dollar circulation

Inverted pyramid structure of dollar circulation

Reserves fall below $3 trillion, which is dangerous, and Treasury bonds are issued. 2.7 trillion, 2.5-2.7 trillion economy will have problems.

The countries that borrow the most dollars are emerging market countries, where the rate hike cycle is the first to impact.

Emerging market countries, the stock market, bond market and foreign exchange market three kills

First to appear - currency basis swaps, in which the degree of negative dollar basis, negative to

Second, the difference between the foreign dollar forward contract and the OIS

How the Fed rescues other economies:

- central bank swap (currency), central bank currency swap

- FIMA International’s standing repurchase lending rate (foreign standing repurchase facility) – FIMA’s overseas repurchase facility in the Federal Reserve’s balance sheet, SRF’s standing repurchase facility in the United States (domestic standing repurchase facility, similar to domestic “sour and hot noodles”) (SLF), the upper limit of the policy rate corridor. That is, when the market rate is higher than the SRF rate, financial institutions can choose to exchange liquidity to the Fed.)

- Foreign and International Monetary Authorities

- At present, it is basically 0. If the data soars sharply, it means that there is a financial crisis.

Where is the tipping point of a new round of financial turmoil?

https://www.federalreserve.gov/releases/h41/current/

https://www.federalreserve.gov/monetarypolicy/fima-repo-facility-faqs.htm

Federal Reserve Currency Swap Network

year 2013

Prepare for exit from QE and address short-term liquidity shortages:

On October 31, 2013, the Federal Reserve, the European Central Bank, the Bank of England, the Bank of Japan, the Bank of Canada and the Swiss National Bank, six major central banks around the world converted the existing temporary bilateral liquidity swap agreements into long-term currency swap agreements. According to the announcement of the Federal Reserve, these swap agreements have established a "bilateral currency swap network" among the central banks of the six countries. Once the two central banks that signed the bilateral swap agreement believe that the current market conditions can guarantee the exchange, then the liquidity needs of the two central banks The central bank can then obtain liquidity in five currencies from the other five central banks as stipulated in the agreement.

According to the agreement, the Federal Reserve has become the de facto lender of last resort to the central banks of Europe, Japan, the United Kingdom, Canada and Switzerland. As the Federal Reserve gradually withdraws from its loose monetary policy in the future, the world is facing a new round of dollar backflow. The capital outflow from emerging markets such as India and Indonesia in 2013 has highlighted the scarcity of international dollar liquidity. The currency swap agreement of six central banks including the Federal Reserve has established a monopoly mechanism of the U.S. dollar lender of last resort. The Federal Reserve assumed the function of the lender of last resort for several other economies, changed and differentiated the international monetary system, and the international monetary system entered a new stage of the "Atlantic system".

2020

2020.3, the price of currency swap agreement is reduced by 25 basis points

In 2020.3, the Fed will directly support the business and residential sectors, help repair the balance sheets of enterprises and residents, and directly purchase commercial paper, corporate bonds and municipal bonds in the financial market, as well as stocks in the future. , the referee, directly entered the Wall Street financial market, and became the most important Wall Street trader. As a result, the rules of the Wall Street game were completely changed.

On March 15, 2020, the Federal Reserve, together with the Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank and the Swiss National Bank, announced a coordinated action to use the existing currency swap lines to provide support for US dollar liquidity. The agreement price was cut by 25 basis points. On March 20, the Federal Reserve announced that it would increase the frequency of swap operations with the five central banks mentioned above from weekly to daily.

According to data released by the Federal Reserve on April 16, 2020 Eastern Time, the size of the Fed's assets reached $6.4 trillion on April 15, 2020, nearly $300 billion higher than a week ago. The Fed continues to be on a rapid "balance sheet expansion" path.

The world pattern in the next 100 years will be completely transformed. The blue side with North America and Latin America as the core and the red side composed of other countries in the world will be completely divided into two parts. The blue side uses the gold-dollar system. As for the red side, it must be dominated by the RMB, including the Russian ruble, the German mark, and even the Japanese yen, British pound, French franc and other currency systems. Therefore, the oil countries in the Middle East are no longer the world economy. The key factors of the system, the domestic demand and population of each country are the key to determining the international status.

The world has returned to the pattern of bipolar hegemony between the Byzantine Empire and the Ottoman Empire.

Unprecedented direct access to the credit markets to purchase corporate bonds and bond ETFs. Correspondingly, the size of the Fed's balance sheet has hit a record. The Fed's assets will be close to $10 trillion.

The first stage: cut interest rates + QE + increase repurchase, and put liquidity into the market.

Phase 2: Enable special liquidity facilities to directly support the corporate and residential sectors.

The third stage: open QE, direct capital injection into the credit market.

How to see the Fed's currency swap network

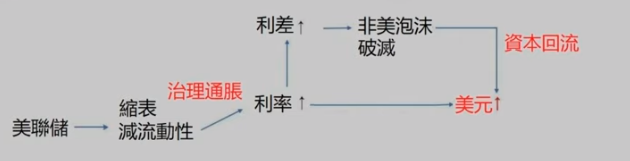

Dollar rate hike circulation

The balance sheet ends up being $250-3000 million less than it is now

Related to protect the linked exchange rate or protect the property market bubble, the middle ground

The Reagan administration scratched the bone to heal the wound, and raised interest rates to 20%. In the 1980s, the IT revolution broke out, and the PC era began, and the stagflation lasted for about 10 years.

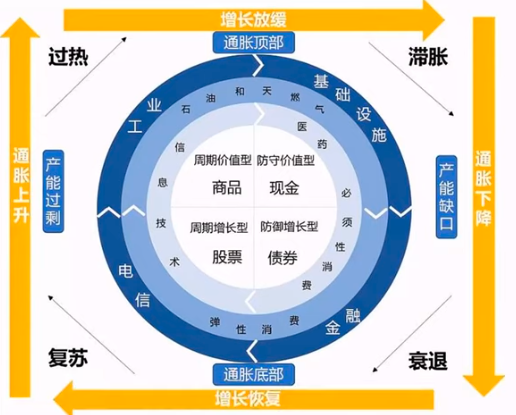

Sino-US trade war supply chain, petrochemical industry (green). When it feels better, it will release water. The Great Stagflation May Be

When the commodity (CRB indicator) turns, the CPI will follow, and the time will lag for more than half a year to a year.

WTI crude oil, can not do any long above 95, go crazy long below 45

Officials admit rate hikes trigger recession

The Fed is making the exact same mistakes it was in the 70s

Inflation expectations cooling down, price-to-earnings ratio revision coming to an end?

Suggest

- Retail investors:

- Only buy stocks when you feel comfortable

- Sell your stock on bad news

- view:

- When the price of house prices rises at the end, and the price of cultivated places starts to rise, it means that the bubble is at the end.

- When the commodity (CRB indicator) turns, the CPI will follow, and the time will lag for more than half a year to a year.

- WTI crude oil, can not do any long above 95, go crazy long below 45

US dollar circulation and trend judgment

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More