[ACY Securities] The euro and the dollar are fighting each other, and the outcome depends on the interest rate decision tonight

In the foreign exchange market, the euro has always been the most important counterparty to the dollar. Judging from the global currency circulation this year, the hegemony of the US dollar is still as stable as Mount Tai, with daily trading volume accounting for 73%; followed by the euro, accounting for 40%; the yen, accounting for 26%; 20%. (Since foreign exchange transactions involve two currencies, the total proportion is 200%.) It can be seen that the key to affecting the exchange rate of the US dollar is the rise and fall of the euro. It's true that the recent big moves in the dollar also tend to follow events in Europe, and that influence is growing day by day. Analyzing the market trend in the last month, news from the United States has made it difficult for the dollar to fluctuate, but policy changes in Europe are more likely to have an impact on the foreign exchange market.

However, this change does not refer to actual policy adjustments, but to changes in market expectations. Take tonight's European interest rate decision as an example, the market is undoubtedly full of expectations for it. The European economy is already in a dilemma in the face of an imminent war. On the one hand, consumer inflation continued to rise to 8.1%, while production inflation exploded to 37%. Failure to raise interest rates could lead to long-term hyperinflation. On the other hand, the negative impact of the war in Europe far exceeded that of other countries, and the economy was in recession. The path is clearly visible. The "anti-war" political correctness is dragging the European economy into a quagmire step by step. Controlling inflation or protecting the economy is not a matter of having the best of both worlds. Therefore, in raising interest rates, the European Central Bank is far more hesitant than other Western countries. Even the Reserve Bank of Australia has raised interest rates by 50 basis points this week, but there is still no clear statement from the European side.

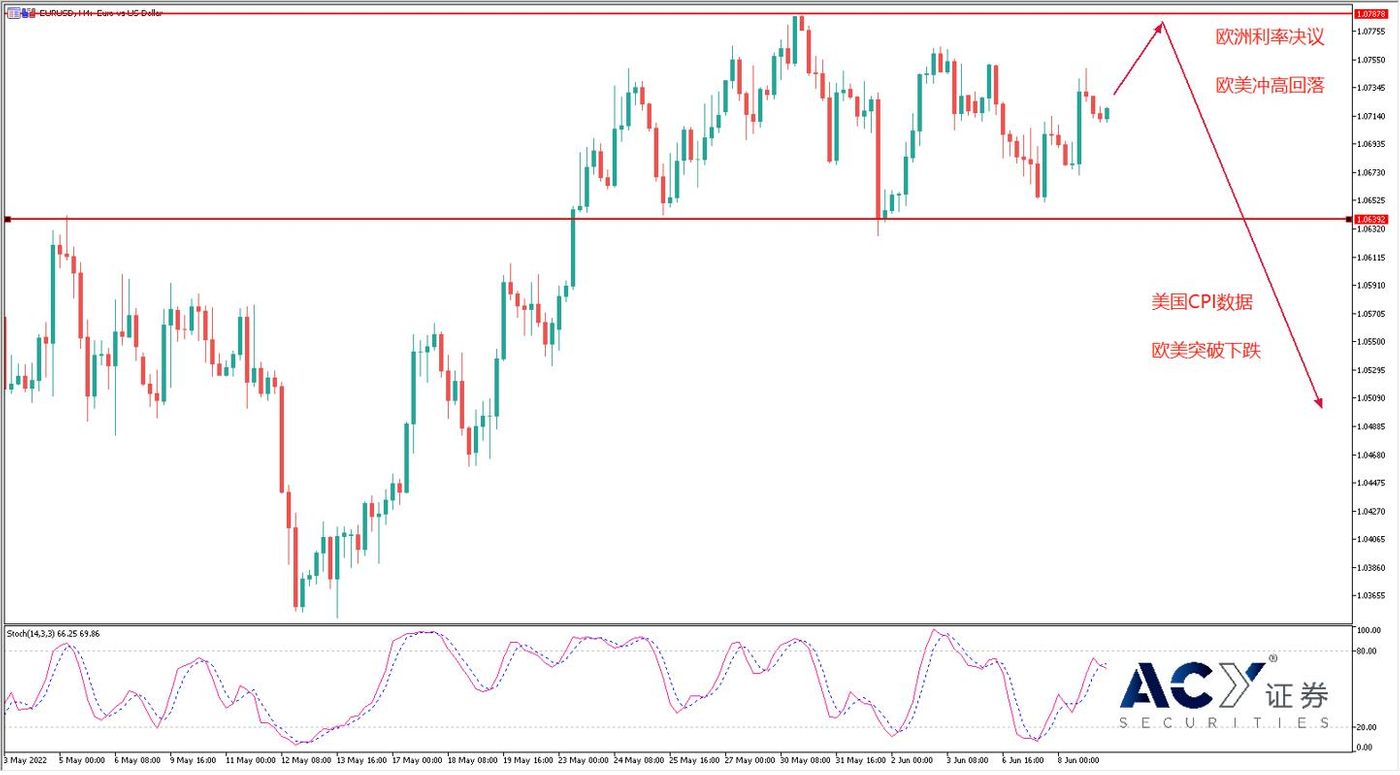

However, as mentioned above, foreign exchange performance is based on expectations. Although the European Central Bank has not stated its position, the market is already speculating on the follow-up strong measures. From the perspective of the foreign exchange market, when the US dollar rose, the exchange rates of Europe and the United States resisted the pressure level and fluctuated; from the perspective of the bond market , the yields of German and French three-year government bonds rose sharply; Interest rate hikes are full of expectations. However, when this expectation is met or failed, the euro may experience a depreciation of the bullish. Judging from the performance of Australia and the United States after Australia's interest rate hike on Tuesday, although the Australian and US exchange rates shot up twice in the day, the gains were firmly held by the US dollar, and the short-term bulls of the US dollar were stronger. Therefore, the euro is likely to have such a market. Even if Europe announces a rapid rate hike, the exchange rate of Europe and the United States will rise and fall. Taking into account that the US CPI data will be released tomorrow, the data is likely to remain at the 8.3% level, thereby raising interest rate expectations again and triggering a surge in the dollar. Therefore, European and American currencies are mainly short-term rallies.

Judging from the four-hour chart of Europe and the United States, the US dollar rose and Europe and the United States did not fall, reflecting the divergence of the exchange rate and the support of the euro bulls. Interestingly, the recent patterns of Europe and the United States are very similar to the Nasdaq and gold, so once Europe and the United States start to fall sharply, we need to be alert to the collapse of gold and the stock market. The head of Europe and the United States has been reflected, and the European interest rate decision tonight is likely to make Europe and the United States rush to the previous high near 1.08. For short-term trading, you can pay attention to the left-side opportunity of shorting on rallies at this position , and cooperate with the overbought area of the stochastic indicator to determine the timing of entry. Another short-selling opportunity appears when Europe and the United States break through 1.064, which can be matched with the unexpected CPI data on Friday night.

Today's attention data

19:45 ECB announces interest rate decision

20:30 ECB President Lagarde holds a press conference

20:30 US Initial Jobless Claims

23:30 Bank of Canada Governor McCollum delivers a speech

The content of this article is provided by third-party vendors. ACY Securities does not make any representations or warranties for the accuracy and completeness of the content in this article; ACY Securities does not assume any responsibility for investment losses caused by the suggestions, forecasts or other information of third parties. The content of this article does not constitute any investment advice and is not related to personal investment objectives, financial situation or needs. If in any doubt, please seek independent professional financial or tax advice.

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More