Dividend Game

What are dividends?

If you buy a stock and become a shareholder, the company may distribute dividends to you, of which the form of "cash" is called dividends.

Some people like the "dividend strategy", which selects companies that have paid dividends steadily over the years, expects to obtain cash flow, and reinvests the dividends to increase the number of shares held.

High dividend → cash flow → reinvestment → more dividend → more cash flow... Sounds like a perfect positive cycle.

But if we think about it more carefully, we will find the word game in it.

1. Although investors can "deposit shares" in the market just like saving money, stocks cannot "guarantee capital" at all.

Think about it, you deposit money in the bank, and as interest accrues, the deposit number will only increase and not decrease.

Even if the interest is paid out every year, there is no need to worry about the principal being affected.

But in the stock market, no one can guarantee this.

The stock price is likely to fall, the company may stop paying dividends, or even make you "earn the dividend, lose the spread".

We know that the stock market is risky, but it is even more dangerous to lose our vigilance "thinking we are safe".

If you want to see the principle, you also need to start with the process of paying dividends.

2. Why does receiving dividends not mean profit?

If a company makes money this year, it can take part of its "surplus" and send it to shareholders.

In case of loss of money, you can also take the old capital and take cash from the "account" to shareholders.

In other words, no matter whether it makes money or loses money this year, the company has a way to pay dividends, it just depends on whether it wants to.

The problem now is that when you buy a stock, you already own the assets of the company.

Should the surplus or reserves remain in the company? Yours.

If the surplus or reserves become dividends and paid to you? It's yours.

Regardless of the source of the dividend, and no matter how much assets are converted into dividends, these shareholders' equity "is yours in the first place."

You have two glasses of water to drink, one is called the dividend and the other is called the spread.

Think about it, pouring two glasses of water over and over, is it possible to increase the total water volume?

It's like the power bank is running out of power, so you connect the output port back to the input port and let the battery charge itself, is it possible?

If the company makes money because it is doing well and pays further dividends, shareholders can get cash.

However, even if one dollar is not issued, the surplus will not disappear out of thin air, and it still belongs to the interests of shareholders.

Therefore, the profit of the company and its investors is one thing, and whether it pays dividends is another.

3. From the perspective of stock price changes, we can also see the impact of dividends on prices.

Ex-dividend and dividend-payment are the same meaning as every day, changing the left hand to the right hand, changing the front foot to the rear foot, and the wool coming out of the sheep, anyway.

In theory, these operations are instantaneous, but in practice companies hold cash for a period of time before sending it back to shareholders.

Therefore, investors will experience ex-dividend first, and then get back the dividend.

In addition, according to the regulations of the Taiwan Stock Exchange, the day before the stock goes ex-dividend, the closing price must be deducted from the dividend amount and used as the "reference" price for the next day.

For example, if a stock closes at 30 yuan today, and the company plans to convert 3 yuan into dividends and distribute it to shareholders, the reference price for the opening tomorrow is set at 27 yuan, and the difference of 3 yuan will be recorded in a few days, which is why the stock price is at 27 yuan. Gap down after ex-dividend.

If you don't own stocks, you won't get any dividends even though the stock is cheaper after ex-dividend.

If you already have shares, although the share price is deducted by a portion, this gap will just be filled by dividends.

So over and over again, this process does not generate additional profit or loss, and it is fair to everyone.

4. Some people will say that dividends can be used to create shares, grandchildren, and great-grandchildren, but can these make total profits higher?

You can think about a question first, is it more for two pieces of 500 yuan, or twenty pieces of 50 yuan?

The answer is the same, because the total is one thousand dollars.

One more question for you, when you calculate the total amount of a tranche of stocks in your hand, do you consider the unit price or the number of sheets?

The answer is that both must be considered, total = unit price × number of sheets

Of course, the higher the yield, the more cash you can get.

At the same time, because the stock price becomes cheaper, the cash can buy back more shares.

However, as the number of stocks increases, the stock price also falls, so the two offset each other, and investors "don't make any losses".

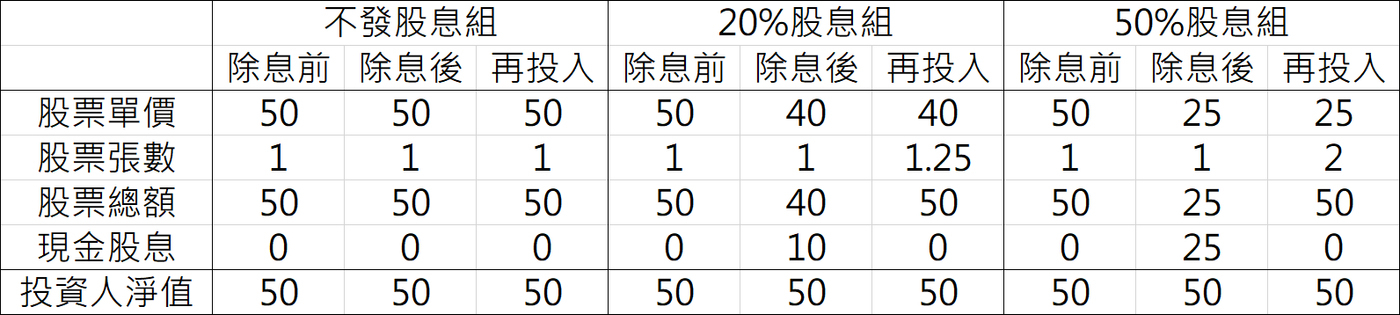

I made a table that describes the status of different dividend yields.

Suppose I have a stock of 50 yuan, whether it is pre-ex-dividend, post-ex-dividend or dividend reinvestment, it will not affect the investor's net worth.

Therefore, dividends can be used to generate shares, and shares can be used to generate grandchildren, but it does not help to increase profits.

Dividends don't matter if you want to "accumulate assets" and make life better.

However, if your goal is not to make money at all, but to see stocks "three generations in the same family" and get a sense of achievement in numbers, then there is nothing wrong with it.

Finally, you may have a question in your wit.

"A madman, I understand every day and night, but I found that some people don't understand. Is there any room for arbitrage?"

If investors are rational, dividends won't matter at all, but what if someone is irrational?

Whether you can eat tofu is really difficult to answer.

The fun part of the market is that all ethnic groups are in it, and everyone wants to make money.

Some people do not know that ex-dividend will reduce the stock price, they think they can get a bargain, so they rush into the market and push up the stock price.

At this time, someone will sell the stock in their hand to earn these "impulse dividends".

After a long time, those irrational investors began to learn, or were eliminated by capital, and the market returned to rationality.

However, if these impulsive groups enter the market continuously, it will turn short-term irrationality into substantial financial assistance and allow the company to grow.

As a result, those who run as soon as they make a profit end up losing money because they deviate from the market consensus.

By the same token, some people will despise companies that don't pay dividends.

As everyone knows, the company is likely to spend the cash on the knife edge, fully expanding its business and maximizing profits.

As a result, when the stock price climbed all the way up, I regretted not keeping up.

There was once a boss who felt that it was more beneficial to put cash in the company, so he never paid dividends. Later, its stock BRK.A rose to the highest price in the world.

Of course, there is another kind of company that doesn't pay dividends because it doesn't pay dividends at all, and its finances are tight.

So those investors who think "no dividend is a good company" are out of luck this time around.

Is it fun?

I predict the market and he predicts my prediction of the market.

So, I predict his predictions about my predictions for the market...

Will dividends affect stock prices? How much?

Will the dividend strategy lose money? How bad is the loss?

Are there any winners in the ex-dividend market? Who are the winners?

These issues are very complex, and all circles have not yet reached a conclusion.

In this case, it is very dangerous to base dividend beliefs on vague speculation.

At the same time, using other people's superstitions about dividends as an arbitrage opportunity may not be successful.

Therefore, I advise readers and friends that there is no need to insist on the "dividend" factor.

On the contrary, it is safe and stable to adopt a broad investment strategy.

refer to:

The Operating Rules of the Taiwan Stock Exchange Corporation, Article 67

Note:

Whether dividends are efficient factors is a controversial topic in the factor field, and I have the opportunity to write about it.

Readers are welcome to give advice.

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More