price changes. Seize profit opportunities.

Method 2 Choose a micro-spread account to reduce transaction costs

Precious metals such as spot gold, investing 1 lot (100 ounces, usually only $1,000 margin) requires a spread fee of $50, and as the number of traded lots increases, the spread fee will continue to expand, eventually reducing the investor's net profit. income. How to buy and sell precious metals? In order to reduce costs, investors can open a micro-spread account, which has a small spread, and the spread fee for trading 1 lot of spot gold can be as low as $15 on average. If you are worried that the cost is too large to affect the income, the micro-spread account is indeed a good choice.

Method 3: Have the courage to take losses and control your positions

Some investors are prone to slump under the blow of losses, and once they are disappointed with the precious metal market and themselves, without the fighting spirit to enter the gold market at the beginning, it will be difficult to find the next investment direction. Therefore, investors must have the courage to bear losses. Of course, if they are actually worried that the losses will be unbearable, they should be cautious when trading, control their positions, and trade in batches.

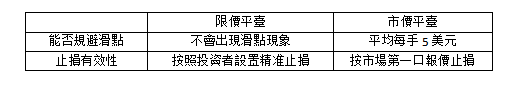

Method 4: Use the price limit platform to stop losses and control risks

Many people only see the high returns of spot precious metals, but often forget the risks behind the returns. In fact, any investment is accompanied by profit and loss. How to buy and sell precious metals? Investors need to pay more attention to how to reduce risks, such as choosing a price limit and no slippage platform, strictly setting stop losses, controlling potential risks, avoiding uncertain factors, and making transactions and profits more stable and controllable.

In general, if you want to gain profits in the precious metal market, you must understand some trading rules and investment methods in advance. If you don’t know how to buy and sell precious metals, you can trade according to the above four points, which can not only reduce risks, control costs, but also easily obtain sustainable benefits.

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!