Re:[Chat] Where does the interest payment for Defi pledge come from?

This article responds to the PTT article

[Chat] Where does the interest payment for Defi pledge come from?

https://www.ptt.cc/bbs/DigiCurrency/M.1636963378.A.110.html

At present, the DEFI market usually has two main categories

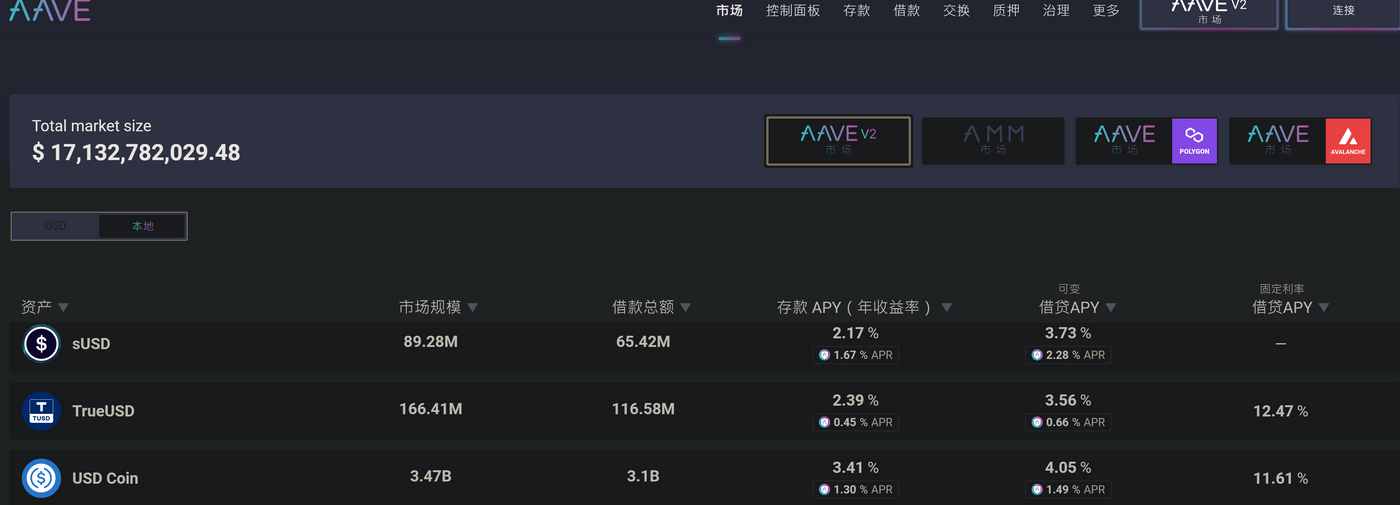

1. The lending category is led by AAVE, which mainly focuses on deposits and loans. For example, the current deposit interest rate for writing an article is 3.41, and the loan interest rate is 4.05. The interest difference in the middle is the platform income. This should be easy to understand, just like a bank. Where is the difference?

The bank makes money and the income basically belongs to the directors, supervisors and all shareholders, and has nothing to do with the depositor.

AAVE loan will issue their tokens to you separately. The smaller number below is the APY of the token

Some platform tokens are governance tokens, while others will be repurchased on a regular basis with income. Each company may be different. If you are interested, you can read the white paper.

As for the token price, it is determined by the market. Some people think that it is a Ponzi scheme, just dig and sell. Some people think it is very valuable and will hoard it, but everyone has different choices.

2. Liquidity mining

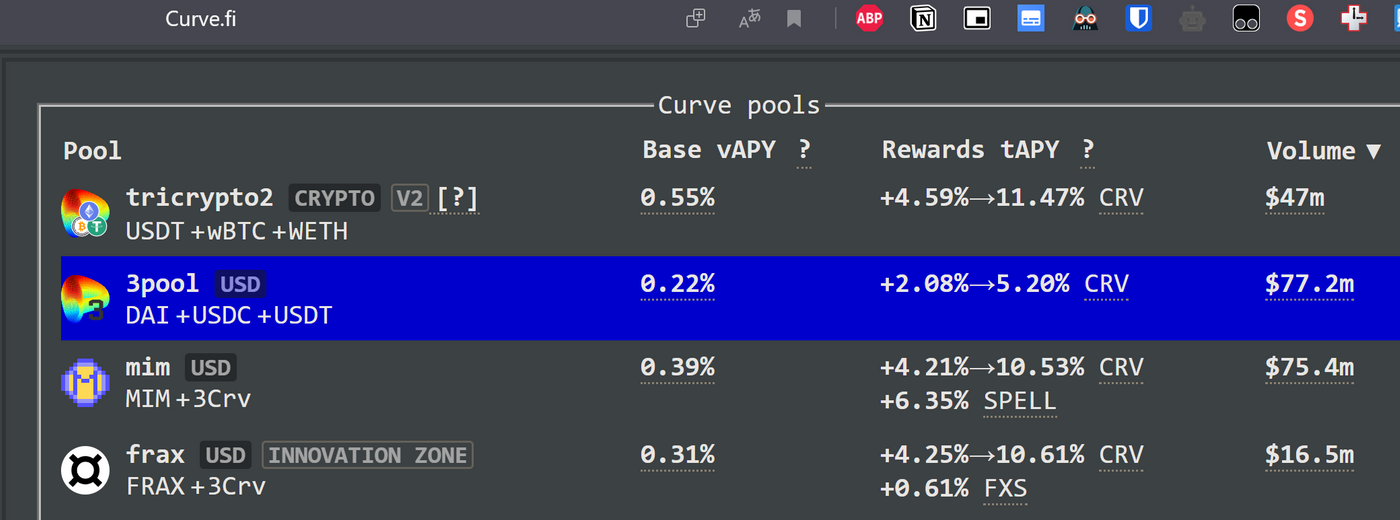

Led by CURVE and UNISWAP, they all belong to the type of transaction mining. A group of people organizes LPs and puts them in CURVE. Traders need to pay a handling fee to exchange tokens. Taking the classic 3POOL as an example, each transaction costs about 4/10,000. Half of the handling fee is charged by ADMIN, and the other half is returned to the LP token holder.

The REWARD APY on the right is the token reward they issued. The number will fluctuate because the reward for staking CRV tokens is doubled at different times.

Same logic. It can be applied to securities brokers. Everyone who buys stocks in Taiwan stocks has a handling fee attached to the broker. This is the basic income. where the real innovation lies)

The brokerage's income is usually owned by their shareholders, but they also send tokens to the miners, and the price of the tokens is determined by the market. Those who think that the Ponzi scheme has no faith will dig and sell, and those who have faith will buy it. , it is difficult to say whether it is a mine or an explosion. Taking CURVE as an example, their tokens have governance rights in addition to staking, and they can initiate community voting. If you read my article a few days ago, you can know the power of community voting.

https://reurl.cc/l5A4mv

OHM is a bit too complicated, someone wants to see it later, let's talk about it

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More