[ACY Securities] The European interest rate resolution is strong, can the euro take the opportunity to turn around and bottom out?

After a long-awaited call, the European Central Bank's interest rate decision is finally coming tonight. Observing yesterday's interest rate decisions in New Zealand and Canada, the impact on the foreign exchange market was different. New Zealand's central bank, which has raised interest rates three times, suddenly announced a 50 basis point hike, which was higher than market expectations. However, the New Zealand dollar failed to break through the key resistance after the short-term rapid rise, and began to retreat sharply. In contrast, the Bank of Canada, which raised interest rates slowly, also announced a 50 basis point interest rate hike, which was in line with market expectations, but the Canadian dollar began to appreciate strongly. The same is to raise interest rates by 50 basis points, and the performance of the New Zealand dollar and the Canadian dollar is very different. From this, a conclusion can be drawn that the impact of the current interest rate decision depends on the position of the local currency exchange rate and the strength of the central bank's previous hawkish attitude. The weaker the currency, the bigger the post-resolution gains are likely to be. Of course, the content of the resolution itself cannot be ignored.

The European Central Bank is undoubtedly the most dovish western economy at the moment, and the euro's decline is second only to the yen. Is there no inflationary pressure in Europe that does not need to raise interest rates? In fact, the current inflationary pressure in Europe is huge. Affected by the Russian-Ukrainian war, the prices of energy and food have soared, leading to a year-on-year surge in the latest CPI. After Germany and France released inflation data at the end of March, the euro performed exceptionally strong, and the exchange rate hit the highest level in the entire March. However, since April, the dovish news of the European Central Bank has been continuously reported. President Lagarde still believes that inflation will fall on its own and may not raise interest rates until the end of the year, and the euro has begun to fall from a high level. Markets also began to believe that under the pressure of war risks, the European Central Bank could not risk stagflation to raise interest rates significantly. Currency traders began to sell the euro, causing the euro to depreciate one-sidedly in April . However, such a unilateral market also means that the central bank's dovish attitude has been incorporated into the market price. Once tonight's interest rate decision releases a hawkish signal, the euro is likely to rebound strongly.

In the foreign exchange market, the euro is most closely related to the dollar. Generally, the euro rises and the dollar falls, or the euro falls and the dollar rises, and there are rarely cases where the same rises and falls. The recent performance of the U.S. dollar can be described as a strong external force and a cadre of cadres. Under the hawkish attitude of the Federal Reserve, the U.S. dollar index has never been able to reach the 100 mark. The dollar's collapse last night after Canada's rate hike was a testament to the same. As previously analyzed by ACY Securities, the Fed's rapid rate hike has been incorporated into the dollar market price, and the dollar may be close to the long-term top. As the monetary policy gap between Europe and the United States narrows, the European and American currency pairs will gradually strengthen the bottom and start a long-term uptrend. Tonight's interest rate decision may be an opportunity for bulls to test the waters.

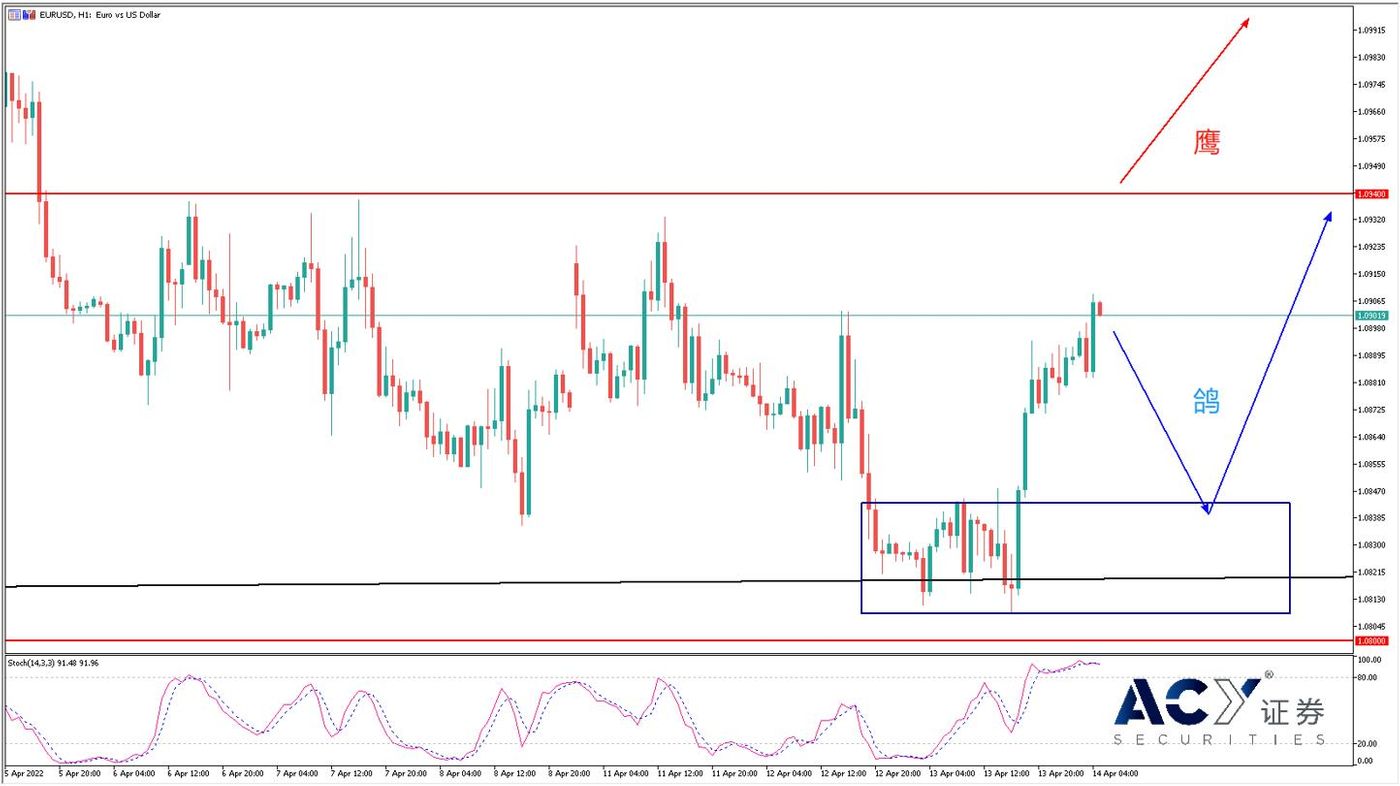

EURUSD Hourly Chart

From the hourly chart of Europe and the United States, although the euro is very weak recently, it is still supported by the bulls when it is close to the 1.08 position. This position is very important and is supported by a combination of the lowest point in the exchange rate in 3 years and the ultra-long-term trend. Affected by Canada's interest rate hike yesterday, the dollar depreciated and the euro rose sharply. Europe and the United States formed a demand zone structure in the 1.081-1.084 range. With the above-mentioned fundamental influence, if the decision tonight is dovish, then the trading strategy is to wait for a pullback to the demand area and then buy more on dips . The 1.08 position below can be used as a strict stop loss reference. If the decision exceeds the expected hawkishness, Europe and the United States are likely to soar rapidly. Traders need to wait patiently for the K-line entity to cross the neckline at the bottom of 1.094 before entering a long order. Finally, long-term traders need to be reminded that the Russian-Ukrainian war is still the biggest bearish risk for the euro.

Today's attention data

19:45 ECB announces interest rate decision

20:30 ECB Lagarde holds press conference

20:30 US initial jobless claims for the week

20:30 US March retail sales monthly rate

22:00 US April University of Michigan Consumer Confidence Index

The content of this article is provided by third-party vendors. ACY Securities does not make any representations or warranties for the accuracy and completeness of the content in this article; ACY Securities does not assume any responsibility for investment losses caused by the suggestions, forecasts or other information of third-party manufacturers. The content of this article does not constitute any investment advice and is not related to personal investment objectives, financial situation or needs. If in any doubt, please seek independent professional financial or tax advice.

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More