[Measurement of the currency circle] The actual operation and revenue sharing of the contract grid with complete pictures and texts

Chapter ◆ Foreword , Introduction to Bybit

◆ Self-introduction & recommendation code sharing

Foreword, Bybit introduction

The platform to be shared this time is Bybit. Before, even beginners can learn how to easily participate in the new currency arbitrage method of Bybit Launchpad . I have also introduced this platform. In fact, the main feature of this platform is the contract function . Due to its conservative nature, I have not used bybit contracts. The function, until I participated in their event a while ago and got a $500 contract experience fee (time-sensitive), I tried it out with the mentality of trying it out.

Back to the night of 4/30, I found that ETH had been consolidating at 2700-2800 for a period of time. Before going to bed, I held a play mentality and opened 5 times the contract. At that time, the current price of ETH was 2779, and the profit was 10%. I hoped to reach 2800, but I woke up and earned 37 dollars. Although it rose to more than 3840 on the day, the profit was enough to scare me, and I was attracted by the charm of the contract.

But I know that everything is good luck. If I go in the opposite direction today, I may have another idea. I was thinking about how to reduce my risk . I just happened to see this video, Daily Coin Research-Bybit Bituniverse Setting Teaching , He mainly uses the function of Bituniverse to connect the API of Bybit. I can create a contract grid in less than 10 minutes by following the steps in the video. Since the text may not be as clear as the video, the creation process is omitted. The following mainly explains the usage process and the parts I encountered that were not mentioned in the video.

Some people may ask why it is better not to use Pinet directly, for two reasons.

1. Because I want to use the trial funds dropped in my Bybit position.

2. Bybit has more small coins, unlike Pai.com that needs to use leveraged tokens.

Measured link

After you have connected it, you will see the Bybit logo on the top. You can connect with the APIs obtained from exchanges such as Binance and Matcha by importing the private key. Bybit is used here.

On Monday 5/2, I saw that CRV had been consolidating around 2 blocks for a while, so I used the contract grid, invested $412 and turned on 5x leverage, which is equivalent to using $2060 of funds ( 412*5) , and the system will automatically buy it for you after pressing the confirmation button.

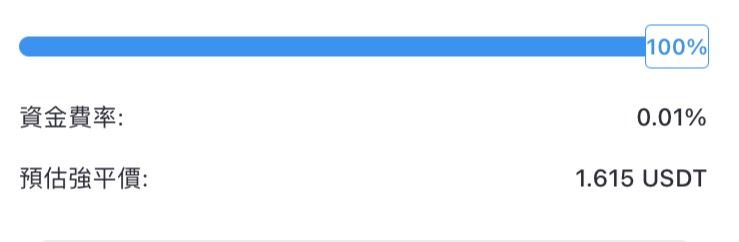

The position is opened at 2.06, the parameters are set between 1.651-2.476, and the grid profit rate is 0.22% and 0.33%, which is smaller than that from Paiwang. The reason is that the handling fee is lower than the 0.05% of Paiwang, as long as 0.01%, so I will pursue extreme arbitrage times during consolidation.

It should be noted here that there will be a margin figure. The CRV here is 1.615USDT, which means that if the price is lower than this amount, it is very likely that your position will be closed. Fortunately, in the future, you can increase the margin and reduce the leverage to reduce the risk of being liquidated.

Withdrawal income

Then let him run away. Basically, just let him run like I introduced Paiwang’s grid trading before, but the difference is the part of extracting profits. The letter to the official did not respond, and when I asked the Daily Coin Research, they also told me that if I turned it off, the profit would come out, but I later found out that this is not the case.

Just open the Bybit app, click on the contract and then click on the closing profit and loss in all orders to find the accumulated closed (to withdraw profit), the reason is because grid trading only buys low and sells high, so the price reaches sell When , theoretically the profit has been realized, so the profit is actually directly entered into the contract account. Don't be too nervous if you can't find it!!

If you are really worried, you can observe the available funds in the contract, he will slowly increase, in fact, the profits will come in.

Achievement sharing

Finally, on the morning of the 5th/5th, the grid order was broken, that is to say, all of them were replaced by USDT, and the actual profit was 90USDT within 3 days, which is a very good result in terms of grid trading.

How to Turn Off Contract Grid

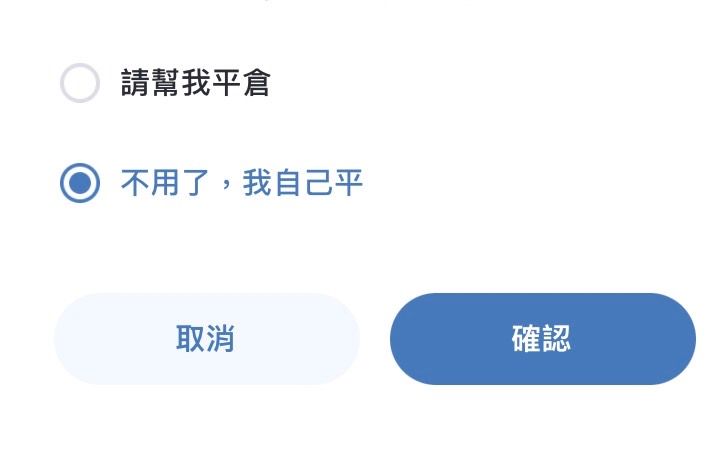

To turn off the grid, you will encounter two options before, "please help me close the position", "no, I will close by myself"

In fact, the principle of the contract grid is just to help you enlarge the funds to lay out the grid. If you look at it in detail, there are many small grid limit orders. Therefore, if you choose "please help me close the position", you will decide to realize profit. To close the contract and exchange it back to USDT, and "No need, I close it myself" is to keep the contract limit pending order position, and wait for a better time to close the position. As long as it does not fall more than the forced liquidation price, basically the contract order is still valid. .

Summarize the experience

When using the contract grid, I feel the most convenient is its leverage function, which allows me to move the leverage with the least amount of money when the downshift is limited (know where the forced parity is) Large fluctuations, although the contract grid is less profitable, it will not get up in the middle of the night to look at the phone all the time. Although you know that the forced parity is still far away, you will always feel uneasy in your heart, but even if the contract grid falls, you know that he is helping you arbitrage, Mentality will be much better.

The disadvantage is also very obvious that the capital efficiency is still worse than that of the contract. The leveraged capital is divided into several equal parts, so the profit is also greatly reduced. In a big market like today, it may be possible to earn more than 100% on a grid. It can be said that there is no right or wrong in trading, but to find the one that suits me. I know that my skills are not good. Through quantitative trading robots, I can increase leverage in limited situations and take risks into account.

Self-introduction & recommendation code sharing

I am a rookie who has been in the currency circle for a year. I am also very interested in the application of blockchain than making money, so I will share some of my experience in the currency circle after the actual measurement from time to time. After all, I am still an ordinary person. , please allow me to leave my referral code, if you still like my article, you can use my referral code, there is a chance to get experience gold, and support me to write more down-to-earth content, if you have any questions about the article Feel free to ask me below.

Register Bybit : ZKEQAR

Registration Pai.com: GdMTLZpS

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More