What are the potential DeFi projects in the next few months?

This article is translated from Thor Hartvigsen

foreword

DeFi has always been a very important track in the development of the blockchain. How important decentralized finance is to the people in the encryption circle, I won’t go into details. For those who have enjoyed the DeFi bonus, you may refer to Thor’s article. At least he is a researcher I have seen so far who has done in-depth research on DeFi, and he often shares some good DeFi information.

The original author of this article collected the data of more than 200 small and upcoming DeFi protocols, and based on these data, sorted out the 20 DeFi projects that are most likely to grow in the next few months, so let’s take a look!

Disclaimer: This article has been authorized by the original author, the author is Thor Hartvigsen ( @ThorHartvigsen )

Article content

When analyzing all DeFi protocols, the following points are mainly used:

- team

- Community

- Does the protocol offer anything novel

- Token economic model and value growth for token holders

- Does the agreement meet the category of actual needs

1. GammaSwap

- Twitter: @GammaSwapLabs

- Status: Not launched

- Token: $GS

GammaSwap is an oracle-free volatility DEX launched on Arbitrum.

Users can go long volatility (gamma) by shorting LP pairs and earn rewards from impermanent losses.

👉Read more details

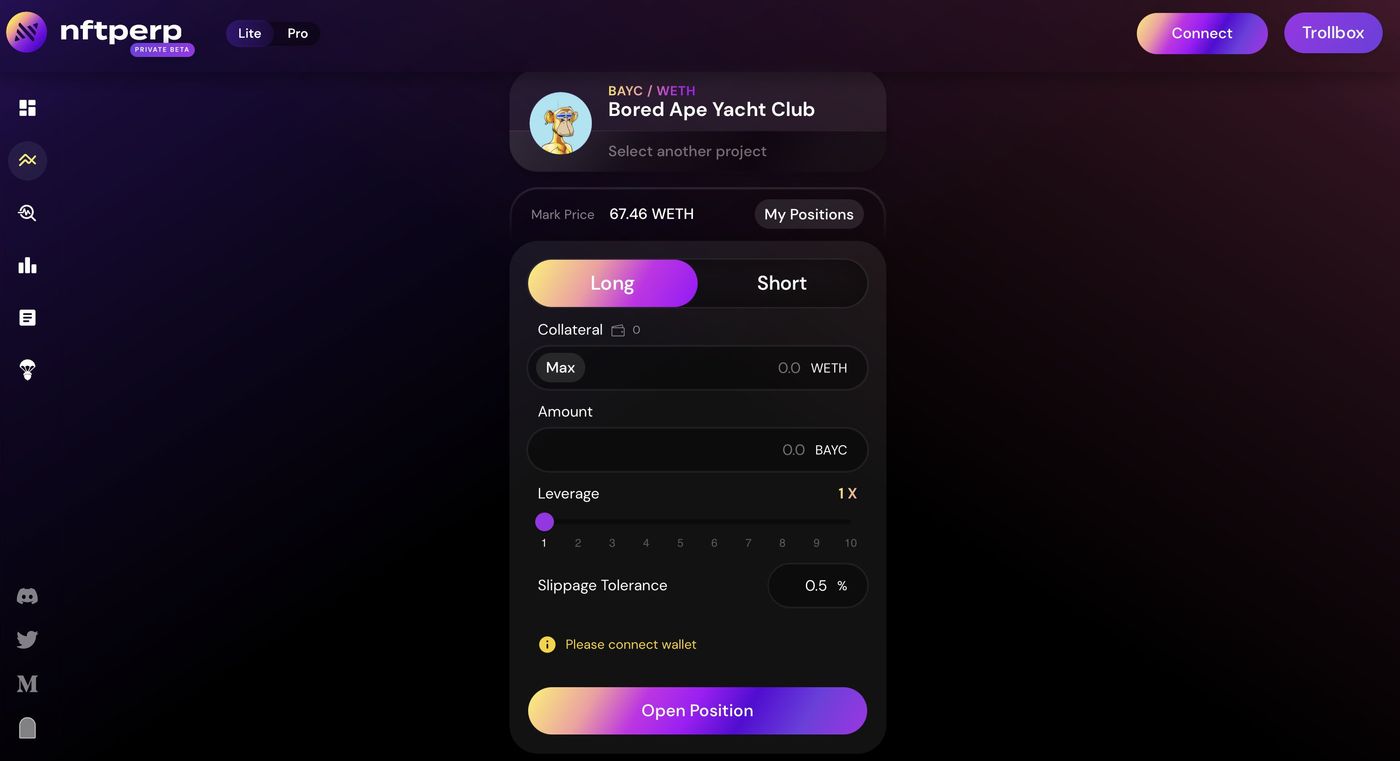

2. nftperp.xyz

- Twitter: @nftperp

- Status: private beta

- Token: $NFTP

The protocol allows for permanent trading of NFTs on Arbitrum. Imagine GMX transactions, but using NFTs instead of some of the cleanest UI/UX in the entire DeFi space. The token $NFTP will be airdropped to traders of the protocol.

3. Umami

- Twitter: @UmamiFinance

- Status: Rolled out

- Token: $UMAMI (28 million market cap)

Umami's GLP Vaults whitelist release schedule is getting closer.

However, the agreement is much more than that. With a skilled team and a solid token economic model, Umami aims to deliver institutional-grade defi returns.

👉Read more details

4.Orbital

- Twitter: @orbitaldex

- Status: Not launched

- Tokens: None

Orbital is developed by the team behind PlutusDAO ( @PlutusDAO_io ) and dopex ( @dopex_io ) and will integrate with both protocols.

There is a lot of competition among Arbitrum DEXs, but these teams have a proven track record in the space.

5.Conic Finance

- Twitter: @ConicFinance

- Status: Not launched

- Token: $CNC (market cap 28.8 million)

Conic Finance is introducing "Omnipools" to Curve Finance ( @CurveFinance ) to spread user liquidity across different pools to maximize APR. Launch day is also approaching.

👉Read more details

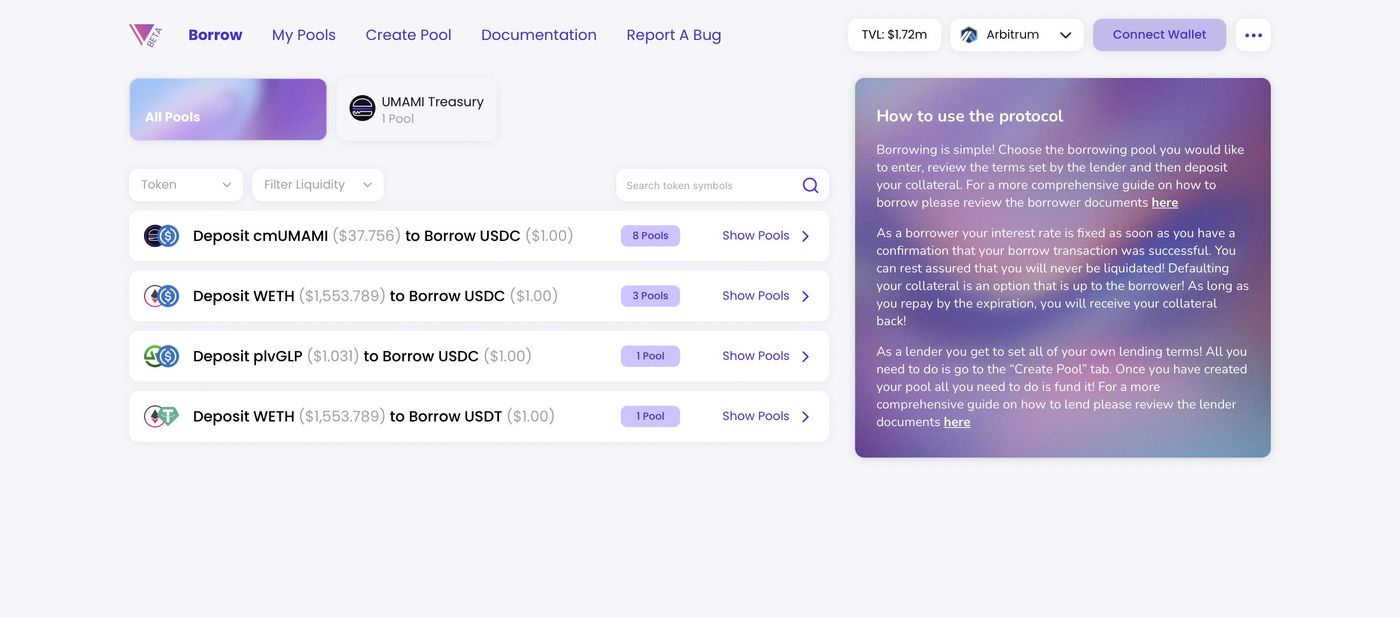

6. Vendor Finance

- Twitter: @VendorFi

- Status: Rolled out

- Tokens: None

Vendor is a permissionless lending platform with the ability to create and set users' own loan terms without liquidation.

It is still in beta, but has many use cases. Currently includes $UMAMI, $plvGLP, etc.

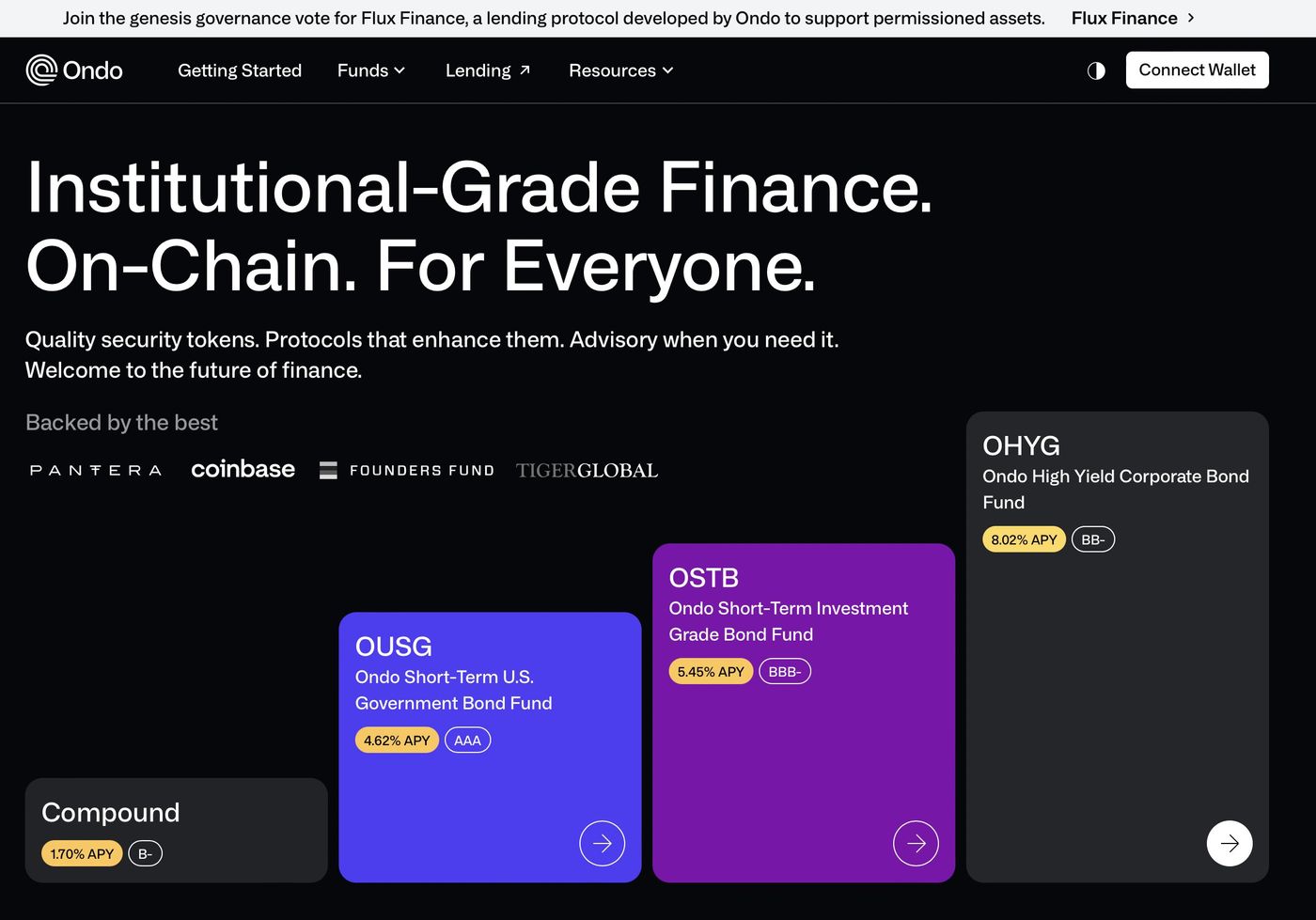

7. Ondo Finance

- Twitter: @OndoFinance

- Status: Not launched

- Token: $ONDO

Ondo finance brings US Treasury bills, Blackrock & Pimco corporate bonds, and more on-chain.

Their mission is to provide institutional-grade financial products and services to everyone around the world.

8. Flux Finance

- Twitter: @FluxDeFi

- Status: Not launched

- Token: $ONDO

is a fork of Compound V2 built by the Ondo Finance ( @OndoFinance ) team.

This is a decentralized lending protocol that, in addition to encrypted assets such as $DAI, also includes risk-weighted assets (RWA), such as Ondo Finance’s tokenized U.S. Treasury bonds.

👉Read more details

9. Scroll

- Twitter: @Scroll_ZKP

- Status: Not launched

- Tokens: None

A Type-2 zkEVM is being built, which is essentially a scaling solution built on top of Ethereum, utilizing zero-knowledge proofs while being equivalent to the EVM. The mainnet launch is planned for later this year.

👉Read more details

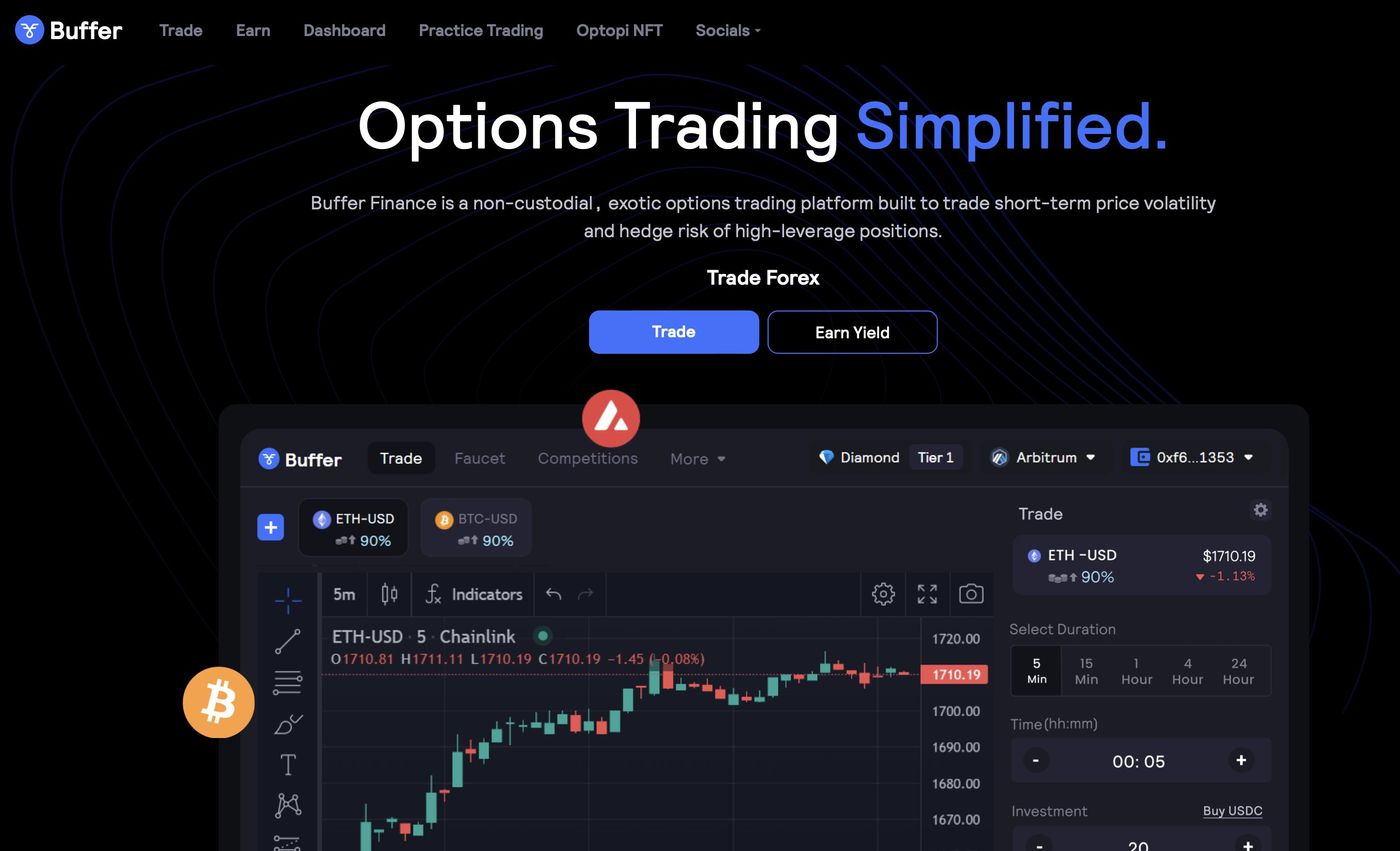

10. Buffer Finance

- Twitter: @Buffer_Finance

- Status: Rolled out

- Token: $BFR (market cap 8 million)

is a decentralized exotic options trading platform with a GMX type token economic model (real return distribution). Allows users to bet on a price above or below a target at expiration on a short time frame (5 minutes to 4 hours).

11. Crypto Volatility Index

- Twitter: @official_CVI

- Status: Rolled out

- Token: $GOVI (market cap 7.4 million)

$CVOL: Pegged to CVI, it is a cryptocurrency volatility index that allows users to speculate on volatility.

$GOVI: Governance token that generates real income through fees.

👉Read more details

12. Factor

- Twitter: @FactorDAO

- Status: Expected to launch on 2/20

- Token $FCTR (public sale on the day)

FactorDAO is an upcoming "decentralized asset management project". Creators build custom strategies (borrowing, derivatives, etc.) that users can fund.

👉Read more details

13. Pendle

- Twitter: @pendle_fi

- Status: Recently launched V2

- Token: $PENDLE (market cap 8 million)

By splitting tokens into principal and yield, offering some of the highest yielding currency pairs such as rETH/ETH, while vePENDLE is used to boost yield; and using the “DeFi Lite” dashboard to attract retail users.

👉Read more details

14. Mars Protocol

- Twitter: @mars_protocol

- Status: V2 is scheduled to launch on 1/31

- Token: $MARS

The Mars Protocol, an over-collateralized and contract-to-contract lending protocol, will soon launch its own application chain on Cosmos. Previous $MARS holders are eligible for an airdrop of new $MARS tokens.

15. Panoptic

- Twitter: @Panoptic_xyz

- Status: Not launched

- Tokens: None

Panoptic is building a perpetual, oracle-free options protocol utilizing Uniswap V3 centralized liquidity pools. Decentralized options have a lot of potential by integrating with the current DeFi infrastructure, which is an exciting approach.

16. Archimedes

- Twitter: @ArchimedesFi

- Status: Not launched

- Token: $ARCH

Archimedes introduces leveraged positions on decentralized stablecoins, such as $OUSD, $LUSD, $sUSD, aiming to provide attractive stablecoin yields. These leveraged positions will be further traded as NFTs.

17. GMD Protocol

- Twitter: @GMDprotocol

- Status: Rolled out

- Token: $GMD (market cap 2.8 million)

GMD is building automated compound vaults on top of the Arbitrum protocol. Current vaults include pseudo-delta neutral GLP vaults and the $BFR USDC vault. The vault is in high demand and will distribute revenue to $GMD stakers.

18. STFX

- Twitter: @STFX_IO

- Status: Rolled out

- Token: $STFX (1/21 public sale raised 6 million)

STFX has developed a social trading platform where individual trades are represented as a vault that users can invest in if they have confidence in the trade/trader.

19. Y2K Finance

- Twitter: @y2kfinance

- Status: Rolled out

- Token: $Y2K (900,000 market cap)

Y2K is an Arbitrum protocol incubated by New Order ( @neworderDAO ) that allows users to speculate on stablecoin pegs.

Users can bet that stablecoins will not be decoupled, or they can hedge their risk exposure by purchasing “insurance”.

👉Read more details

20. Gamma

- Twitter: @GammaStrategies

- Status: Rolled out

- Token: $GAMMA (market cap 4 million)

This is a cross-chain automated centralized liquidity pool manager. Automate Uniswap V3 strategies for higher returns by rebalancing positions and reinvesting fees.

👉Read more details

Those are the 20 smaller DeFi projects Thor will be watching closely in the coming months.

However, keep in mind that potential projects are often agreements with a small market value or that have not yet been released. This type of project is usually risky, so don’t take it as investment advice and put too many positions in this area.

in conclusion

This article is mainly to provide you with a direction. After all, there are actually quite a few mainstream DeFi, such as UniSwap, PancakeSwap, AAVE, and Curve. It is safer and less risky than others. If you are new to DeFi, of course, it is recommended to use a large platform.

However, if you like to research new projects, or want to find potential projects for layout, then you can try to pay attention to these 20 projects, not necessarily all of them, just pick the ones that have been launched, or just look at the names that are pleasing to the eye Yes, is also a way. Anyway, during the bear market, just give yourself a little more time to research and plan, and you may have a chance to pick your first hundred times coin, maybe.

References

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More