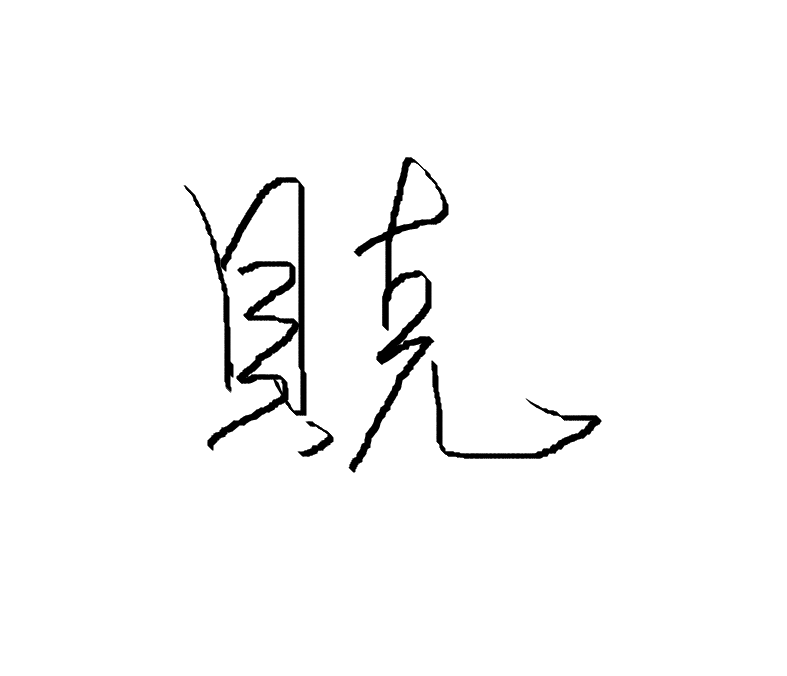

Analysis rather than prediction | Am I a "stock" physical therapist? ! (seven)

No matter what kind of investment market you are in,

Retail investors are always " passive ".

The volatility of the stock market is a wave set off by " main forces and big players ".

It's hard for you to know that this big wave is wind? Is it an earthquake? or a volcanic eruption,

And retail investors are just surfers trying to ride the wind and waves. It's not easy to stay away from the shore...

It's realistic,

When retail investors invest in stocks, they are fighting one after another " psychological warfare " with these " super rich people".

(The main profit is the overflowing emotions of retail investors)

Even if things are as expected, such as Zhuge Liang, the Shu Han, who is loyal to him, cannot dominate the Three Kingdoms.

The reason is that there is absolutely no way to accurately predict the trend .

As Warren Buffett said, " If history is a game, the rich are the librarians. "

All we can do is try to " analyze " their methods,

In this ever-changing battlefield, you don’t lose much, and occasionally win small.

Or let the bullet fly for a while .

static braking

Recalling the principles of "cycle" and "stand by the side" introduced earlier,

If you are a "right trader" in the "short to medium period" band,

Because we don't know when this wave will start ,

So you have to wait until the " splashing waves " to enter the market,

This is the " entry signal " often referred to in short- and medium-term trading;

Conversely, when the " exit signal " appears,

It should be sold immediately.

You will find that such a trading model is " riding the main force ":

He doesn't move, I don't move;

Even if he moves, I have to reach the position I set before I move .

Different genres have different "entry and exit signals".

But they all have one thing in common -

"Strict discipline, long-term execution; stop loss and stop profit, small loss and big profit"

Watching Tiger Fighting from the Mountain

For long-term investors , the volatility in the middle has nothing to do with you,

Whether it is a fixed fixed deposit or a value investment deposit,

What you earn is the long-term profit potential of this company in the future.

After buying, it is " waiting for profit ":

dividends or capital gains in excess of value ,

The rest is to quietly watch the mountain on the opposite side kill you to the death,

The premise is to know enough about the company.

George Soros , chairman of Soros Fund Management and the Open Society Foundation, said:

"The history of the world economy is a series based on falsehoods and lies. "

Benjamin Graham , the father of value investing, also mentioned:

"The stock market is irrational most of the time. "

" It's ridiculous to think that you can make money from prediction markets. "

Warren Buffett put forward the "nut shell" theory:

"The financial world is turbulent, chaotic, and chaotic. Mathematics cannot control the financial market, and psychological factors are the key to controlling the market. More precisely, the market can only be controlled by grasping the instinct of the masses. "

......

This all means that the operation of the market is not as "logical" as those data and line charts seem.

More often, it is an " irrational " phenomenon caused by the influence of " emotion ".

So if you often hear a lot of self-proclaimed masters, teachers...or so-and-so making a lot of money, Abo said to you:

"The roar of xxxx will go up tomorrow"

"Let me tell you, believe me this one will definitely make money, the rate of return will be at least... take off, if you don't buy it, you will regret it..."

...This kind of "prophet" type of speech is recommended to maintain a skeptical attitude.

Whether you enter the stock market from technical, chip, fundamental...

Remember, " Soldiers never tire of deceit, this is war! "

What we do is:

" Strategize and adapt, instead of predicting the future, you'll end up being slaughtered. "

I'm Baker, I'm a physiotherapist, and I'm not just a physiotherapist.

The Fortune Quadrant ESBI tells us:

Wealth freedom depends on "passive income", which must be an entrepreneur or an investor,

I'm still in the E quadrant, and I'm a member of the S quadrant,

Although it is currently unable to cross the B quadrant, it is also a member of the I quadrant.

It doesn't matter when you suddenly realize, as long as you don't limit yourself, you and I are both on the road to wealth and freedom.

Let's do it together, before the freedom of wealth...

Finally if you like my article

Please help me click "5 likes" below and support me,

or become my Appreciated Citizen:

Sponsor a cup of coffee every month,

Help me go further and give me full motivation to continue to bring good articles to the residents.

You are also welcome to leave a message below to tell me what you think or what you want to see!

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More