OpenSea is not decentralized - the contradiction between openness and governance

The Ukrainian-Russian war has entered its second week, and more and more international companies have responded to the sanctions against Russia by the European and American governments.

Financial payment networks Visa , Mastercard and American Express have successively announced the suspension of all operations in Russia, which is equivalent to returning Russia to the era of paper money transactions. Not only the financial cards of the Russian people were immediately "crippled", but foreign financial cards could not be used in Russia.

It is not surprising that financial institutions responded to sanctions, but the main open Web3 trading platform also blocked users and caused controversy.

Last week, several Iranian users found that their accounts were blocked by OpenSea. Not only could they not be able to buy and sell NFTs on the platform, but even the NFT collections on their personal pages turned into "404s" overnight. Users are dissatisfied, where is the "decentralization" that OpenSea should achieve?

This article discusses why OpenSea is not a decentralized application, and the dilemma between OpenSea's pursuit of openness and platform governance.

Block Iran

OpenSea is the world's largest NFT distribution center, where more than 90% of NFT transactions take place. Its website operation is very Web3. If OURSONG and Nifty Gateway are closed (Web2) NFT stores, OpenSea is an open (Web3) store.

To use the OURSONG platform, people must first register an account with an email and pass real-name authentication before they can trade. If you want to put NFT on other stores, you must first withdraw the NFT from the original closed platform.

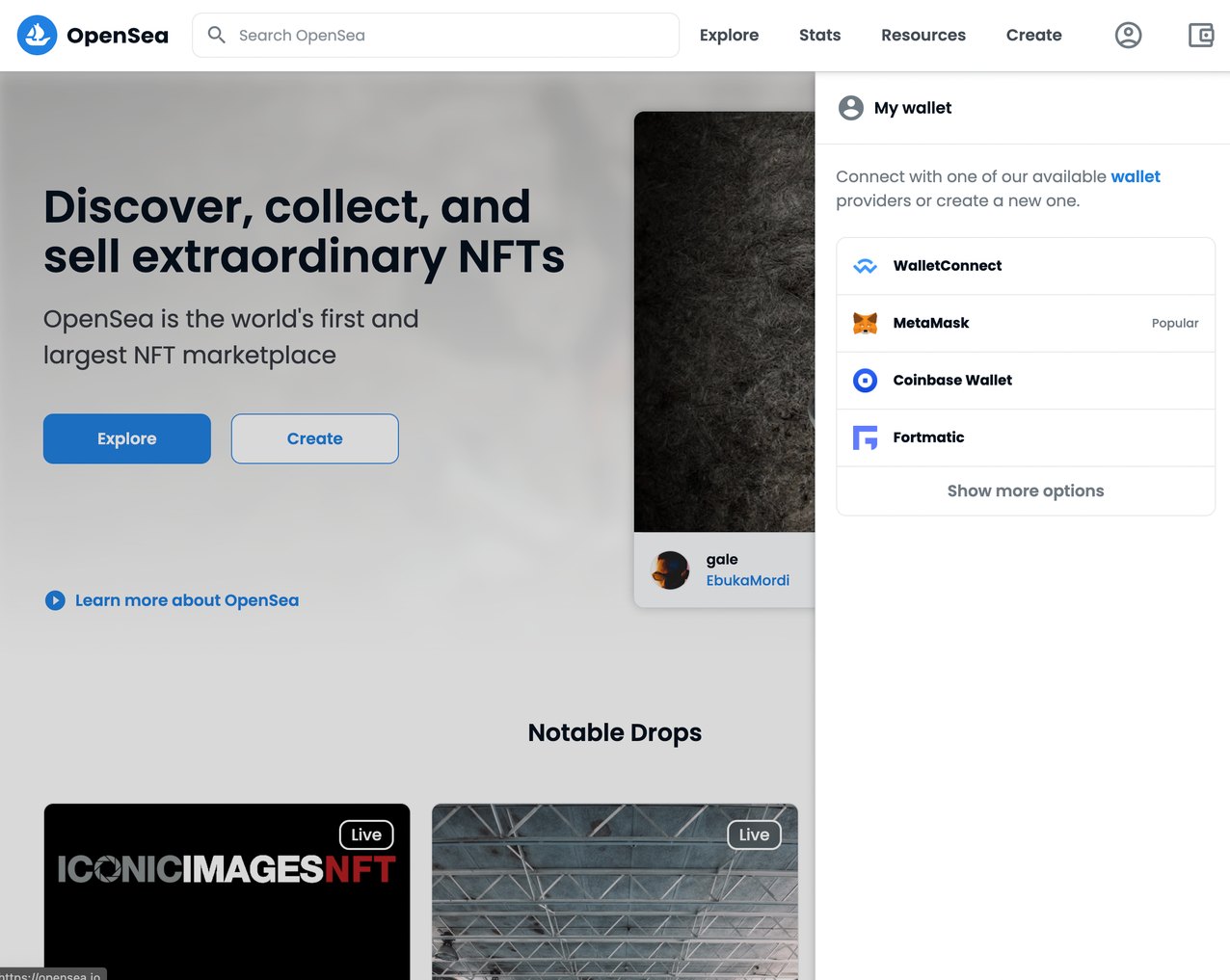

But at OpenSea, people can start buying and selling simply by connecting their wallet. Every transaction has an on-chain record, and the obtained NFT will immediately appear in the personal MetaMask wallet. Most importantly, OpenSea does not keep NFTs for users from beginning to end, but only provides information matching transactions.

Therefore, users can freely list NFTs in their wallets to other stores (such as LooksRare) for simultaneous sales. If you use the metaphor of physical items, OURSONG is similar to merchant consignment, while OpenSea is like a personal online auction.

These new Web3 experiences led many to believe that OpenSea was a decentralized NFT marketplace — until people's accounts were blocked without warning. According to Decrypt :

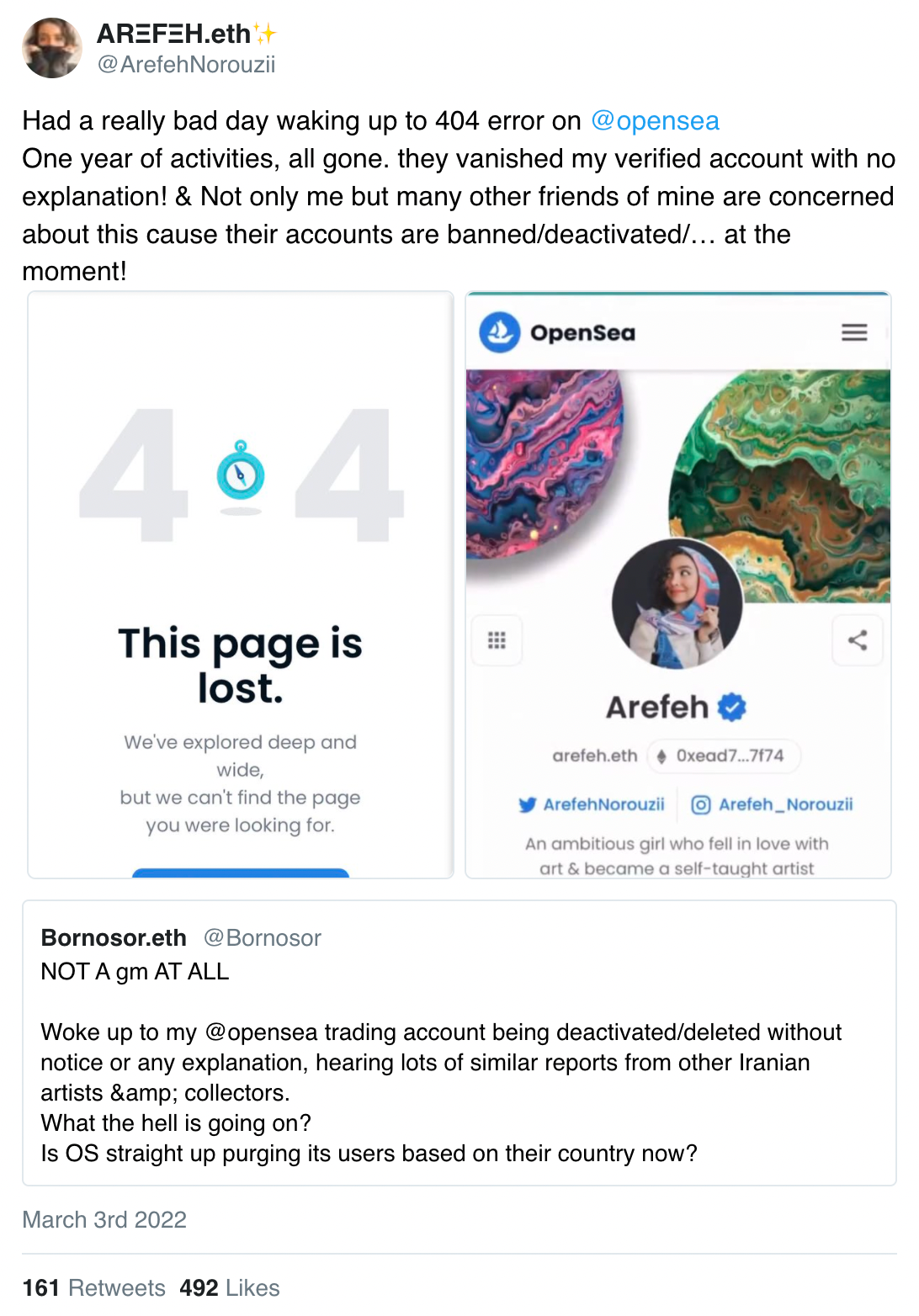

More than five Iranian users reported having their OpenSea accounts blocked. They claim that their photography has disappeared from the platform, their personal pages have turned into "404s", and their accounts have been deleted without warning. A spokesperson for OpenSea later confirmed that they were blocking users in sanctioned areas in accordance with the platform's terms of use.

Below is a screenshot of one of the blocked Iranian users. The personal page that was supposed to display a rich collection turned into a cold "404" screen overnight.

This is like Shopee and Taobao blocking suspicious sellers. But isn't OpenSea an open, decentralized Web3 application?

The contradiction between openness and governance

There are many opinions on the Internet about whether OpenSea is "decentralized".

For example, CoinMarketCap calls OpenSea a decentralized trading market, but OpenSea's official website says nothing about decentralization. Their original intention was to create eBay for cryptogoods.

To clarify the market positioning of OpenSea, you can find the answer from the terms of service :

OpenSea is not a wallet provider, exchange, broker, financial institution or creditor. OpenSea provides peer-to-peer Web3 services that help users discover and interact directly with NFTs on the blockchain. We have no management or control over the NFTs, blockchains that users interact with, nor do we perform the purchase, transfer or sale of NFTs. To use our service, you must use a third-party wallet to transact directly on the blockchain.

As with most of Web3's services, your blockchain address represents your identity on OpenSea, and the account shows the NFTs held by that address. OpenSea may request information or documents from users upon government request and investigate possible violations of the Terms of Service. In such a case, OpenSea will, at its sole discretion, disable the account.

It is not difficult to find that, on the one hand, OpenSea says that it has no control over the user's on-chain assets (NFT), and on the other hand, it says that the user's account on OpenSea is under their control. It may seem contradictory, but it is easy to understand if you use physical goods as an example.

OpenSea is like a shopee store for NFTs. If Shopee finds a suspicious seller, it can suspend the account, but cannot confiscate or freeze the physical items held by the seller. Sellers can also "make a comeback" as long as they re-register their accounts or transfer to other stores.

OpenSea's role in the NFT market is very similar to that of Shopee. Both are operated by enterprises, but the goods in the store have changed from physical to digital. Therefore, OpenSea not only has to abide by the laws of the United States and block Iranian users, but also shoulder the responsibility of identifying "counterfeit goods".

There are many creators who like to satirize current events through free and open NFTs, and their artworks may be separated from counterfeit goods by a thin line. How OpenSea should manage the scale of openness and governance has become their most difficult problem. According to The Verge in late 2021 :

There are two groups of NFT works that are testing OpenSea's line between plagiarism and art. The Boring Ape (BAYC) is the most expensive NFT creation today, but anyone can modify it based on a public monkey image. Recently, two NFT works PAYC and PHAYC wanted to satirize the NFT craze at that time by mirroring the monkey image of the boring ape.

They also joked on the website that holding these NFTs does not have any membership and will not have any holding rewards. This is the exact opposite of what the BAYC development team promised. But in the end, OpenSea took down these two works on the grounds of violating intellectual property rights.

In the currency circle, price speculators who quickly resell NFT for profit are called flippers. The two derivative works, PAYC and PHAYC, satirize current affairs by flipping the original head portrait of Boring Ape 4 , turning the monkey facing the right to the left. Is this a copycat or an artistic creation?

OpenSea thinks it's the former, and "artists" think it's the latter. In the end, of course, OpenSea has the final say. But these "artists" did not give up, and also put their works on the shelves of Rarible and Mintable, two NFT stores. Ultimately, Rarible decided to keep these "creations" on the platform.

But OpenSea is synonymous with the NFT trading market. If the work cannot be put on the shelves, it is equivalent to passing by the majority of buyers.

This can be said to be the biggest contradiction in the current NFT market - centralized OpenSea dominates more than 90% of NFT transactions - NFT creators who pursue freedom and openness must go through OpenSea's review before their works can enter the mainstream market. And the censorship scale, only OpenSea knows.

Whenever OpenSea adjusts platform governance norms, it may affect the direction of NFT development. This is similar to how Facebook adjusts its algorithms to affect content reach.

decentralization

OpenSea is not decentralized, but an open centralized store.

What's innovative about it is that people don't have to deposit digital assets in a closed store before they can trade them. This thing is commonplace in the physical world, but it is a big breakthrough in the digital world. After all, how could a bank let you transfer money before people have deposited the money in their account?

But openness does not mean decentralization. OpenSea is operated by the US company Ozone Network and, like cryptocurrency exchanges, must comply with US sanctions. However, OpenSea's governance is trickier than a cryptocurrency exchange.

Exchanges can restrict services based on users' real-name authentication information. However, OpenSea only has the user's wallet address, and the login IP address alone will inevitably "kill" the user by mistake. In addition, the centralized exchange can decide which currency to open for trading from top to bottom, but OpenSea has to face the bottom line of the user uploading "artwork" test platform every day.

This puts OpenSea in a dilemma of content management on social media like Facebook and Twitter. There is still room for verification of the authenticity of information on social media. Who should decide whether the NFT uploaded by the creator is "art"? In the long run, OpenSea will definitely not be human on both sides.

Most people may only see OpenSea's 90% market share, but don't realize the hidden contradictions of openness and governance. After all, I am afraid that no NFT store is completely decentralized. What people need may only be decentralized assets, with more open stores that can rival OpenSea, not necessarily a completely decentralized NFT store.

Block Potential is an independent media that is maintained by readers' paid subscriptions, and the content does not accept factory or commercial distribution. If you think the block potential article is good, please share it. If the bank has spare capacity, it can also support the block potential operation with a regular quota. To view the content of past publications, you can refer to the article list .

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More