【Financial Management Series】 - How to measure fear and greed in the market? How would you use this set of indicators?

As the saying goes, don’t go to places with a lot of people. When everyone is rushing to participate in the market and they are very optimistic, it is easy to correct and fall. When the market is pessimistic, it usually brings opportunities for reversal. As an investor How should we judge the current sentiment in the market? The answer is the "Fear and Greed Index". This measurement tool is mainly a calculation method developed by CNN Money to observe market sentiment. We can use such tool indicators to judge the timing of buying/selling.

composed of seven indicators

hedging needs

When the risk of the market rises, funds will be transferred to safe-haven places, such as gold, bonds, etc. Therefore, the lower the index, the more fearful it is, which means that there is a risk-averse mood in the market, and investors tend to transfer funds to For safe-haven assets such as government bonds and gold, on the contrary, when the index is higher, it means more greed, and investors are more willing to put money into the stock market.

market volatility

Taking the panic indicator VIX index as a measure, using the 50-day moving average to measure, the higher the value, the more fear, the lower the more greed.

junk bond demand

The junk bonds here refer to high-yield bonds, which are also relatively risky, so they are also called junk bonds.

It is measured by the spread between investment bonds and high-yield bonds (junk bonds). When the market is in panic, the price of high-yield bonds (junk bonds) will fall, so the yield rate will rise, and the spread will widen. On the contrary Yes, when the market is in greed, junk bond prices get higher (because people believe in stability), spreads shrink, and yields fall with it.

put and call options

In the options market, the ratio of the trading volume of the put option (PUT) and the call option (CALL) of the stock market is also called the Put/Call Ratio value. The more fearful, conversely, when the value is smaller, it means that the larger the trading volume of the call option, the more greedy.

stock price strength

According to the stock price of stocks listed on the New York Stock Exchange, the number of stocks that have made a new 52-week high and a new 52-week low is compared. When the number of new highs is greater than the number of new lows, it represents the more greedy the market is, and vice versa, the more fearful.

stock price breadth

Measure the gap between the total trading volume of rising stocks and the total trading volume of falling stocks in the past period. When the total trading volume of rising stocks is relatively large, it means that the market is more greedy, and vice versa, the more fearful.

market momentum

This indicator is compared by the S&P 500 index and the 125-day moving average (125MA), and is measured according to the degree of difference between each other. When the S&P 500 index is higher than the average line, it means that the trend is more and more greedy, and vice versa Emotions are more fearful.

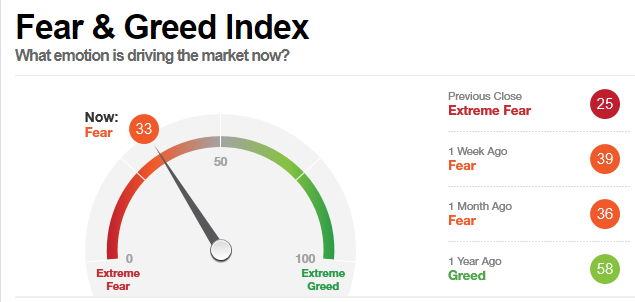

Where can I find the current fear and greed index in the market?

In the ever-changing market, if we can understand how to use more tools, it will not spread with market sentiment and affect our decision-making. No matter what time we invest, we just need to be disciplined and avoid being short-term by the market. Volatility affects mood, which can create a predictable rate of return, and we can also go to " Money CNN Fear & Greed Index " to observe the current fear and greed index in the market, and then decide whether to enter the market.

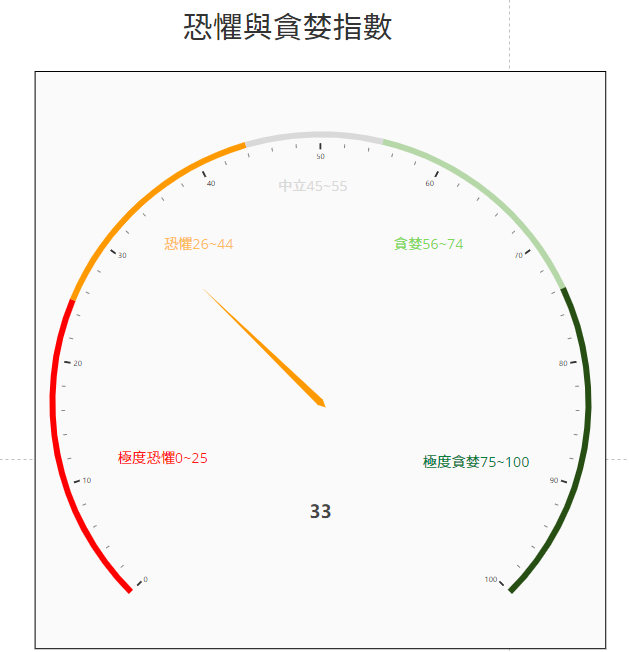

What do the high and low levels of the Greed and Fear Index represent?

The index ranges from 0 to 100. The lower the value (closer to 0), the more fearful the market is, and the higher the value (closer to 100), the more greedy the market is.

With this indicator reference, what can we do?

Investment is a test that violates human nature. When everyone is hot, we should be careful. I believe we have all heard the shoe-shine boy theory. When the stock market reaches its peak, the market sentiment is full of greed, so it is very easy to cause The occurrence of a bubble, on the contrary, when the market is in a downturn, many very valuable stocks are easily undervalued. This time is also a very suitable time to pick up bargains, but such a move is against our human nature. No one We are willing to increase investment when the environment is in a downturn, so in addition to this indicator for our reference, we can judge for ourselves when we can enter and when we should exit, but the most important thing is to overcome our emotions.

📝Financial management series

- Introduction to Financial Management (Stocks) — Fundamental Terms

- Financial Management Series - What is the right to choose?

📚 If you want to see more featured articles, or information about me, please go here...

💬 Would you use the Fear and Greed Index to make investment decisions? Please leave a message below to tell me 💬

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More