DAY 8- Retire from labor, should I raise it by myself (Part 1)

I'm a freshman thinking about retirement, Xiao Zinc.

May is tax filing season. Although it has been a while, this is the first time in my life that I have to pay income tax. It is really novel. Since my salary is not high, the amount of tax I pay is only a few thousand yuan. At this time, I happened to hear my colleague talking about the topic of "labor retirement" and tax reduction. I didn't care about it at first. amount of pension.

DAY-8 Pension

I often think about early retirement, but I have no idea about the pension. Before I left the society, I thought it would be an astonishing amount of money. Otherwise, how would I face the long, unpaid old age after retirement. When I entered the workplace at this moment, I realized that the pension fund was very small and that I had to rely on my savings when I was young to support it . This made me quite surprised. I have worked for the company for half my life, how can I end up in an unstable old age, and I am always worried about the money in my account. Money is running out, not to mention that the average life expectancy of modern people is gradually increasing, such concerns are becoming more and more serious.

How is the pension calculated?

Pensions can be roughly divided into three types, labor insurance , labor retirement and national annuity . Many people confuse them. At first, I also thought that labor insurance and labor retirement refer to the same retirement mechanism, while the national annuity is a retirement system that I don’t know where it comes from. Later, I went directly to the website of the Labor Insurance Bureau of the Ministry of Labor to check the information, and I realized that they are completely different. The pension bankruptcy that everyone often mentions is actually only the part of labor insurance, while labor retirement and national pension are different. one thing.

Below, I will analyze the information that I have obtained and analyze it individually for you to understand.

DAY-8 National Pension

Let’s talk about the best to understand the national pension, mainly to protect those who cannot participate in any social insurance (labor insurance, military insurance, public education insurance and agricultural insurance), such as common housewives and non-workers, if workers are unemployed You can also join the National Pension during the period, which means that you can participate in labor insurance when you have a job, and you can join the National Pension when you are not working, and you can get coverage at any time.

DAY-8 Labor Insurance

In simple terms, labor insurance is the government’s insurance for our retirement . In addition to ordinary workers employed by companies, other workers such as workers without specific employers and self-employed workers can also participate, in case we are unemployed when we retire In general, life is not settled, so the labor insurance expenses are deducted from the monthly salary in advance, 20% by the individual, 70% by the company, and only 10% by the government. After reaching the legal retirement age, you can get it back or Choose to get it back monthly.

Then why worry about the possibility of bankruptcy? Obviously, it belongs to the type of insurance. It should not be like the generation of interest, and it is even more impossible to drain it.

It is because he pooled all the labor insurance funds and handed them over to investment trust companies to invest on their behalf. It was inevitable that they would lose money. Another major factor was that the number of employed people was decreasing year by year, the number of retirees was increasing, and the average life expectancy was continuously extended , making the original Good intentions for insurance, people who retire first take it all out in advance, the younger generation can only receive a smaller amount, and the retirement age is continuously deferred, and there is even the possibility of bankruptcy. I really don’t know when I retire. , whether the labor insurance can survive.

DAY-8 Labor Retirement

Labor retirement is to force the company to allocate salary as your pension . Generally speaking, the company will contribute 6% of the salary to the worker every month, and the worker can also set the amount of the withdrawal, up to 6%, and finally The money will be transferred to the retirement pension personal account set up by the Bureau of Labor Insurance. It can be seen that, unlike the centralized management of labor insurance, it is obvious that labor retirement is a personal account, and it will not affect one's pension due to changes in the number of retirees, not to mention the risk of bankruptcy. Take care of institutions and invest in financial management for us.

How much pension can you get?

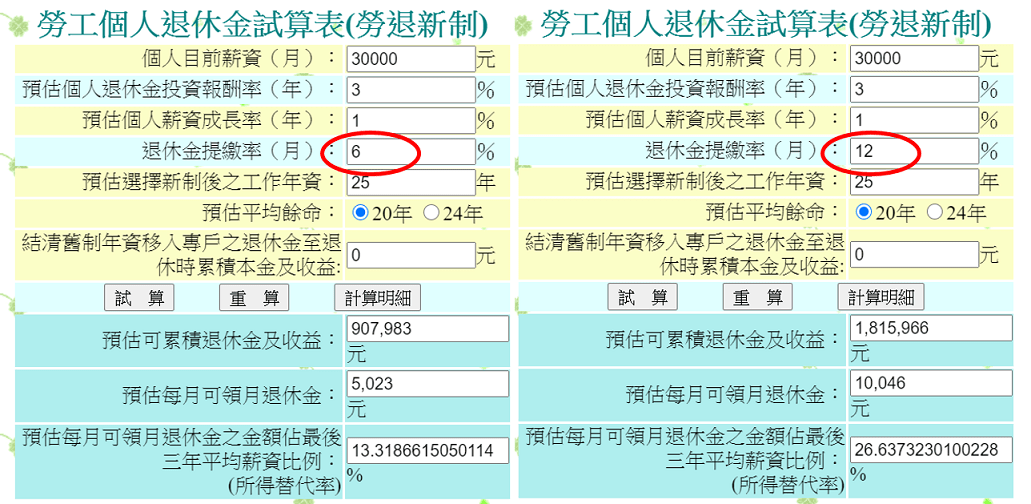

In fact, you can calculate the overall amount from the labor individual pension trial balance sheet and your current salary income. Here, I will take my personal situation, 30,000 yuan per month for 25 years of work as an example, and let everyone see the trial calculation.

From the line of "estimated accumulative pension and income", it can be seen that when I retire, I can only get 900,000 yuan (picture on the left), which is really pitiful, but this trial is based on 6% of the pure company If I set the salary growth rate at 1% to calculate, if I set aside another 6% myself, the pension amount will be doubled (right).

Summarize

- The pension is very small, and you have to rely on your savings when you are young to support it.

- The National Pension is for those who cannot participate in any social insurance

- Labor insurance is the government's insurance for our retirement, in case we retire as if we were unemployed, and our lives are lost.

- The labor insurance cannot make ends meet because the employed population is decreasing year by year, the number of retirees is increasing, and the average life expectancy is continuously extending

- Labor retirement is forcing the company to allocate wages as a pension for workers, and contribute 6% to workers every month

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More