LINE Tax Treaty Application Teaching 2021 Edition

Follow me and conquer the LINE tax treaty application!

What is a tax treaty related application form?

In simple terms, it is to avoid double taxation of the amount of income from the sale of creations in Japan (the country of origin of the income) for companies or individuals located outside of Japan.

Reduce income tax from 20.42% to 10%

Whether it is theme or sticker creation, the amount that can be received is our final payment, of which "income tax" plays a large part. It is strongly recommended that creators who want to operate "LINE original themes/stickers" to increase their income apply for rent tax Agreement to reduce income tax.

Income tax will significantly affect the actual amount received

Take the distribution amount of my August income in < LINE original theme monthly income exceeded 5 figures > as an example.

If a tax treaty is proposed and passed:

- Allotment amount: 50,335 yen

- Withholding tax: 5,033 yen (10%, tax treaty has been passed)

- Amount received: 45,302 yen

Assuming no tax treaty is proposed:

- Allotment amount: 50,335 yen

- Withholding tax: 10,278 yen (20.42%, no tax treaty passed)

- Amount received: 40,057 yen

The tax deduction % is more than double the difference, which will add up to a considerable sum over the long term.

Whether or not you have applied for a tax treaty, it will not affect the sale of stickers and themes.

How to know if you have a tax treaty

In the application for remittance income in the background, you can see the fields for income tax and submission of documents!

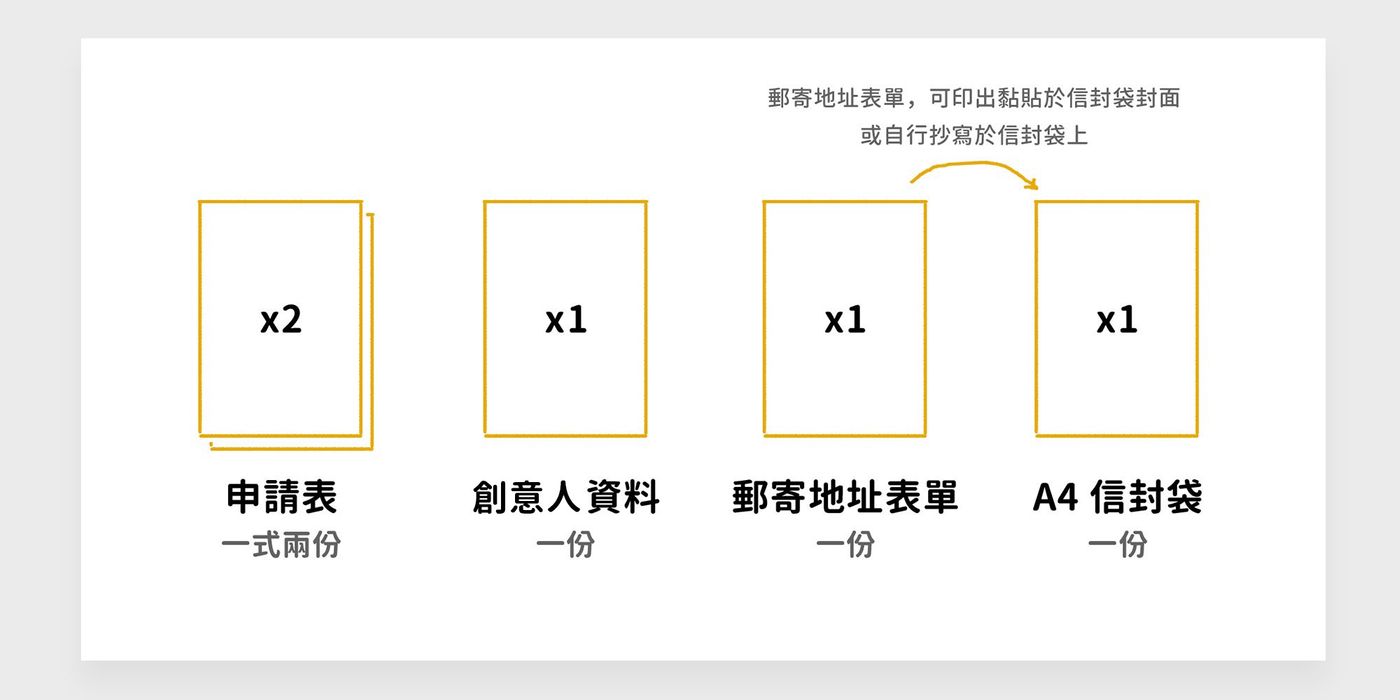

Items that need to be prepared

Because there is a new version of the document in 2021, this article is specially written.

Complete the application form (in duplicate)

The content is different due to the official update, please use the latest official version as the main.

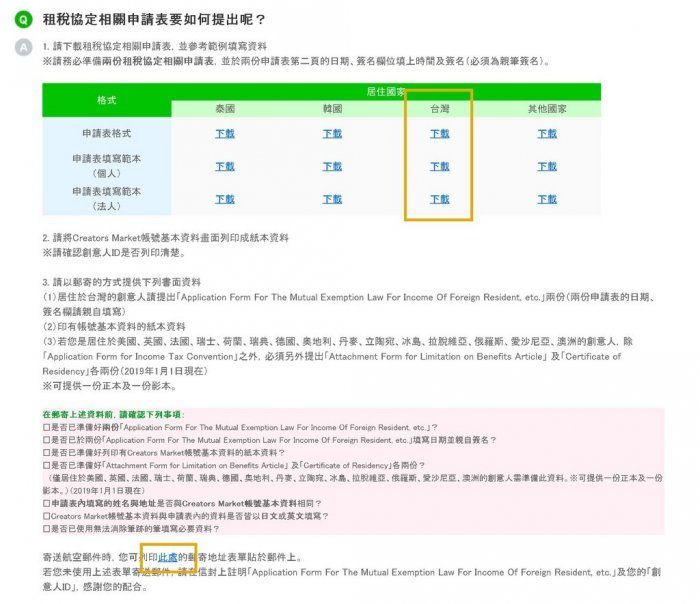

1. Download the application form: download link (please select according to the region)

Download location: the left menu of the creator's backstage → sales amount / remittance amount → click on the application form related to the tax agreement. Scroll down to " How do I submit an application form related to a tax treaty?" to see the relevant documents and download the application form .

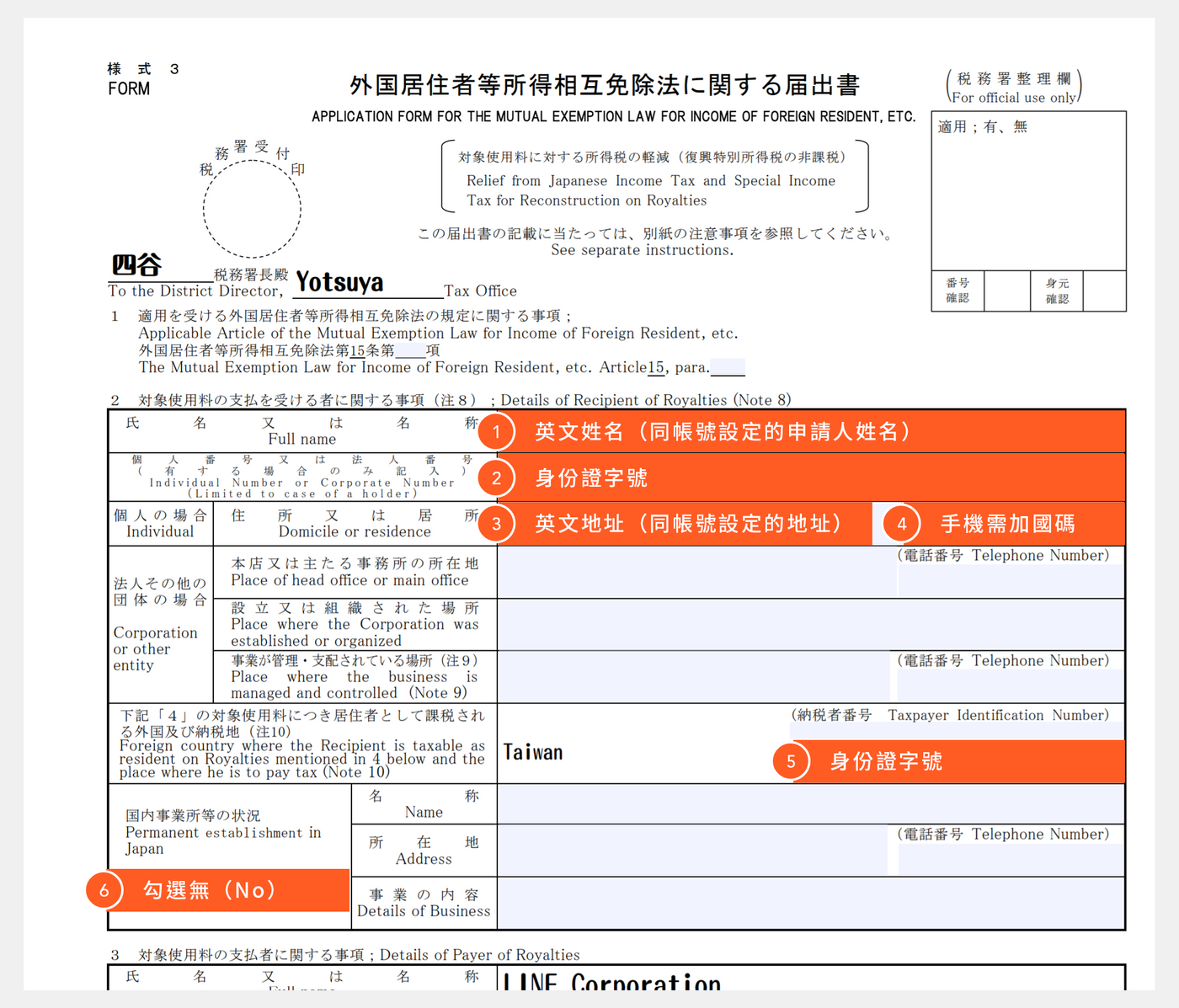

2. Fill out the application form

Open the downloaded file, click the input box to enter, and I tend to write it all by hand. The example is an individual who does not conduct related business in Japan as an example.

These data, please correspond to the creative person data.

Data location: left menu in the backstage of creative people → account settings.

- English name: corresponding to the applicant's name in the account settings

- ID number (I couldn't enter it successfully, so I printed it out by hand)

- English address: corresponds to the address in the account settings

- Mobile phone number: The phone number in the account setting, need to add the country code (Taiwan area +886)

- ID number

- Check None (No)

Note: Only the first page needs to be filled out . Whether the second page is filled out or not, it must be sent together.

3. Two photocopies of the application form

The 2020 version requires an additional signature, but the 2021 version does not.

Prepare basic information for creative people (one copy)

Screenshot your creative profile

Print out your creative profile, just one copy. Data location: left menu in the backstage of creative people → account settings.

Prepare mailing address form (one copy)

Download Mailing Address Form: Download Link

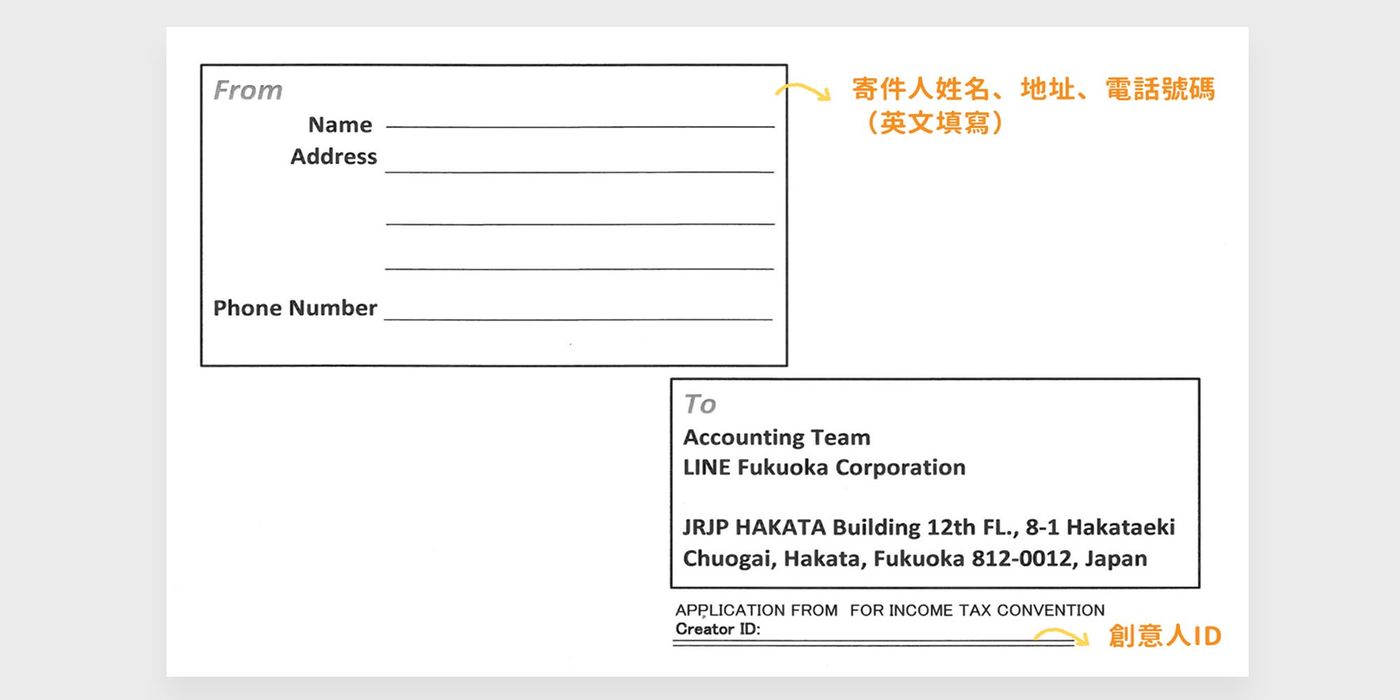

We will need the mailing address. There are two methods below. Method 1 is recommended. The format is more uniform and it is not easy to make mistakes.

Method 1, use the official mailing address form:

- Download the mailing address form

- Fill in the sender information, your creative ID (ID can be found in the creative profile)

- photocopy and paste on envelope

Method 2, fill in by yourself:

- mailing address:

Accounting Team

LINE Fukuoka Corporation

JRJP HAKATA Building 12th FL., 8–1 Hakataeki Chuogai

Hakata, Fukuoka 812–0012, Japan - Note: Application Form For The Mutual Exemption Law For Income Of Foreign Resident, etc.

- Fill in: your "Creator ID"

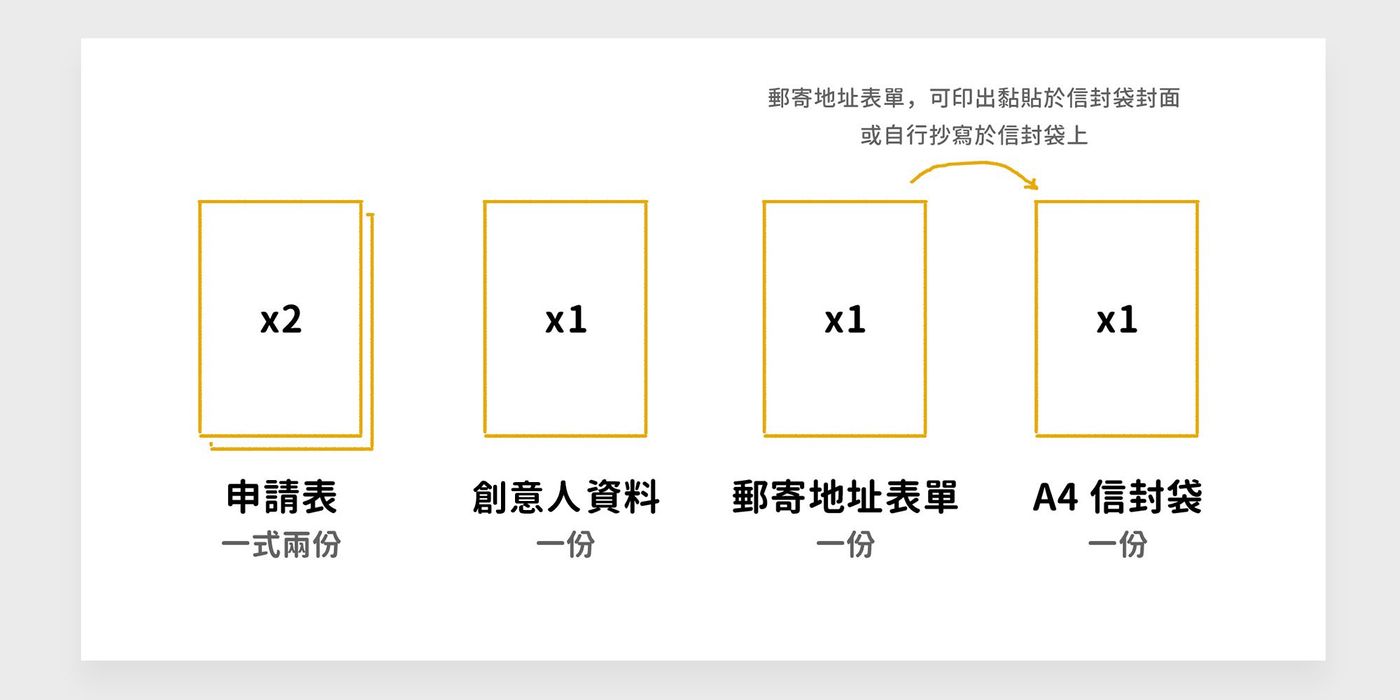

Confirm data

Finally, confirm whether the content is correct.

- Application form (in duplicate), the content needs to be filled out

- Creative person profile (one copy)

- Paste the mailing address form on the envelope bag and fill in the sender information and creative person ID

- Pack all the above information into an A4 envelope

send by post

When using international registered mail, it is recommended to keep the serial number of the mail. You can track and check the progress of domestic and international mail in the postal service after it is sent out.

Review time

I mailed it on January 14, 2020, passed on February 10, 2020. In the background, you can see that the income tax has been reduced from 20.42% to 10% 👏 👏 👏 👏.

It's been nearly a month before and after, I'm not sure if it's due to the relationship between the Chinese New Year, so the time is longer~

The above is personal application experience sharing, if there are any changes, please refer to the official website.

Small business

Although it is not the main income, I am very happy to be able to subsidize a little money~ If you have any questions about the theme or the production of stickers, you are welcome to ask me.

SUBSCRIBE AUTHOR ✶ SUBSCRIPTION

Subscribe to me through this link ( Medium account only) Whenever I publish a new article on Medium , a notification will be sent to your mailbox synchronously, inviting you to participate in my every moment! You are also welcome to read the article guide to learn more about this column and me :)

The article was first published on Medium , and the version I'm currently reading is the synchronous version.

Thank you for your reading and support, any questions are welcome to communicate with us| imjhanemi@gmail.com

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More