The reason why 90% of rookie contracts are liquidated

From the perspective of the recent disk, the prices of encrypted assets such as Bitcoin and Ethereum have rebounded and rebounded. However, due to the large decline in the past, the top ten currencies in the encrypted market still fell more and rose less. As of the writing date, Bitcoin is still hovering at around $38,000.

In a situation where currency prices are low in the short term, the contract turnover in the cryptocurrency derivatives market has increased significantly. It can be said that contract transactions have improved the utilization of funds to a certain extent.

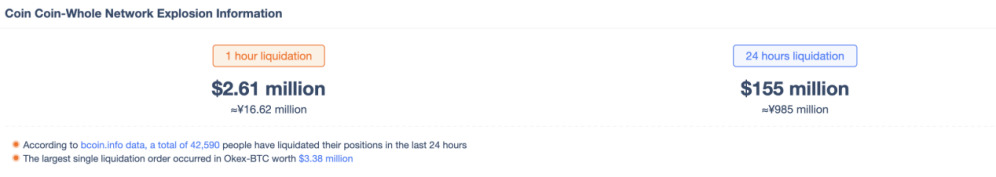

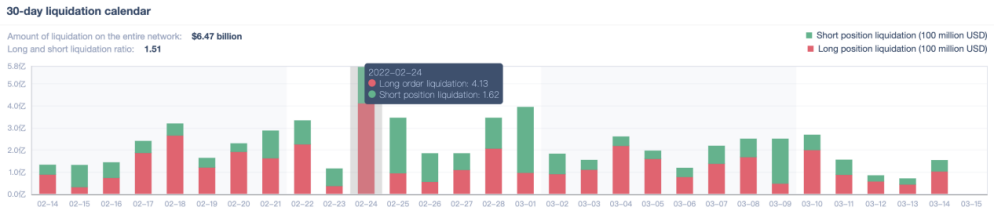

Although the contract market has always been the preference of crypto investors, its high-risk nature cannot be ignored, especially the frequent liquidation of positions. According to Coin’s network-wide contract liquidation statistics, the daily liquidation amount on February 24 exceeded US$500 million, and the number of liquidation liquidations in the past 24 hours exceeded 40,000. The liquidation data is so amazing, is it a must for contract trading? Of course not, to learn to summarize the reasons for liquidation, novice can try to avoid or reduce liquidation.

So what are the behaviors that cause the perpetual contract to liquidate?

1. Stud enters every time, and the beginning is the end. Stud is a full investment of principal. It often occurs in the situation of newcomers playing contracts, enjoying a momentary thrill, and the result is mostly liquidation. Therefore, controlling positions and learning to invest rationally are what newcomers must learn before playing contracts.

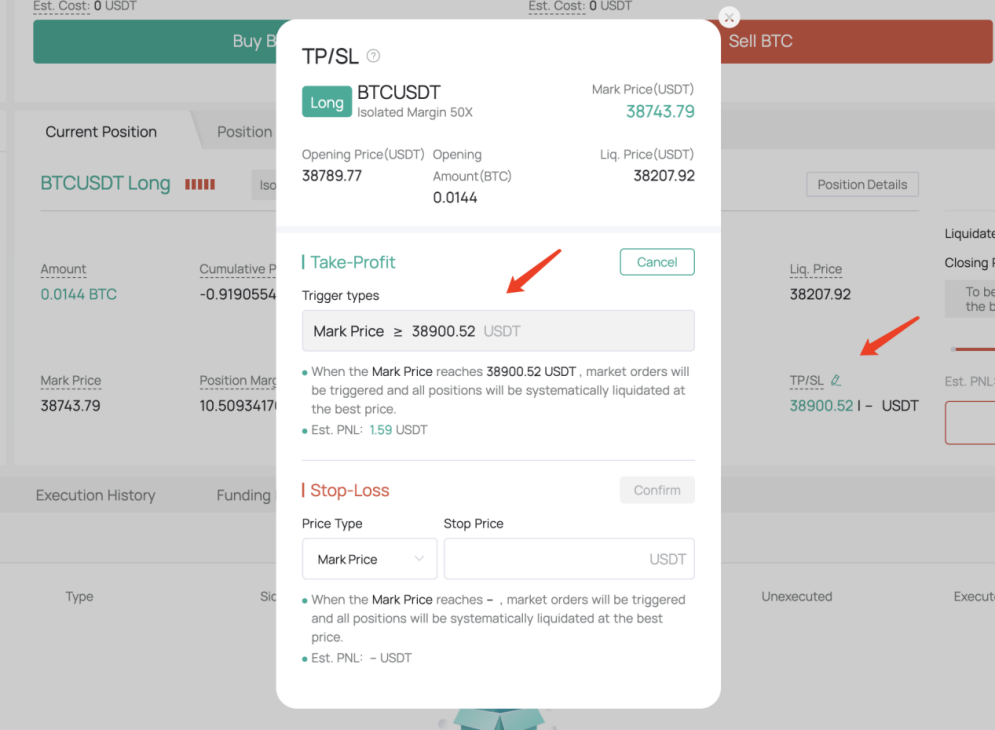

2. No stop-profit and stop-loss. This is a common liquidation phenomenon, which is related to the psychology of most investors. Those who lose money want to recoup their capital, those who make profits want more income, and in the end, it is very likely that they will directly liquidate their positions under the impact of a wave of market conditions. Therefore, newcomers must learn to clarify the take profit/stop loss point of their positions, and set the take profit and stop loss.

In fact, many exchanges now have the function of stop-profit and stop-loss, in order to help users control risks. For example, the stop-profit and stop-loss function of CoinEx exchange is located at the position of the contract position, which can be set after opening the position. Simple. The take profit and stop loss of CoinEx exchange will trigger the price to close the position and the expected profit and loss are very clearly described, and newcomers can quickly learn to use it.

3. Frequent entry and exit, excessive trading. This is a common habit of newcomers. They cannot accept short-term market changes and trade frequently. However, they do not know that frequent trading will reduce the fault tolerance rate of the market.

Fourth, buy the dips in a hurry, you are the one who explodes the position. This kind of rookie who has a little profit experience, thinks that he has mastered the skills of playing contracts, but does not analyze the situation at all, just refers to the previous price, and thinks that the current price must be copied to the bottom, but the market is wave after wave. , once the quilt is covered, it is not far from the explosion.

Fifth, do not understand the market, make mistakes in prediction. If you do not understand the market fluctuation trend, it is easy for investors to blindly follow orders, carry orders by mistake, and operate against the trend. Because they don't understand the market, newcomers who are not assertive often blindly follow others to open positions, which is a very bad habit; and some newcomers will continue to hold orders because they are unwilling to stop losses, until the positions are liquidated; contrarian operations are He is too confident in his own predictions, and conducts contrarian operations too early, but the market does not reverse, resulting in the final liquidation.

6. Hold the position overnight, and the position will be liquidated unknowingly. Holding a position overnight refers to the situation where the position is not closed before going to bed at night after the contract is placed. It is also common to hold a position overnight and cause a liquidation, because digital currency is a 24-hour uninterrupted investment product. Holding a position overnight cannot always control the ups and downs of the market, and it is easy to cause liquidation.

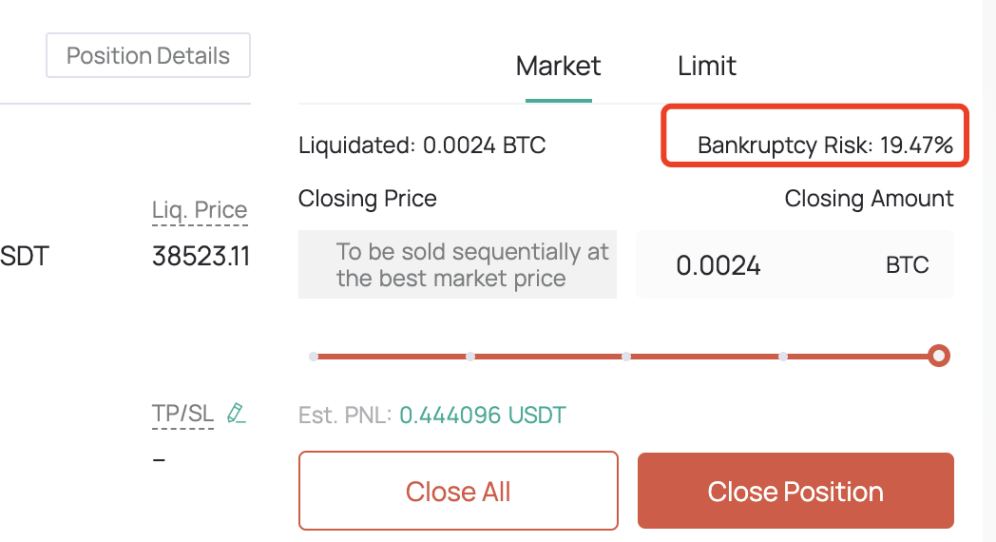

The above six points are all operations that are easy to liquidate in contract trading. In addition to avoiding the above problems, newcomers to play contracts should also learn to use the knowledge base of the exchange to learn, and use the tools of the exchange to detect the risk of liquidation. For example, CoinEx exchange On the contract trading page, there is an obvious risk warning of liquidation, and there is also a contract trading knowledge base (URL: https://support.coinex.com/hc/zh-cn/categories/360001448453-contract trading ) to provide users with learning, hope Everyone has become an investor who can calmly control the rhythm and move afterward.

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More